This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

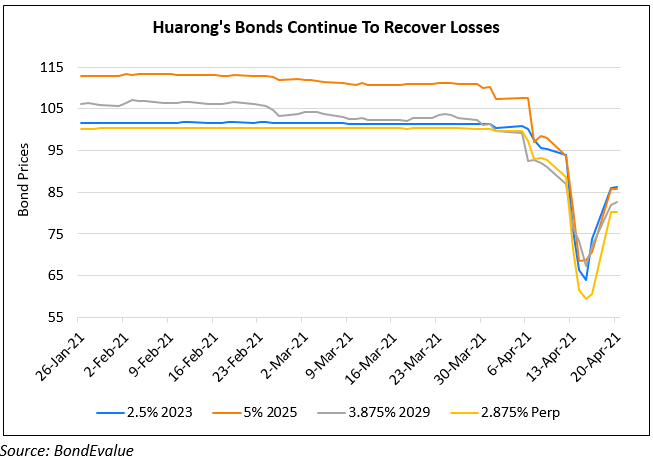

Huarong to Restructure, Exit Units and Downsize to Shore up Finances

August 3, 2021

China Huarong Asset Management Company will restructure a unit and exit another unit in an effort to shore up its finances. Huarong plans a public transfer of its 70% stake in Huarong Consumer Finance to external parties. While the listing price is not known yet, Huarong said that the listing price shall not be lower than the asset valuation results filed with the Ministry of Finance. The bad-debt manager also plans to negotiate with the main institutional creditors of Huarong Trust’s outstanding debt to complete a “debt-to-equity swap and equity transfer”. Huarong is yet to set out a full restructuring plan. Huarong’s board also said that the HKD 3bn ($386mn) of proceeds used from its 2015 IPO will be used to contribute capital and fund support to major subsidiaries. Huarong’s EGM is on August 17 where shareholders will vote on the proposals.

Sources say that Huarong is expected to announce its 2020 financial results before month-end. Regarding the above stake sale and a potential 79.6% stake sale in Huarong Zhongguancun Distressed Asset Exchange Centre, CreditSights says that Huarong is likely to have the support of the Chinese authorities. Once the disposals are completed, it would bolster the parent’s finances and give it greater means to repay outstanding debt obligations. They add that the focus on its core business “slims down its bloated balance sheet and refocuses its energies on its core business of distressed debt management”.

Huarong’s bonds were stable – its 5% 2025s were at 70.6, yielding 14.4%.

For the full story, click here

Go back to Latest bond Market News

Related Posts: