This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

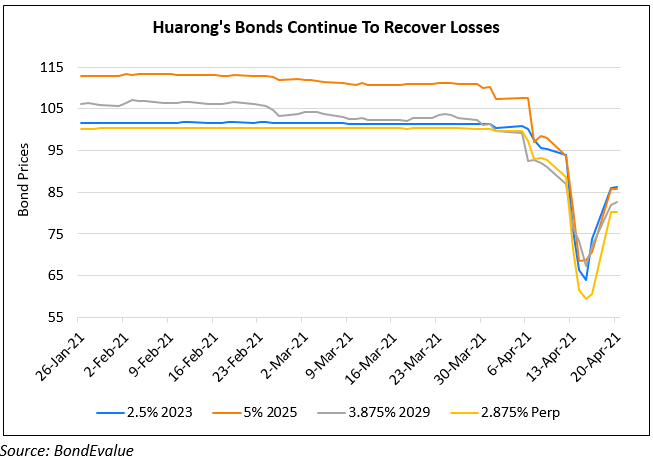

Huarong’s Bonds Surge on Plans to Redeem its Dollar Perp

July 16, 2021

China Huarong’s $500mn 2.875% Perp surged almost 13 cents yesterday to trade over 96 cents on the dollar as the company was said to have started preparations with bankers and lawyers to call back the bond at 100 on its call date of September 14, as per sources. A Huarong representative said the company could not provide an immediate comment on its bond repayment plans. Bloomberg notes that while Huarong doesn’t have an obligation to buy back the bond, most Chinese investment-grade issuers of Perps are expected to exercise their call. In Huarong’s case, failure to call back the bond would heighten concerns about a potential debt restructuring given its financial position is already under scrutiny. The move is a “boost of confidence for Huarong debt across the curve, suggesting the group foresees having enough liquidity to call the perp and is keen to avoid further damage to its reputation,” said Dan Wang, a Bloomberg Intelligence analyst.

Besides Huarong’s 2.875% Perp, its other dollar bonds and Perps also jumped – its 2.031% 2022s were up over 5.5 points to 83. Its 4% Perp callable in September 2022 and 4.5% Perp callable in January 2022 were up 8.1 and 13.4 cents respectively to 67.25 and 76.5 cents on the dollar.

Go back to Latest bond Market News

Related Posts: