This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

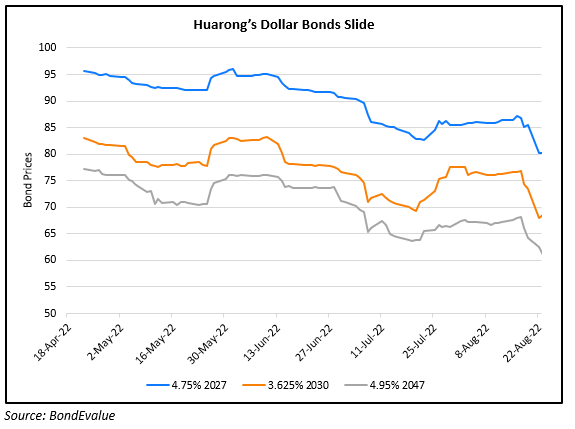

Huarong’s Dollar Bonds Drop over 6% after Profit Warning

August 23, 2022

China Huarong’s dollar bonds filled the losers list yesterday after the bad-debt manager was placed on review for a downgrade by Moody’s. The rating action was taken in response to Huarong’s $2.8bn loss warning last week for 1H 2022 where it said that credit impairment losses “increased significantly” on account of its exposure to China’s distressed property sector. Moody’s said that the number was larger than its expectation and that it would “erode Huarong AMC’s weak equity base and capital positions”. Huarong AMC’s total capital adequacy ratio at the parent level was 12.95% as of the end-2021, just slightly higher than the minimum regulatory requirement of 12.5%. After its recapitalization and bailout in 2021 by CITIC Group, the extent of capital and strategic support by the state-owned conglomerate on Huarong remains to be seen as a key driver of its ratings.

Go back to Latest bond Market News

Related Posts:

Huarong Gets Approval to Raise $11bn bond in Interbank market

November 17, 2021

Huarong Set to Receive $6.6bn via Share Sale

November 18, 2021