This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

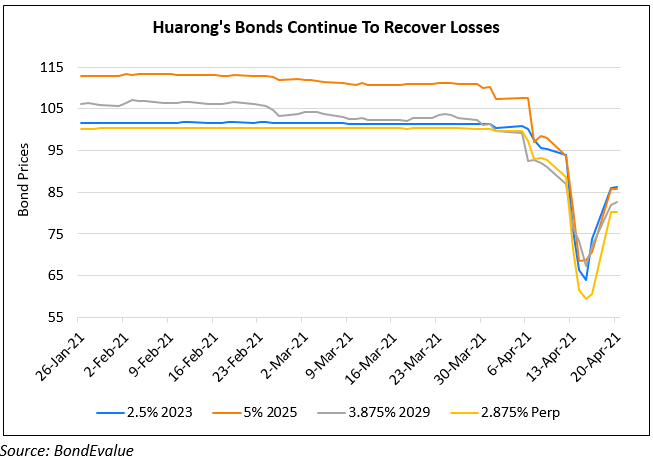

Huarong’s Dollar Bonds Rally; Long Tenor Up ~30%, Short Tenor Up 10-15%

April 20, 2021

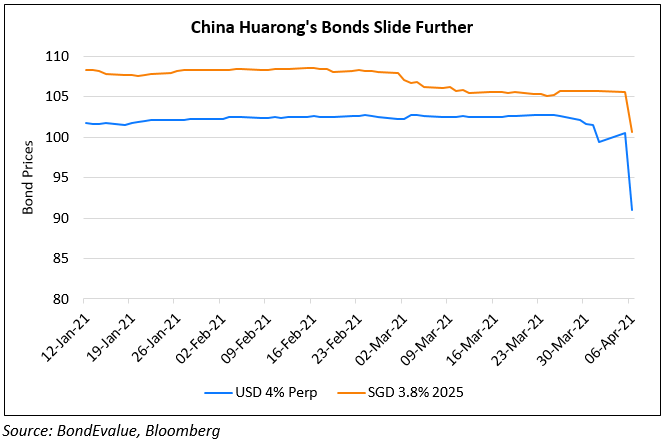

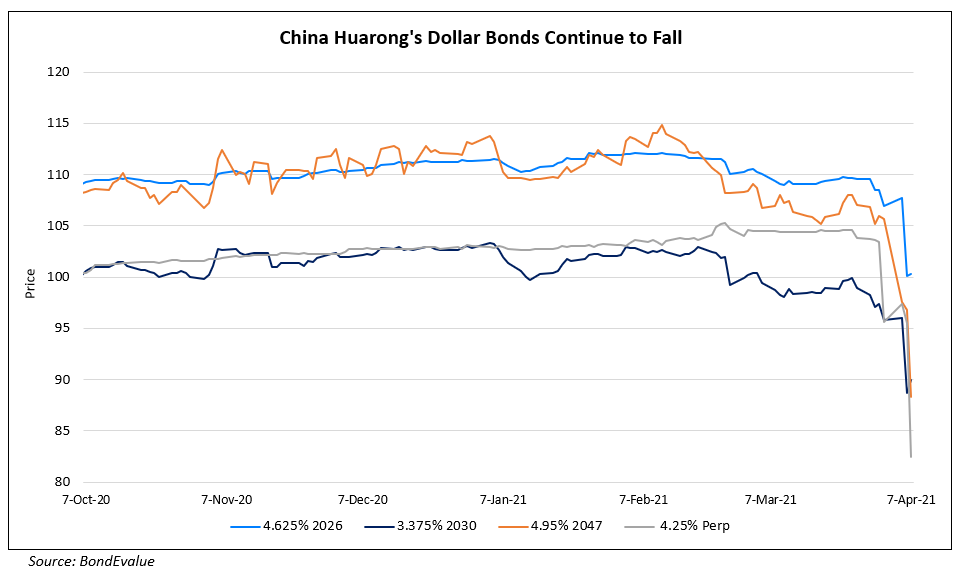

China Huarong’s dollar bonds rallied for a second day after the regulator publicly announced that the company has adequate liquidity. Huarong’s 2.875% Perp rallied the most by 32% to 80.25 and its 4% Perp rallied over 31% to 79.25. Shorter tenor bonds maturing between 2022 and 2025 moved higher by 10-15% as market participants’ worries over the company ease.

Go back to Latest bond Market News

Related Posts: