This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Huarong’s Dollar Bonds See Sharpest Sell-Off Yet Tumbling 15-20%

April 14, 2021

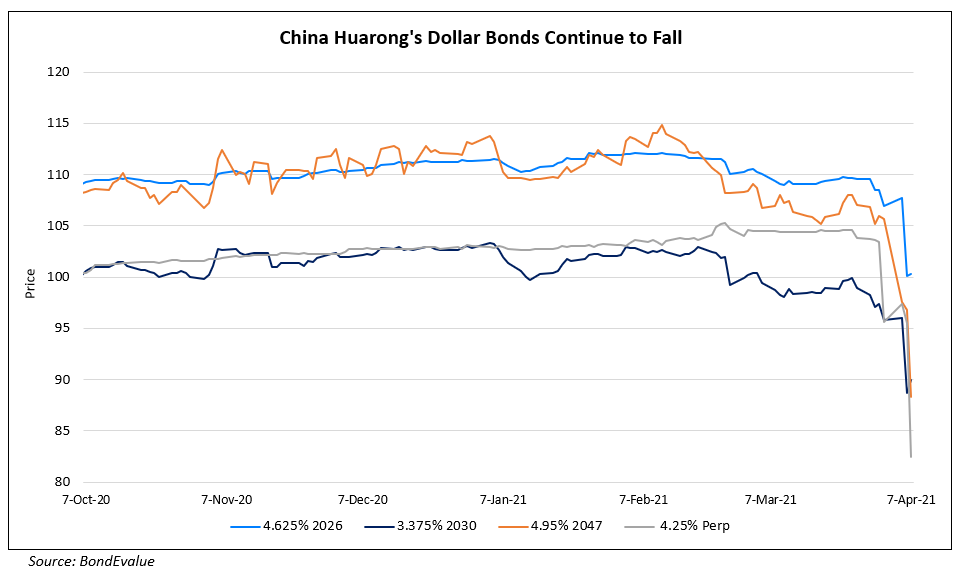

China Huarong Asset Management Company (CHAMC) saw its dollar bonds sell-off over 15-20% yesterday. Concerns about restructuring continues to worry investors with the delay in publishing its results while global major ratings agencies have put the distressed asset manager on review for a downgrade. The government authorities have not disclosed publicly any steps taken towards calming credit markets and some analysts warn of contagion risks. CHAMC tried to assuage concerns by saying that debt payments have been made ‘on time’ and its operations are running as ‘normal’. Despite this, Huarong’s bonds have sold-off and now trade around 75 cents on the dollar from near par/above par a couple of weeks ago. Sources say that the finance ministry is considering transferring its controlling stake in CHAMC to a unit of the nation’s sovereign wealth fund that has more experience resolving debt risks.

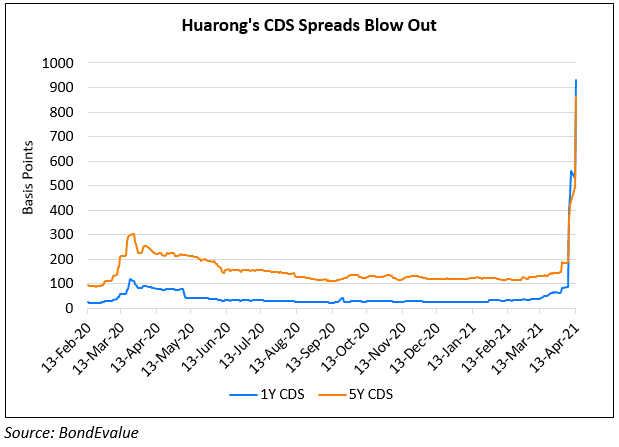

CHAMC’s perps were down over 20% – their 4% Perp is now at 70.7 yielding 10.3% and their 2.875% Perp at 70.6 yielding 10.5%. The largest fall in early trading today can be seen in their 4.25% Perps, down 10.2 cents to 65, yielding 10.1%. As with their bonds, Huarong’s CDS spreads have also exploded (as seen in the chart above) with default risks rising. The 1Y and 5Y CDS spreads have moved from levels of 80bp and 186bp in the beginning of April to 932bp and 860bp currently. Yesterday’s move alone in the CDS spreads were about 400bp each.

For the full story, click here

Go back to Latest bond Market News

Related Posts: