This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

ICBC to the Rescue for Huarong to Meet SGD Bond Repayment

April 28, 2021

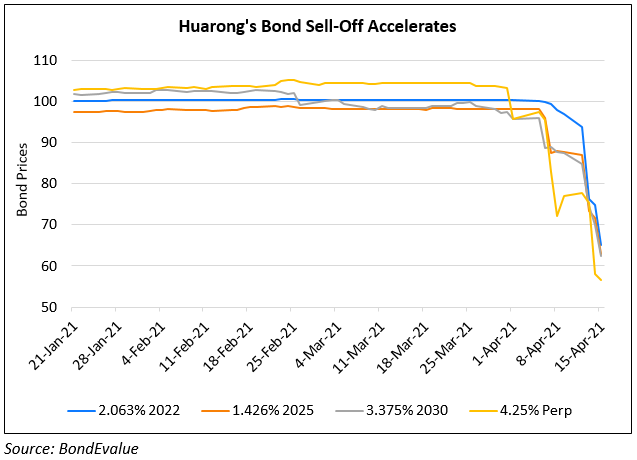

Chinese state-owned banking major Industrial & Commercial Bank of China’s (ICBC) Singapore branch came to the rescue of distressed asset manager China Huarong Asset Management Co. with the former granting a S$600mn ($452mn) loan to the latter to repay its SGD 3.2% bonds due on Tuesday. This marks a vote of support from the Chinese government, which should ease investor concerns to some extent. This comes just a day after Fitch cut Huarong’s rating by three notches to BBB from A citing “a reassessment of the government support factors”. While the loan from ICBC helped Huarong avert a default on its offshore bond, there is still uncertainty as to the current financial position of the company and the extent of government support. The news helped push the SGD 3.2% bonds to 99.5 cents on the dollar from 98.2 on Monday and 94.6 last week. Its other offshore bonds have had a bumpy ride on the secondary markets with most falling to 60-70 cents on the dollar on April 15 before recovering some of the losses to trade above 80 levels and finally now settling at ~75 cents on the dollar. It’s 4.25% and 4.5% perps however continue to trade at distressed levels of 55.65 and 66.30 respectively.

For the full story, click here

Go back to Latest bond Market News

Related Posts: