This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

ICBC, Trafigura Launch $ Bonds; ABN, Rabobank, Europcar Downgraded; China SOEs on Pentagon List Raise $4.3bn in Bonds

September 16, 2020

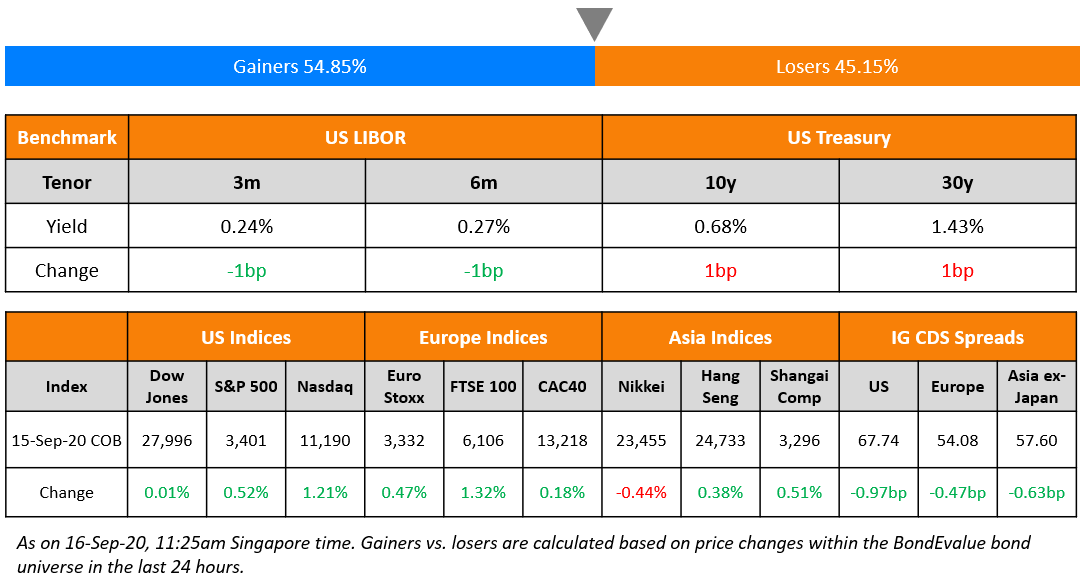

Better economic data improved sentiment and lifted US and European markets as the FOMC meeting got underway. US factory output climbed 1% and Germany’s ZEW economic sentiment index came at 77.4 vs. 71.5 expected. Investors will look to the Fed meeting for further clues on monetary policy. Apple’s new product launches didn’t inspire any big moves as the stock was only higher by 0.16% for the day but other technology stocks outperformed with the Nasdaq gaining around 1.2%. Retail and mining stocks helped European shares higher. US Treasuries were still stuck in a narrow range with the 10-year hovering unchanged around 0.68%. CDS spreads globally narrowed on the improved sentiment. Asian markets are having a quiet open this morning.

.jpg?upscale=true&width=1400&upscale=true&name=NL-All-Modules%20(2).jpg)

New Bond Issues

- ICBC $ Perp NC5 AT1 preference share @ 3.95% area

- Trafigura Group $ 300mn 5yr @ 6.375% area

- Scentre Group $ 60NC6/60NC10 @ low 5%/mid 5%

.png?upscale=true&width=1200&upscale=true&name=New%20Bond%20Issues%2016%20Sep%20(1).png)

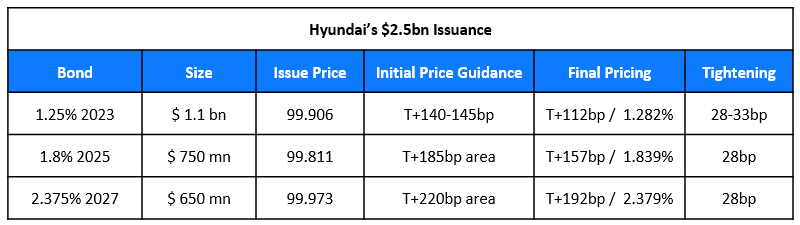

Hyundai Capital America raised $2.5bn via a triple-tranche bond offering. The bonds are rated Baa1.

The operator of the world’s largest hydropower plant China Three Gorges Corp raised a total of $1bn via a dual-tranche bond offering. It raised $500mn via 5Y bonds to yield 1.3%, 115bp over Treasuries and 30bp inside initial guidance of T+145bp area. It also raised $500mn via 10Y bonds to yield 2.15%, 150bp over Treasuries and 35bp inside initial guidance of T+185bp area. The bonds, with expected ratings of A1/A+/A, received total final orders over 2.6bn, 2.6x issue size.

Bangkok Bank raised $750mn via a Perpetual non-call 5Y (PerpNC5) AT1 bond to yield 5%, 40bp inside initial guidance of 5.4% area. The bond is expected to be rated Ba1. The coupon resets every five years from 2025 to the then prevailing 5Y Treasury yield plus the initial spread of 472.9bp with no step-up. The bond has a dividend stopper and will be written down if the bank’s core equity Tier 1 ratio is less than 5.15% or if there is a non-viability event, as determined by the Bank of Thailand.

Qatar National Bank raised $ 600mn via a 5Y debut green bond to yield 1.679%, 135bp over Mid-Swaps and 25bp inside initial guidance of T+160bp area. The bonds have expected ratings of Aa3/A/A+.

South Korea’s Tongyang Life Insurance raised $300mn via a 30Y rolling Perpetual non-call 5Y (PerpNC5) bonds to yield 5.25%, 12.5bp inside initial guidance in the 5.375% area.The bonds, with expected ratings of Baa3/BBB, have a coupon reset every five years from 2025 to the prevailing 5Y Treasury yield plus the initial spread of 498.1bp, with a 100bp step-up from year 2030 if the bond’s maturity is extended from 30Y to perpetuity. The bond also has a dividend stopper and a pusher.

The Hong Kong-listed Chinese real estate company Times China Holdings raised $350mn via 5.5Y non-call 3Y (5.5NC3) bond to yield 6.2%, 25bp inside initial guidance of 6.45% area. The bonds, with expected ratings of B1/B+, received final orders over $1.3bn, 3.71x issue size. Proceeds of the new bonds include financing a concurrent tender offer for its $500mn 6.25% 2021s at $1,008 per $1,000 in principal plus accrued and unpaid interest. The deadline of the tender offer is September 22 and capped at $350mn.

Japanese trading company Marubeni raised $500mn via 5Y bonds to yield 1.319%, 105bp over Treasuries and 30bp inside initial guidance of T+135bp area. The bonds are expected to be rated Baa2/BBB.

Rating Changes

Fitch Downgrades ABN AMRO’s Long-Term IDR to ‘A’; Outlook Negative

Fitch Downgrades Rabobank’s IDR to ‘A+’, Outlook Negative; Affirms VR

Moody’s downgrades 13 Turkish banks; outlooks remain negative

Fitch Revises de Volksbank’s Outlook to Stable; Affirms IDR at ‘A-

Future Retail Ltd. Assigned ‘CCC-‘ Rating With Developing Outlook; Senior Secured Notes Rated ‘CCC-‘

ChemChina, Three Gorges & AVIC Manage to Raise ~$4.3 Billion via Bonds Despite Being on The US Potential Sanctions List

China state-owned China National Chemical Corp (ChemChina), China Three Gorges and Aviation Industry Corporation (AVIC) sent a strong message by successfully issuing new bonds worth a total of ~$4.3bn despite being placed on the US list of “Communist Chinese military companies“. While implications of being placed on this list are unclear, it is seen as a threat of potential sanctions to come if relations between the two largest economies worsen. While ChemChina raised ~3bn via a five-tranche dollar and euro issuance priced yesterday, China Three Gorges and AVIC raised $1bn and $300mn respectively via dollar bonds priced this morning (details in the New Bond Issues section). Interestingly, being placed on the list did not deter US banks from participating in the issuance as Bank of America, Goldman Sachs, JP Morgan and Morgan Stanley ran the ChemChina and Three Gorges deal, along with other large banks. Further, as per the order book details of the Three Gorges deal, investors bid worth $1.4bn and $1.2bn for the 5Y and 10Y tranche respectively. Of the orders, 41% ($574mn) and 56% ($672mn) came from US-based investors, 55% ($770mn) and 42% ($504mn) from APAC-based investors and the balance from EMEA. As per IFR, ChemChina reassured investors by stating in its bond prospectus that being added to the list had no impact on its collection of payments. One of the bookrunners said, “There was no real impact from being on the Pentagon list. Investors are familiar with the issuer and just needed to check internally that there was no problem buying the bonds.” However, ChemChina’s new bonds fell by 0.20-0.90 points on the secondary market with its 3% and 3.7% bonds due 2030 and 2050 falling to 99.38 and 99.08 from issue price of 99.86 and 100 respectively. AVIC’s 3.3% bonds due 2030 also fell ~0.50 points to 97.69 from issue price of 98.23.

For the full story, click here

Hyflux Suitor Widjaja Receives Warm Response from Creditors

Pison Investments, which is controlled by Indonesian businessman Johnny Widjaja informed markets via an exchange filing that it has received 158 applications, representing a “significant portion of eligible creditors” for its tender offer to buy Hyflux’s senior unsecured bonds. Pison said that it is considering an extension of its tender offer, which ended on September 4. Pison’s offer, made on July 13 includes a minimum discount of 91%, implying a maximum recovery of 9% for its debt holders. However, the offer has been rejected by a group of seven banks that constitute the unsecured working group (UWG), which has moved to place the troubled water treatment company in judicial management. A hearing at the Singapore High Court is scheduled for October 14. The banks in the UWG are Mizuho Bank, KfW, Bangkok Bank, BNP Paribas, Standard Chartered Bank, CTBC Bank and Korea Development Bank, collectively owed more than S$900m ($662mn).

For the full story, click here

Mexico Takes The Lead in Issuance of Sovereign Sustainable Development Bonds

Mexico raised €750mn (~$890mn) via 7Y 1.603% yielding sustainable bonds, the world’s first sovereign bonds linked to the United Nations’ sustainability development goals. The bonds met with solid investor demand as orders stood at 6.4x issue size. The bond’s coupon of 1.35% is the second lowest on record offered by Mexico for a euro denominated bond. This agrees with the current global trend of issuance of sustainable bonds and follows issues by European corporates Orange SA and Burberry. Mexico’s Deputy Finance Minister Gabriel Yorio tweeted in Spanish that “Mexico is the first country to issue a sovereign sustainable linked to the development objectives of the UN. Thus, our country begins its sustainable financing program, placing itself at the forefront in this type of financial instruments”. According to a UN Development Programme statement, “Mexico has become the first country in the world to issue a Sovereign Sustainable Development Goals (SDGs) Bond, an important step forward in the country’s commitment to the achievement of SDGs and a major advance for development finance”. However, the government is still to specify the use of proceeds and the investment provisional prospectus does not guarantee that the projects funded by the issuance meet the UN characteristics.

For the full story, click here

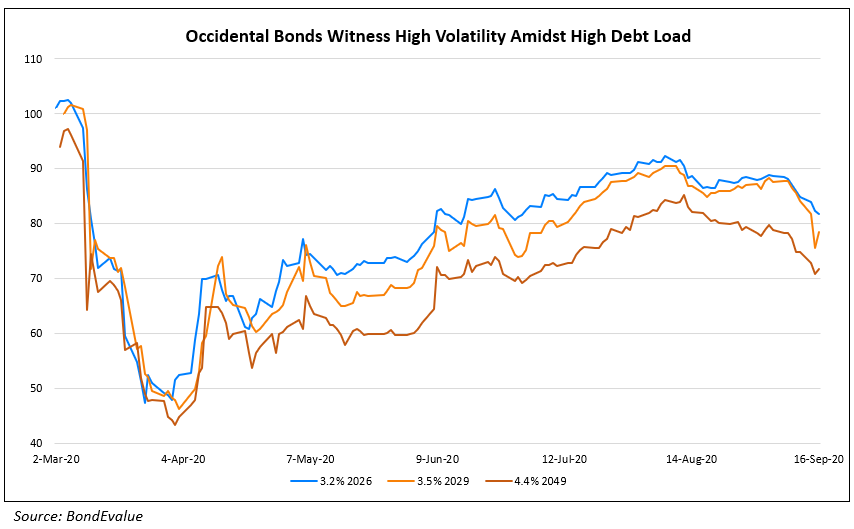

Occidental Petroleum’s Bonds Witness Increased Volatility on Fears Over Hurricane Sally & Its Huge Debt Load

One of the companies to be hit hardest by the pandemic and low oil prices is Occidental Petroleum. The company reported dismal Q2 earnings in August and is sitting on a huge debt pile.The debt of the company had increased to the current high levels due to its ~$57bn acquisition of Anadarko Petroleum late last year. The payment of $31.8bn in cash and $25.6bn in other costs pushed the long term debt burden of the company to $38.5bn, which includes a $2.5bn payout this year. Bloomberg had reported on August 11 that the company’s operations could reduce to a single oil rig due to slowdown in the shale industry. Last year, Occidental and Anadarko had 12 and 10 operational rigs respectively. The reduced operations have squeezed the cash flows of the company. The strategic plans of consolidation in the shale industry were executed at an unfortunate timing as the pandemic has led to reduced demand for petroleum products and low oil prices.

The shares of the company have nosedived this year. The OXY stock was down 70%YoY and 22% in the last one month alone. The bonds were down to a record level in April before recovering in the subsequent months. These have witnessed a period of volatility in September and their prices are down ~4% to 5%. The bonds also seemed to have reacted to the news of the impact of Hurricane Sally on Occidental’s Gulf platforms. The platforms, which are no longer in the path of the hurricane were expected to be hit by the hurricane till September 14. The bonds were down over the one week and have nudged up today. Its 3.2% bonds due 2026 traded at 81.75 cents on the dollar, down 0.63 points while its 3.5% bonds due 2029 and 4.4% bonds 2049 bonds traded at 78.5 and 72.79 cents on the dollar, up 3 and 1 point respectively.

Term of the Day

144A Bonds

144A bonds refer to privately placed debt instruments that can be traded among qualified institutional buyers (QIBs) and with a shorter holding period of six months. These bonds get their name from Rule 144A, which exempts the securities from SEC registration that typically requires extensive documentation and a two-year holding period. 144A bonds can be issued with a lesser amount of documentation as the underlying assumption is that QIBs are sophisticated investors who do not need the same level of information and protection as individual investors. The SEC defines a QIB as institutional investors that have at least $100mn in assets under management.

In an interesting op-ed in the FT, Ellen Carr, a portfolio manager at Weaver Barksdale critiques the 144A rule for its restricted access to large institutions only. She gives the example of cruise operator Carnival Corp’s 3Y first lien bond offering a 11.5% coupon priced at 99 in April. The bond has since rallied to currently trade at 112 on the back of first lien on its collateral. However, this bond along with other attractive high yield issues are out of reach of individual investors as these are 144A bonds accessible to QIBs only. As per JP Morgan, 72% of new high-yield issues in 2020 are 144A, indicating that issuers prefer this structure given the strong demand from institutions and lesser documentation involved.

Talking Heads

“The hope is that we’ll still get to a deal,” Kushner said. “It may have to happen after the election, because there obviously are politics involved. This is Washington.” “We do think there is a need for another intervention, we’ve reached out to Congress, we’ve been negotiating,” he said. “There’s a lot of posturing, some differences of opinion.”

“The BOE’s not done,” said Rossiter. “More quantitative easing is necessary and this meeting does provide a bit of an opportunity to shift things in that direction. The big cliff coming is on the employment side.”

“The data underscore that the ECB has now probably moved to a steady purchase pace of just above €100bn per month,” Rieger said.

On Venezuela’s proposal to bondholders for eventual restructuring of defaulted bonds

Delcy Rodriguez, Venezuela’s new finance minister

“We are announcing a conditional offer to interrupt certain entities to avoid investors from being affected,” Rodriguez said.

Asdrubal Oliveros, a director at the Caracas-based research firm Ecoanalitica

The idea “does not make much sense within the framework of U.S. sanctions,” said Oliveros. “Under Venezuela’s current conditions, with a 75% drop in its dollar revenue this year, the country will hardly have the ability to enter a cycle of debt restructuring.”

Ray Zucaro of RVX Asset Management LLC in Miami.

According to Zucaro, the ultimate motive may be trying to get U.S. investors to push the Trump administration to loosen the sanctions that have crippled Venezuela and left it locked out of mainstream financial markets. Are you familiar with the expression ‘with a grain of salt?’ In this example, I would say like 10 kilos of salt,” Zucaro said. “It’s a no-brainer: They’re trying to get foreign creditors to lobby on their behalf.”

Good quality corporate bonds are preferable to low-yielding Treasuries for such a role, Cheang said in emailed comments. Together with gold, they can help portfolios weather “short-term volatility potentially arising from a contested election,” Cheang added.

The head of macro strategies at Record Currency Management, which oversees $63 billion in assets, is shorting government bonds of Spain, France and Italy — as well as the euro itself — on the expectation that Turkey’s market ructions will soon be felt on the balance sheets of European banks. “It’s a Turkey trade, but also it’s not just a Turkey issue,” New York-based Floyd said in an interview. “Europe is severely challenged. Their economies are weakening, Covid-19 is increasing again, unemployment is very high, debt levels are very high, they are in a straitjacket of being in the single currency.”

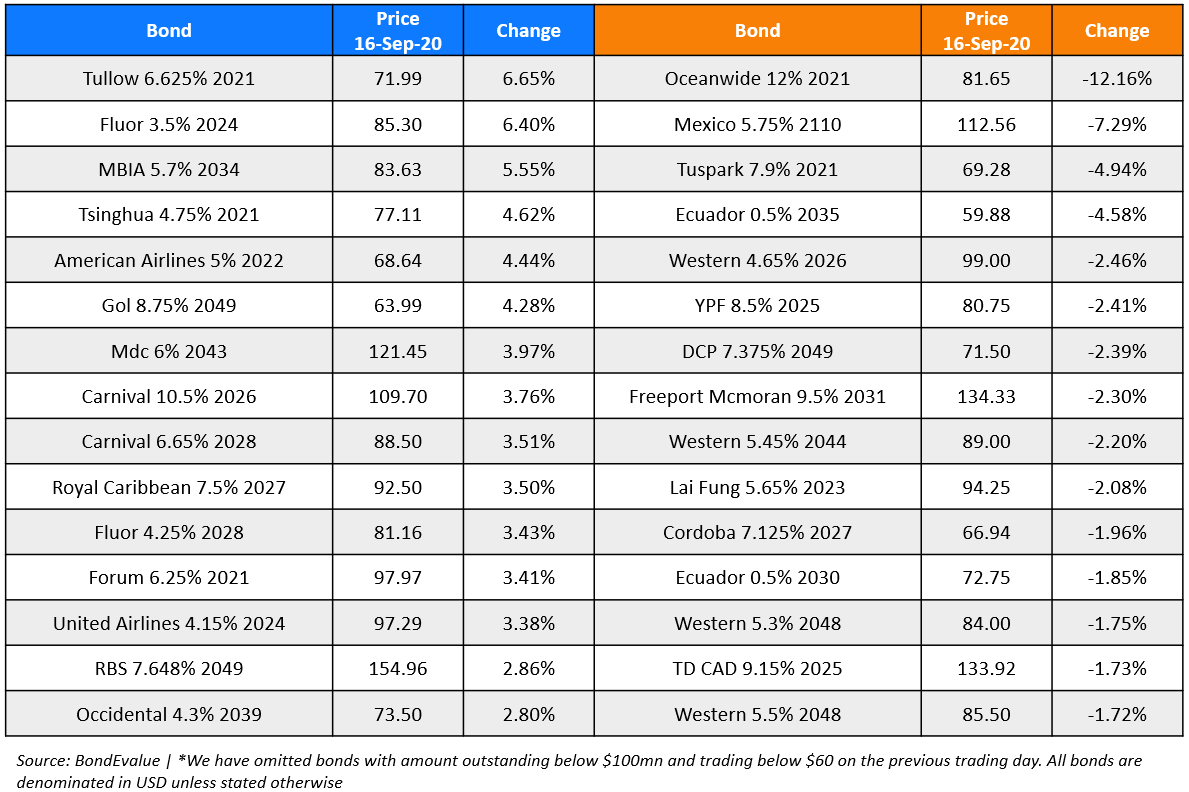

Top Gainers & Losers – 16-Sep-20*

Go back to Latest bond Market News

Related Posts: