This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Investors Continue to Dump Huarong Bonds on Reports of Restructuring

April 7, 2021

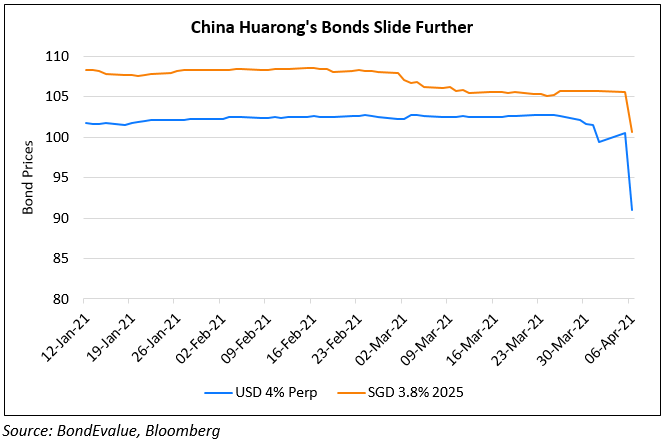

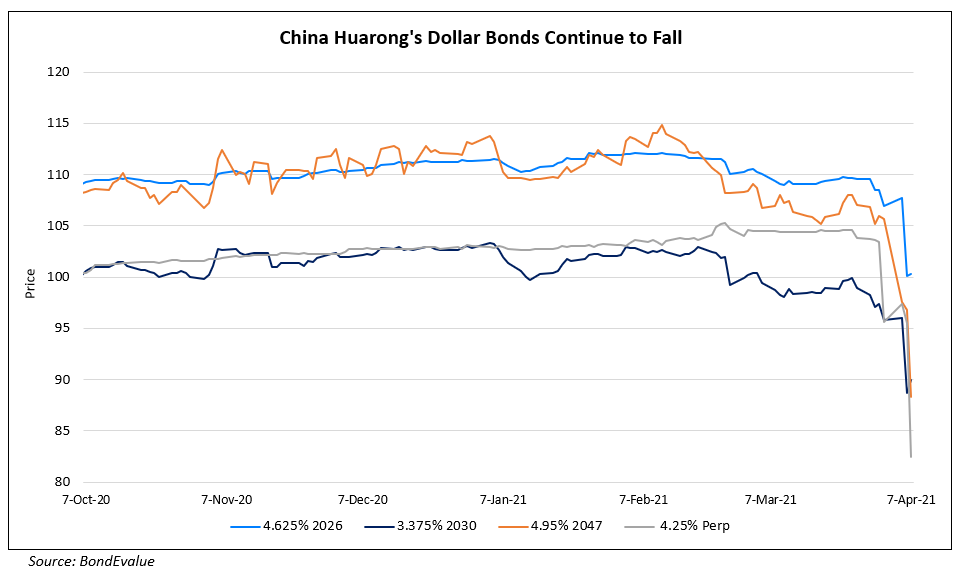

Tuesday marked another grim day for China Huarong’s dollar bonds as investors continued to sell amid reports of a financial restructuring coming up at one of China’s largest asset managers. As per Bloomberg, the company had submitted “financial restructuring, recapitalization and other major reform plans” to its major shareholders and government authorities for approval, reported by Chinese media group Caixin. The media group further said that this was the primary reason for a delay in releasing its annual earnings. However, there have been no official notice of such a restructuring by the company. Most of Huarong’s dollar bonds have been trading lower with its 2047s and perps falling the most followed by its relatively shorter tenor bonds.

Go back to Latest bond Market News

Related Posts: