This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Investors’ Hunt for Yield Leads to US Junk Bond Yields Dropping to Record Lows Below 4%

February 9, 2021

Yields on US junk bonds, measured by the yield on the Bloomberg-Barclays US Corporate High Yield Index, have been tightening for six straight sessions to reach record lows below 4% on Monday.

Positive investor sentiment driven by ultra-low interest rates, huge stimulus programs and Covid-19 vaccine rollouts have led yield-hungry investors to lap up junk-rated bonds since the new year began with record issuance of $52bn, the highest-ever January issuance. Yields have been falling across the board within junk-rated bonds with even CCC-rated average bond yields dropping to record lows of 6.21% despite being just three notches above default. David Norris, head of U.S. credit at TwentyFour Asset Management said, “This robust new issue pipeline of lower-quality credit is worth poring over as there are likely to be some good stories in here for investors with sufficient liquidity to get involved.”

For the full story, click here

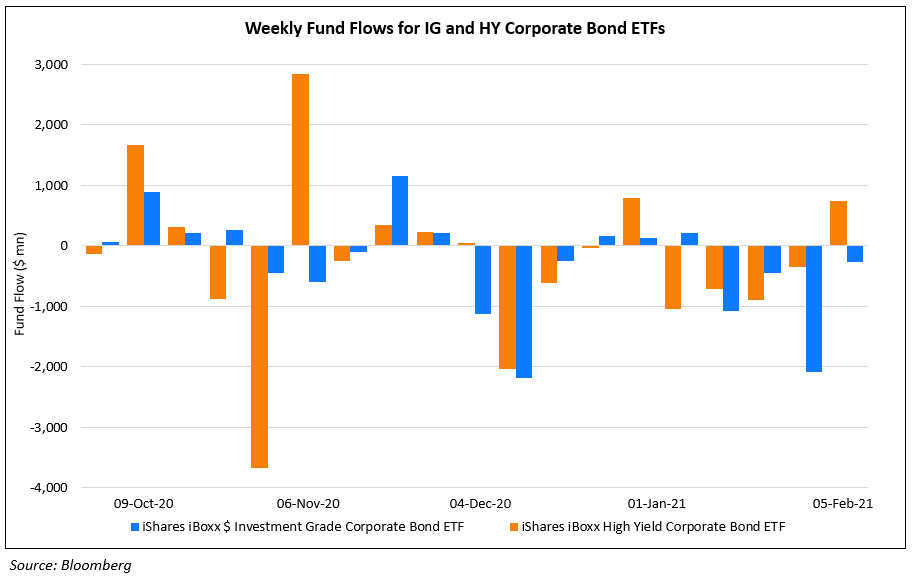

The iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) witnessed weekly outflows of $2.08bn and $270mn for the weeks ended January 29 and February 5, which indicates the investors are moving out of IG credit. The iShares iBoxx $ High Yield Corporate Bond ETF (HYG) ETF on the other hand witnessed outflows of $340mn and inflows of $750mn for the same two weeks.

Go back to Latest bond Market News

Related Posts:

1, 2, 3, 4th Fed Hike!

June 14, 2017

Fed’s Dudley Shakes Up Complacent Markets

June 20, 2017