This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Kaisa, ESR, CK Infra Launch Bonds; Macro; Rating Changes; New Issuer; Talking Heads; Top Gainers & Losers

May 24, 2021

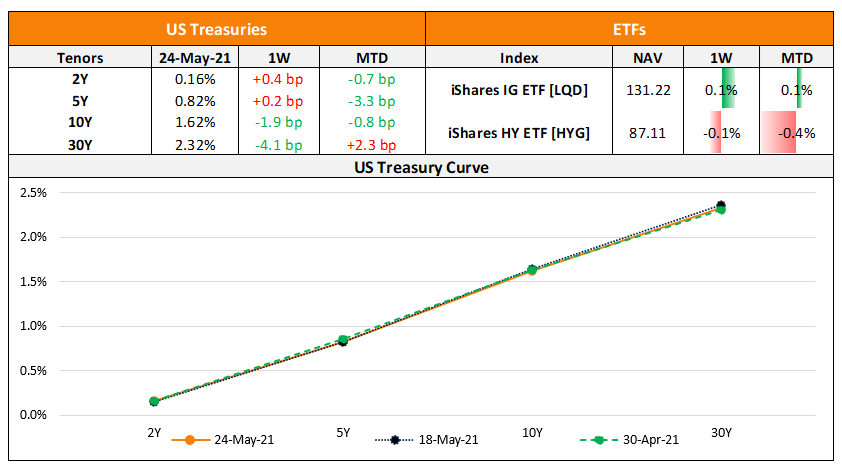

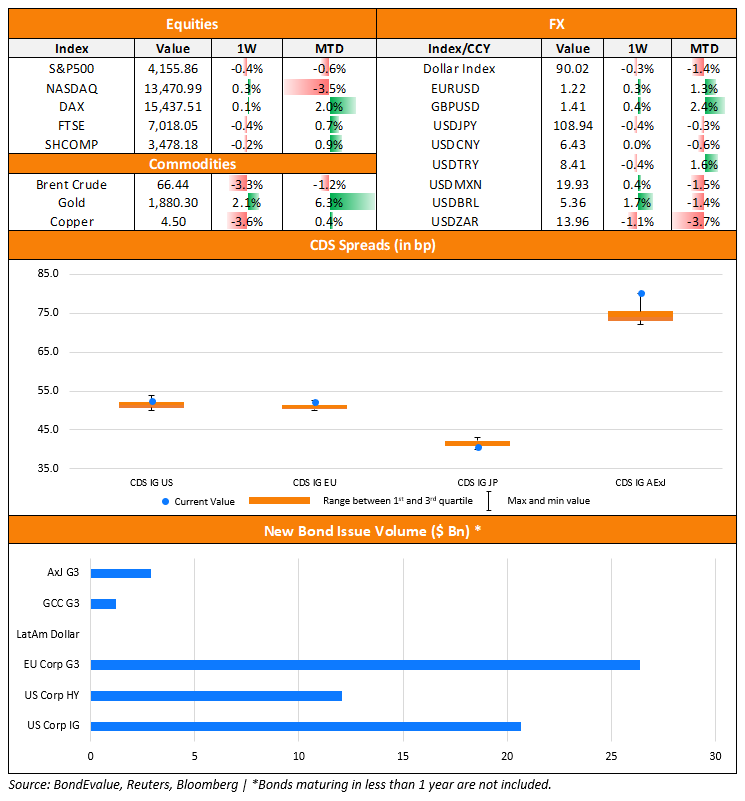

US markets ended lower on Friday mainly pulled down by the tech and consumer discretionary sectors. S&P was marginally down by 0.1% while Nasdaq was down by 0.5%. While Apple dropped 1.5%, Amazon 1.4% and Tesla 1%, Nvidia continued trending higher by 2.6%. US 10Y Treasury yields fell ~1bp to 1.62% as the Dallas Fed data indicated that they expected lower growth in jobs in the US for May, stating that while business hiring demand remains high, the supply of people willing or able to work is lower. In European Indices, FTSE ended flat while DAX and CAC were up 0.5% and 0.7%. US IG CDS spreads were 0.2bp wider and HY spreads were 1bp tighter. EU main spreads were 0.6bp wider and crossover spreads were 3.3bp wider. Asian equities have witnessed a mixed start – Nikkei and Shanghai are up 0.5% and 0.2%, Hang Seng is down ~0.3% with Asia ex-Japan CDS spreads widening 0.4bp.

Do you invest or plan to invest in CoCo/AT1 bonds?

If yes, do attend the upcoming masterclass conducted by debt capital market professionals Pramod Shenoi, Head of Research APAC at CreditSights and Rahul Banerjee, Founder and CEO at BondEvalue. The session will cover understanding the AT1 structure, common features & covenants, and how to pick the right AT1 bond(s) for you. Click on the banner below to register.

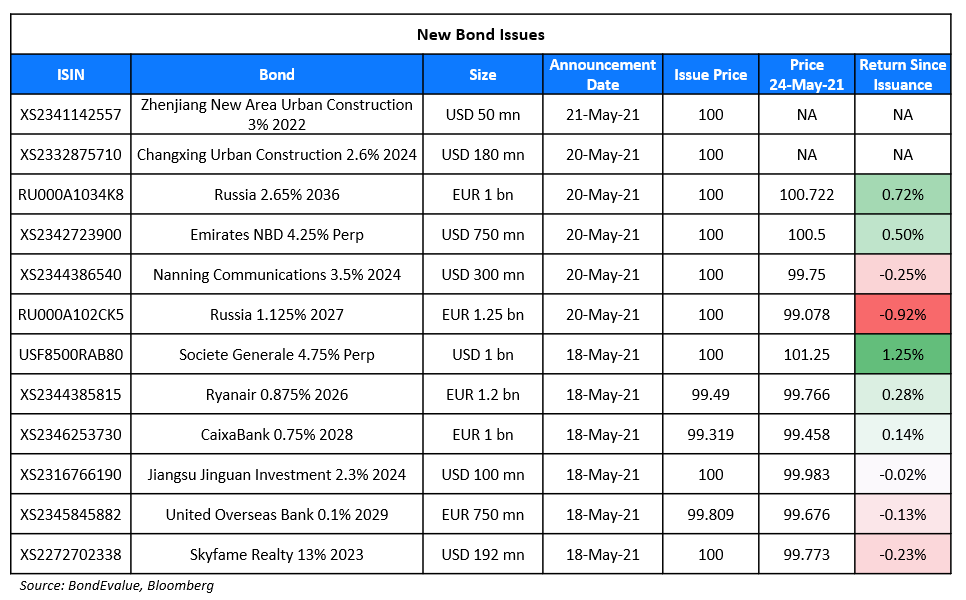

New Bond Issues

- Kaisa Group $ 5NC3 sustainable notes at 12% area

- CK Infrastructure $ fixed-for-life sub PerpNC5 at 4.5% area; books over $600mn

- ESR Cayman tap of S$ 5.65% PerpNC5 at 100 area/5.64% YTC

- Guoren Property and Casualty Insurance $ 5Y IPG T+300bp area; books over $1.75bn

New Bond Pipeline

- Chinalco hires for $ senior bonds

- CMB International Capital $ bond

- Jiujiang Municipal Development Group hires for $ bond

- Shandong Fi-nance Investment hires for $ bond

- AAC Technologies Holdings $ bond offering

- Jiangsu Shagang Group $ bond issue

- Jinke Property Group hires for $ bond issue

- Zhongyu Gas hires for $ bond offering

- Maldives HDC $ sukuk

Rating Changes

- Italian Utility Edison SpA Upgraded To ‘BBB’ By S&P On Improved Performance And Credit Metrics; Outlook Stable

-

Fitch Upgrades Postal Savings Bank of China’s VR to ‘bbb-‘; Affirms Long-Term IDR at ‘A+’

-

Fitch Upgrades Agricultural Bank of China’s VR to ‘bbb-‘; Affirms Long-Term IDR at ‘A’

-

Fitch Upgrades ICBC’s VR to ‘bbb’, Affirms Long-Term IDR at ‘A’: Outlook Stable

- Fitch Affirms Banco Industrial’s IDR at ‘BB-‘; Outlook Revised to Stable

- Moody’s changes outlook on Peru’s A3 rating to negative; affirms ratings

- Moody’s changes Tapestry’s outlook to stable; affirms Baa2 senior unsecured rating

- Moody’s changes Brinker’s outlook to positive; affirms B1 CFR

- Moody’s changes outlooks of three Korean regional banks to stable from negative; affirms ratings

The Week That Was

US primary market issuance dipped to $33.5bn, down 34% vs. $50.8bn in the week prior. The drop can be attributed primarily to IG issuances, which were at $20.7bn vs. $37.2bn in the prior week while HY issuances were at $12.1bn vs. $12.7bn in the prior week. The largest deals in the IG space were led by UnitedHealth’s $6bn four-trancher followed by BofA’s €4bn ($4.8bn) and Athene Global Funding’s $1.5bn issuance. In the HY space, Square’s $2bn two-trancher and Tenet Healthcare’s $1.4bn led the issuances. In North America, there were a total of 68 upgrades and 28 downgrades combined across the three major rating agencies last week. LatAm saw no new dollar bond deals last week. EU Corporate G3 issuance saw a marginal increase last week to $26.3 vs. $25.1bn in the week before led by HSBC’s $5bn dual-trancher, Credit Suisse’s €1.5bn ($1.8bn) and DTEK’s €1.35bn ($1.64bn) deals. Across the European region, there were 32 upgrades and 12 downgrades across the three major rating agencies. GCC bond and sukuk G3 issuances were at $1.2bn vs. a mere $33mn in the week prior – Emirates NBD’s $750mn AT1 led the list followed by QIB’s $150mn Sukuk. Across the Middle East/Africa region, there was 1 upgrade and downgrade each, across the three major rating agencies. APAC ex-Japan G3 issuances were lower at $4.7bn vs. $9.9bn in the prior week – National Australia Bank led with a $1.25bn issuance followed by UOB’s €750mn ($900mn) covered bond and CIMIC’s €510mn ($611mn). In the Asia ex-Japan region, there were 15 upgrades and 6 downgrades combined across the three major rating agencies last week.

Term of the Day

Fallen Angel

A fallen angel is a company whose credit rating has been cut from investment grade to junk due to deteriorating financial conditions of the company. The downgrade to junk may have a negative impact on its bond prices as asset managers that are mandated to hold only investment grade debt are forced to sell off their holdings in the fallen angels.

The Colombia sovereign was recently downgraded by S&P to junk (BB+) from investment grade (BBB-) while it still maintains an IG rating from Moody’s and Fitch.

Talking Heads

“There’s just going to be a sequence of these temporary factors that are going to persist probably through the end of the year,” Daly said. “They will start to roll off at the beginning of next year. How many of them will roll off or whether other bottlenecks will emerge as we start to get the economy back into shape and get back into recovery is hard to say.”

”I don’t want to front run the committee discussions by coming down on any particular thing because we’re not in a place where that’s been decided,” Daly said. “You would hear that first from the chair and he has signaled that we’re not ready to start talking about talking about these types of things.”

“It is something that, in my mind, we should start to have a conversation about sooner rather than later,” Harker said.

“We are committed to preserving favourable financing conditions using the PEPP [Pandemic Emergency Purchase Programme] envelope, and to do so until at least March 2022.” “It’s far too early and it’s actually unnecessary to debate longer-term issues. Our focus in June is going to be on favourable financing conditions for the economy at large and to all sectors.” “I have repeatedly said that policymakers needed to provide the right bridge across the pandemic, well into the recovery, so we can actually deliver on our mandate,” she said.

Jan von Gerich, chief strategist at Nordea Markets

“Volatility will increase now that there are more competing drivers and increasing questions about the ECB’s willingness to buy bonds aggressively.”

Peter Chatwell, Mizuho International’s head of multi-asset strategy

“The risk of a premature tightening is lower than in the past, and is currently over-estimated by market participants.”

Imogen Bachra, European rates strategist at NatWest

“The key thing for Italy is that the ECB – and central banks in general – is that they will be the last to believe and react to the inflation story.” “The recovery story should be a bigger positive for Italy than the withdrawal of ECB support.”

Leo Hu, fund manager at NN Investment Partners

“People are still worried interest rates have to rise and they are looking for yield and interest-rate duration.”

Jens Nystedt, a fund manager in New York at Emso Asset Management

“We have been allocating more to frontier sovereign credits.” “In particular, we like the outlook for Nigeria, Ghana and Angola given that they would be some of the main beneficiaries from higher oil prices.”

Edgardo Sternberg, co-manager for emerging-markets debt portfolios at Loomis Sayles & Co

“There are quite some risks, such as the worsening of the pandemic or too much stimulus, but we stick with the rosier scenario for frontier markets.” “Frontier markets should continue to outperform,” he said.

Iris Pang, chief economist for Greater China at ING Bank NV

“As credit risk increases, everyone wants to limit their exposure by investing in shorter maturities only,” said Pang. “Issuers also want to sell shorter-dated bonds because as defaults rise, longer-dated bonds have even higher borrowing costs.” On the cycle of refinancing and repayment risk, “it may last for another decade in China,” she said.

Wu Zhaoyin, chief strategist at AVIC Trust Co

“It’s difficult to sell long-dated bonds in China because there is a lack of long-term capital,” Wu said.

William Jackson, chief emerging markets economist for Capital Economics Ltd.

“The downgrade of Colombia to junk status on its foreign currency credit rating reflects the deterioration in its fiscal dynamics and could be a prelude to further downgrades.” “That, to us, seems quite likely given the political difficulty of passing tax reform.”

Guido Chamorro, co-head of emerging-market hard-currency debt at Pictet Asset Management Ltd

“Colombia is still technically investment grade, but this is just semantics,” Chamorro said. “Downgrades are typically get priced by the time they happen.”

On investors increasingly drawn to ESG bonds – Andrew Inwood, founder and principal of CoreData

“These findings indicate that difficulties assessing and benchmarking the sustainability credentials of ESG bonds are acting as a barrier to stronger growth,” said Inwood.

“Long bonds as your hedge worked in a Goldilocks era.” “But now, due to the pandemic response, that old dynamic simply no longer applies. Inflation is a volatility catalyst.” “Only in the case of an extreme inflation overshoot would the Fed’s hands be tied.”

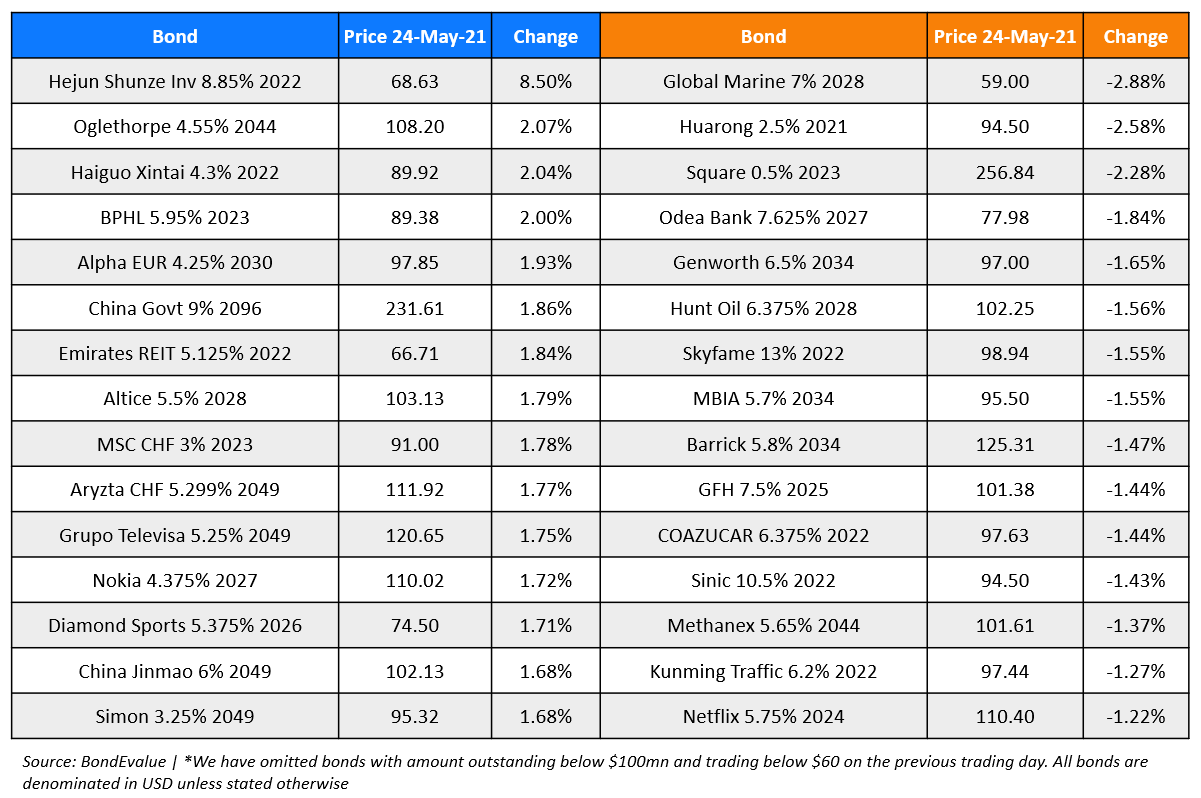

Top Gainers & Losers – 24-May-21*

Go back to Latest bond Market News

Related Posts: