This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Kaisa’s Dollar Bonds Recover as the Developer Plans Partial Buyback

October 18, 2021

Chinese developer Kaisa Group said in a statement to Bloomberg News, that it plans to repurchase part of its 6.5% dollar bond due December 7, 2021 to bolster market confidence. The company said it wired some funds from onshore to Hong Kong for the planned early redemption and that it will choose “appropriate timing” to carry out the buyback depending on the market situation. It added that the objective of the buyback was to optimize its debt structure and reduce leverage. Kaisa also mentioned that it doesn’t rule out the possibility to repurchase more bonds. Separately, Kaisa said that it the paid the coupon due on its 11.25% 2022s on October 9, 2021.

Kaisa’s 6.5% 2021s jumped 11.5 cents (17.3%) on Friday to 77.97 cents on the dollar whilst its other bonds were up 2-3 points to trade around 40 cents on the dollar.

Go back to Latest bond Market News

Related Posts:

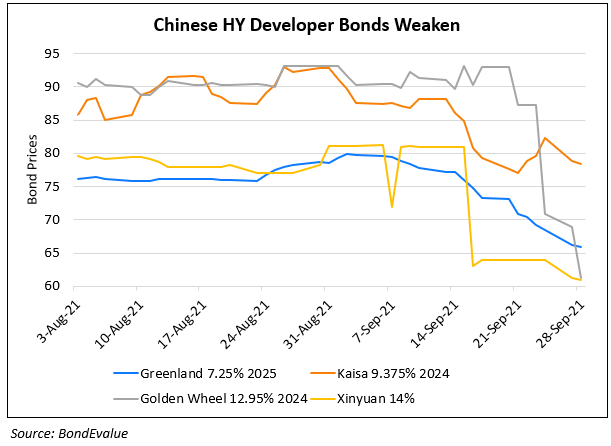

China Property Developers’ Bonds Trend Lower

June 1, 2021

Other Chinese Developers’ Dollar Bonds Move Further Lower

September 28, 2021