This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

KT Corp Launches $ Bond; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers & Losers

July 14, 2021

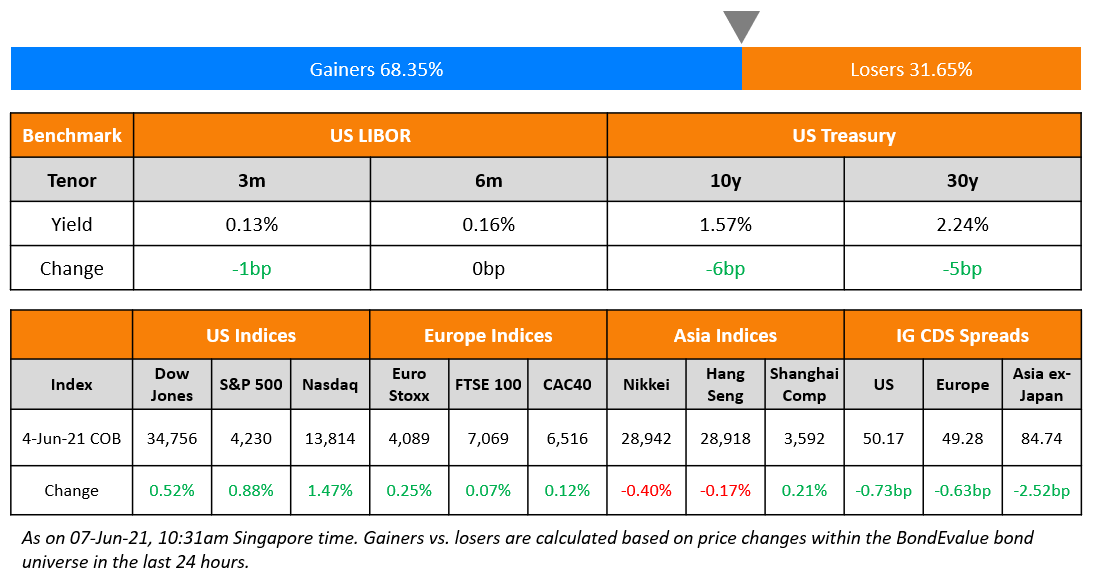

US Markets retreated from their early gains even after strong Q2 earnings from banking majors JPMorgan and Goldman Sachs (details below). S&P and Nasdaq were down ~0.4% with the fall spearheaded by Boeing’s 4.2% drop after the FAA reported a manufacturing quality issue on its 787 fleet (details below). Real Estate, down 1.3% and Consumer Discretionary down 1.2% led the drop while IT up 0.4% provided some support. Financials, Industrials and Energy were also down ~1%. US CPI rose to 0.9% MoM in June against a forecast of 0.5% – the largest one month change since June 2008. The inflation reading YoY came in at 5.4%, the highest in 13 years, vs. an estimate of 5.0%. The Core CPI, the index for all items less food and energy, rose 4.5% over the last year, the highest since 1991. US 10Y Treasury yields ended 3bp higher to 1.4% after the CPI release and a weak 30Y bond auction. European indices were broadly flat – DAX, CAC and FTSE down 0.01%. US IG and HY CDS spreads widened 0.7bp and 3.8bp respectively. EU main CDS spreads were flat while crossover spreads tightened 0.5bp. Brazil’s Bovespa was up 0.5%. Saudi TASI and Abu Dhabi’s ADX were up 0.4% and 0.3% respectively. Asian markets opened in the red – HSI and Shanghai were down 0.4%, Nikkei was down 0.2% and Singapore’s STI was down 0.1%. Asia ex-Japan CDS spreads were 0.1bp tighter.

New Bond Issues

- KT Corp $ 5.5Y bond at T+100bp area

Country Garden raised $200m via a tap of their 2.7% 2026s at a yield of 3.04%, 35bp inside initial guidance of T+260bp. The bonds have expected ratings of Baa3/BBB-, and received orders over $1bn, 5x issue size. The bonds are fungible with their outstanding $500mn note. Proceeds will be used to refinance medium to long-term offshore debt due to mature within one year. The tap was priced 5bp over their initially issued 2.7% 2026s that yield 2.99% in secondary markets.

Sunac China raised $400mn via a 3.25Y non-call 2.25Y (3.25NC2.25) bond at a yield of 7%, 20bp inside initial guidance of 7.2% area. It also raised $100mn via a tap of their 6.5% 2026s at a yield of 7.3%, 20bp inside initial guidance of 7.5% area. The bonds have expected ratings of B1/BB-/BB, and received orders over $1.4bn, 3.5x issue size. The real estate company plans to use the proceeds for debt refinancing. The 3.25NC2.25s were priced 62bp over its 5.95% 2024s callable in January 2023 that yield 6.38%. The tapped bonds were priced 11bp over their initially issued 6.5% 2026s that currently yield 7.19% in secondary markets.

Far East Consortium International raised $150mn via a tap of their 5.1% 2024s at a yield of 4.25%, 37.5bp inside initial guidance of 4.625% area. The bonds have expected ratings of , and received orders over $900mn, 6x issue size. Asia took 99% of the bonds and EMEA 1%. Private banks received 59%, and asset managers, fund managers and financial institutions 41%. FEC Finance is the issuer and the Hong Kong-listed property developer is the guarantor. Proceeds will be used for refinancing, business development and general corporate purposes. The company concurrently plans to conduct an on-market repurchase of its outstanding $236.63mn 3.75% 2021s, subject to market conditions.

Housing and Development Board raised S$750mn ($554.6mn) via a 12Y bond at a yield of 1.865%. The bonds have expected ratings of AAA. HDB resized the issue from S$600mn to S$750mn. Proceeds will be used to support HDB’s development programmes and to fund working capital as well as refinance debt.

Zhejiang Provincial Energy raised $500mn via a 5Y bond at a yield of 1.737%, 45bp inside initial guidance of T+140 area. The bonds have expected ratings of A2/A+, and received orders over $4.9bn, 9.8x issue size. Proceeds will be used for refinancing and general corporate purposes. Moody’s on July 2 upgraded the issuer rating to A1 from A2 with a stable outlook, to reflect its high strategic importance to the Zhejiang government as the sole provincial energy vehicle as well as its dominant position in the province’s energy sector, as per IFR.

CLP Power Hong Kong raised $300mn via a 10Y bond at a yield of 2.253%, 25bp inside initial guidance of T+115bp area. The bonds have expected ratings of A1/A+, and received orders over $1.35bn, 4.5x issue size. CLP Power Hong Kong Financing is the issuer and CLP Power Hong Kong is the guarantor. Proceeds will be on-lent to the guarantor for general corporate purposes.

New Bonds Pipeline

-

Temasek subsidiary Vertex Venture hires DBS for S$ bond investor calls

-

CSI Properties hires banks for $ unrated bonds

-

CCB Financial Leasing hires for $ bonds

-

Adani Electricity Mumbai hires for $ 10Y sustainability-linked bond

-

Minmetals Land plans sustainable bond offering

Rating Changes

- U.K.-Based Oil And Gas Producer EnQuest Rating Raised To ‘B-‘ From ‘CCC+’ By S&P On Refinancing Progress; Outlook Stable

- Fitch Upgrades Levi Strauss to ‘BB+’; Outlook Stable

- Moody’s upgrades NAB’s CFR to B1, outlook stable

- Sichuan Languang Downgraded To ‘D’ By S&P On Missed Bond Repayment

- Kuwait Projects Co. (Holding) K. S.C. Downgraded To ‘BB-‘ And ‘gcBBB-‘ By S&P; Outlook Negative

- Lenovo Group Ltd. Outlook Revised To Positive By S&P On Deleveraging And Improving Profitability; ‘BBB-‘ Rating Affirmed

- Fitch Revises Citizens Financial Group’s Outlook to Positive; Affirms IDR at ‘BBB+’

- Fitch Assigns First-Time IDR of ‘BB’ to Transportadora Associada de Gas S.A. – TAG; Outlook Negative

- Fitch Affirms and Withdraws Ratings on Offshore Drilling Holding, S.A

Term of the Day

Kauri Bond

A Kauri bond is a New Zealand dollar denominated security, issued and registered in New Zealand by a foreign entity. Kauri bonds are akin to Kangaroo/Yankee/Maple bonds.

IFC priced a NZD 600mn 5Y bond earlier today at a yield of 1.513%.

Talking Heads

“[A Treasury cash balance of $ 450 billion is] where we expect to be on July 31.” “That’s consistent with the amounts that we would hold based on our expenses.” “If Congress doesn’t act, I will send a letter indicating my intention to invoke (extraordinary measures).” “I’ll provide more details about how long I think emergency powers would last. There’s a lot of uncertainty around it and I think we have to be careful,” Yellen said.

“Elevated asset valuations and compressed risk premia imply a vulnerability to a sharp correction in asset prices.” “Sharp decreases in asset prices can amplify economic shocks” and directly affect the financial system.

Marilyn Ceci, global head of ESG debt capital markets at JPMorgan Chase & Co.

“What began with ‘why should I issue?’ is now ‘why aren’t you?’.” “Your absence in the market says something now.”

Philip Brown, head of public sector debt capital markets at Citigroup Inc

“Every issuer is going to want to be able to demonstrate that they have a sustainable business model.” “What the asset owner wants, the asset manager provides, and the issuer has to respond if they want to reach these portfolios.” “ESG is part of every conversation that we have now with all corporate issuers in Europe.”

Tom Joyce, head of capital markets strategy at Mitsubishi UFJ Financial Group Inc.

“The growth in ESG funding markets will exceed anything you’ve seen so far.” “This is a holistic, systemic change in the way the entire global financial market is structured and in the way business strategy and the regulatory environment operates.”

On the progress in Argentina’s $45 billion debt talks

According to the International Monetary Fund

“The Argentine authorities and IMF staff held productive meetings to further advance the technical work towards an IMF-supported program.” “In particular, progress was made in identifying policy options to develop the domestic capital market, mobilize domestic revenue, and strengthen Argentina’s external resilience.”

Argentine Economy Minister Martin Guzman

“We have been making important steps towards the normalization of the macroeconomic situation.” “Today, the balance of payments’ pressures have to do with the record loan from the IMF, and reaching a deal to roll-it-over would enhance Argentina’s external resilience,” he said.

Top Gainers & Losers – 14-Jul-21*

Go back to Latest bond Market News

Related Posts: