This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

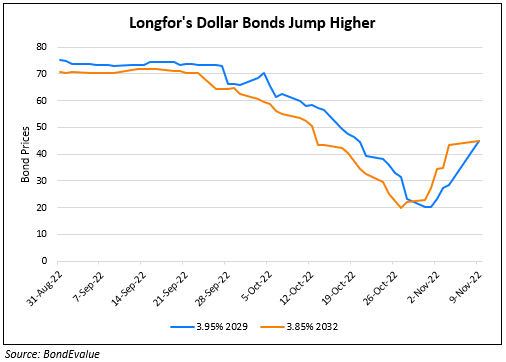

Longfor’s Dollar Bonds Jump Over 7 Points on Early Redemption Announcement

November 10, 2022

Chinese developer Longfor Group’s dollar bonds rallied after the firm announced the early redemption of its 3.9% bond due April 2023. The news is a welcome positive development at a time when defaults have been on the rise across dollar bonds in the real estate sector. Longfor’s 3.9% 2023s were up 2.1 points to 99.12, yielding 6.03%.

In related Chinese property sector news, Zhenro Properties has hired Alvarez & Marsal Corporate Finance and E&Y as joint financial advisers and Sidley Austin as legal adviser for its debt restructuring. Zhenro said that an ad hoc group of creditors of its dollar bonds was formed. The developer had encouraged this group and other offshore creditors to contact the financial advisers to explore debt restructuring solutions. This comes after Zhenro defaulted in April 2022 on its 8.35% 2024s and 7.1% 2024s. Zhenro’s dollar bonds are trading at less than 3 cents on the dollar.

Go back to Latest bond Market News

Related Posts: