This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

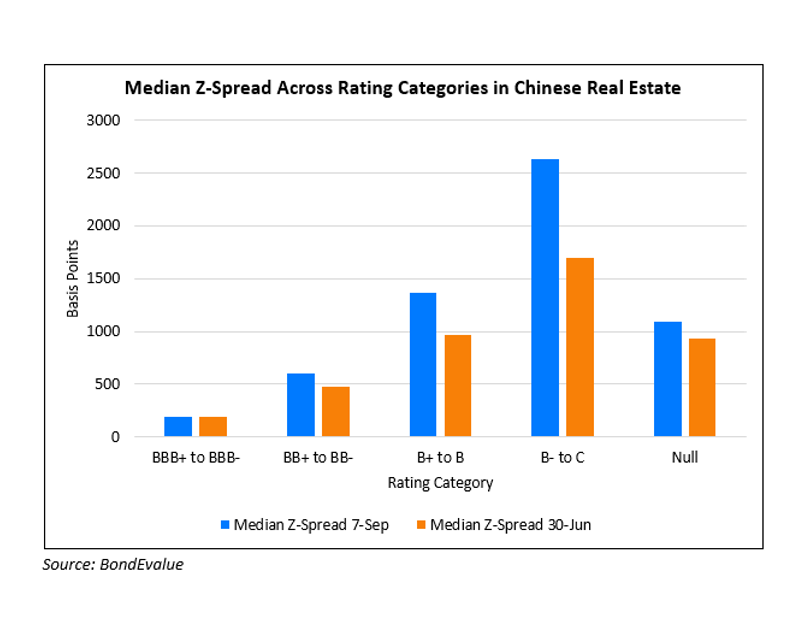

Lower Rated Chinese Property Developers’ Z-Spreads Widen

September 9, 2021

Dollar bonds of lower rated Chinese property developers have seen their Z-Spreads widen sharply in recent months, indicating the increasing credit, liquidity and optionality risks. Looking at the overall real estate space, we can see a large widening across single-B rated issuers’ bonds (see B+ to B and B- to C in the chart below). The risk divergence between triple and double-B names vs. single-B names can be clearly observed in the chart below.

Delving further into single names, the charts below show the extent of Z-spread widening since the end of Q2 on June 30. The largest widening in Z-Spreads have been observed in Evergrande, RiseSun, Xinyuan, Sinic, Fantasia and R&F Properties, with bond prices of these companies falling sharply during this period.

Go back to Latest bond Market News

Related Posts: