This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Bond Issuances; Talking Heads; Top Gainers & Losers

February 15, 2021

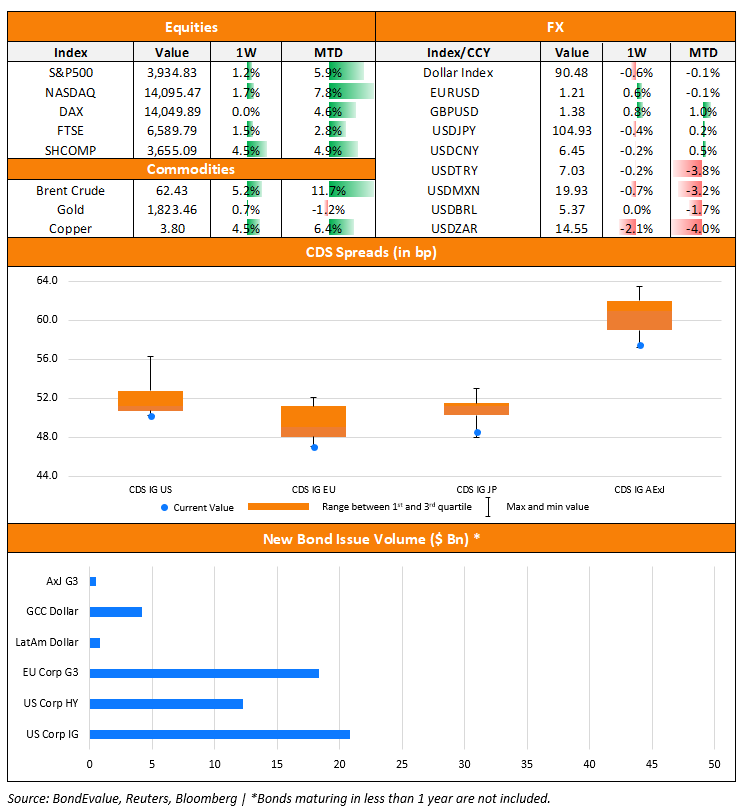

S&P and Nasdaq ended Friday ~0.6% and ~0.9% higher. US 10Y Treasury yields firmed by 9bp to 1.21% with prospects for a $1.9tn fiscal package and inflation expectations rising despite a soft CPI report earlier last week. The 5Y5Y forward inflation swap, which is an indication of inflation expectations, jumped 5bp on Friday. European equities were also higher by 0.4%. US IG CDS spreads were 0.1bp wider while HY was flat. EU main CDS spreads tightened ~0.2bp and crossover spreads widened 1.9bp. Asian primary markets remain muted as China and Hong Kong have a holiday today on account of Chinese New Year. Asian markets have opened with a positive bias today, up 0.5% while Asia ex-Japan CDS spreads are marginally lower.

Bond Traders’ Masterclass

If your first language is Spanish and you are keen on learning the fundamentals of bonds, do join our masterclass on A Practical Introduction to Bonds, which will be conducted in Spanish on February 17 at 9am Mexico City / 3pm London / 7pm Dubai. The session will be conducted by bond market veterans that have previously worked at premier global institutions such as HSBC and Citibanamex. Click on the image below to register.

New Bond Issues

Goldman Sachs raised $800mn via a 5Y non-call 4Y (5NC4) sustainability bond at a yield of 0.855%, or T+40bp, 20bp inside initial guidance of T+60bp area. The SEC registered bonds have expected ratings of A2/BBB+ and final books were not available. The deal was upsized to $800mn from $750mn.

New Bond Pipeline

- JSW Steel $ bond

- First Abu Dhabi Bank € bond

- Liberty Mutual Group

Rating Changes

- Moody’s upgrades Lithuania’s ratings to A2, outlook stable

- Moody’s downgrades Sharjah’s ratings to Baa3, changes outlook to negative

- Ethiopia Downgraded To ‘B-‘ BY S&P; Placed On CreditWatch Negative On Potential Debt Restructuring

- Fitch Downgrades Ferroglobe to ‘C’ on Distressed Debt Exchange; Withdraws Ratings

- Canadian Natural Resources Ltd. Downgraded To ‘BBB-‘ By S&P Due To Weaker Business Risk Profile Assessment; Outlook Stable

- ConocoPhillips Ratings Lowered To ‘A-‘ By S&P On Revised Industry Risk Assessment; Outlook Stable

- Exxon Mobil Corp. Ratings Lowered To ‘AA-‘ By S&P On Revised Industry Risk Assessment; Outlook Negative

- Fitch downgrades TV Azteca’s ‘ IDRs to ‘C’

- Fitch Downgrades Avation’s IDRs to ‘C’ on Announced Debt Restructuring

- French Steel Tube Producer Vallourec Downgraded To ‘SD’ From ‘CC’ By S&P On Principal Nonpayment

- Red Star Macalline Downgraded To ‘BB’ By S&P On COVID-19-Induced Operational Deterioration; Outlook Stable

- Fitch Affirms Starbucks at ‘BBB’; Revises Outlook to Stable

- U.K.-Based Oil And Gas Producer EnQuest Ratings On CreditWatch Positive BY S&POn Announced Acquisition

- Norway-Based Debt Purchaser B2Holding ASA Outlook Revised To Stable BY S&POn Improving Covenant Headroom; ‘B+’ Rating Affirmed

- Fitch Revises Outlook on Kraft Heinz to Positive; Affirms IDR at ‘BB+’

- Moody’s affirms Kraft Heinz’s Baa3 unsecured rating, outlook revised to stable

- Fitch Revises Ahli United Bank (UK)’s Outlook to Negative; Affirms IDR

- Fitch Revises 11 Kuwaiti Banks’ Outlook to Negative; Affirms IDRs

- ArcelorMittal Outlook Revised To Stable By S&P On Likely Strong Recovery In 2021; ‘BBB-/A-3’ Ratings Affirmed

- Mattel Inc. Ratings Placed On CreditWatch With Positive Implications By S&P Following Substantial 2020 Outperformance

- Oceaneering International Inc. ‘B+’ Ratings Affirmed By S&P ; Outlook Revised To Stable From Negative

- S.F. Holding Ratings Placed On CreditWatch Negative By S&P Pending Share Placement

- Chesapeake Energy Corp. Assigned ‘B+’ Issuer Credit Rating By S&P, Outlook Stable; New Debt Rated ‘BB-‘

The Week That Was

US primary market issuances stood at $35.8bn, down over 40% vs. $60bn the week prior. The drop in issuance can be attributed to US IG issuances, which stood at $20.8bn, down 58% WoW. HY on the other hand was up 47% WoW at $12.5bn as junk rated issuers rushed to tap the primary markets as US junk rated bond yields fell to a record low of less than 4%. Prominent IG issues include Citi’s $2.3bn deal, JPMorgan’s $1bn deal and Goldman’s $800mn green issuance. Among the HY names, Carnival led with a $3.5bn 5.75% bond due 2027. In North America there were a total of 49 upgrades and 44 downgrades combined, across the three major rating agencies last week. LatAm saw just one new new deal worth $850mn from Guara Norte Sarl priced last week vs. $4.96bn in the week prior. EU Corporate G3 saw a decrease with $18.4bn of new bonds priced last week vs. $26.9bn the week before – Deutsche raised €3bn via a dual-trancher that was 2.5x covered while Socgen and Gazprom raised €1bn each. GCC and Sukuk issuances were higher at $4.2bn vs $0.35bn in the week prior led by Galaxy Pipeline Assets‘ $3.92bn two-trancher. Last week also saw Africa’s largest dollar bond this year thus far – Egypt’s $3.75bn three-trancher. Asian primary markets had a slow week on account of the Lunar New Year holidays. APAC ex-Japan G3 issuances totaled a meagre $1.4bn vs $12.8bn in the week prior – three Indian issuers led with India Green Power / ReNew Power, UltraTech and IRB Infra raising $460mn, $400mn and $300mn respectively. In the region there was 9 upgrades and 14 downgrades combined, across the three major rating agencies last week.

Term of the Day

Orphan SPV

An orphan special purpose vehicle (SPV) is a type of corporate structure commonly used for securitization transactions. In an orphan structure, the equity of the SPV is held in a trust that is not legally related to the main sponsor or its subsidiaries.

This can be explained with India Green Power’s new dollar bond priced last Monday. In this structure, India Green Power Holdings is the orphan SPV, whose equity is held by a trust that is not linked to ReNew Power (the sponsor) or its subsidiaries. India Green Power will use proceeds from the dollar bond to subscribe to a senior local currency (INR) debt issued by 7 ReNew Power subsidiaries with the bonds carrying a guarantee from ReNew.

Talking Heads

On ECB’s need for new bond-buying rules that reflect climate risk

Francois Villeroy de Galhau, French central bank chief

“I propose to start decarbonising the ECB’s balance sheet with a pragmatic, progressive and targeted approach to all corporate assets whether they be held on the central bank’s balance sheet as purchases or taken as collateral,” Villeroy said.

Klaas Knot, president of Dutch central bank

“What does this neutrality mean if there is a carbon bias in European capital markets because the relative price of carbon emissions is distorted?” Knot asked.

“The biggest risk is probably the market prematurely pricing the end of the pandemic,” said Mead. “It’s easy for markets to get a little too optimistic.” “Inflation is something to think about but we’re not concerned about it in the 12-month horizon,” said Mead. “It’s not as though we think yield curves can reprice significantly because you do have central banks observing and wary of a complete shift in the borrowing cost across the whole economy.”

“A number of central banks have been a little more explicit around allowing inflation to get back to their targets before they would do anything. The way we would express that in a portfolio position would be through thinking about yield curve shape rather than large positions to be overweight or underweight interest-rate risk. Everything that we’ve said is also supportive of emerging-market assets. The Fed positioning, what we’re seeing in capital flows, the fundamental improvement, the eventual vaccine roll-out — all of those things may be delayed in some emerging economies and much more rapid in others, which again as active managers gives us opportunities.”

On the risk to investors of stretched valuations and risky assets

Alessandro Tentori, chief investment officer at Axa Investment Managers

“It’s a double whammy,” he said. “It might be painful, because expectations would be self-reinforcing.”

Peter Chatwell, head of multi-asset strategy at Mizuho International Plc

“The growth impulse next quarter will be very difficult for bond markets and monetary policymakers to deal with,” Chatwell said. “Their macroeconomic models will be suggesting they should be significantly more hawkish, and the bond market will be pricing this, but their focus on financial conditions will consequently be deteriorating.”

Christoph Rieger, head of fixed-rate strategy at Commerzbank AG

“The problem with these VAR shocks or sudden stops or flash crashes is that by their nature they are not predictable,” said Rieger. “We haven’t had one in a while and the low volatility goldilocks environment amid huge debt build-up and central-bank distorted markets certainly warrant caution.”

“Six months ago, all Asia curves were steeper than the US (2Y-10Y segment). Now, only Philippines, Indonesia and India curves are steeper than that of the US,” said DBS. “The relative steepness of curves has a direct impact on the relative attractiveness of bonds, and by extension, could influence the strength of capital inflows into the region.”

On ESG finance to become ‘core part’ of Goldman’s strategy

Carey Halio, chief executive officer of Goldman Sachs Bank USA

“We expect to issue once every 12 to 18 months with respect to benchmark issuance and we have the flexibility to do other kinds of liabilities as well in addition to the benchmark bond,” said Halio. “We think it will be a core part of our strategy going forward.” “We do think the size of our ESG bonds will grow over time,” said Halio. “We think investors value the liquidity in the benchmark size issuance.”

Heather Miner, global head of investor relations for Goldman

“It was so critical to us to do a robust evaluation of what we’ve seen over recent years to identify a group of themes where we feel we can really advance the transition and advance the story globally,” Miner said.

Stephen Liberatore, head of fixed-income ESG and impact investing strategies at Goldman Sachs

“The more issuers come and the more prominent those issuers are, only helps further the message that we are looking at things in a different way,” said Liberatore. “That’s a real positive and should help borrowers that maybe aren’t sure what they need to do.”

Top Gainers & Losers – 15-Feb-21*

Go back to Latest bond Market News

Related Posts: