This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Bond Issues; Talking Heads; Top Gainers & Losers

April 23, 2021

S&P and Nasdaq fell over 0.9% as equities were lower again. Market sentiment was down as US President Joe Biden eyed a tax rate as high as 43.4%, in a proposal to tax the rich as per Bloomberg. US weekly initial jobless claims dropped 39k to a 13-month low of 547k. US10Y yields were 3bp higher at 1.56%. European equities were stronger with DAX up 0.8%, CAC and FTSE up 0.6% and 0.9% respectively. The ECB kept its policy unchanged during its monetary policy meeting yesterday. US IG CDS spreads were 0.5bp tighter and HY was 1.1bp wider. EU main CDS spreads were flat and crossover spreads widened 0.4bp. Asian equity markets are 0.7% higher today after Wall Street’s losses yesterday and Asia ex-Japan CDS spreads have widened 3.3bp.

New Bond Issues

Petronas raised $3bn via a two-trancher. It raised $1.25mn via a 10Y bond at a yield of 2.482%, 42.5bp inside initial guidance of T+135bp area. It also raised $1.75mn via a 40Y bond at a yield of 3.404%, 40bp inside initial guidance of T+155bp area. The bonds have expected ratings of A2/A-. Proceeds will be used for debt refinancing and general corporate purposes.

AVIC Automative Systems raised $260mn via a 5Y bond at a yield of 3.1%, 32.5bp inside initial guidance of T+260bp area. The bonds have expected ratings of A3, and received orders over $820mn, 3.2x issue size. Proceeds will be used to repay offshore borrowings and for general corporate purposes.

Pakuwon Jati raised $300mn via a 7NC4 bond at a yield of 4.875%, 32.5bp inside initial guidance of 5.2% area. The bonds have expected ratings of Ba2/BB/BB, and received orders over $2bn, 6.7x issue size. Asia bought 85% and the rest with Europe. Fund/asset managers took 87% and private banks and corporates 13%. The Indonesian real estate company plans to use the proceeds to fully redeem its $250m 5% 2024s and for general corporate purposes.

BOC Aviation raised $750mn via a 3Y bond at a yield of 1.728%, 25bp inside initial guidance of T+165bp area. The bonds have expected ratings of A-/A-. Proceeds will be used for new capital expenditure, general corporate purposes and/or debt refinancing.

Dalian Wanda Commercial Management Group raised $325mn via a 364-day at a yield of 7.25%, 25bp inside initial guidance of 7.5% area. The bonds are unrated and received orders over $1.2bn, 3.7x issue size. Wanda Properties Overseas is the issuer and Wanda Commercial Properties (HK), Wanda Real Estate Investments and Wanda Commercial Properties Overseas are the subsidiary guarantors. The issuer is the keepwell & equity interest purchase undertaking (EIPU) provider. Proceeds will be used for debt refinancing and general corporate purposes.

Santos raised $1bn via a 10Y bond at a yield of 3.649%, 40 bp inside initial guidance of T+250bp area. The bonds have expected ratings of BBB-/BBB.

New Bond Pipeline

- Incheon Int’l Airport $ 5Y green bond

-

China Water Affairs Group $ green bond

- Hyundai Motor Manufacturing Indonesia $ bonds

Rating Changes

- Taiwan Ratings Raised To ‘AA/A-1+’ By S&P With Positive Outlook On Strong And Sustained Growth

- Allied Universal Upgraded To ‘B’ By S&P On Improved Competitive Positioning, Scale On Acquisition Of G4S; Outlook Stable

- Altice USA Inc. Ratings Raised By S&P On Favorable Business Prospects Despite High Leverage; Outlook Stable

- Moody’s revises Alaska’s outlook to stable, affirms GO and related ratings

- Moody’s affirms Southwest Airlines’ Baa1 senior unsecured ratings, changes rating outlook to stable

- Moody’s changes Bed Bath’s outlook to stable; affirms Ba3 CFR

- Moody’s changes Honghua’s outlook to stable from positive; affirms B1 ratings

- Fitch Affirms KUO’s Ratings at ‘BB’; Outlook Revised to Stable

- Alpek Outlook Revised To Positive From Stable By S&P, On Stronger Credit Metrics, ‘BB+’ Ratings Affirmed

- Ratings Raised On Access Group Inc. Series 2002-A Class B Notes And Removed From CreditWatch Positive By S&P

- China Merchants Bank Outlook Revised To Positive By S&P; ‘BBB+/A-2’ Ratings Affirmed

- Correction: Fitch Affirms Micron Technology at ‘BBB-‘; Revises Outlook to Positive

Term of the Day

Gearing

Gearing refers to the financial leverage a company takes in the form of debt. While gearing ratio is typically calculated as a company’s debt divided by its equity, it could also be measured as a company’s debt divided by its total assets, since it ultimately shows leverage.

In the case of Saudi Aramco, gearing is a measure of the degree to which Aramco’s operations are financed by debt. Aramco defines gearing as the ratio of net debt to net debt plus equity – total borrowings less cash and cash equivalents to total borrowings less cash and cash equivalents plus total equity. Based on their calculations it stands at 23% end 2020 vs 21.8% as at September, 2020 and -0.2% in 2019.

Talking Heads

On ECB Not Discussing Phase-Out of Stimulus – Christine Lagarde, ECB President

“Overall, while the risks surrounding the euro area growth outlook over the near term continue to be on the downside, medium-term risks remain more balanced…Incoming economic data, surveys and high-frequency indicators suggest that economic activity may have contracted again in the first quarter of this year, but point to a resumption of growth in the second quarter. Any phasing out was not discussed and it is just premature.”

“We do think there will be lingering impact on China, particularly investment-grade bond spreads in the foreseeable future… Investors are assessing which sectors with low transparency or high leverage show similarities to Huarong, how government support should be priced going forward and how to interpret*t different reactions in offshore and onshore markets”

On US President Biden Eyeing Tax Rates As High As 43.4% In Next Economic Package

Chuck Grassley of Iowa, a top Republican on the Senate Finance Committee

“It’s going to cut down on investment and cause unemployment. If it ain’t broke, don’t fix it.”

Ron Wyden, Senate Finance Committee Chairman

“There ought to be equal treatment for wages and wealth. On the Finance Committee we will be ready to raise whatever sums the Senate Democratic caucus thinks are necessary.”

Shana Sissel, chief investment officer at Spotlight Asset Group

“We will see a lot more selling (in markets) at the end of the year as people try to get in front of that”

“The decision to exclude additional Covid-related expenditure from the spending ceiling this year is negative for Brazil’s credit profile… If recurrent exceptions are made for higher spending above the ceiling, questions will be raised about the credibility of the spending ceiling as a fiscal anchor, with negative implications for Brazil’s borrowing costs and debt dynamics”

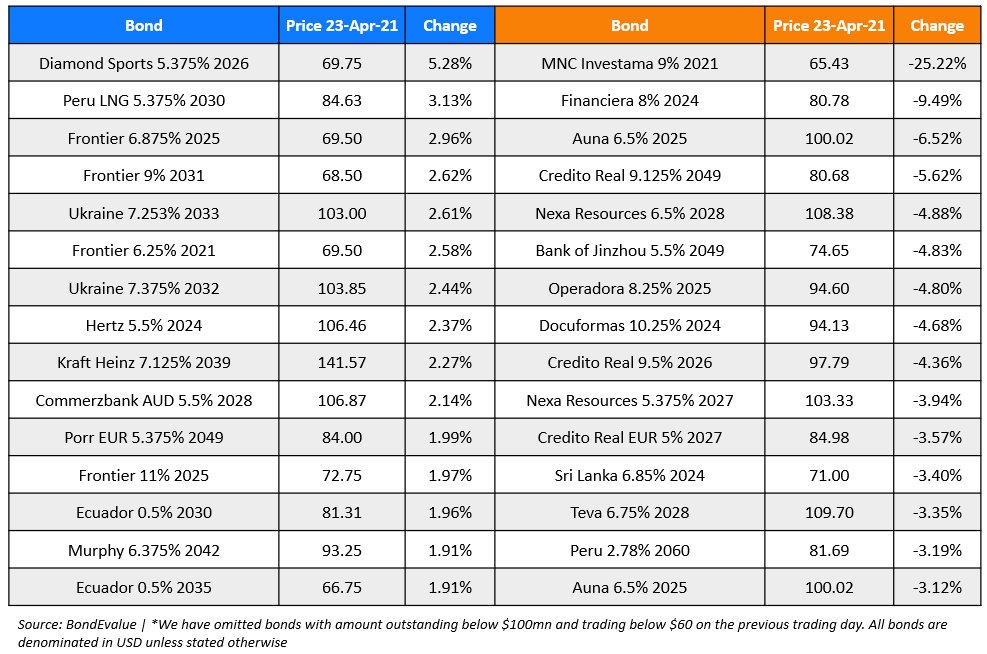

Top Gainers & Losers – 23-Apr-21*

Other Stories

Go back to Latest bond Market News

Related Posts: