This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Bond Issues; Talking Heads; Top Gainers & Losers

January 29, 2021

Both the S&P and Nasdaq recovered some of their prior day’s losses to advance 1% and 0.5% respectively. Microsoft and Alphabet rose 2.6% and 1.9% while Apple and Tesla fell over 3.3%. Risk sentiment improved with US 10Y Treasury yields moving 4bp higher and the curve steepening. US GDP grew by 4% in 4Q2020, in line with forecasts, while it contracted 3.5% for the whole of 2020. US jobless claims printed at 847k, lower than forecasts of 875k. EU CPI jumped to 1.6% from 0.7% last month. FTSE fell 0.6% while DAX and CAC rose 0.3% and 0.9%. US IG CDS spreads were 0.3bp tighter and HY was 1.3bp tighter. EU main CDS spreads tightened 0.3bp and crossover spreads tightened 2.9bp. Asia ex-Japan CDS spreads are 1.2bp wider while Asian equities are slightly higher ~0.2%.

Bond Traders’ Masterclass

Sign up for the upcoming sessions on Understanding New Bond Issues & Credit Ratings on Tuesday, February 2 and Using Excel to Understand Bond Calculations on Wednesday, February 3. This session is part of the Bond Traders’ Masterclass across four sessions specially curated for private bond investors and wealth managers to develop a strong fundamental understanding of bonds. The sessions will be conducted by debt capital market bankers with over 40 years of collective experience at premier global banks. Click on the image below to register.

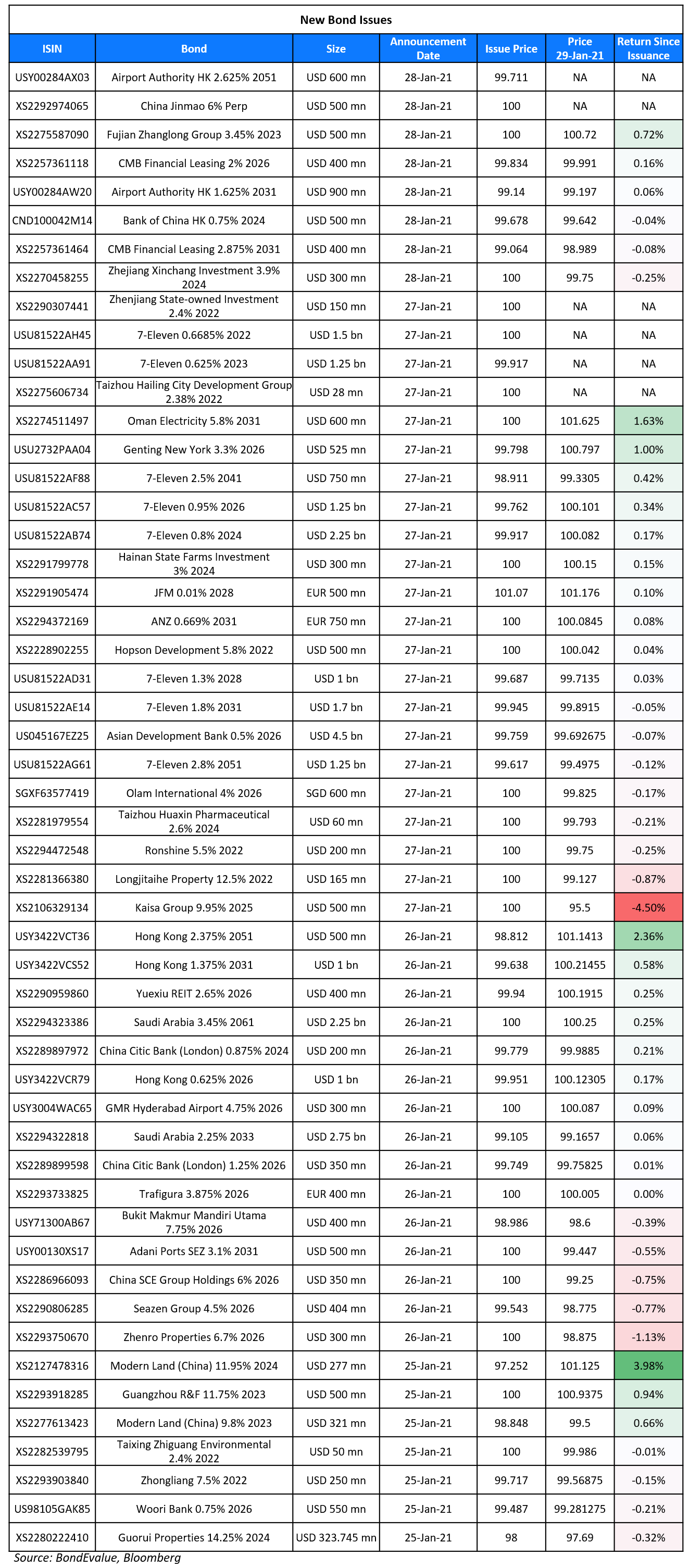

New Bond Issues

Airport Authority of Hong Kong (AAHK) raised $1.5bn via a dual tranche offering. It raised $900mn via a 10Y bond at a yield of 1.719%, or T+65bp, 35bp inside initial guidance of T+100bp. It also raised $600mn via a 30Y bond at a yield of 2.639%, or T+80bp, 40bp inside initial guidance of T+120bp area. The bonds have expected ratings of AA+, and received orders of over $10.25bn, 6.8x issue size. Proceeds will be used to fund the issuer’s capital expenditure, including the construction of a third runway, and for general corporate purposes. AAHK last tapped the dollar bond markets in December 2020 with dual–tranche perp offerings to the tune of $1.5bn that received orders ~10x issue size.

CMB Financial Leasing raised $800mn via a two tranche offering. It raised $400mn via a 5Y bond at a yield of 2.035% or T+160bp, 35bp inside initial guidance of T+195bp area. It also raised $400mn via a 10Y bond at a yield of 2.984% or T+192.5bp, 37.5bp inside initial guidance of T+230bp area. The bonds have expected ratings of Baa1, and received orders over $3.5bn, 4.4x issue size. Asian investors took 97% and EMEA 3% across both the issues. For the 5Y, fund managers and insurers were allocated 41%, banks 43%, sovereign wealth funds 15% and private banks 1%. For the 10Y, fund managers and insurers received 65%, banks 29% and private banks 6%. Proceeds will be used for general corporate purposes.

BOC HK Branch raised $500mn via a 3Y Yulan bond at a yield of 0.859%, or T+67bp, 43bp inside initial guidance of T+110bp area; The bonds have expected ratings of A1/A/A, and received orders over $2bn, 4x issue size. Proceeds will be used for general corporate purposes.

Zhejiang Xinchang Investment raised $300mn via a 3Y bond at a yield of 3.9%, unchanged from initial guidance. The bonds were unrated and proceeds will be used for debt refinancing and project construction purposes. The issuer is a local government financing vehicle of Xinchang County in China’s Zhejiang province. Activities involve land development, public infrastructure construction, water supply and sewage treatment, and trading.

Fujian Zhanglong Group raised $100m via a tap of its 3.45% 2023s at a yield of 3.25%, 40bp inside initial guidance of 3.65% area. The bonds have expected ratings of BBB-, and received orders over $480mn, 4.8x issue size. Proceeds will be used for general corporate purposes and offshore debt refinancing.

Hopson Development raised $100mn via a tap of its 5.8% 2022s at a yield of 5.8%. The bonds were unrated. Hopson Capital International Group is the issuer and Hopson Development (B2/B/B+) is the guarantor.

New Bond Pipeline

- CABEI $ 5Y social bond

- Continuum Energy $ green Yankee

- Lippo Malls $ bond

- Liberty Mutual Group

- Zhejiang Xinchang Investment

- KEXIM $ bond

- Jinchuan Group $ bond

- Buma $ 5NC2 bond

Rating Changes

- PetSmart Inc. Upgraded To ‘B’ By S&P On Proposed Refinancing Transaction; Outlook Stable; New Debt Rated

- Brazilian Electric Utility CEMIG And Subsidiaries Upgraded To ‘BB-‘ From ‘B’ By S&P On Improved Credit Metrics; Outlook Stable

- Moody’s upgrades ENN Natural Gas to Ba1; outlook stable

- Export-Import Bank of the Slovak Republic Outlook Revised To Stable From Negative By S&P In Line With The Sovereign

- Fitch Revises Outlook on Lippo Karawaci to Stable; Affirms ‘B-‘; Upgrades National Rating

- U.K. Oil And Gas Producer Ithaca Energy ‘CCC+’ Rating Affirmed And Removed From CreditWatch By S&P; Outlook Stable

Term of the Day

Kauri Bond

A Kauri bond is a New Zealand dollar denominated security, issued and registered in New Zealand by a foreign entity. Investors in Kauri bonds are a mix of domestic and offshore institutions while issuers range from supranationals to banks, as per the Reserve Bank of New Zealand. Kauri bonds are akin to Kangaroo/Yankee/Maple bonds. Investors in Kauri bonds are a mix of domestic and offshore institutions while issuers range from supranationals to banks as per the Reserve Bank of New Zealand.

ADB raised NZD 700mn ($502mn) via a 7Y Kauri issue at a yield of 1.141% or MS+24bp.

Talking Heads

“Worry about the Fed tapering its stimulus is premature right now, as the slow COVID-19 vaccine rollout will likely delay any kind of Fed stimulus withdrawal until well into 2022,” said Booth. “The bond market remains unconvinced of the Fed’s commitment to low rates and stimulus, given the volatility in Treasury yields over the past month,” Booth said.

On Euro zone bonds awaiting German inflation and ignoring comments of rate cut

According to ING analysts

“The market impact of that figure rising into positive territory again should be muted as even the ECB has already flagged it as being mainly mechanical (due to a VAT hike),” ING analysts said.

Michael Leister, head of interest rate strategy at Commerzbank

“The moves seem contained … suggesting that markets are increasingly looking through such verbal interventions given the lack of tangible follow-up in the past,” Leister said.

“After a sharp repricing of risk in March, many investors foresaw that markets would eventually return to ‘normal’—the surprise was in how quickly that return came,” the report said. “The goal isn’t typically to generate 100% of the desired cash flow through current yield; the point is to generate a total return sufficient to cover the projected outflows with minimal volatility along the way.”

“Short duration products in this sense are a relatively expensive hedge against an extremely unlikely event,” Manulife said. “Looking out over the next year, we see an investment environment in which active managers will have a chance to earn their pay,” the report said. “None of the drivers of passive returns—clipping coupons, or tightening spreads, or falling rates—will likely be meaningful drivers of performance in 2021.”

On cashing out weeks after buyout in junk frenzy

Matt Freund, co-chief investment officer at Calamos Investments

“It’s a case of fear of missing out,” said Freund. “The economic outlook has not dramatically changed, but market yields are lower, investors look ahead to the new year with more optimism and new mandates. It all leads to higher risk tolerances.”

John McAuley, head of North American leveraged finance at Citigroup Inc

“Investors have become less emotional about dividend deals,” said McAuley. They can either buy debt of a “company with a solvency issue, or manufacture that excess yield by doing a dividend.”

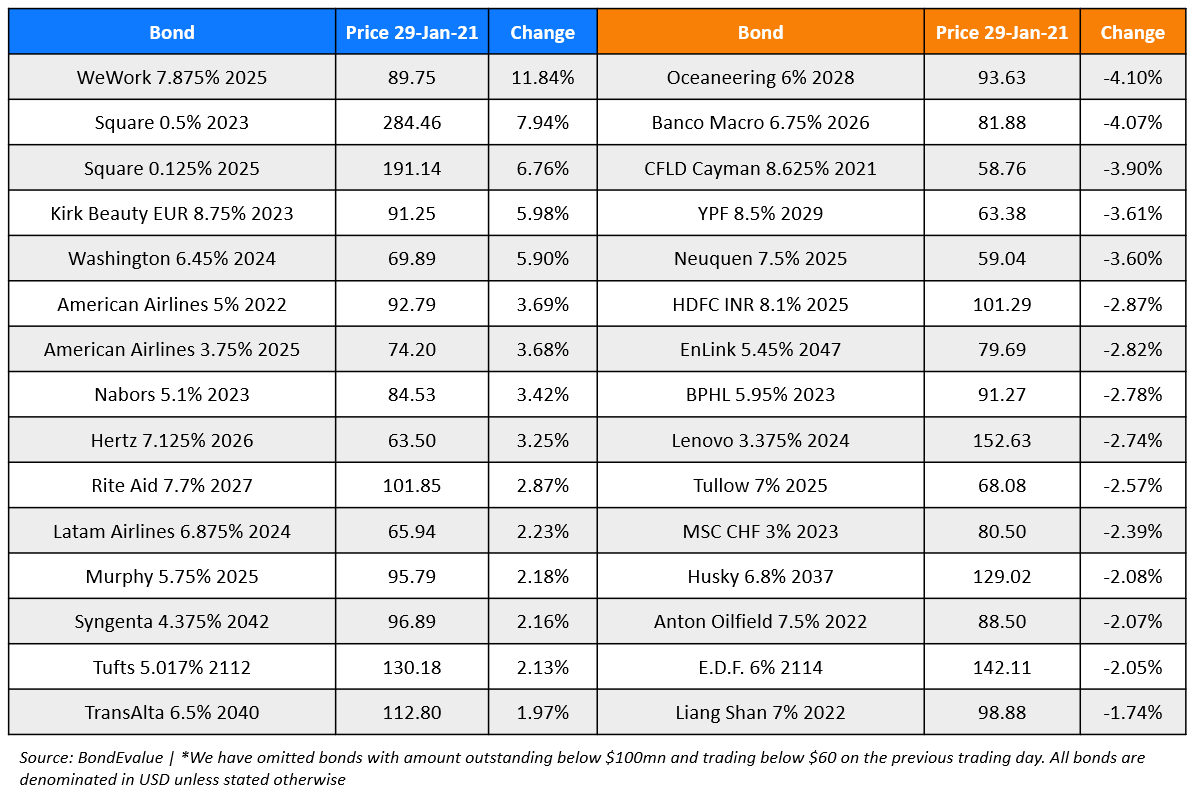

Top Gainers & Losers – 29-Jan-21*

Go back to Latest bond Market News

Related Posts: