This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

December 1, 2022

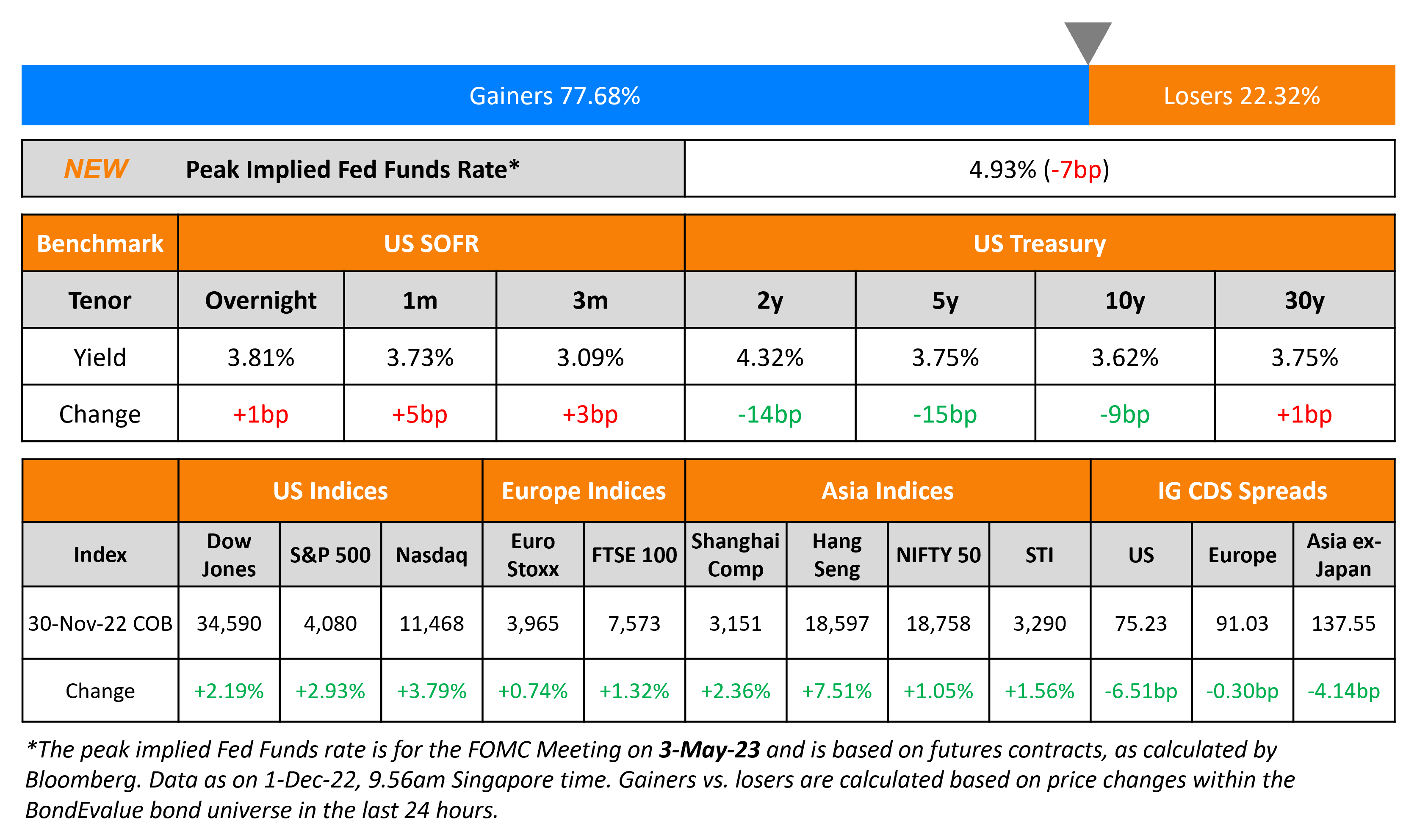

US Treasuries rallied across the curve on Wednesday with yields falling as much as 15bp after Powell’s comments. The peak Fed Funds rate also moved 7bp lower to 4.93% for the May 2023 meeting. Fed Chairman Jerome Powell said that the “time for moderating the pace of rate increases may come as soon as the December meeting” strengthening the chances of a 50bp hike this month. He did note that the fight against inflation was far from over. The probability of a 50bp hike at the FOMC’s December meeting currently stands at 76%, up from 68% a day back amid Powell’s comments. US IG and HY CDS spreads tightened 6.5bp and 25bp. US equity markets ended with a strong rally led by Nasdaq up 4.4% and S&P higher by 3.1%.

European equity markets ended higher. EU Main CDS spreads tightened 0.3bp and Crossover spreads tightened 0.2bp. Asian equity markets have opened higher today across the board. Asia ex-Japan CDS spreads tightened by 4.1bp.

New Bond Issues

- Guilin ETDZ Investment $ 3Y Sustainability at 6.8% area

Bank of Nova Scotia raised $1bn via a 2Y bond at a yield of 5.299%, 20bp inside initial guidance of T+110bp area. The senior unsecured bonds have expected ratings of A2/A-/AA-. Proceeds will be used for general corporate purposes.

EDF raised €1bn via a PerpNC6 bond at a yield of 7.5%, 75bp inside initial guidance of 8.25% area. The hybrid subordinated notes have expected ratings of Ba1/B+/BBB-. The bonds have a first call date of 06 September 2028, with the first coupon reset happening on 06 December 2028 and every five years thereafter. Proceeds will be used for general corporate purposes and refinancing the issuer’s perps. The new bonds are priced 47bp tighter to its existing 3% Perps callable in 2027 that yield 7.97%.

New Bonds Pipeline

- Korea Investment & Securities hires for $ Green bond

- Zhongrong International Trust hires for $367mn Short 1Y bond

- Kunming Rail Transit Group hires for $ Green bond

- Deyang Development hires for $ Sustainability bond

Rating Changes

- Fitch Downgrades Lai Fung to ‘B-‘; Outlook Negative

- Braskem Idesa S.A.P.I. Outlook Revised To Negative On Higher-Than-Expected Leverage, ‘B+’ Ratings Affirmed

Term of the Day

Credit Default Swap (CDS)

A Credit Default Swap (CDS) is a financial contract between two counterparties that allows an investor to “swap” or offset the credit risk with another investor. CDS acts like an insurance policy wherein the buyer makes regular payments to the seller to protect itself from an issuer default. In the event of a default, the buyer receives a payout, typically the face value of the bond or loan, from the seller of the CDS as per the agreement. CDS spreads are a commonly used metric to track the market-priced creditworthiness of an issuer. A widening (increase) in CDS spreads indicates a deterioration in creditworthiness and vice-versa.

Talking Heads

On Ghana Bond Slump Holds Key to Market-Beating Returns

Bank of America Strategists

“We continue to think that, ultimately, the recovery value will be well above 50, depending on the details of the restructuring… We like the valuation but expect volatility until there is more clarity on the IMF program and conditionality associated with restructuring. It is very difficult to gauge at this stage what the final outcome of any restructuring may be”

Lars Jakob Krabbe, PM for frontier-market fixed income at Coeli Frontier Markets AB

“On the back of the restructuring proposal, we have seen a fairly strong rally in the market”

Nick Eisinger, co-head of EM active fixed income at Vanguard Asset Services

“The challenge is to get a haircut that allows debt to become more sustainable, secure the IMF funding and do good reforms, but not so harsh that bondholders hold out… A lot depends on if they can execute a rapid restructuring.”

On BlackRock backing banks, cutting European, EM debt as part of ‘new playbook’

Wei Li, global chief investment strategist

“The macro damage we expect for next year is yet to be fully reflected in market pricing”

BlackRock expects global central banks to over-tighten financial conditions in their fight against stubbornly high inflation to the point of causing a recession next year. It therefore maintained a tactical underweight on developed market equities, while recommending investors to gravitate towards high-quality corporate debt and short-dated U.S. Treasury bonds, given the returns they offer after this year’s rapid increase in interest rates.

On Credit Markets Just as Baffled as Stocks in 2022 – DataTrek Research’s Nicholas Colas

“Which is the smart money, is it equities, is it corporate fixed-income, is it Treasuries, what is it? The upshot is it’s there’s no clear answer… I went through the math of the individual turns in the market between spreads and the S&P. Sometimes they lead by a day or two, sometimes they lag by a week or two, all I can say for sure is they’ve been very coincident in general in turns all this year.”

On Powell’s Comments Impacting Risk Assets

Krishna Guha, head of central bank strategy for Evercore ISI

“Most importantly for risk assets, Powell’s remarks embraced the return of some two-sided risk management. That is a big deal for equities and means an outsized move in stocks relative to the rates market is justified”

Top Gainers & Losers – 01-December-22*

Go back to Latest bond Market News

Related Posts:%20x%20311px%20(h).jpg?upscale=true&width=1400&upscale=true&name=Tablet%20banner%20661px%20(w)%20x%20311px%20(h).jpg)