This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

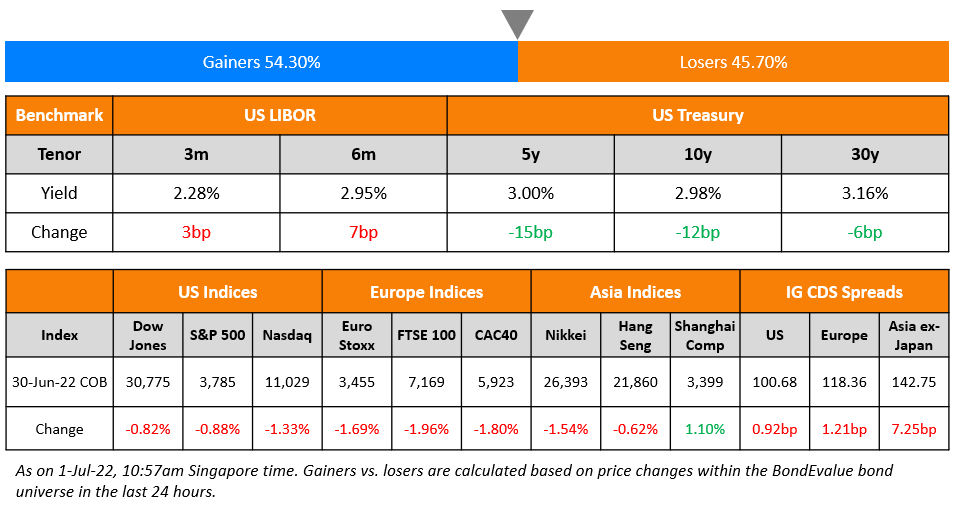

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

December 13, 2022

US Treasury yields inched higher by 2-3bp across the curve yesterday with markets awaiting the CPI inflation print today. Expectations are for the headline number to come at 7.3% YoY and Core CPI to come at 6.1% YoY for November. This may serve as an important print for the policy guidance in FOMC meeting due tomorrow. The peak Fed Funds rate was 2bp higher to 4.98% for the May 2023 meeting. The probability of a 50bp hike at the FOMC’s meeting on Wednesday stands at 75%. US IG and HY CDS spreads tightened 2.5bp and 12.9bp respectively. US equity markets jumped with the S&P and Nasdaq up 1.4% and 1.3% respectively on Monday.

European equity markets ended lower. EU Main CDS spreads tightened 0.1bp and Crossover spreads widened by 5.5bp. Asian equity markets have opened slightly higher today. Asia ex-Japan CDS spreads tightened by 0.3bp.

New Bond Issues

- Zhenjiang LGFV € 364-day at 4.7% area

JPMorgan raised $3bn via a 3NC2 bond at a yield of 5.546%, 15bp inside initial guidance of T+130bp area. The senior unsecured bonds have expected ratings of A1/A-/AA-. Proceeds will be used for bail-in purposes.

New Bonds Pipeline

- Korea Investment & Securities hires for $ Green bond

- Zhongrong International Trust hires for $367mn Short 1Y bond

- TSMC Arizona hires for $ bond

Rating Changes

- Moody’s downgrades Greenko’s ratings to Ba2 from Ba1; outlook stable

- Mongolian Mining Corp. Downgraded To ‘SD’ From ‘CC’ On Completion Of Distressed Exchange; Issue Rating Lowered To ‘D’

Term of the Day

Inflation-Linked Bonds or Linkers

Inflation linked bonds (aka linkers) are fixed income securities issued whose returns are linked to the inflation rate. The most commonly known linkers are Treasury Inflation-Protected Securities (TIPS), issued by the US Treasury. TIPS provide investors protection against inflation by adjusting the principal higher with inflation and lower with deflation, as measured by the Consumer Price Index (CPI). At maturity, investors are paid the higher of the adjusted principal or the original principal. Interest on TIPS is fixed, paid out twice in a year and is applied to the adjusted principal.

Talking Heads

On Vanguard Seeing Good Year Ahead for Bonds — If You Pick the Right Ones

“This is not an environment where all boats are going to rise and selection is going to be critical. We are maintaining dry powder that we can deploy at more attractive levels… Choosing the right names, avoiding the losers, can be just as important as finding the winners in an environment like this. Right now it is a terrific environment for that because there’s such a dispersion in valuations and in quality that using that elbow grease and really getting in the weeds and going name by name, we can add a tremendous amount of value.”

On Inflation Being So Bad That It Even Crushed Inflation-Linked Bonds

George Goncalves, head of US macro strategy at MUFG

“The TIPs product is not a pure play inflation hedge. You might think you are diversified, but TIPS have the same underlying interest rate risk exposure as other bonds. This was ultimately a duration lesson for TIPs holders which was perhaps inevitable given the low starting point for yields. You have not seen a year like this in decades”

On ‘Too Far, Too Soon’: Big 2023 Credit Rebound Already Partly Done

Brian Kloss, PM at Brandywine Global Investment Management.

Long positions in credit “can absolutely become a crowded trade, and we’ve seen some of this happen in recent weeks… This risks limiting returns too fast, so you have to be careful about your allocations”

UBS Group AG strategists led by Kamil Amin

“Credit spreads have rallied too far, too soon”

JPMorgan strategists led by Matthew Bailey

“Our impression is that the speed of the rally has taken many investors by surprise, leading them to question whether this move is sustainable”

Top Gainers & Losers – 13-December-22*

Go back to Latest bond Market News

Related Posts: