This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

September 23, 2021

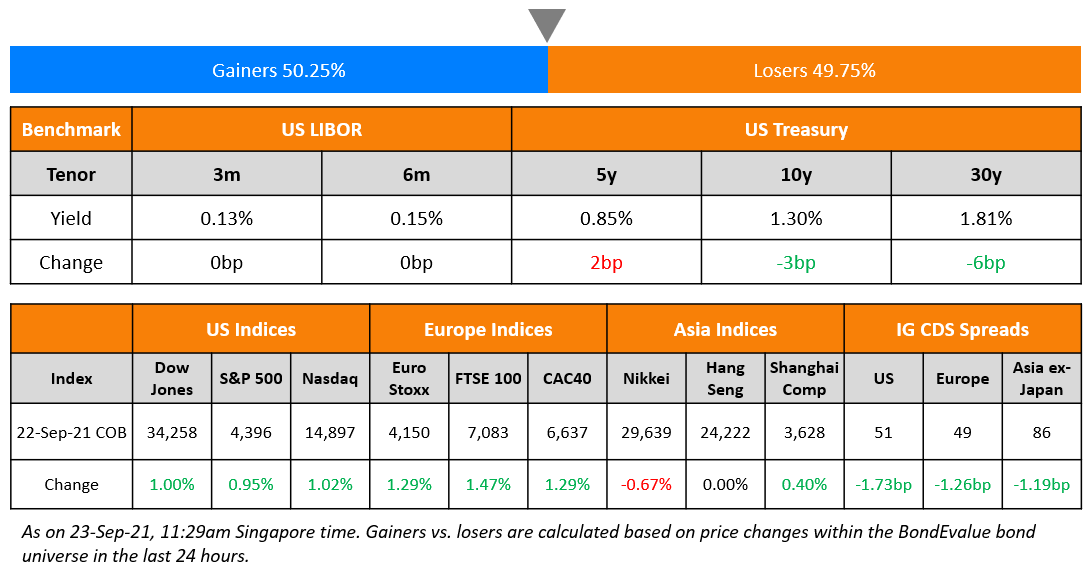

Wall Street ended higher as both the Nasdaq and S&P closed ~1% higher despite a slightly hawkish Federal Reserve meeting with more details on tapering and half of the FOMC expecting a rate hike next year (scroll down for details). Most sectors rallied led by Energy, up 3.2% followed by Financials, IT and Consumer Discretionary, up 1.3-1.6%. European stocks also saw a solid rise – DAX, CAC and FTSE ended 1%, 1.3% and 1.5% higher. Brazil’s Bovespa gained 1.8%. In the Middle East, UAE’s ADX gained 0.4% while Saudi TASI slid 0.4%. Asia Pacific markets have started positively – Shanghai is up 0.6%, HSI is up 0.7% and Singapore’s STI is up 0.9% while Nikkei is down 0.7% respectively and. US 10Y Treasury yields fell 3bp to 1.30%. US IG and HY CDX spreads tightened 1.7bp and 7.7bp respectively. EU Main CDS spreads were 1.3bp tighter and Crossover CDS spreads tightened 5.9bp. Asia ex-Japan CDS spreads tightened 1.2bp.

Eurozone consumer confidence came at -4, better than expectations of -5.8. Weekly US Crude inventories saw a drawdown of 3.48mn, a seventh straight weekly decline with crude oil price rallying ~2%.

Register for The Upcoming Bond Masterclass | 25% Discount

Sign up for the upcoming 8-module course designed & curated to help develop a comprehensive understanding of bonds along with practical and actionable insights on how to trade and advise on bonds better. The course will be conducted via Zoom over 8 modules on 27-30 September and 4-7 October (Monday-Thursday) at 5pm Singapore / 1pm Dubai / 10am London.

The modules will cover bond valuation and risk, portfolio and leverage, AT1 bonds, high yield bonds, ESG bonds and more.

All attendees will receive a 1-month complimentary Premium subscription to the BondEvalue App, a certificate, presentations materials as well as 14-days access to video recordings to re-watch the sessions.

New Bond Issues

- Oxley Holdings S$ tap of 6.9% 2024s at 100

- Maldives’ HDC $ 250 mn 3Y sustainability at 13% final

- CCBI $ 5Y at T+100bp area

- Bank of China Sydney branch $ 3Y green at T+70bp area

- Jiayuan International $ tap of 11% 2024s at 13.25% area

ING Groep raised €1.5bn via a 7NC6 bond at a yield of 0.496%, 15-20bp inside initial guidance of MS+85-90bp. The bonds have expected ratings of Baa1/A-/A+. The bond is callable on 29 September 2027 at 100, and if not called, the coupon will reset on 29 September 2027 to the prevailing 3-month Euro Interbank Offered Rate (Euribor) + 70bps.

New Bonds Pipeline

- Clover Aviation Capital hires for $ bond

- Apicorp hires for $ 5Y green bond

- Dat Xanh Group hires for $ debut bond

- Helenbergh China hires for $ 270 mn 2Y green bond

- GD-HKGBA Holdings hires for $ 2Y bond

- NH Investment & Securities hires for $ 5Y bond

- Gansu Province Electric Power Investment hires for $ bond

Rating Changes

- Fitch Upgrades Newell’s Long-Term IDR to ‘BB+’; Outlook Stable

- Genesis Energy L.P. Downgraded To ‘B’ From ‘B+’; Outlook Stable

- Gol Outlook Revised To Positive On Stronger Liquidity; ‘CCC+’ Ratings Affirmed; National Scale Rating Raised To ‘brBB+’

- Fitch Upgrades GOL to ‘B-‘; Outlook Stable

- Fitch Upgrades Signet to ‘BB’; Outlook Stable

- Fitch Upgrades ForteBank to ‘B+’; Outlook Positive

Term of the Day

SEC’s Rule 15c2-11

The SEC’s Rule 15c2-11 is a rule that governs the publication or submission of quotations by broker-dealers in a quotation medium other than a national securities exchange. Broker-dealers must review key, basic information about the issuer of the security before initiating or resume quotations. Market participants have typically largely considered it as an attempt to protect retail investors from predatory schemes and fraudulent activity in penny stocks, but has not explicitly excluded bonds from the list. Market participants fear that since there are corporate issuers that are not listed on stock markets and thereby do not regularly produce regular earnings reports, the market for price quotes on these companies’ bonds by broker-dealers may stall.

Talking Heads

On taper likely to be done by ‘middle of next year’

Jerome Powell, Federal Reserve Chairman

“Participants generally viewed that so long as the economic recovery remains on track, a gradual tapering process that concludes around the middle of next year is likely to be appropriate.” “The test of substantial further progress for employment is all but met.” On the effect of Evergrande on the US economy, “it’s something they’re managing,” Powell said. “In terms of the implications for us, there’s not a lot of direct U.S. exposure.”

In a statement by the Federal Open Market Committee (FOMC)

“If progress continues broadly as expected, the Committee judges that a moderation in the pace of asset purchases may soon be warranted.”

The Fed’s projections are “probably a little bit more hawkish than many would have anticipated, basically acknowledging that should the economy continue to grow as we have seen, it would warrant a tapering to occur.” “You could say it’s a tentative tapering announcement even though they did lower their 2021 GDP forecast.”

“I’d be naive to think that the turmoil in the market doesn’t have the potential to have second-order and third-order impact. Clearly with the changes that are taking place in the Evergrande situation it’s concerning.” “There is a potential for second and third-order impact, particularly on the capital markets and the bond markets, and we’ve got to stay close to that.” “I don’t think the regulatory reform that we see necessarily is wholly unexpected because there have been some strong signals, particularly around shadow banking, around the commercial real estate market, that some of the regulatory regime was going to change.”

Li Kai, founding partner of bond fund Shengao Investment

“Usually it will involve extension, payment in installment or a reduction in the coupon,” Li said. “This is one of the ways to avoid defaults by distressed companies.”

Daniel Fan, a credit analyst at Bloomberg Intelligence

“Evergrande might have arrived at some kind of standstill with onshore holders.” “They might have asked them not to act, pending for negotiation for a rescheduling or something of that sort.”

Victor van Hoorn, executive director of Eurosif

“That is an issue of credibility of the system at a time when Europe is trying to be the first jurisdiction to have some sound, robust sustainable finance rules in place.”

Alexander Lehmann, former lead economist for the European Bank for Reconstruction and development

“A sovereign exposure is not carbon neutral, and some less so than others,” Lehmann said.

On the era of Gulf jumbo bonds likely to be over – Hani Deaibes, head of debt capital markets for the Middle East and North Africa at JPMorgan

“Governments are trying to spread issuance through the year, trying to optimize pricing. They are now well established and have that flexibility.” “With lower financing needs, you don’t have to de-risk funding via large transactions and as such less need to do jumbo trades”. “Saudi Arabia has been gradually reducing its funding requirements, Abu Dhabi is in a very good position, Qatar has done the bulk of its large capex”, said Deaibes. “Maybe Kuwait is the only one that – when they eventually get approval to raise debt – may decide to do a jumbo transaction since they haven’t accessed the market since their inaugural transaction”. “We’re now in the period of refinancing of those large deals that came out in 2016, 2017, so issuance volume should be sustained by refinancing and issuances from new entities as the market continues to evolve and irrespective of a reduction in fiscal deficits, at least for the coming few years”, Deaibes said.

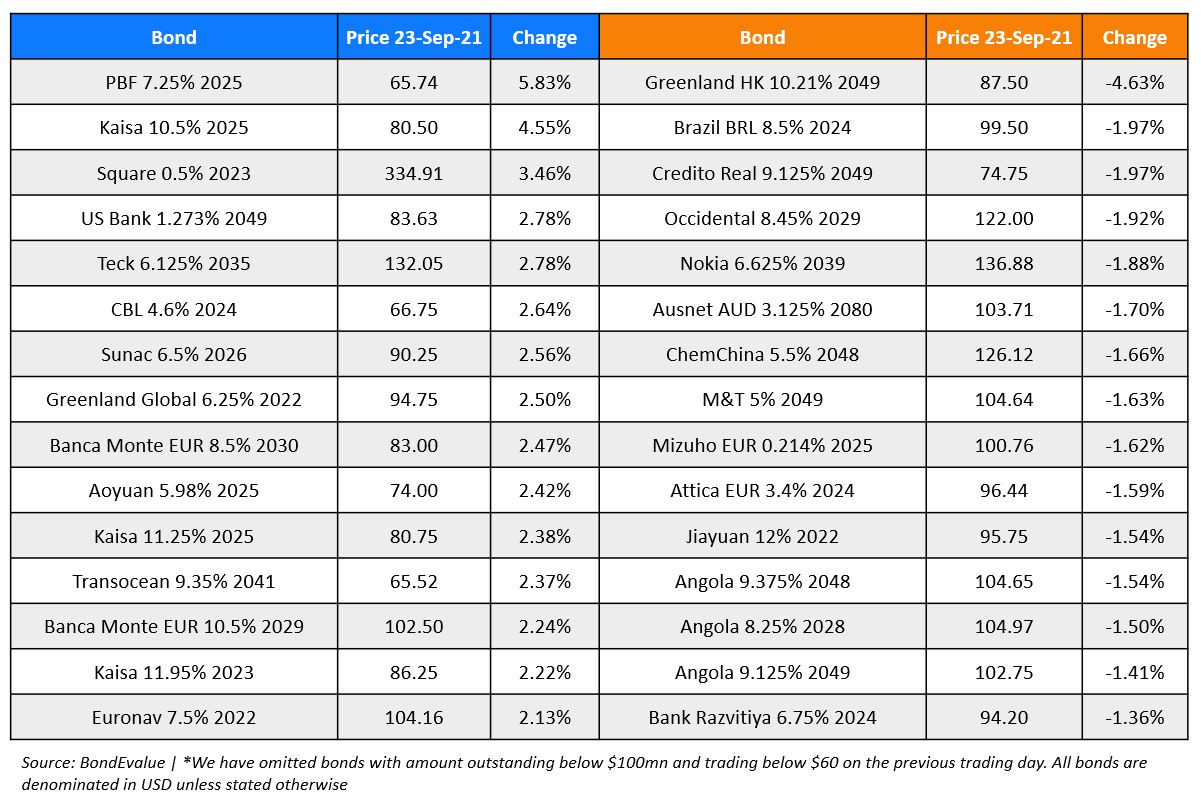

Top Gainers & Losers – 23-Sep-21*

Go back to Latest bond Market News

Related Posts:.png?width=1400&upscale=true&name=image%20(32).png)