This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

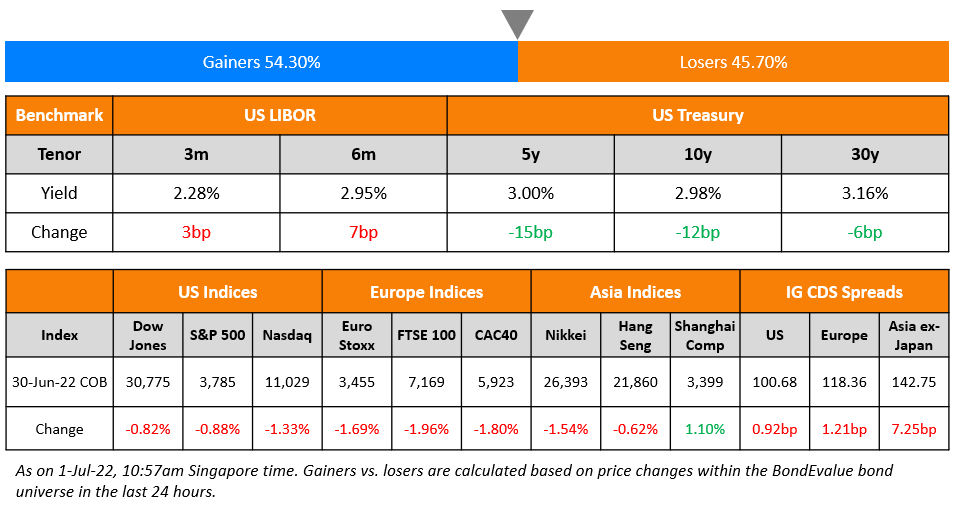

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

January 18, 2023

US 2Y Treasury yields moved 5bp lower while the rest of the curve was little changed. The peak Fed funds rate was 1bp lower at 4.92% for the June 2023 meeting. The probability of a 25bp hike at the FOMC’s February 2023 meeting stands at 95%, almost unchanged. US equity markets ended mixed with the S&P down 0.2% and Nasdaq up 0.1%. US IG CDS spreads widened 1.4bp and HY spreads were 9.1bp wider.

European equity markets ended slightly higher. The European main and crossover CDS spreads tightened by 1.3bp and 4.4bp respectively. Asian equity markets have opened mixed today. Asia ex-Japan CDS spreads tightened by 1bp. The BOJ’s monetary policy was maintained at status quo with YCC trading band maintained at 50bp on either side of its 0% target and short-term rates set at -0.1%. With markets expecting another policy tweak which was not the case, USDJPY jumped 2% higher to 131.11.

New Bond Issues

Asahi Life Insurance raised $375mn via a PerpNC5 bond at a yield of 6.9%, 60bp inside initial guidance of 7.5% area. The bonds have expected ratings of BBB, and received orders over $6.3bn, 16.8x issue size. APAC took about 84% and the remainder was taken by EMEA. Asset and fund managers took 79%, private banks took 11%, banks/financial institutions 7% and insurers/pensions 3%. The first call date is on 26 January 2028 and if not called, the coupons reset then and every 5 years at the US 5Y treasury yield plus the initial credit spread of 324bp and a 100bp step-up.

Morgan Stanley raised $6bn via a three-tranche deal. It raised:

- $1.5bn via a 4NC3 senior unsecured bond at a yield of 5.05%, 25bp inside initial guidance of T+145bp area. The new bonds are priced 12bp tighter to its existing 1.593% bonds due November 2027, callable in 2026 that yield 5.17%.

- $2.5bn via a 6NC5 senior unsecured bond at a yield of 5.123%, 22bp inside the initial guidance of T+175bp area. The new bonds are priced at a new issue premium of 6bp to its existing 6.296% bonds due October 2028, callable in 2027 that yield 5.06%.

- $2bn via a 15NC10 subordinated bond at a yield of 5.948%, 27bp inside the initial guidance of T+270bp area. The new bonds are priced at a new issue premium of ~14bp to its existing 5.297% bonds due April 2037, callable in 2032 that yield 5.81%.

The senior unsecured notes have expected ratings of A1/A-/A+, while the 15NC10 subordinated notes have expected ratings of Baa1/BBB+/A. Proceeds from all tranches will be used for general corporate purposes.

Bank of America raised $3bn via a 4NC3 bond at a yield of 5.08%, 25bp inside initial guidance of T+145bp area. The senior unsecured bonds have expected ratings of A2/A-/AA-. Proceeds will be used for general corporate purposes. The new bonds are priced 41bp wider to its existing 4.183% bonds due November 2027 callable in 2026, that yield 4.67%.

Woori Bank raised $600mn via a 5Y sustainability bond (Term of the Day, explained below) at a yield of 4.955%, 40bp inside initial guidance of T+175bp area. The senior unsecured bonds have expected ratings of A1/A+. Proceeds will be used to (re)finance projects in accordance with the issuer’s green, social and sustainability bond framework. The new bonds are priced 4.5bp wider to its existing 2% 2027s that yield 4.91%.

New Bonds Pipeline

- Khazanah Nasional Bhd hires for $ bond

Rating Changes

Term of the Day

Sustainability Bond

As per ICMA, an authority in capital markets, “Sustainability bonds are bonds where the proceeds will be exclusively applied to finance or re-finance a combination of both green and social projects.” These can be issued by financial/non-financial companies, governments or municipalities and should follow guidelines by the ICMA. The green and social aspects would be aligned to ICMA’s Green Bond Principles (GBP) and Social Bond Principles (SBP).

Talking Heads

On Julius Baer Saying It’s Going to be a Glorious Year for Bond Investing

Julius Baer Asia CIO, Bhaskar Laxminarayan

“It’s going to be a glorious year for bond investing. The straight and simple way of investing in bonds has become real again… There is no better time to actually buy into equities from a long-term perspective”

On bets that market is wrong on Credit Suisse – Hedge fund manager Boaz Weinstein

“The curve trade in Credit Suisse reflects my view that one way or the other, in the next two years the drama around Credit Suisse will resolve for better or for worse. I believe it will be for better and that they recover… think Credit Suisse’s CDS and bond curves are mis-priced because they imply that the bank will be seen as similarly risky many years down the road as it is today”

On JPMorgan seeing sustained rally in Chinese equities, upgrading property bonds

“Arguably, the policy U-turn has happened at a much faster pace than anyone’s imagination… The broad market is a buy-on-dip market, thanks to further fiscal, monetary and regulatory policy shifts… “strongly recommends” latching onto the reopening theme and picking up inexpensive internet companies.”

On Asian bonds in 2022 seeing first foreign outflows in six years

Duncan Tan, a strategist at DBS Bank

“Indonesian bonds would be expected to benefit most from the lower U.S. rates-lower U.S. dollar environment, while foreign investors are likely piling into Thailand bonds to pre-position for the full recovery in Chinese tourist arrivals”

Khoon Goh, head of Asia Research at ANZ

“Conditions look favourable for a return of inflows in 2023… Fed is close to the end of their hiking cycle, the U.S. dollar has peaked, and importantly, China’s re-opening has fueled investor optimism towards the region”

Top Gainers & Losers – 18-January-23*

Go back to Latest bond Market News

Related Posts: