This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

April 6, 2023

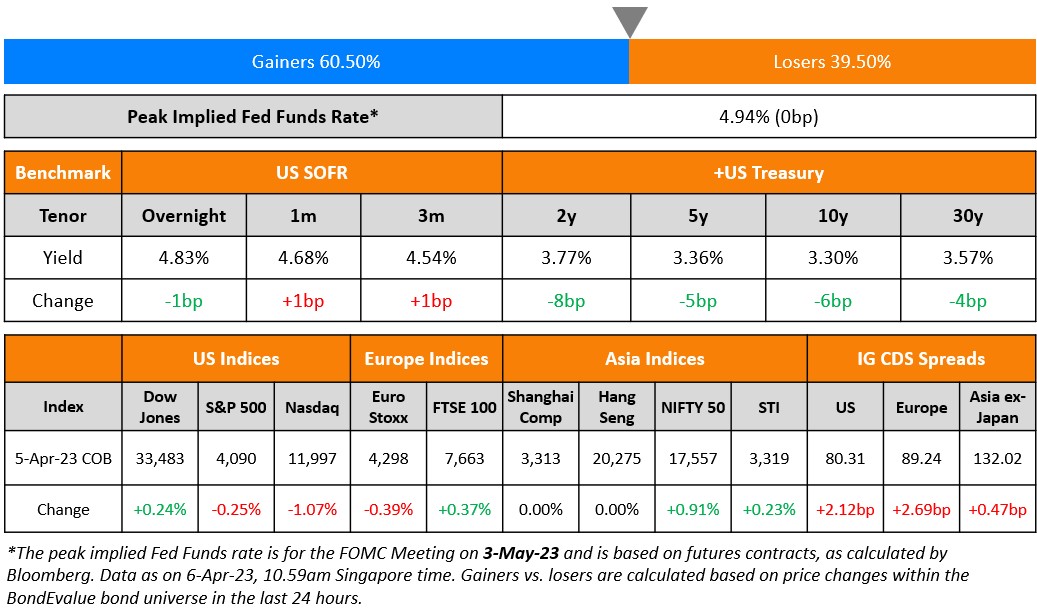

US Treasuries continued to rally with the 2Y and 10Y yields down by 6-8bp. US ADP employment data came at 145k, below estimates of 210k and also a decrease from February’s revised print of 261k. Also, US ISM Non-Manufacturing PMI for March came at 51.2, below estimates of 54.5 and seeing a drop of 3.9 points. The peak Fed funds was unchanged at 4.94% for the May meeting. CME maximum probabilities show a 53% chance of a rate hike at the May 2023 FOMC meeting as compared to a 58% chance of a 25bp hike a couple of days before. US IG and HY CDS spreads widened 2.1bp and 14bp respectively. US equity indices were lower as the S&P slipped 0.3% and the Nasdaq saw a further 1.1% decline.

European equity markets ended broadly lower. European main CDS spreads widened by 2.7bp and Crossover spreads were 16bp wider. Asia ex-Japan CDS spreads widened by 0.5bp. Asian equity markets have opened flat this morning.

New Bond Issues

Turkey raised $2.5bn via a long 7Y green bond at a yield of 9.3%, 30bp inside initial guidance 9.6% area. Proceeds will be used to finance/refinance Eligible Green Projects inline with Turkey’s Sustainable Finance Framework. The issuance comes a month ahead of its general elections that are set to be held on 14 May 2023. The new bonds are priced at a juicy new issue premium of 56bp vs. its existing 5.25% bonds due March 2030 that currently yield 8.74%.

Brazil raised $2.5bn via a 10Y bond at a yield of 6.15%, ~41bp inside initial guidance of 6.5-6.625% area. The bonds are rated Ba2/BB-/BB-. Proceeds will be used to repay outstanding debt. The new bonds are priced 7bp wider to its existing 8.25% 2034s that yield 6.08% in secondary trading.

BPCE raised €1bn via a 3Y bond at a yield of 3.754%, 25bp inside initial guidance of MS+95bp area. The bonds are rated A1/A/AA- and received orders over €2.7bn, 2.7x issue size. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- Bahrain hires for $ Long 7Y/ 12Y bond

- Kookmin Bank hires for $ 3Y and/or 5Y bond

Rating Changes

- Fitch Upgrades Saudi Arabia to ‘A+’; Outlook Stable

- Fitch Upgrades Accor to ‘BBB-‘; Outlook Stable

- Moody’s downgrades Codere’s CFR to Ca

Term of the Day

RT1 Bond

Restricted Tier 1 (RT1) bonds are junior subordinated securities issued by insurers that qualify as capital under Europe’s insurance regulation (known as Solvency II). To qualify as Tier 1 capital, the bonds must be perpetual with a minimum 10-year non-call, no step-up in coupon and a contractual trigger to principal write-down or equity conversion. According to the Solvency II directive, RT1s will automatically convert into equity or be written down upon three events:

- Breach of the Solvency Capital Requirement (SCR), which defines the capital required to ensure that the insurance company can meet its obligations over the next 12 months, for more than three months

- Drop of solvency ratio below 75% of the SCR

- Breach of the Minimum Capital Requirement (MCR), which is the threshold below which the national regulator would intervene

S&P notes that the adverse impacts from the events of Credit Suisse could trigger a possible pause in RT1 bond issuance by insurers.

Talking Heads

On Bank Slump Being Just a Blip to AT1 Evangelists Doubling Down on Trade

Mark LiebSource, CEO of Spectrum Asset Management

“When you see these types of markets, you’ve got to take advantage of them. This is why I’ve been in the business longer than anybody else”

Sebastiano Pirro, an investor running a €9bn fund for Algebris Investments

“There were some weak hands, shaky hands, and the market is now mispriced. The market is a spectacular buy.”

Romain Miginiac, a credit investor at Geneva-based Atlanticomnium

“Credit Suisse was an idiosyncratic event. While the underlying story had not changed, spreads have widened for the wrong reasons, which we believe creates an opportunity.”

On Dollar May Fall Another 15% on Peak Rate Bets – Eurizon

“With so much Fed tightening already in place, the risks to inflation in the US and the world are heavily biased to the downside… The already subdued level of economic activity in major parts of the world will, ironically, likely prevent global demand from collapsing”

On UBS telling investors ‘Herculean’ Credit Suisse takeover will pay off

“A new beginning and huge opportunities ahead for the combined bank and for the Swiss financial center as a whole. We believe the transaction is financially attractive for UBS shareholders… The acquisition of Credit Suisse will be a major challenge. It is expected to create a business with more than USD 5 trillion in total invested assets”

On US Recession Signal Seeing A Global Rush Into Indonesian Bonds

Jennifer Kusuma, a senior Asia rates strategist at ANZ Grou

“We are constructive on the rupiah-government-bond outlook”… Domestic bond demand is sufficient to absorb supply, the inflation outlook is benign, and the comfortable fiscal position means there’s downside potential to the bond-supply target. Indonesia’s bonds have already returned 7.3% this year

Top Gainers & Losers – 06-April-23*

Go back to Latest bond Market News

Related Posts: