This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

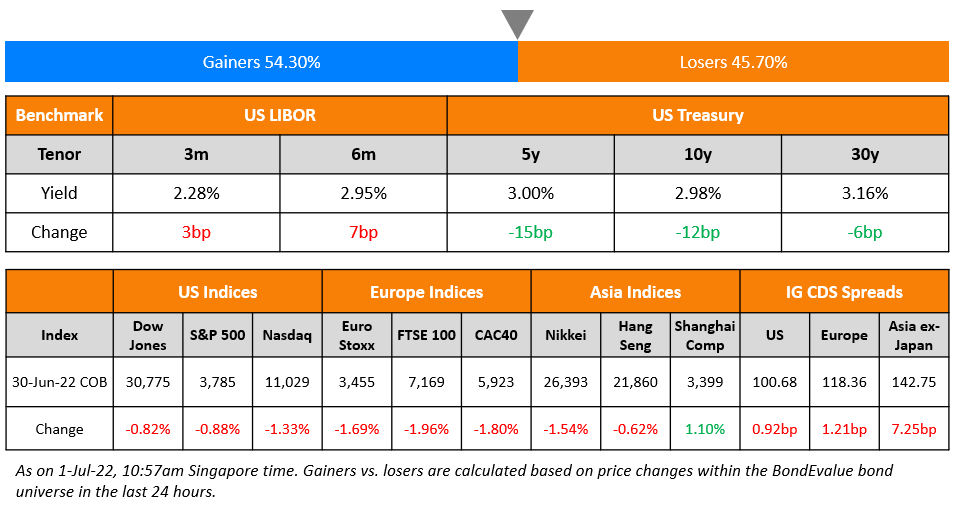

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

April 24, 2023

US Treasury yields firmed by 3-5bp across the curve with the US Flash Composite PMI reading for April rising from March’s 52.3 to a 11-month high of 53.5. This was also much higher than estimates of 51.2, indicating some underlying strength in the economy. CME probabilities all but confirm a 25bp hike in the Fed’s May meeting with the hike probability now at 90%. The peak Fed funds rate was 1bp higher to 5.11% for the June meeting. US IG and HY CDS spreads tightened by 1bp and 7.8bp respectively. US equity indices were marginally higher with the S&P and Nasdaq up by 0.1% each. Bloomberg notes that the US is showing signs of a credit crunch with certain indicators now warranting a closer look. They report that bankruptcies have spiked among small private companies have jumped to an average of almost 7 per week as against 2-3 per week during 2022. Also, the default rate has been rising slowly from lows of 1.2% last year to 2.7% currently.

European equity markets ended mixed. European main CDS spreads were flat and Crossover spreads were tighter by 2bp. Asia ex-Japan CDS spreads widened by 1bp. Asian equity markets have opened mixed this morning.

.png)

New Bond Issues

- Korea Ocean Business Corp $ 5Y at T+140bp area

New Bonds Pipeline

- Banco BTG hires for $ bond

Rating Changes

- Anheuser-Busch InBev Upgraded To ‘A-‘ On Resilient Performance And Deleveraging Trend; Outlook Stable

- Moody’s downgrades U.S. Bancorp’s ratings (senior unsecured to A3 from A2); outlook stable

- Fitch Downgrades Ghana’s LTLC IDR to ‘RD’

- Fitch Downgrades DTEK Energy to ‘RD’; Upgrades to ‘CC’

- Egypt Outlook Revised To Negative On External Financing Risks; ‘B/B’ Ratings Affirmed

Term of the Day

Equity Risk Premium

Equity risk premium refers to the extra expected return/spread that investors can get for holding stocks over the benchmark risk-free government bond. A higher premium indicates a greater compensation for risk that investors will receive for holding stocks vs. bonds. A lower premium would indicate the opposite.

Reuters notes that the risk premium on equity over bonds has hit historic lows of 243bp last seen in 2007, around the time of the Global Financial Crisis. They note that it is significantly below the 20Y and 35Y averages of 372bp and 314bp. “The risk-reward for equities does not look attractive in light of risk-free hurdle rate at 5%. We believe stocks are set to weaken for the remainder of the year and one should be underweight from here”, said JP Morgan analysts.

Talking Heads

On Making the Case for Soft Landing – Morgan Stanley’s Seth Carpenter

“We’ve actually been in the soft-landing camp for awhile…. The first thing is that it seems hard to avoid the fact that the US economy is going to slow down… Partly, because the slowdown is the Fed’s choice, at least having a chance to avoid a recession should also be the Fed’s choice.”

On Riskiest Country Debt Left Out of Emerging-Market Renaissance

Joe Delvaux, a money manager in London at Amundi

“The countries that are under stress are clearly demonstrating a larger concern”

Morgan Stanley strategists

“We don’t come away from the meetings with more optimism… The protracted stalemate with the IMF makes us less optimistic (on Tunisia). If this persists, Tunisia could fall into arrears”

On Bond Traders Waiting for Calm to Shatter With Fed ‘Breaking Stuff’

Gregory Faranello, head of US rates trading and strategy for AmeriVet Securities

“The volatility has really been in the two-year note and it’s a function of the fact that the Fed and other central banks are breaking stuff. The Fed is trying to separate financial stability in the system and monetary policy — and I think that collides in May”

Michelle Girard, head of US at NatWest Markets

“Where our concern lies is around the potential for a credit crunch — to really put restraint on the consumer. You have a whole host of data that can tell a bunch of different stories. So no one can be confident, the Fed included, on exactly what the path will be”

On Bonds Being in Trouble as $1tn Liquidity Drains

Matt King, Global Markets Strategist at Citi

“With peak liquidity past, we would not be at all surprised if markets were now to experience a sudden pressure loss. Keep watching the liquidity data — and buckle up… We now expect almost all of them to stall or go into outright reverse”

Top Gainers & Losers – 24-April-23*

Go back to Latest bond Market News

Related Posts: