This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

October 4, 2021

US markets ended higher on Friday to end a volatile week for equities as the S&P was up 1.2% and Nasdaq up 0.8%. US 10Y Treasury yields eased 1bp to 1.47%. Energy led the sectoral gains, up 3.3%, followed by Communication Services, Materials and Financials up over 1.6%. European stocks were mixed with the DAX falling 0.7%, FTSE down 0.8% while CAC was flat. Brazil’s Bovespa was marginally lower, down 0.1%. In the Middle East, UAE’s ADX and Saudi TASI were 0.4% lower. Asia Pacific markets are down again. While Shanghai remains closed, HSI and Nikkei were down 2.3% and 1% while STI was up 1.4%. US IG CDS spreads were 0.9bp tighter while HY CDX spreads tightened 3.7bp. EU Main CDS spreads were 0.2bp wider and Crossover CDS spreads widened 0.8bp. Asia ex-Japan CDS spreads tightened 0.3bp.

US ISM Manufacturing PMI came at 61.1, beating expectations of 59.6, with the prices paid component soaring to 81.2 after a slight dip last month to 79.4 and beating forecasts of 78.5, suggesting inflationary pressures. German retail sales missed forecasts of 1.9%, coming at 0.4% YoY. PMIs for Germany, France, Spain and Italy were almost in-line with expectations. EU HICP inflation came at 1.9% YoY, inline with forecasts.

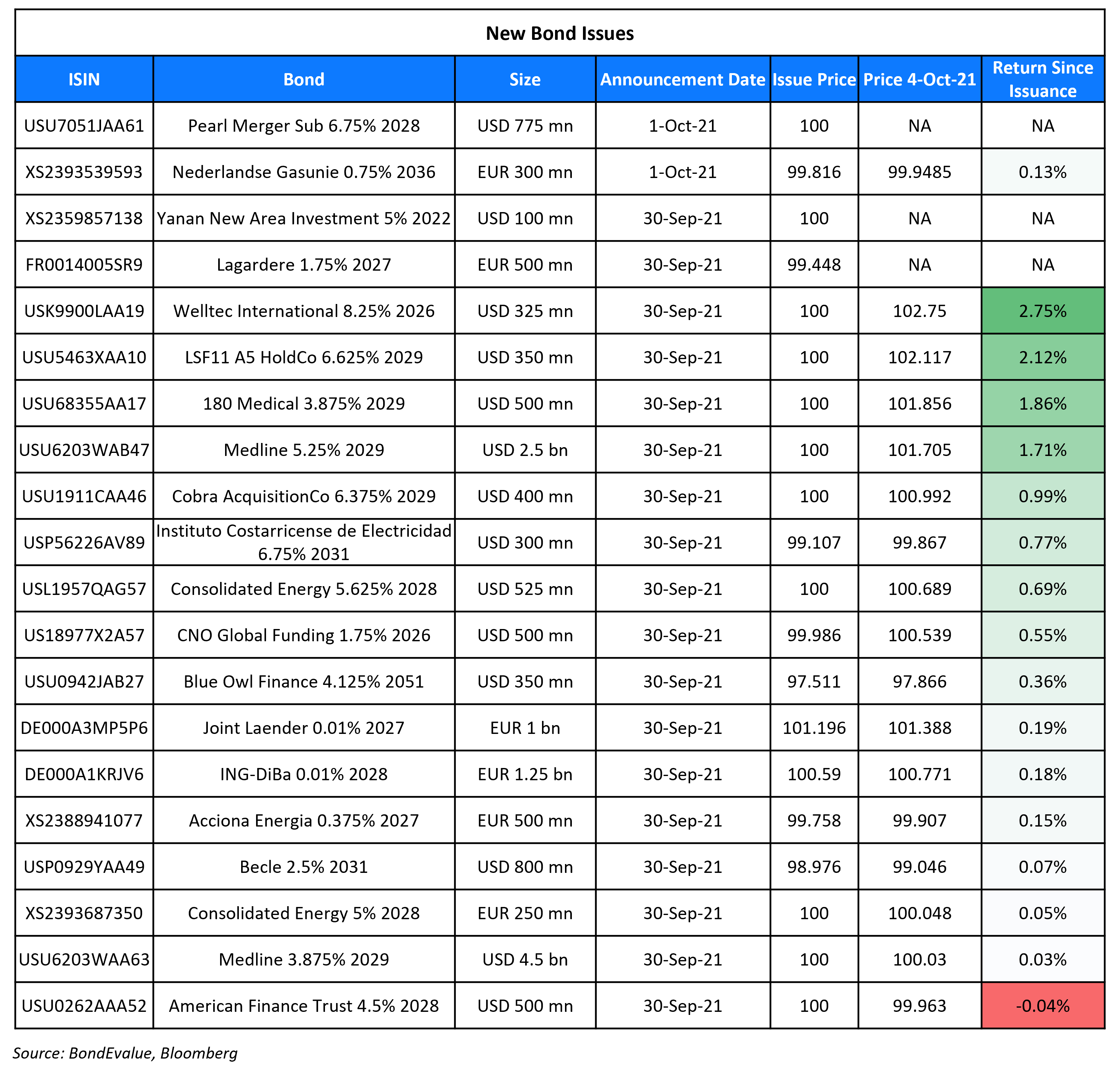

New Bond Issues

- Helenbergh China $ 102 mn 2Y green @ 11% final

New Bonds Pipeline

- Tuan Sing hires for S$ bond

- Korea hires for € 3Y to 5Y bond and/or $ 10Y bond

- China plans for $ 4 bn 3/5/10/30Y bond

- Saigon-Hanoi Bank hires for $ bond

- Burgan Bank hires for $ 500mn 6NC5 bond

- Kexim hires for $/€ bond

- Clover Aviation Capital hires for $ bond

- Dat Xanh Group hires for $ debut bond

- GD-HKGBA Holdings hires for $ 2Y bond

Rating Changes

-

Moody’s changes outlook on Belarus to negative; affirms ratings

- Moody’s revises CF Industries outlook to positive, affirms Ba1 CFR

- Moody’s upgrades Metalloinvest’s rating to Baa3; stable outlook

- Moody’s upgrades Ibercaja’s deposit ratings to Ba1; outlook stable

- Oman Outlook Revised To Positive On Improving Fiscal Position; ‘B+/B’ Ratings Affirmed

- Fitch Upgrades U. S. Steel’s IDR to ‘BB-‘; Outlook Remains Positive\

Term of the Day

Catastrophe Bonds (Cat Bonds)

Catastrophe Bonds also referred as Cat Bonds are risk-linked securities that are designed in favor of the issuer as these allow the transfer of risks related to a major catastrophe or a natural disaster to the investors. These are generally high yield debt instruments that payout to issuers in case of specific triggers. These bonds essentially act as insurance policies against natural disasters and are generally purchased by governments, insurance and reinsurance companies. In the event of a trigger event, the proceeds are paid to the borrower and the principal repayment and interest payments are either deferred or cancelled. In case the trigger event does not occur, the borrower continues to pay the interest and the principal as scheduled, similar to a regular bonds. These bonds have gained traction as the frequency of natural disasters is on the rise.

China Reinsurance issued its first catastrophe bond in Hong Kong to cover future typhoon damage in the bay area.

Talking Heads

“I think we’ll see progress in the labor market and progress on inflation coming back down,” Mester said.

“When it comes to an orderly taper, the window is closing.” “We’re still buying $40 billion of mortgages every month,” he said. “The problem in the housing market is not that it needs support. It’s that it is pricing out Americans. Americans can no longer afford what’s happening in the housing market.” “We’re still buying $120 billion of assets every single month, what we have been buying since the worst of the Covid crisis,” he added,. “Does it make sense in this environment when demand isn’t a problem, when the bond markets are wide open?”

On headwinds for global economy in final quarter of 2021

Frederic Neumann, co-head of Asian economic research at HSBC Holdings Plc

“Expectations of a swift exit from the pandemic were always misplaced.” “Full recovery will be measured in years, not quarters.”

Alicia Garcia Herrero, chief economist for Asia Pacific at Natixis

“Central banks are playing with fire by tapering to avert inflationary pressures without being fully sure of where we stand in the cycle.”

On China focusing efforts on ring-fencing Evergrande rather than saving it

Bruce Richards, Marathon Asset Management Chief Executive Officer

“The first obligation is going to make sure that homeowners who bought those homes take delivery and are made whole.” “At the very end of the pecking order are offshore bondholders.” “We don’t know what that recovery value is but we’re getting close to the point where it now makes sense” to buy, Richards said.

Alejandra Grindal, chief economist at Ned Davis Research Inc

“A disorderly default of Evergrande is unlikely because of the broad-based risk it presents to a large amount of the Chinese population.” “The government is probably less concerned about restructuring the offshore debt.”

James Feng, founding partner of Poseidon Capital Group

“It’s highly likely that Evergrande’s offshore bondholders will be wiped out,” he said.

Christina Zhu, Moody’s analyst

“Given the gigantic size and importance of the sector to the economy, we expect China to make every effort to avoid a hard landing, especially at a time when the economy is facing heightened uncertainty amid a pandemic.”

Zhou Hao, senior emerging markets strategist at Commerzbank AG

“Regulators will make sure no systemic financial crisis will happen, which is their bottom line.” “At the same time, they will punish developers that are highly leveraged.

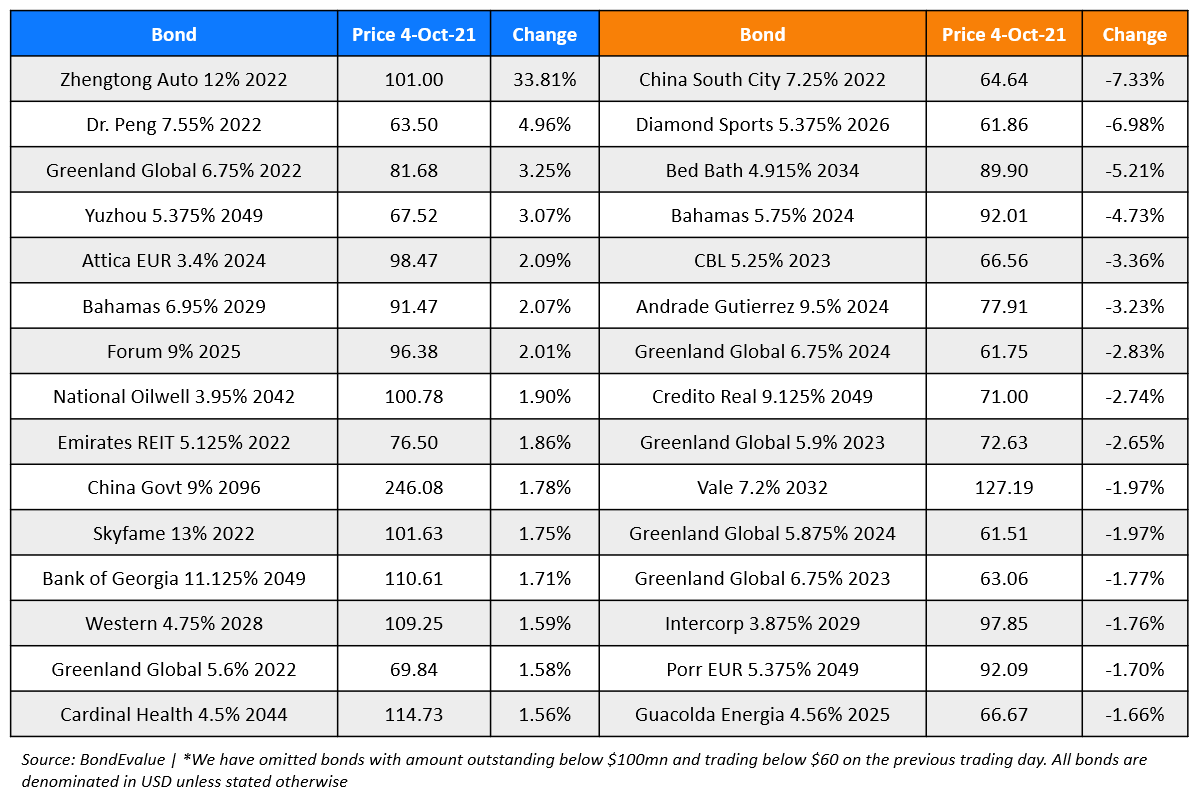

Top Gainers & Losers – 04-Oct-21*

Other Stories:

Go back to Latest bond Market News

Related Posts:-1.png?width=1400&upscale=true&name=image%20(9)-1.png)