This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

October 15, 2021

Wall Street saw a sharp jump higher with the S&P and Nasdaq up 1.7% each, with bank earnings coming stronger than forecasts (scroll below for details). All sectors ended in the green led by Materials and IT, up 2.4% and 2.3% respectively. US 10Y Treasury yields eased 2bp to 1.53%. European stocks also had a merry day with the DAX, CAC and FTSE up 1.4%, 1.3% and 0.9% respectively. Brazil’s Bovespa ended 0.2% lower. In the Middle East, UAE’s ADX was 0.3% higher and Saudi TASI was up 0.6%. Asian markets have opened positive too with Shanghai, HSI, STI and Nikkei up 0.1%, 0.6%, 0.4% and 1.3%. US IG and HY CDS spreads tightened 2bp and 10.1bp respectively. EU Main CDS spreads tightened 2.2bp and Crossover CDS spreads tightened 13bp. Asia ex-Japan CDS spreads were flat.

US initial jobless claims for the prior week fell 36k to 293k, the first sub 300k print in 19 months and better than the 319k forecast. Meanwhile OPEC trimmed its oil demand outlook for 2021 to 5.8mbpd compared to its previous estimate of 5.96mbpd while maintaining its 2022 projections at 4.2mbpd.

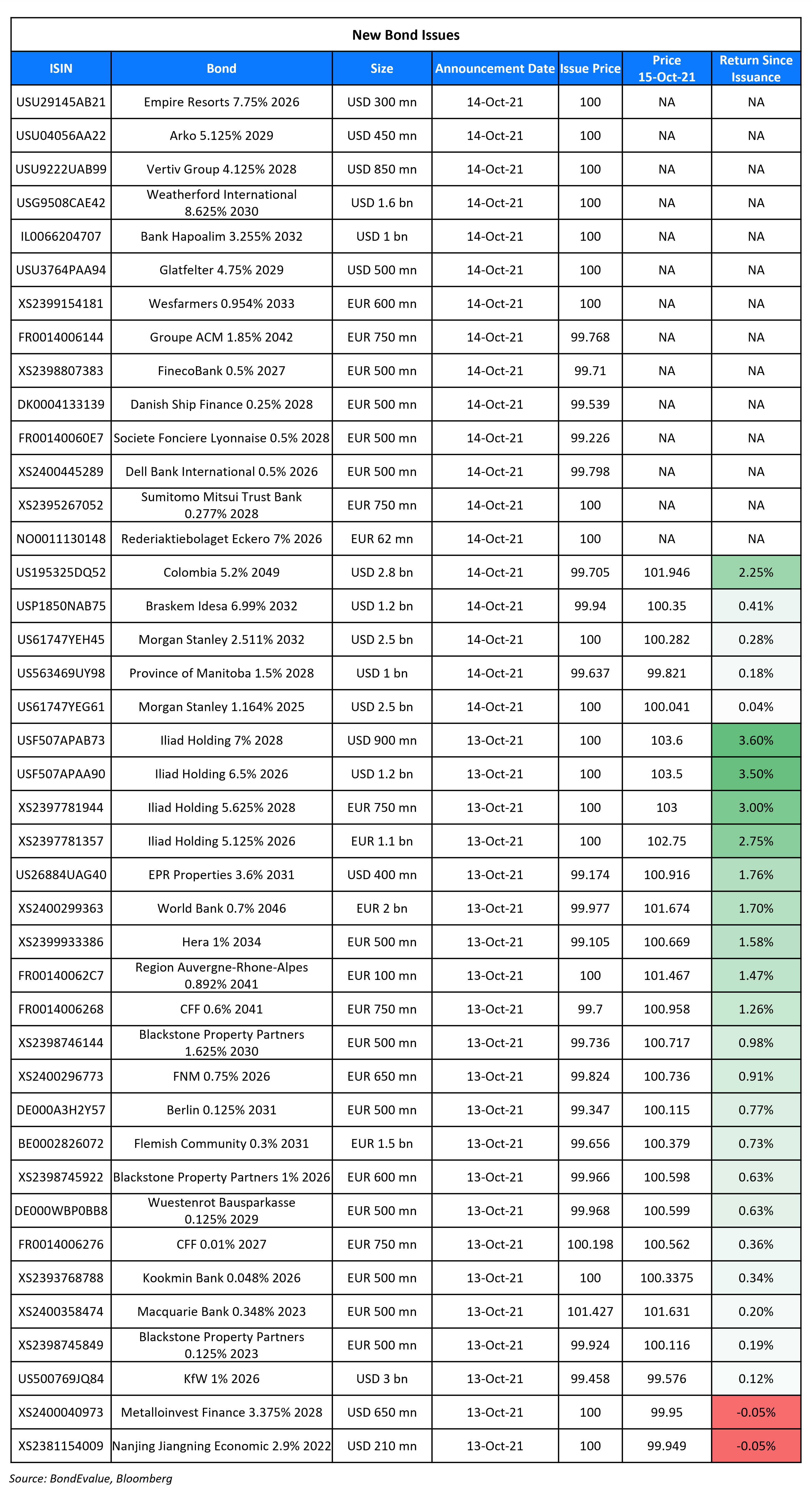

New Bond Issues

Morgan Stanley raised $5bn via a two-tranche deal. It raised $2.5bn via a 4NC3 bond at a yield of 1.164%, 13bp inside the initial guidance of T+70bp area. It also raised $2.5bn via a 11NC10 bond at a yield of 2.511%, 15bp inside the initial guidance of T+115bp area. The bonds have expected ratings of A1/BBB+/A. Proceeds will be used for general corporate purposes. The new 4NC3 bonds are priced 15.4bp wider to its existing 0.864% 2025 social bonds that yield 1.01%, whereas the new 11NC10 bonds are priced 8.1bp wider to its existing 1.928% 2032s that yield 2.43%.

Braskem Idesa raised $1.2bn via a 10NC5 sustainability-linked bond (SLB) at a yield of 7% vs initial guidance of low-mid 7%. The bonds have expected ratings of B+/B+ (S&P/Fitch). Proceeds will be used to repay its existing senior secured project finance facility. The bonds are first callable on and anytime after 20 Feb 2027 at 103.495. The call price will then change on 20 Feb 2028 to 101.748, on 20 Feb 2029 to 100.874 and on 20 Feb 2030 to 100.

Sumitomo Mitsui Trust Bank raised €750mn via a 7Y bond at a yield of 0.277%, 3bp inside initial guidance of MS+28bp area. The bonds have expected ratings of Aaa (Moody’s), and received orders over €885mn, 1.2x issue size.

Colombia raised $1bn via a tap of its 5.2% 2049s bond at a yield of 5.125%, 27.5bp inside initial guidance of 5.4% area. The bonds have expected ratings of Baa2/BB+. Proceeds will be used for general budgetary purposes. The bonds were priced 6bp wider to its existing 5.2% 2049s that currently yield 5.065%.

New Bonds Pipeline

- Chengdu Hi-Tech Investment Group hires for $ bond

- China plans for $ 4bn 3/5/10/30Y bond

Rating Changes

- Geo Energy Resources Upgraded To ‘B-‘ From ‘CCC’ On Completion Of Bond Redemption, Outlook Stable

- Fitch Downgrades Modern Land to ‘C’ on Distressed Debt Exchange

- Moody’s downgrades IBM’s senior unsecured rating to A3; outlook stable

- Moody’s downgrades Tunisia’s ratings to Caa1, maintains negative outlook

- Moody’s changes the outlook on Oman’s rating to stable, affirms Ba3 rating

- Peru Outlook Revised To Negative On Increased Risks To Debt Dynamics; ‘BBB+/A-2’ Foreign Currency Ratings Affirmed

- Fitch Affirms Murphy Oil’s IDR at ‘BB+’; Outlook Revised to Stable

- Fitch Affirms Pfizer Inc.’s IDR at ‘A’; Revises Rating Outlook to Stable from Negative

-

Moody’s changes Kosmos Energy’s outlook to positive, upgrades notes to B3

Term of the Day

Mark-to-Market

Mark-to-market (MTM) is an accounting method that requires companies to value (mark) certain assets to its current market value (market). MTM is used to determine the realistic value of a company’s current financial situation on the basis of current market conditions, since the value of assets and liabilities fluctuate over time. In cases of bonds, MTM implies recording the value of bonds at the current market value on the secondary markets, rather than the book value.

Talking Heads

On the view that rate hikes are needed – James Gorman, Morgan Stanley Chief Executive Officer

“You’ve got to prick this bubble a little bit,” Gorman said. “Money is a bit too free and available right now.” On the timing of the rate hike, Gorman says “certainly by the first quarter of next year I’d start moving.” “They have got a lot of capacity to move.” “I think the market has digested that the Fed will have to move, not just on tapering, but rate increases,” he said. “And by the way, we are 10 rate increases away from what would be considered normal.”

“Markets have likely seen their secular, long term lows in interest rates, but expectations for a 30-year bear market to match the previous 30-year bull market are way overdone.” “Bonds’ ‘days of wine and roses’ may be over,” but they “may do nicely while investors wait out uncertainties related to the U.S. budget, GDP growth in China, and run-ups in energy prices as we approach winter in the Northern hemisphere,” he said.

“Number one is inflation. It’s everywhere.” “The Fed is probably going to taper [and] announce it next month,” he said. “It’s going to push yields up in our view. [Treasury yields] will go up a bit more, and then probably drop in December.”

On 10-year treasury yields remaining relatively low despite inflation fears

Joseph Wang, a former Fed trader

According to Wang, low yields are hard to decipher “if you assume that bond yields are basically a reflection of economic conditions and inflation expectations.” “And there are definitely people who buy bonds with that framework, but there are also many people who buy bonds without that framework.” “You can’t really take the price of Tesla as an input in your model and back out supposedly market expectations for revenue growth, because people are buying Tesla for momentum,” says Wang. “It’s a mistake to infer economic conditions from them,” he says.

Jared Gross, head of institutional portfolio strategy at JPMorgan Asset Management

“When the rhetoric around the bond vigilantes was at its peak there was a sense that if fiscal and monetary policy were not taking care of inflation then the markets would do it. That the bond market would step in and drive interest rates higher -– and the effect on the economy would lead to the desired result.” “In this world, the amount of capital – whether you are looking at central bank holdings, insurance companies, pension funds, retirees, that is either entirely or somewhat price insensitive dwarfs the amount of capital that is willing to short Treasury bonds as a way to send a message on inflation.”

John Fath, managing partner at BTG Pactual Asset Management

“We may not have a time when the Fed is not involved in the Treasury market during our lifetimes.” “It’s almost like a prisoner’s dilemma for the Fed: For them to completely extract themselves from the market may cause an incredible amount of disruption.”

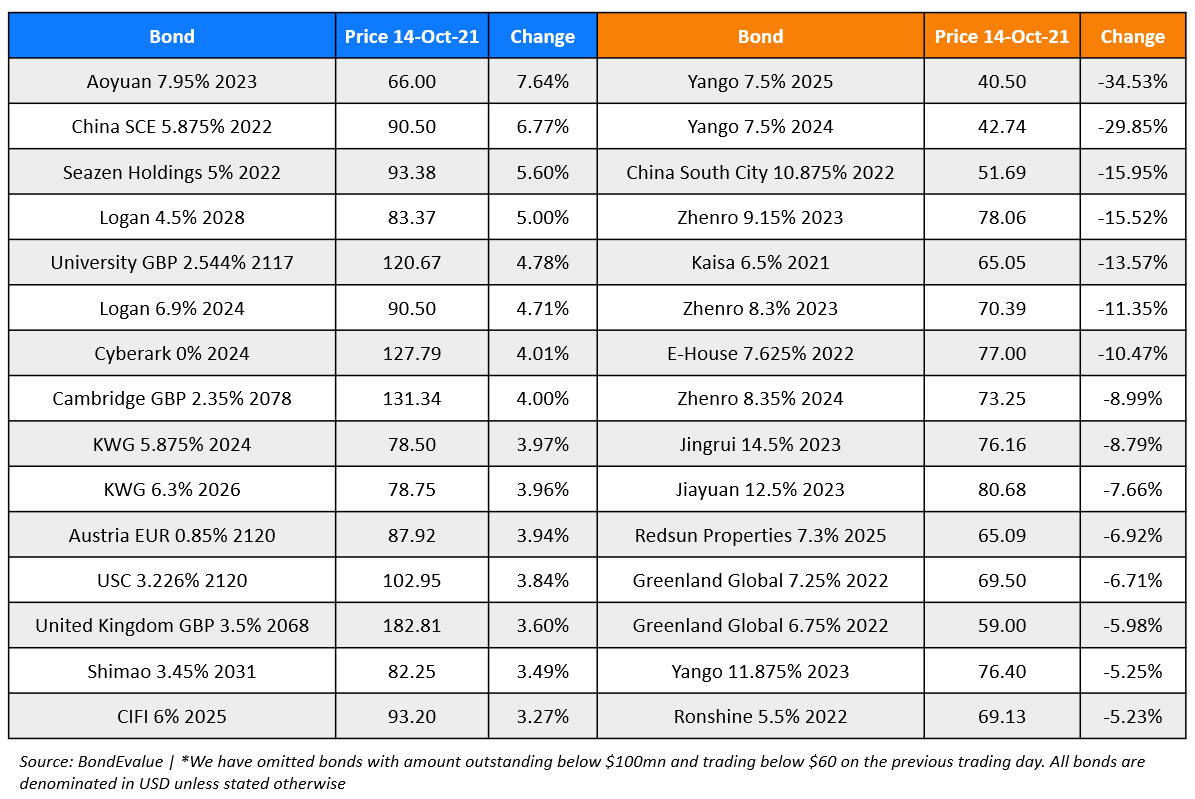

Top Gainers & Losers – 15-Oct-21*

Go back to Latest bond Market News

Related Posts: