This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

November 12, 2021

US equities ended slightly higher with the S&P up 0.06% and Nasdaq up 0.5%. Sectoral gains were led by Materials and IT, up 0.9% and 0.5% respectively. The US Treasury was shut for Veteran’s Day. European markets were higher with the DAX, CAC, FTSE up 0.1%, 0.2%, 0.6%. Brazil’s Bovespa ended 1.5% higher. In the Middle East, UAE’s ADX was up 0.7% and Saudi TASI was up 0.4%. Asian markets opened broadly higher – HSI, STI and Nikkei were up 0.3%, 0.1% and 1.1% respectively while Shanghai was flat. EU Main CDS spreads were 0.2bp tighter and Crossover CDS spreads were 0.3bp tighter. Asia ex-Japan CDS spreads widened 0.2bp.

US industrial production and manufacturing production came lower at 2.9% and 2.8% YoY for September vs. expectations of 3.1% each. Peru’s central bank hiked rates by 50bp to 2% in an effort to curb its current inflation of 5.8%, the fastest since 2009. Uruguay’s central bank also hiked its policy rate by 50bp to 5.75% in order to help lower inflation expectations that remain above its 3-6% target. The Mexican central bank hiked its policy rate by 25bp to 5%, after inflation accelerated to 6.24% YoY in October, more than double the central bank’s target of 3%, ±1%.

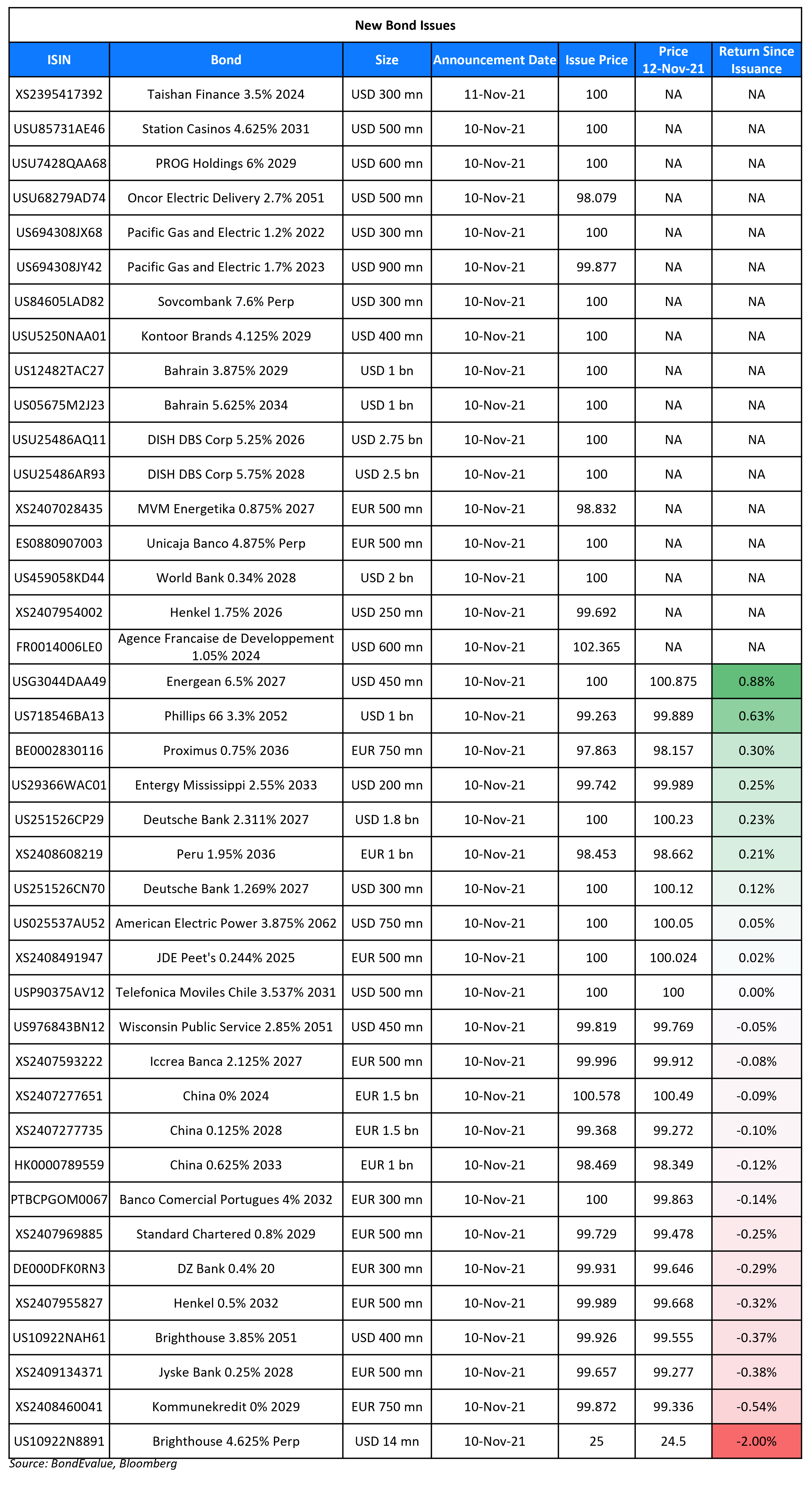

New Bond Issues

-

Changde Economic Construction Investment Group $ 364-day at 5% final

Peru raised €1bn via a 15Y social bond at a yield of 2.071% or MS+175bp, 25bp inside initial guidance of MS+200bp +/- 5bp area. Proceeds will be used for pre-finance purposes for next year, budgetary requirements for this year and to fund eligible social programs under its sustainable bond framework, including affordable housing, education, and healthcare. The notes are rated BBB (Fitch), in line with Peru’s credit rating, and received orders of €1.2bn, 1.2x issue size. Europe took 80%, America 14%, Asia 2% and the other regions 4%. Asset managers received 66%, insurance companies 12%, banks took 7%, pension funds 4% and the remaining 9% went to others.

Tai’an Municipality Taishan Finance and Investment Group raised $300mn via a 3Y bond at a yield of 3.5%, 50bp inside initial guidance of 4% area. The bonds are unrated. Proceeds will be used for debt refinancing and project construction. The bonds are issued by its indirect wholly owned subsidiary Taishan Finance International Business and guaranteed by Tai’an Municipality Taishan Finance and Investment Group.

New Bonds Pipeline

- Port of Newcastle hires for $ 10Y bond

- Impact Investment Exchange hires for $ 31.5 mn 4Y women’s livelihood bond

- Plaza Indonesia hires for $ 5NC3 sustainability-linked bond

Rating Changes

- Fitch Downgrades China South City to ‘B-‘, Outlook Negative; Removes from UCO

- Moody’s changes Occidental Petroleum’s rating outlook to positive; affirms Ba2 CFR

Term of the Day

HONIA

Hong Kong Overnight Interest rate Average (HONIA) is the overnight interest rate at which banks would lend funds in the interbank markets, denominated in HKD. This is considered an effective benchmark and has been identified to replace the Hong Kong Interbank Offered Rate (HIBOR). HONIA is similar to the SONIA in UK and EONIA in Europe. Hong Kong is planning to issue its first HONIA floating-rate bond as “part of the efforts to promote the usage of alternative reference rates and further the local bond market development”.

Talking Heads

On all ECB bond purchases could end by next September- Governing Council member Robert Holzmann

“So the elimination of the condition and therefore the end of the programme could – depending on the inflation development – happen in September or at the end of the year… The data analyses we have show that additional lending effects were very low… I see no reason for this to keep on running – the economic effect is low… Inflation being below 2 per cent at the end of 2022 – I wouldn’t bet a lot of money on that happening.”

On the US Treasury Market Is Most Treacherous Since Pandemic’s Onset

Peter Boockvar, chief investment officer at Bleakley Advisory Group

“The Fed’s idea of confronting now 6% inflation is to take their balance sheet higher by another $500b over the next 8 months and still have rates at zero… At least right now they are not credible, but we’ll see if the reality of the data and/or markets forces their hand to act more aggressively but to the risk of market valuations and eventually the economy.”

On Billionaire Investor Ray Dalio Warning that Inflation Is Driving Down Real Wealth

Some people make the mistake of thinking that they are getting richer because they are seeing their assets go up in price without seeing how their buying power is being eroded… The ones most hurt are those who have their money in cash… When a lot of money and credit are created, they go down in value, so having more money won’t necessarily give one more wealth or buying power… Printing money and giving it away won’t make us wealthier if the money isn’t directed to raise productivity.”

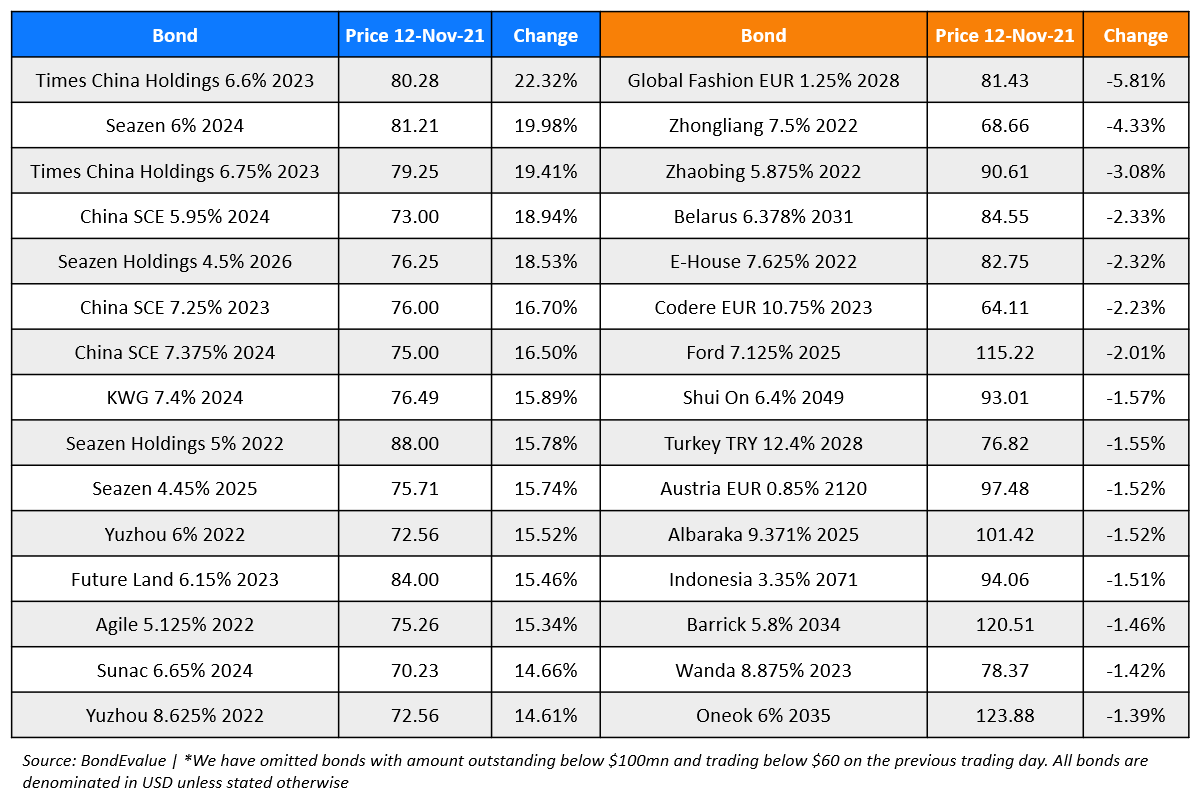

Top Gainers & Losers – 12-Nov-21*

Other Stories

Go back to Latest bond Market News

Related Posts: