This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

August 11, 2021

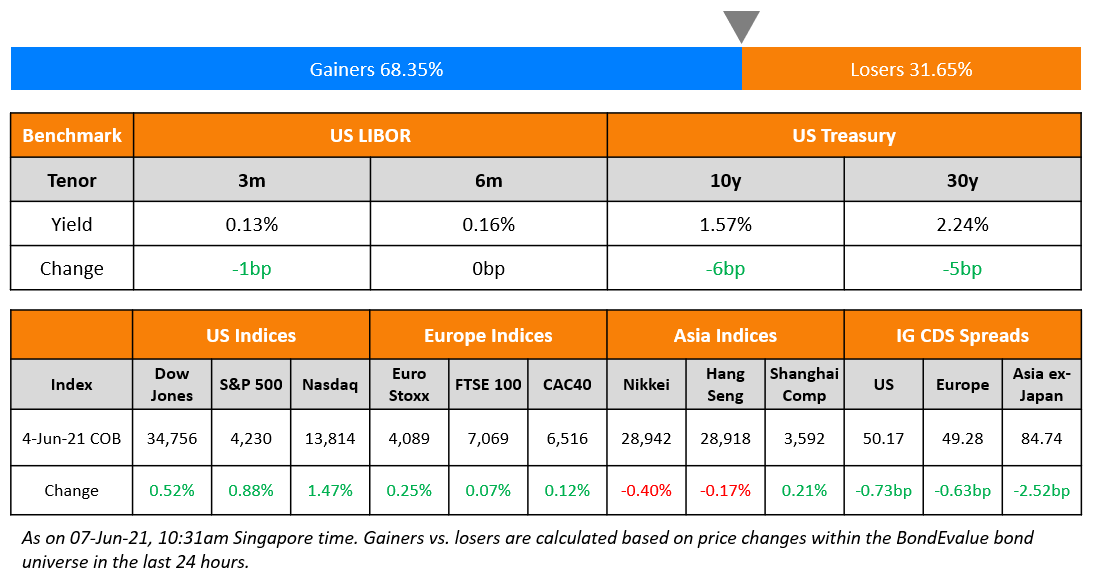

S&P gained 0.1% to close at another all-time high as the $1tn infrastructure plan was passed by the US Senate. The tech heavy Nasdaq on the other hand shed 0.5%. Energy and Materials rose 1.7% and 1.5% while Industrials and Financials closed 1% higher. Real Estate and IT led the losses, down 1.1% and 0.7% respectively. European markets inched higher on positive investor confidence despite fears over the Delta variant and inflation talks – the FTSE was up 0.4%, DAX 0.2% and CAC ~0.1%. Saudi’s TASI ended 0.9% higher while UAE’s ADX shed 0.2%. Brazil’s Bovespa reversed its gains to close 0.7% lower. APAC stocks had a mixed start – Nikkei was up 0.5% while Singapore’s STI and HSI were down 0.4%. Shanghai was flat. US 10Y Treasury yields widened 4bp to close at 1.35%. US IG and HY CDS spreads widened 0.9bp and 4.1bp. EU Main and Crossover CDS spreads also widened 0.2bp and 1.9bp respectively. Asia ex-Japan CDS spreads were 0.9bp tighter.

US nonfarm productivity was 1.2% lower than forecast at 2.3% for Q2 and vs. 4.3% in Q1. Singapore raised its 2021 GDP estimate to 6-7% from 4-6% after the economy grew 14.7% in 2Q2021 vs. estimates of 14.3%. Brazil posted a better than expected CPI of 0.96% for July vs. 0.53% in the previous month.

%20(1).jpg?width=1400&upscale=true&name=CapbridgeBonds_Newsletter%20(1)%20(1).jpg) With CapBridge’s fully digital investment platform, it’s fast and easy to get started.

With CapBridge’s fully digital investment platform, it’s fast and easy to get started.

- Hassle-free onboarding in 3 simple steps: SingPass MyInfo onboarding available for Singapore residents

- Curated list of fractional bonds

- Yields of up to 7-9%

- Fully transparent fee structure

- Instant settlement

For a limited time, investors get to enjoy up to 50% rebate off annual fees. Now, enjoy an even lower cost of bond ownership.

New Bond Issues

- Azure Power $ amortizing 5NC2 green bond at 4% area

-

Zhuhai Huafa Group $ PerpNC3 at 4.5% area

-

Sichuan Development Holding $ 5Y bond at 3.3% area

-

Yibin Emerging Industry Investment $ 35-month SBLC notes at 2.4% area

HSBC raised $3.5bn via a two-trancher. It raised $1.5bn via a 3Y non-call 2Y (3NC2) bond at a yield of 0.732%, 20bp inside initial guidance of T+70bp area. It also raised $2bn via an 8NC7 bond at a yield of 2.206%, 22bp inside initial guidance of T+130bp area. The SEC-registered bonds have expected ratings of A3/A-/A+. Coupons are fixed until the call dates and if not called, resets to SOFR + the initial margins on both the bonds on a quarterly basis. Proceeds will be used for general corporate purposes.

StanChart raised $1.5bn via a PerpNC7 AT1 bond at a yield of 4.3%, 45bp inside initial guidance of 4.75% area. The bonds have expected ratings of Ba1/BB-/BBB-. Coupons are fixed until the first reset date of February 19, 2029, and if not called, resets then and every five years thereafter to the 5Y US treasury yield + 313.5bp. Proceeds will be used for general business purposes of the group, including, without limitation, to repurchase or refinance existing debt, including a tender offer, and to strengthen further the regulatory capital of the group. The bonds were priced 43bp wider to HSBC’s 6.5% Perp (Baa3/BBB) callable in March 2028, that yield 3.97%

Temasek raised S$1.5bn ($1.1bn) via a 50Y bond at a yield of 2.8%, 5bp inside initial guidance of 2.85% area. The bonds are rated Aaa/AAA and received orders over S$1.7bn, 1.1x issue size. Insurance companies took 88% fund managers/agencies 10% and others 2%. By region, Singapore took 98% of the bonds and 2% went to others. The issuer is Temasek Financial I and guaranteed by the parent company. The issuer intends to provide the net proceeds from the issuance of what it calls ‘T2071-SGD Temasek Bond’ to Temasek and its investment holding companies to fund their ordinary course of business.

Taiyuan Longcheng Development Investment Group raised $77mn via a 364-day note at a yield of 2.2%, 55bp inside initial guidance of 2.75% area. The notes are unrated. Proceeds will be used for general corporate purposes. The issuer is 100% owned by the Taiyuan municipal finance bureau.

Shangrao Innovation Development raised $96mn via a 35-month credit-enhanced bond at a yield of 4%, unchanged from initial guidance. The bonds are unrated and have the support of an irrevocable standby letter of credit provided by Bank of Jiujiang. Proceeds will be used for industrial park construction.

New Bonds Pipeline

- Perusahaan Pengelola Asset hires for $ bond

-

PCGI Holdings hires for $ 5NC3 bond; calls today

- HDFC Bank hires for $ AT1 Bond

Rating Changes

- Moody’s changes Cenovus’s outlook to stable; affirms Baa3

- Hilton Grand Vacations Inc. Lowered To ‘B+’ After Diamond Acquisition Completion; Outlook Stable

Term of the Day

Standby Letter of Credit (SBLC)

Standby Letter of Credit (SBLC) is a note issued by the buyer’s bank to the seller’s bank, where the former guarantees to pay a sum of money to the latter if the buyer defaults on the agreement. Particularly in the shipping of goods, SBLCs are used to reduce risks associated with the transaction on unforeseen events leading to a default. Bonds backed by the above structure are called SBLC-Backed Bonds. Unlike guarantees, which are direct obligations of a bank to cover the timely payment of related bonds, SBLCs require trustees of the bonds to provide demand notices to the banks in the event that issuers fail to make bond payments. Thus as Moody’s says, more analysis is required on whether the language of SBLCs and transaction mechanisms support timely payments.

Shangrao Innovation Development raised $96mn via a 35-month credit-enhanced bond that have the support of an irrevocable standby letter of credit provided by Bank of Jiujiang.

Talking Heads

“Everybody is wondering about September, November, December, January,” as possible dates to start bond taper. “I don’t think that one meeting on either side is going to have an important effect.” “Employment is going to be good.” “Inflation continues to be something that is going to have to behave differently over the next couple of years than it has over the last 10 [years].”

“Risks remain. While inflation data has so far not been a major market mover, Wednesday’s July consumer price index release has the potential to cause volatility, especially given expectations that inflation has passed the peak.”

“First, deal reception in the high yield market took an appreciable step backward yesterday. While new issue concessions were all over the board, some of yesterday’s high yield deals came with concessions upwards of 20bp.” “Second, on the anecdotal side, reports of investor fatigue are coming in with increasing regularity as lightly staffed credit teams are overwhelmed by the sheer deal volume coming to market. This suggests the possibility of market saturation that could further exacerbate the recent technically driven widening.”

Seema Shah, chief strategist at Principal Global Investor

“For risk assets it’s not so much the level of yields that matters, but how quickly they rise,” she said.

Antoine Bouvet, senior rates strategist at ING

“Getting to 2 per cent from here would be a pretty sharp adjustment.” “There’s a feedback effect which means risk assets will be hit and some money will flow back into Treasuries. It’s a natural brake on rising yields.”

“Getting to 2 per cent from here would be a pretty sharp adjustment.” “There’s a feedback effect which means risk assets will be hit and some money will flow back into Treasuries. It’s a natural brake on rising yields.”

Top Gainers & Losers – 11-Aug-21*

.png?width=1400&upscale=true&name=BondEvalue%20Gainer%20Losers%2011%20Aug%20(1).png)

Go back to Latest bond Market News

Related Posts: