This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

December 13, 2021

US equity markets recovered on Friday with the S&P and Nasdaq closing 1% and 0.7% higher. All sectors were in the green led by IT and Consumer Staples, up over 2% each. US 10Y Treasury yields moved 1bp higher to 1.50%. European markets were higher too with the DAX, CAC and FTSE up 0.1%, 0.2% and 0.4% respectively. Brazil’s Bovespa was up 1.4%. In the Middle East, UAE’s ADX was up 1% and Saudi TASI up 0.3% on Sunday. Asian markets have opened strong with the Shanghai, HSI and Nikkei up almost 1% each and the STI up 0.3%. US IG CDS spreads tightened 1.3bp while HY CDS spreads tightened 5.2bp. EU Main CDS spreads were 0.5bp tighter and Crossover CDS spreads were 1.8bp tighter. Asia ex-Japan CDS spreads tightened 1.8bp.

US CPI YoY for November came at 6.8%, in-line with expectations. Separately, Sri Lanka’s finance minister Basil Rajapaksa said that the country will not default on its debt repayments in 2022 despite facing a depletion in its forex reserves. He said, “I will assure that every dollar that we have to pay will be paid”.

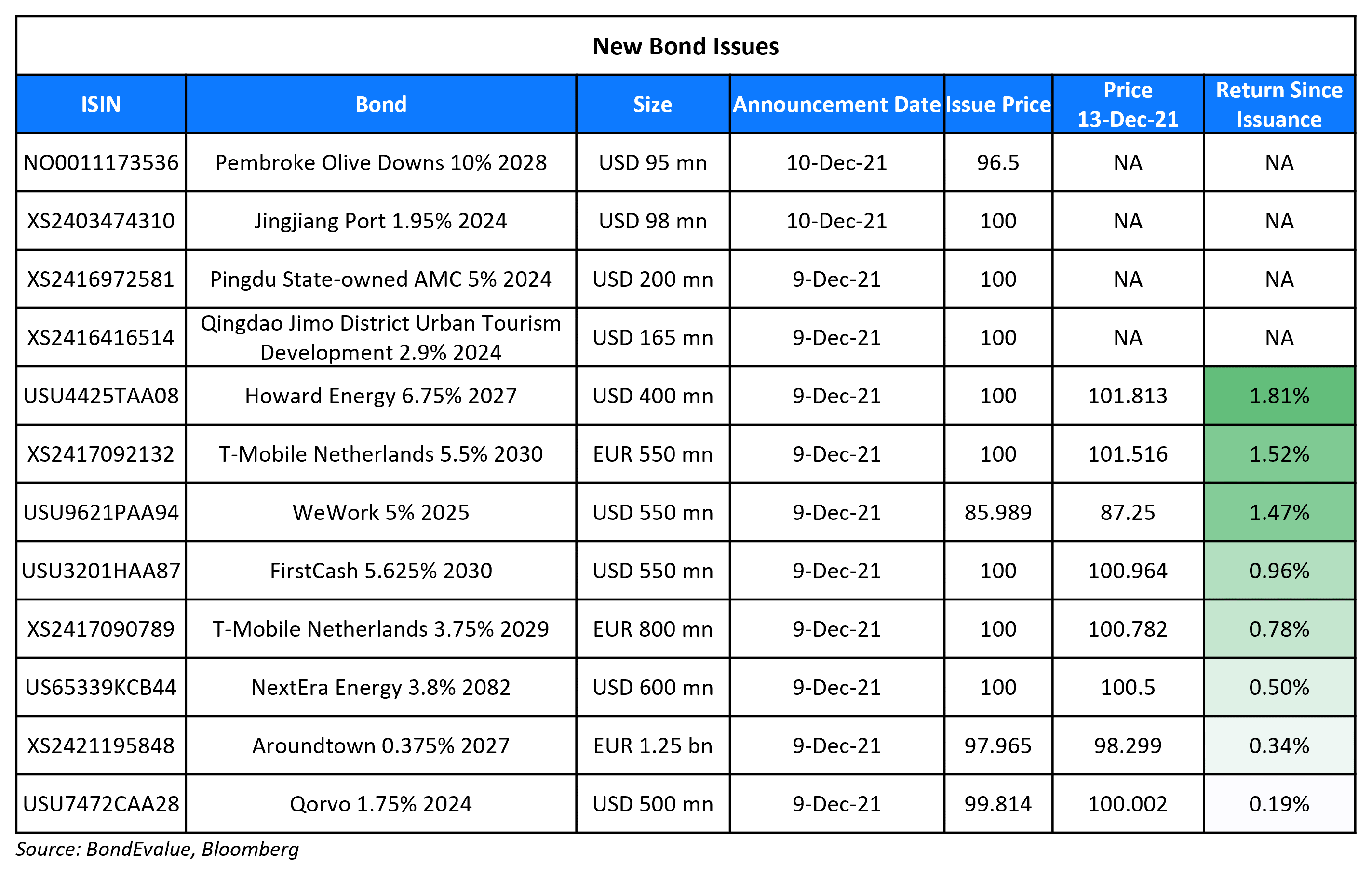

New Bond Issues

-

CCB Macau $ 3Y green at SOFR+80bp area

Powerlong Real Estate raised $150mn via a tap of its 6.25% 2024 bond at a yield of 11.975%, bringing the total size of the bond to $500mn. The bonds are rated B2/B+ (Moody’s/S&P). Proceeds from the tap will be used to refinance its medium to long term offshore debt that will become due within a year. The new bonds have a significant new issue premium of 269.5bp over the existing 6.25% 2024s that yield 9.28%.

Jingjiang Port raised $98mn via a 3Y bond at a yield of 1.95%, 15bp inside initial guidance of 2.1% area. The bonds are unrated. Proceeds will be used for projects construction, debt repayment, working capital and general corporate purposes. The bonds are supported by a letter of credit from Bank of Shanghai Nanjing branch.

Baoji Investment raised $60mn via a 3Y bond at a yield of 3.35%. The bonds are unrated. Proceeds will be used to repay offshore debt. The bonds are supported by a letter of credit from Bank of Xi’an.

New Bonds Pipeline

- SGSP (Australia) hires for $ green bond

Rating Changes

- Moody’s upgrades Caleres’ CFR to Ba3

- Fitch Upgrades OCI to ‘BB+’; Outlook Stable

- Serba Dinamik Downgraded To ‘D’ On Missed Coupon Payment; Issue Ratings On 2022 And 2025 Sukuks Lowered To ‘D’

- Turkey Outlook Revised To Negative On Uncertain Policy Direction Amid Rising External Risks; Ratings Affirmed

- Serbia Outlook Revised To Positive On Strong Economic Growth, Strengthening External Metrics; ‘BB+/B’ Ratings Affirmed

- Moody’s affirms Medco’s B1 rating and revises outlook to stable following acquisition announcement

- Fitch Revises Logan’s Outlook to Stable, Affirms IDR at ‘BB’, Removes UCO

- Moody’s withdraws Fantasia’s ratings due to insufficient information

- Moody’s withdraws Modern Land’s ratings due to insufficient information

Term of the Day

Breakeven Rate

The Breakeven Rate aka Treasury Breakeven Rate refers to the difference between the nominal Treasury bond’s yield and that of Treasury Inflation Protected Securities (TIPS). Higher breakeven rates imply that inflation is rising and lower breakevens imply a slowdown in inflation. Bloomberg notes that the US 5Y breakeven rate, which hit a record high last month, were at 2.80% Friday.

Talking Heads

On El-Erian Says Transitory Inflation Call Likely Fed’s Worst Ever

“The characterization of inflation as transitory — it’s probably the worst inflation call in the history of the Federal Reserve… It results in a high probability of a policy mistake. So the Fed must quickly, starting this week, regain regain control of the inflation narrative and regain its own credibility. Otherwise, it will become a driver of higher inflation expectations that feed off themselves.”

On Fed Hikes Seen Starting With Yield Curve Flattest in Generation

Julia Coronado, president of MacroPolicy Perspectives LLC in New York

“It is a leading indicator of the economy,” she said. “It doesn’t get everything right, but you wouldn’t, also, want to completely ignore it.”

El-Erian, chief economic adviser to Allianz SE

“When you start late, at some point developments on the ground force you to go faster than you would normally want to go. And if you go faster than you normally want to go, you risk breaking something”

Daniel Tenengauzer, head of market strategy at BNY Mellon in New York

“The term structure in the U.S. is already pricing cuts, even before the tightening cycle has started.”

Jim Bianco, president of Bianco Research

“Usually the Fed raises rates until they break something. And the flattening yield curve is suggesting it won’t take much to break something — maybe just a move to 1% and we’ll start seeing breakage”

On Stock-Market Bravado Tested as Bonds Flash Fed Policy Danger

Brian O’Reilly, head of market strategy at Mediolanum International Funds

“It’s the expectation that short-term rates are going to increase and a risk that by moving too aggressively the Federal Reserve and other central banks could choke off the recovery. That’s what the bond market is saying. I don’t necessarily agree”

Gene Tannuzzo, the global fixed-income head at Columbia Threadneedle

“The yield curve is too flat. Quantitative easing and asset purchases have both become very significant portions of what central banks do. Because of that longer-return yields are less of a natural signal.”

On Lenders Seizing $63m worth of Evergrande chair’s shares

Logan Wright, a Hong Kong-based director at consultancy Rhodium Group

“I think a fair interpretation is that the markets were already pricing in a very high probability of default. The second is that the market environment has been changed to some extent by the easing of measures and state policy.”

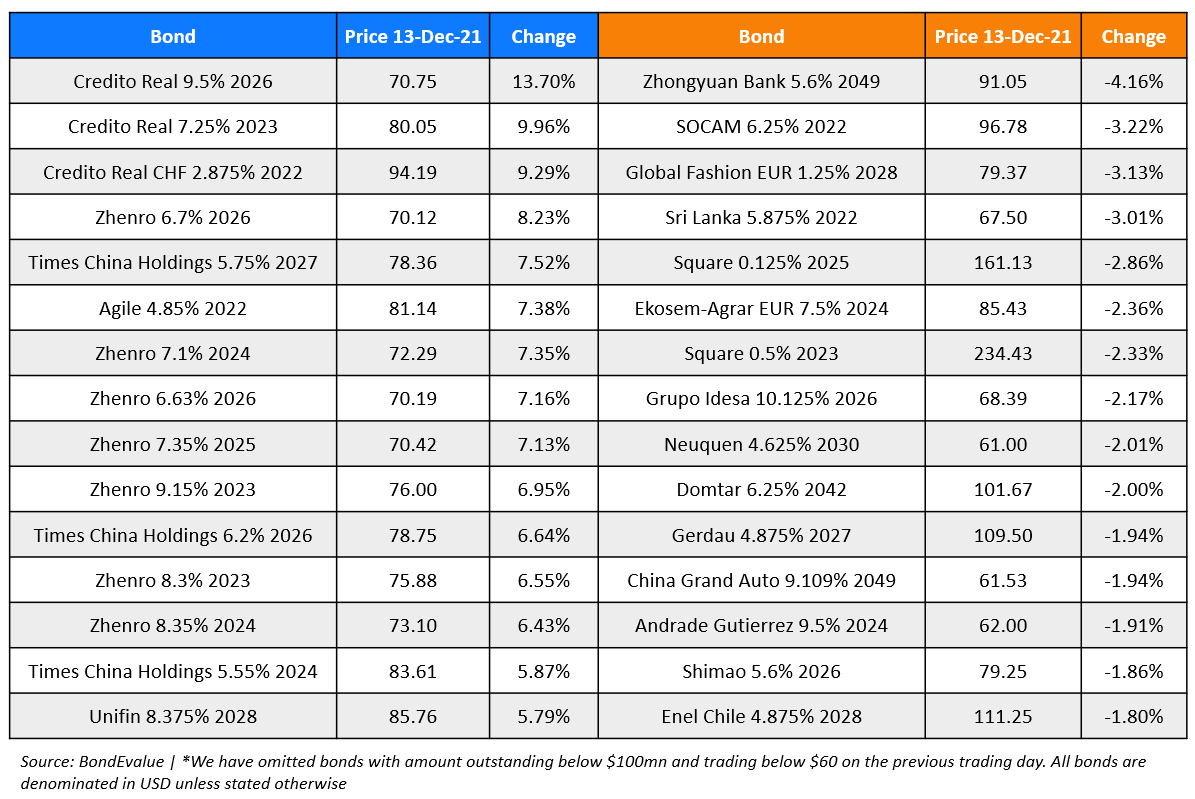

Top Gainers & Losers – 13-Dec-21*

Other Stories:

ConocoPhillips offloads Indonesia assets in Asia-Pacific revamp

Go back to Latest bond Market News

Related Posts: