This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

December 15, 2021

US equity markets continued its move downward with the S&P and Nasdaq closing 0.8% and 1.1% lower. All sectors barring Financials were in the red led with IT Real Estate and Industrials down over 1% each. US 10Y Treasury yields moved 2bp higher to 1.43% with the FOMC meeting decision later today. European markets were lower too with the DAX, CAC and FTSE down 1.1%, 0.7% and 0.2% respectively. Brazil’s Bovespa was down 0.6%. In the Middle East, UAE’s ADX was down 1.1% while Saudi TASI ended flat. Asian markets have opened mixed with Shanghai flat, HSI up 0.3% while STI and Nikkei were down 0.3% and 0.1% respectively. US IG CDS spreads widened 0.5bp while HY CDS spreads widened 3.1bp. EU Main CDS spreads were 0.5bp wider and Crossover CDS spreads were 2.6bp wider. Asia ex-Japan CDS spreads widened 0.8bp.

China’s November Industrial Production rose 3.8% YoY vs. forecasts of 3.6%. Retail Sales and Fixed Asset Investments however, were softer at 3.9% and 5.2% vs. forecasts of 4.6% and 5.4% indicating some signs of slowing down.

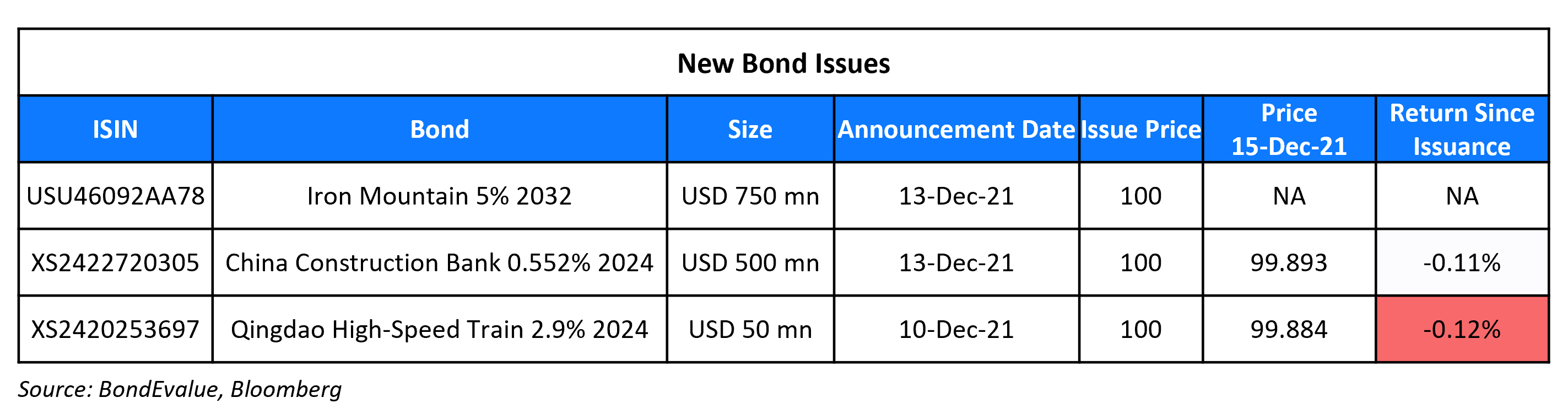

New Bond Issues

- Sunkwan Properties $ 364-day at 13.5%

Qingdao High-Speed Train raised $50mn via a 3Y bond at a yield of 2.9%. The bonds are unrated. The bonds are supported by a letter of credit from the Bank of Qingdao for up to $51.225mn. Parent Qingdao Bullet Train Town Investment Group, a state-owned Chinese infrastructure construction and park services provider has provided a keepwell.

New Bonds Pipeline

- SGSP (Australia) hires for $ green bond

Rating Changes

- U.K.-Based TalkTalk Downgraded To ‘B’ On Operating Underperformance; Outlook Negative

- Moody’s affirms Pfizer’s A2 rating; revises outlook to positive

- Fitch Revises Hellenic Bank’s Outlook to Positive, Affirms IDR at ‘B’

- Moody’s changes Boparan’s outlook to negative; assigns B3 rating to the mirror notes

- Fantasia Holdings Ratings Withdrawn At Issuer’s Request

Term of the Day

Private Placement

A private placement is a sale of securities, i.e., shares or bonds directly to select private investors, rather than issuing them via a public offering. Investors in privately placed securities generally comprise large banks, mutual funds, or insurance companies. The advantage of private placements is that they may not be subject to the same strict regulations regarding disclosure and reporting of public offerings. Also, the cost and time savings add to its attractiveness. A privately placed bond however may carry a higher rate to entice investors and they limit the number and variety of investors that can take part unlike public offerings. Unlike bonds issued via public offerings, privately placed bonds may not trade on the secondary market.

Talking Heads

On the clockwork-like trading pattern in US bond futures

Priya Misra, global head of interest-rate strategy at TD Securities

“Pension demand is a structural bid in the long-end” of the Treasury yield curve.

In a study by Morgan Stanley

Demand from pension funds could “flatten the curve more than normal for a rate hike cycle.”

According to the IMF

“It would be important to avoid inaction bias, in view of costs associated with containing second-round impacts [of inflation].” A shift towards lower Treasury spending in 2022-2023 would “help contain demand in the short run with the benefit of also reducing the drag on growth in [the medium term]”. “It is important to bear in mind that initial steps [to raise interest rates] would still leave policy accommodative, that changes in policy can provide important signals to dampen inflation expectations, and that policy is best focused on the period 12 to 24 months out, when it has its maximum impact (and this would be beyond near-term Covid-19 developments).”

Kristalina Georgieva, managing director of the IMF

“We are in no position today yet to identify to what extent [this labour market tightness] is due to the pandemic and what role Brexit may play in it,” she said.

On the Bank of Japan’s quiet approach to tapering

Hideo Kumano, executive chief economist at Dai-Ichi Life Research Institute

“The whole tapering debate is something the BOJ avoids.” “In a way you can say that what they are doing, they are doing pretty well.”

Freya Beamish, head of macro research at TS Lombard

“That facilitated a stealthy early withdrawal for the BOJ. In contrast, the Fed is now left in the position of accelerating its taper and communicating that in a way that doesn’t derail equity markets,” she said.

Top Gainers & Losers – 15-Dec-21*

Other Stories

Go back to Latest bond Market News

Related Posts: