This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

January 7, 2022

US equity markets ended marginally lower, with the S&P and Nasdaq down 0.1% each. Energy led the gainers, up 2.3% while Healthcare and Materials led the losers, down over 1.2% each. US 10Y Treasury yields were up 1bp to 1.72%. European markets were lower with the DAX, CAC and FTSE down 1.4%, 1.7%, and 0.9% respectively. Brazil’s Bovespa was up 0.6%. In the Middle East, UAE’s ADX was down 0.1% while Saudi TASI was down 0.2%. Asian markets have opened broadly higher today – Shanghai, HSI and STI were up 0.4%, 1.1% and 0.6% respectively while Nikkei was down 0.3%. US IG CDS spreads were flat and HY CDS spreads tightened 0.8bp. EU Main CDS spreads were 1.6bp wider and Crossover CDS spreads were 7.5bp wider. Asia ex-Japan CDS spreads widened 4.6bp.

US ISM Non-Manufacturing PMI came at 62 vs. 66.9 forecasted. The sub-components were mostly softer across the board with the new orders index down to 61.5 from 69.7. US jobless claims came at 207k vs. 195k forecasted.

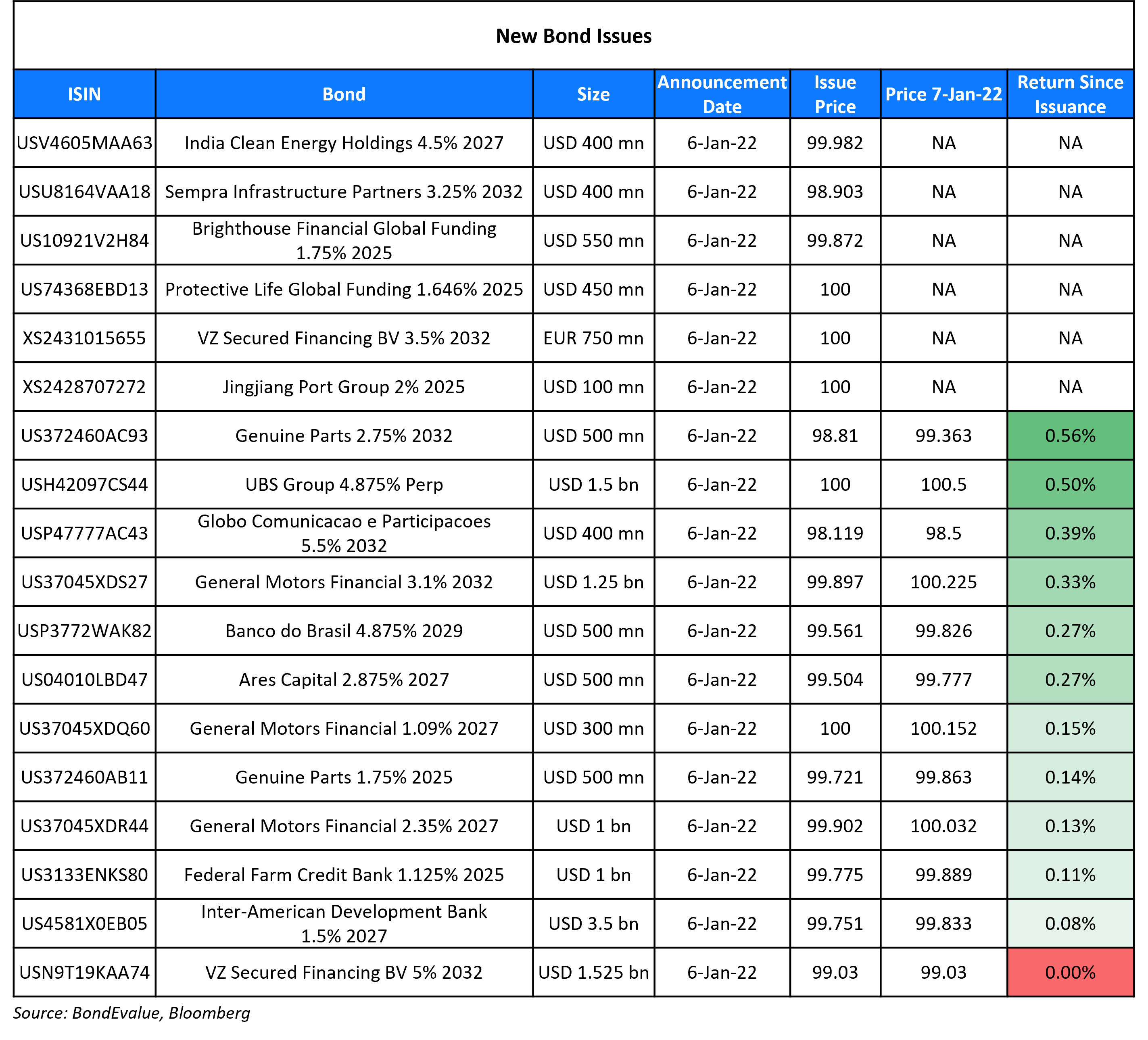

New Bond Issues

- Fuzhou Digital Economy Investment Group $ 3Y at 2% area

- Zhenjiang State-owned Investment Holding $ 364-day at 1.98% area

VodafoneZiggo raised €2.1bn equivalent via USD and EUR bonds. More details are covered separately below.

UBS Group raised $1.5bn via a PerpNC5 AT1 bond at a yield of 4.875%, 25bp inside the initial guidance of 5.125% area. The bonds have expected ratings of BB/BBB (S&P/Fitch). The coupon is fixed until the first call date of February 12, 2027 and the bonds are callable at every interest coupon payment date thereafter at par. If not redeemed, coupon resets every 5Y at 5Y UST plus a margin of 3.404%.

India Clean Energy Holdings / ReNew Power raised $400mn via a 5.25NC3.5 green bond at a yield of 4.5%, 30bp inside initial guidance of 4.8% area. The bonds have expected ratings of Ba3/BB– (Moody’s/Fitch), and received orders of over $900m, 2.25x issue size. Fund managers took 91%, insurers, pension funds and sovereign wealth funds 8% and banks and private banks 1%. Asia took 39%, EMEA 21% and the US/Canada 40%. Proceeds from the notes will be primarily used by the issuer to subscribe to onshore USD-denominated notes to be issued by ReNew Power Private Limited (RPPL), a wholly owned subsidiary of ReNew Energy Global and a sister company of the issuer. The onshore notes in turn will be used by RPPL to refinance existing debt and/or capital expenditure on eligible green projects. India Clean Energy Holdings is a wholly owned subsidiary of Nasdaq-listed ReNew Energy Global PLC. The notes have been certified as green bonds by the Climate Bonds Initiative and verified by KPMG.

Banco do Brasil raised $500mn via a 7Y social bond at a yield of 4.95%, ~5bp inside initial guidance of low 5%. The bonds have expected ratings of Ba2/BB- (Moody’s/Fitch). Proceeds will be used to finance or refinance existing or future eligible Social projects in accordance with the bank’s Sustainable Finance Framework.

General Motors raised $2.55bn via a three-tranche deal. It raised:

- $1bn via a 5Y bond at a yield of 2.37%, 15bp inside initial guidance of T+105bp

- $300mn via a 5Y FRN bond at a yield of 1.09% or SOFR+104bp vs initial guidance of SOFR equivalent

- General Motors raised $1.25bn via a 10Y bond at a yield of 3.112%, 17bp inside initial guidance of T+155bp

The bonds have expected ratings of Baa3/BBB. Proceeds will be used for general corporate purposes. The new 5Y fixed-rate bonds are priced at a new issue premium of 10bp to its existing 4.35% 2027s that yield 2.27%.

New Bonds Pipeline

-

Woori Bank hires for $ sustainability bond

- KNOC hires for $ 3.25/5.25/10.25Y bond

-

Shriram Transport Finance hires for $ social bond

- China Oilfield Services Limited hires for $ bond

Rating Changes

Term of the Day

Greenwashing

Greenwashing is a term used to describe corporate/government marketing practices that emphasize on its environmentally-friendly initiatives that are, in truth, vastly overstated. While this is not a new term, its relevance has increased over the past few years with the surge in green, social and sustainable bond issues, with several institutional investors and industry bodies questioning the intent and/or effectiveness of these bond issues. The term greenwashing was coined by environmentalist Jay Westerveld in 1986 and originates from his visit to the Beachcomber Resort in Fiji in 1983. He noticed that the resort had placed a note beside the towel stand that encouraged patrons to reuse towels to reduce ecological damage. However, looking at the ongoing construction of new bungalows and vast amounts of wastage at the resort, it was clear to Westerveld that the resort did not care much for the environment and were simply looking to reduce its expenses associated to towel cleaning.

Concerns of greenwashing have emerged on Airport Authority Hong Kong (AAHK’s) dollar bond priced yesterday. As part of its $4bn issuance, it issued a 1.75% green bond due 2027 where critics argued that the ESG angle was incompatible with AAHK’s expansion plans. Reclaim Finance, a climate change think tank, published a critical analysis of the AAHK issuance, noting that the expansion of the airport through its third runway project, will have massive environmental impacts, including an increase in carbon emissions.

Talking Heads

On the possibility that the Fed could starting raising rates in March

James Bullard, Federal Reserve Bank of St. Louis President

“The FOMC could begin increasing the policy rate as early as the March meeting in order to be in a better position to control inflation.” “Subsequent rate increases during 2022 could be pulled forward or pushed back depending on inflation developments.” “It makes sense to get going sooner rather than later, so I think March would be a definite possibility, based on data that we have today,” he said. “It would make sense to go ahead and lift off and then if inflation moderates as much as hoped by some forecasters then we would be able to slow down or not raise as fast as we otherwise would in the second half of the year.” “My own view is that we could go ahead with balance-sheet runoff shortly after lifting off the policy rate.” “With the real economy strong but inflation well above target, U.S. monetary policy has shifted to more directly combat inflation pressure.”

San Francisco Fed President Mary Daly

According to Daly, shrinking the balance sheet is “a very different conversation than reducing our balance sheet.”

On emerging market currencies seeing further declines with Fed’s rate hike and rising bond yields

Piotr Matys, senior currency strategist at InTouch Capital Markets Ltd

“EM currencies whose central banks haven’t started raising interest rates or their rates are still negative in real terms could be particularly vulnerable.”

Cristian Maggio, the head of portfolio strategy at TD Securities

“The adjustment will end eventually, and most emerging markets have already started hiking rates.” “I expect the market to find an equilibrium point and after the first one to two hikes from the Fed, we may see EM FX return to a stronger performance.”

“All members mentioned that headline and core inflation expectations for 2021, 2022 and for the next 12 months increased again, along with medium-term expectations, while long-term expectations have remained stable at levels above the target.” “Most members pointed out that expectations corresponding to the end of 2022 are already above the upper limit of the target range.”

On greenwashing concerns over Airport Authority HK’s new green bond

Lucie Pinson, director of Paris-based climate campaigner Reclaim Finance

“The issuance of a green bond for such a devastating project might have been cleared for take-off, but the biodiversity and climate risks associated with the project speak for themselves.” “Sincere investors should stay clear of this bond, if their climate commitments mean anything at all.”

Elsa Pau, founder and CEO of BlueOnion

“While the authority’s green bond may have checked all the boxes under these green finance principles, it has little control over the emissions of its airline customers and business partners,” she said.

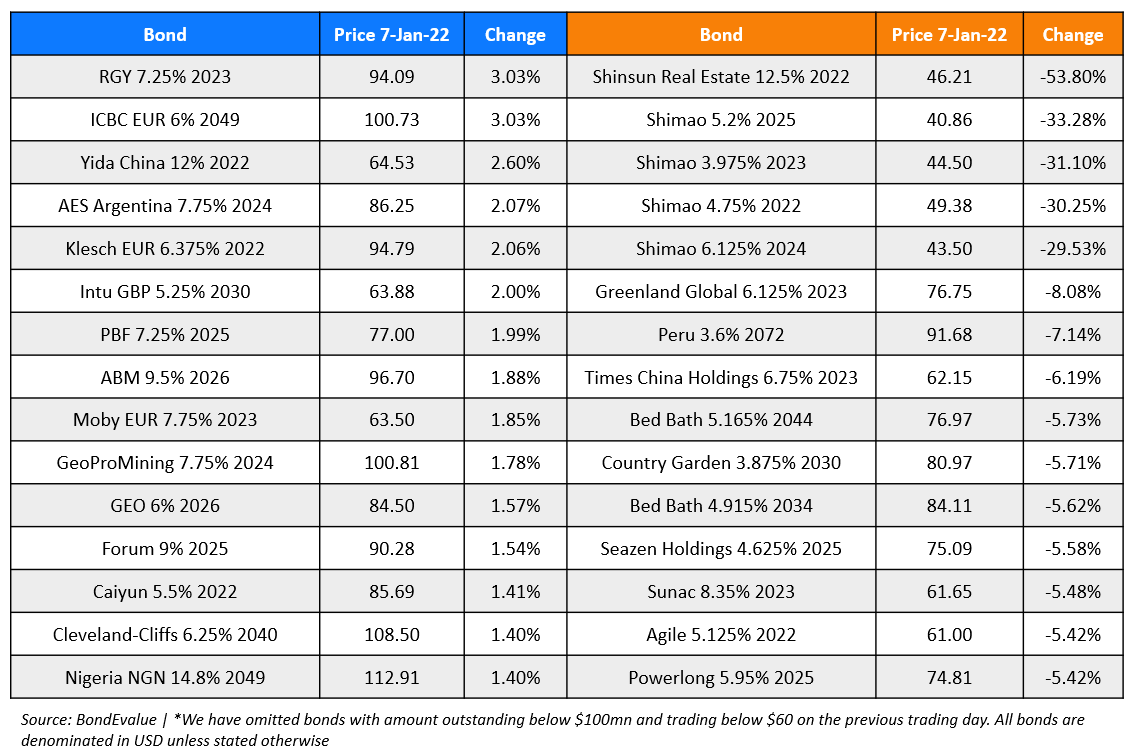

Top Gainers & Losers – 07-Jan-22*

Go back to Latest bond Market News

Related Posts: