This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

January 24, 2022

US equity markets dropped yet another day on Friday, with the S&P and Nasdaq down 1.9% and 2.7% as the risk-off sentiment continued to weigh on markets. Most sectors were in the red with Communication Services and Consumer Discretionary down 3.1% and 3.9%. US 10Y Treasury yields were flat at 1.77% after easing 8bp on Thursday. European markets closed mostly higher with the DAX and CAC down 1.9%, 1.8% and 1.2%. Brazil’s Bovespa closed 0.2% lower. In the Middle East, UAE’s ADX was up 0.3% and Saudi TASI was down 1.1%. Asian markets have broadly opened in the red – HSI, STI and Nikkei were down 1%, 0.1%, 0.6% while Shanghai was up 0.2%. US IG CDS spreads were 1.1bp wider and HY CDS spreads were 5.7bp wider, EU Main CDS spreads were 1.7bp wider and Crossover CDS spreads were 7.9bp wider. Asia ex-Japan CDS spreads were 1.5bp wider.

New Bond Issues

- Cinda HK $ 5Y at T+210bp area

- Zhuhai Huafa Properties $ 364-day at 4.2% final

- Hanwha Life $ 10NC5 sustainability tier 2 at T+200bp area

- Health and Happiness International Holdings (H&H) $ 5NC2 at 8% area

- Zibo Hi-Tech State-owned Capital Investment $ 364-day at 4.9% final

.png)

Taixing Zhiguang Environmental raised $100mn via a 364-day bond at a yield of 1.95%. The bonds are unrated. Proceeds will be used for debt repayment, working capital and general corporate purposes. The bonds are issued by Huan Zhi and guaranteed by Taixing Zhiguang Environmental. The bonds are supported by a letter of credit from the Bank of Hangzhou Shanghai branch.

Taian City Development and Investment raised $110mn via a 364-day bond at a yield of 3.75%, 35bp inside initial guidance of 4.1% area. The bonds are unrated. Proceeds will be used for general corporate purposes and debt refinancing. The bonds are issued by Taishan City Investment and guaranteed by Taian City Development and Investment.

New Bonds Pipeline

- Pakistan hires for $ 7Y sukuk bond

- Zhengzhou Airport Economy Zone Xinggang Investment Group hires for $ bond

- Dongtai Communication hires for $ 65 mn 180-day bond

- Kalyan Jewellers India hires for $ 5Y bond

- Electricity Generating (EGCO) hires for $ 7Y or 10Y bond

- Petron hires for $ 7NC4 bond

Rating Changes

- Fitch Upgrades Angola to ‘B-‘; Outlook Stable

- Fitch Downgrades China Aoyuan Group to Restricted Default

- Greif Inc. Upgraded To ‘BB’ On Strong 2021 Operating Performance; Outlook Stable

Term of the Day

Advance Rate

Advance rate refers to the portion of a collateral’s value in percentage terms, that a lender is willing to extend to a borrower. A higher advance rate indicates higher risk tolerance by the lender and the a lower advance rate indicates a lower risk tolerance. It is typically calculated as the maximum value of the loan that can be extended divided by the value of collateral, in percentage. Thus if a collateral is worth $100, an advance rate of 80% implies that a lender can extend a loan of a maximum of $80.

Talking Heads

On global bonds rallying amid tech selloff and Russia tensions

Gregory Faranello, head of U.S. rates trading at AmeriVet Securities

“The Treasury market is reacting to equities; we saw an ugly close for European equities and the Nasdaq is down 10% plus this year.” “Treasuries have repriced sharply higher this year and now they are providing some offset to declining equities.” “Heading into the Fed meeting next week, the 10-year at 1.75% is a market that looks better balanced.”

Andrew Ticehurst, rates strategist at Nomura Inc

The recent bond rally is “a function of stretched investor positioning and some global risk-off due to continuing U.S.-Russia tensions around Ukraine, and as reflected in sharply weaker equity markets.”

In a note by OCBC Bank strategists Frances Cheung and Terence Wu

“From here, we look for a consolidation in Treasuries, but with a mild upward bias to yields as expectations for rate hikes and sustained growth remain.”

On the narrow spread between junk bond and Treasury yields

Peter Boockvar, Bleakley Financial Group Chief Investment Officer

“Watching high yield is necessary when looking for contagion and any economic repercussions of the changing macro landscape and worries about the inflation stressed consumer.”

George Bory, managing director for fixed-income strategy at Allspring Global Investments

“By far the most compelling positives in the credit markets today are credit fundamentals and the trajectory of those fundamentals. The backdrop is still very supportive.” “When the Fed is removing liquidity and removing accommodation from the system, credit volatility and spread volatility goes up, creditworthiness tends to plateau, and we’re looking for that tipping point. We think that’s still at least 12 months out.”

On balance sheet shrinking a wild card for Treasury yield flattening trend

Zachary Griffiths, strategist at Wells Fargo Securities

“For steepening to really have legs, it would take the Fed relying more heavily on its balance sheet to convey monetary policy as opposed to the fed funds target rate.”

Peter Yi, director of short-duration fixed income and head of credit research at Northern Trust Asset Management

“The market is getting way ahead of itself in terms of pricing in hikes.”

Don Ellenberger, senior portfolio manager at Federated Hermes

“This will be a tough year for investors,” Ellenberger said. “The Fed wants to bring inflation to its 2% target without hurting growth and the stock market.”

“Personally, I expect the economic data to remain relatively good despite being affected by the Omicron variant.”

“If we see risks of those sort of second round effects happening then we will definitely be taking action at the European Central Bank to manage that.” “We do see inflation falling during the course of this year.” “It’ll probably — in the euro area — stay over 2% throughout the course of this year, but it’ll fall from the level it’s been at.”

“We are of the view that we are at a major inflection point in terms of policy and we are likely to see some significant easing.” “The property market had been under pressure because (the government) wanted to deleverage and to some extent they achieved that.” “Now China wants to make sure that the rest of the sector is not at risk.” “SOEs are a significant part of the market but are not dominating it so it is difficult for them to engineer an SOE-lead restructuring. You need to have strong participation from the private sector,” he said. “We think it’s going to be the year of the great normalization in Asia high yield, with a focus on China.” “Asian high yield, and China more specifically, will be a key driver of EM fixed income performance in 2022.”

“Under the current economic situation, the role the PBOC can play is limited.” “Monetary policy loosening should be limited because its not very useful as it may create other problems.”

“How much longer, or further, can this bear market go?” “Our judgment is we’re getting closer to the end, but unfortunately, we think that further de-rating of the growth part of China and emerging markets is likely.”

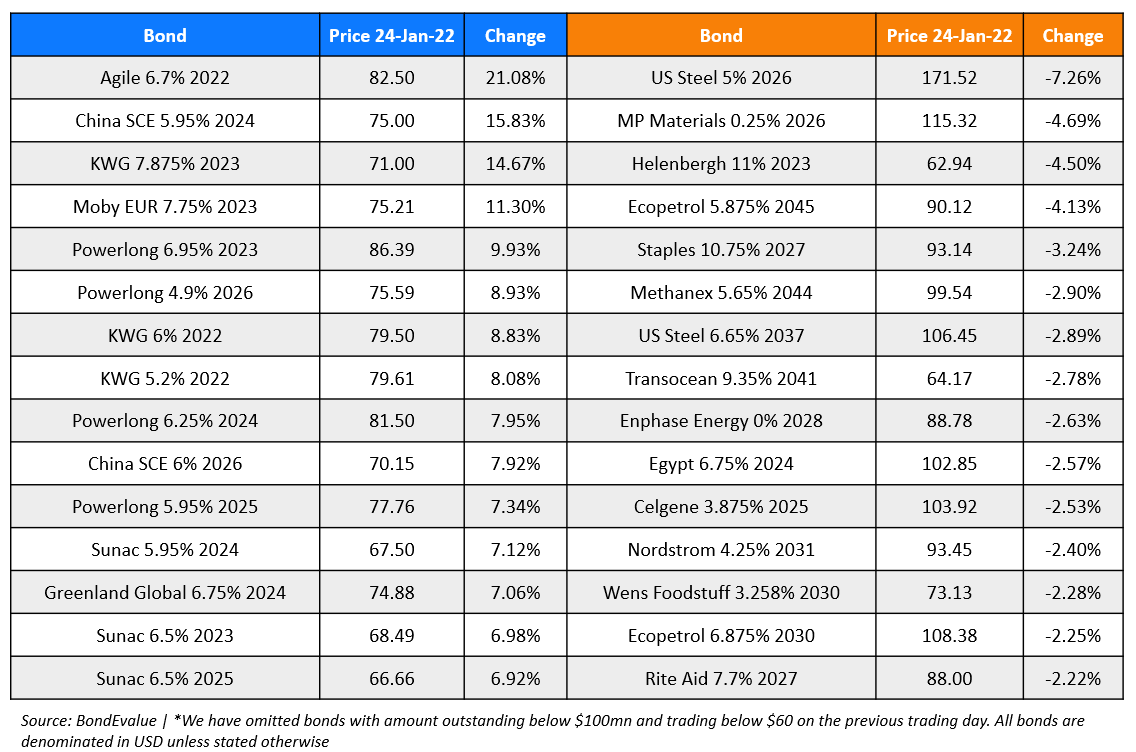

Top Gainers & Losers – 24-Jan-22*

Other Stories:

Go back to Latest bond Market News

Related Posts: