This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

January 25, 2022

US equity markets ended slightly higher with the S&P and Nasdaq ending up 0.3% and 0.6% after dropping almost 5% mid-day. Sectoral gains were led by Consumer Discretionary, up 1.2%, Energy and Industrials, up 0.5% each. US 10Y Treasury yields were 2bp lower at 1.76%. European markets closed sharply lower with the DAX, CAC and FTSE down 3.8%, 4% and 2.6%. Brazil’s Bovespa closed 0.9% lower. In the Middle East, UAE’s ADX was down 0.2% and Saudi TASI was down 0.6%. Asian markets have opened in the red – Shanghai, HSI, STI and Nikkei were down 1%, 1.3%, 1.1% and 2%. US IG CDS spreads were 0.5bp tighter and HY CDS spreads were 4.7bp tighter, EU Main CDS spreads were 2.7bp wider and Crossover CDS spreads were 12.2bp wider. Asia ex-Japan CDS spreads were 1.3bp wider.

New Bond Issues

-1.png)

Pakistan raised $1bn via a 7Y sukuk at a yield of 7.95%, 30-47.5bp inside initial guidance of 8.25-8.375% area. The sukuk have expected ratings of B3/B– (Moody’s/Fitch), and received orders over $2.4bn, 2.4x issue size. The bonds are issued by Pakistan Global Sukuk Programme Co. The President of the Islamic Republic of Pakistan is acting as the obligor on behalf of the country. The bonds priced largely inline with its existing curve between its 6.875% 2027s and 7.375% 2031s that are currently yielding 7.52% and 8.41% currently.

Olam raised $275mn via a two-tranche deal. It raised $200mn via a 5Y bond carrying a coupon of 3.05% and $75mn via a 7Y bond carrying a coupon of 3.25%. The notes were privately placed via sole placement agent ING Financial Markets. Proceeds will be used for general corporate purposes The bonds are issued by Olam Americas. No further details of the deal were disclosed.

Societe Generale SFH raised €1.25bn via a 7Y bond at a yield of 0.215%, 3bp inside initial guidance of MS+4bp area. The bonds have expected ratings of Aaa/AAA (Moody’s/Fitch), and received orders over €1.7bn, 1.4x issue size. The new bonds are priced 0.3bp wider to its existing 0.125% 2029s that yield 0.212%.

Cinda HK raised $1bn via a 5Y bond at a yield of 3.25%, 35bp inside initial guidance of T+210bp area. The bonds have expected ratings of A–/A (S&P/Fitch), and received orders over $4.8bn, 4.8x issue size. Proceeds will be used to refinance debt. The bonds are issued by China Cinda 2020 I Management and guaranteed by China Cinda HK. Cinda HK paid a new issue premium of about 10–15bp, lower than an expected 20–25bp when bookbuilding began, said a banker on the deal. The new bonds are priced at a new issue premium of 12bp over its existing 3% 2027s that currently yield 3.13%.

Zhuhai Huafa Properties raised $200mn via a 364-day bond at a yield of 4.2%. The bonds are unrated. Proceeds from the Reg S unrated issue will be used for offshore debt refinancing. The bonds are issued by Guang Tao Investment and guaranteed by Zhuhai Huafa Properties.

Hanwha Life raised $750mn via a 10NC5 sustainability tier 2 bond at a yield of 3.379%, 15bp inside initial guidance of T+200bp area. The bonds have expected ratings of Baa1/A– (Moody’s/S&P). Proceeds will be used to finance or refinance new or existing green or social eligible projects under its sustainability bond framework.

Health and Happiness International Holdings has pulled a USD 5Y non-call 2Y (5NC2) bond after opening orders for the trade on Monday. H&H told investors in an update that it decided not to proceed with the issuance due to “adverse market conditions”. H&H intended to raise $400mn via the 5NC2 bond with an initial guidance of 8% area. The bonds had expected ratings of Ba3/BB.

New Bonds Pipeline

- Zhengzhou Airport Economy Zone Xinggang Investment Group hires for $ bond

- Dongtai Communication hires for $ 65 mn 180-day bond

- Kalyan Jewellers India hires for $ 5Y bond

- Electricity Generating (EGCO) hires for $ 7Y or 10Y bond

- Petron hires for $ 7NC4 bond

Rating Changes

- Fitch Upgrades Guangzhou R&F and Subsidiary to ‘CC’ After Exchange Offer

- Moody’s downgrades Shinsun to Caa2/Caa3; outlook negative

- Fitch Downgrades Guorui to ‘CCC+’; Removes UCO

- Moody’s downgrades Talen’s senior unsecured debt to Caa2 from Caa1, affirms CFR at B3, outlook negative

- Credito Real Downgraded To ‘B-‘ On Higher Refinancing Risk And Weaker Liquidity; Remains On CreditWatch Negative

- Enel Chile S.A. And Enel Generacion Chile Downgraded To ‘BBB’ From ‘BBB+’ On Expected Higher Leverage, Outlook Stable

- LG Chem Outlook Revised To Positive Following Battery Subsidiary Listing; Ratings Affirmed At ‘BBB+’

- Fitch Revises Outlook on Ciputra Development to Positive; Affirms ‘B+’

Term of the Day

Greenshoe Option

A greenshoe option is an over-allotment in a security offering where the underwriter can sell more securities than the issuer initially planned if there is an oversubscription. Greenshoe options are known to be used in stock IPOs but can also be part of bond offerings. Last week, Housing and Development Board raised S$950mn via a 7Y bond at a yield of 1.971%, with their target of a minimum S$800mn size with a S$150mn greenshoe.

Talking Heads

“What amazes me is that the Fed would even consider an attempt to raise rates and reduce the balance sheet simultaneously given how badly the last episode of balance sheet reduction played out in the markets while the Fed raised rates in 2018.” “An unexpected shock is not going to immediately flow through to inflation, but it will immediately impact already overvalued financial asset prices and undermine confidence and destabilize the economy.”

“Strong auction demand would indicate that good demand for Treasuries will blunt the rise, in terms of rate of change.” “That probably does help because one of the things the market needs to come to terms with is that yields aren’t going up in a straight line.”

“Stock index weakness this year paints, thus far, a misleadingly bleak indicator of risk sentiment for credit investors.”

“There is building evidence that inflation won’t recede as much as the ECB currently expects and that the liftoff criteria will be met already from the end of this year.”

On the opportunity in battered Chinese real estate dollar bonds

Jianda Ni, chairman of Chinese wealth manager Jupai Holdings Ltd

“I think roughly half of the developers’ dollar bonds were slaughtered by mistake.” “We will spot value in what others dumped as trash.”

Paula Chan, senior portfolio manager at Manulife Investment Management

“The high-yield space presents a lot of opportunities, especially for distressed investors.”

On Chinese property investors taking refuge in broader Asian credit market

Wai Mei Leong, portfolio manager at Eastspring Investments

“Investors have been hiding in Indian investment-grade and high-yield credit, and other parts of Asia outside of China, as a means to reduce their exposure to China property.”

Jean-Louis Nakamura, chief investment officer for Lombard Odier in Asia Pacific

“I’m afraid that this kind of indirect weakening of the Asia credit market will continue for some time.”

Paula Chan, a senior portfolio manager at Manulife Investment Management (Hong Kong) Ltd

“We quite like the India space because there is a lot of ESG bond supply coming from those companies and they aren’t quite expensive compared with other Asian peers.” “Supply from there also offers quite a good diversification.”

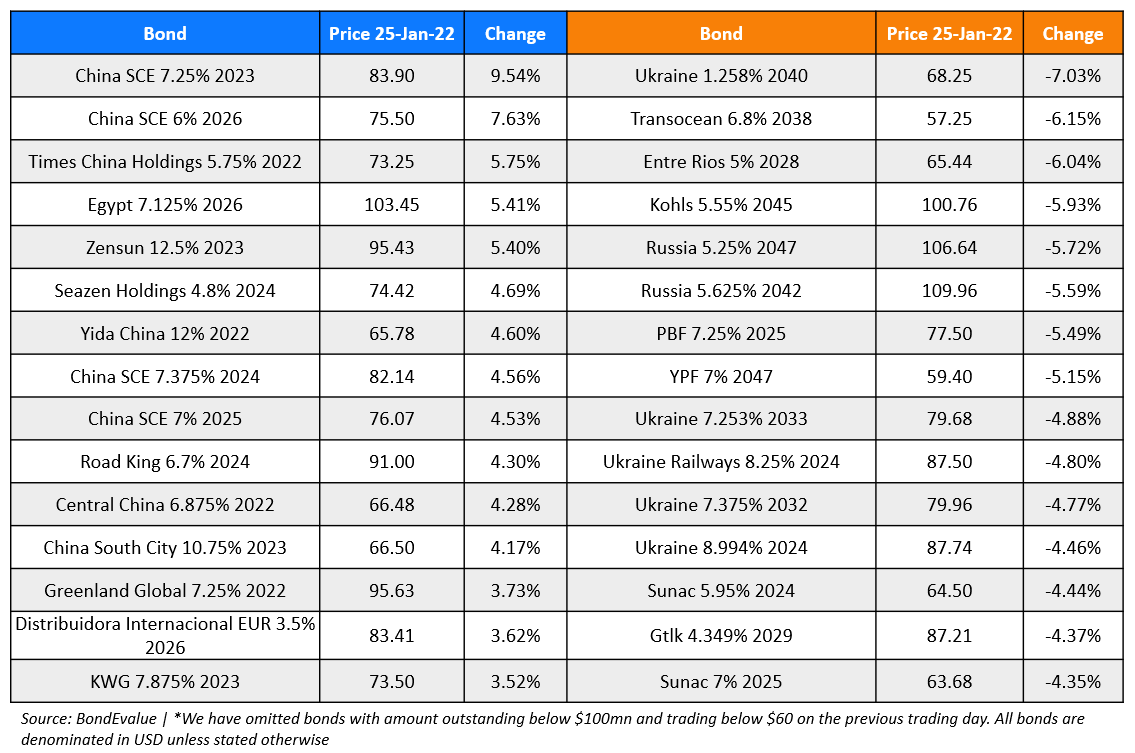

Top Gainers & Losers – 25-Jan-22*

Other Stories

Go back to Latest bond Market News

Related Posts: