This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

February 16, 2022

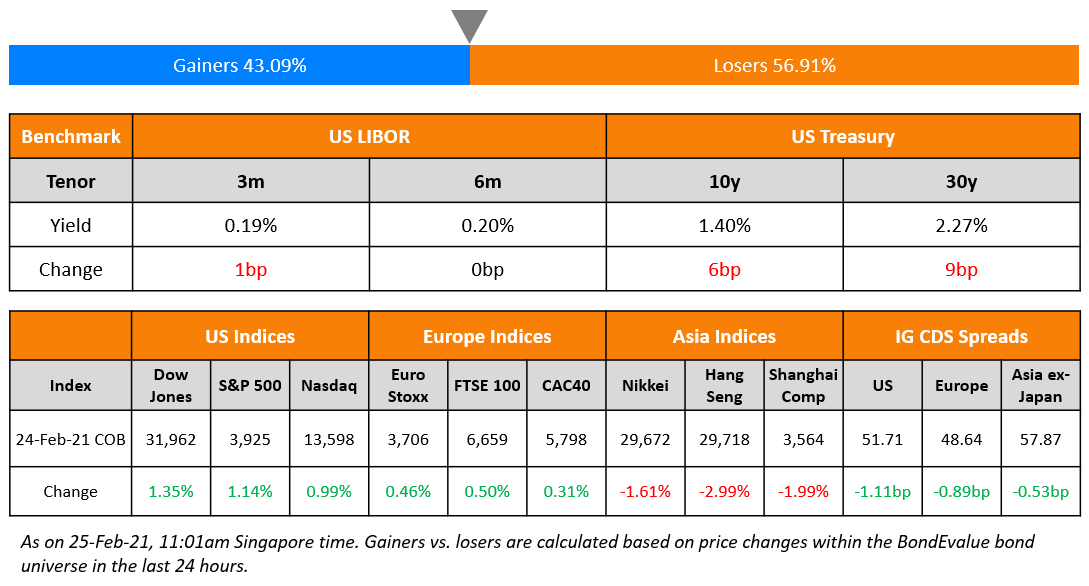

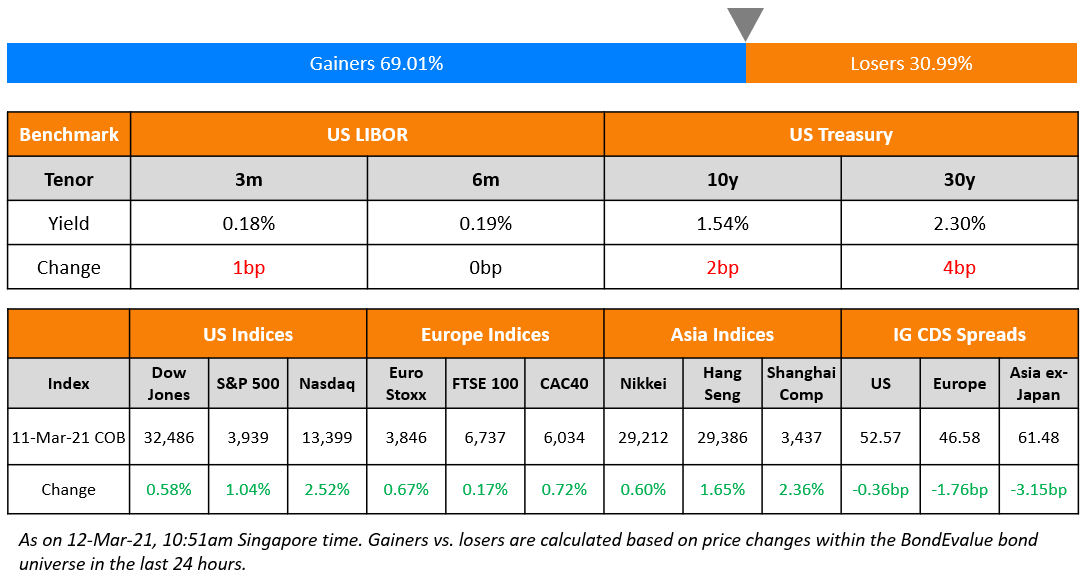

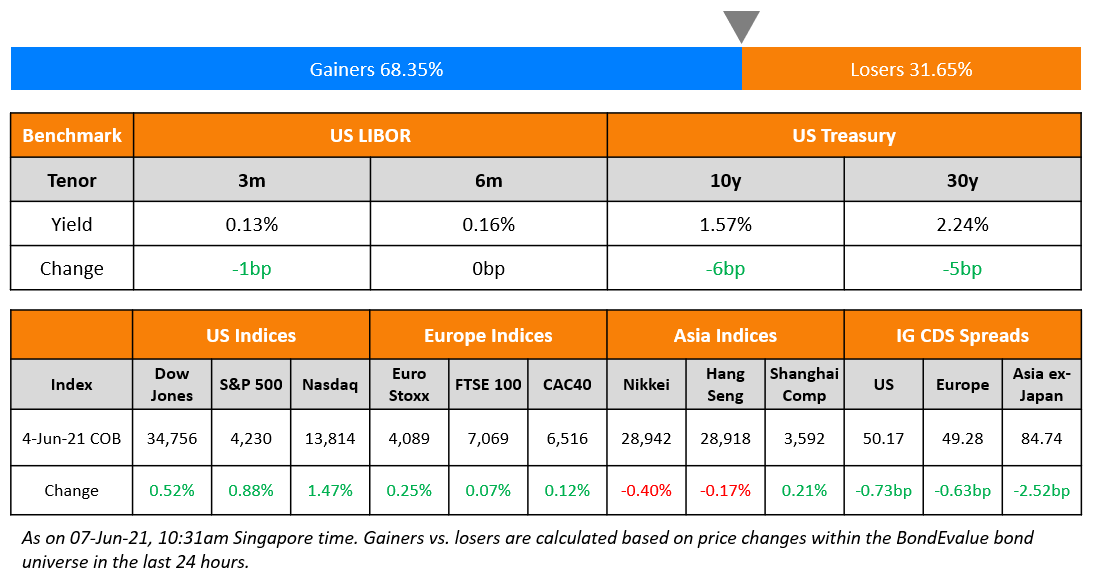

S&P and Nasdaq saw a risk-on move, up 1.6% and 2.5%. Sectoral gains were led by IT and Consumer Discretionary, up 2.7% and 2.1% each. The US 10Y Treasury yield rose by 5bp to go back above the 2% mark to 2.03%. European markets were also higher with the DAX, CAC and FTSE up 2%, 1.9% and 1.1% each. Brazil’s Bovespa closed 0.8% higher. In the Middle East, UAE’s ADX was up 0.3% and Saudi TASI closed 1.2% higher. Asian markets have opened broadly higher with Shanghai, HSI, STI and Nikkei up 0.7%, 1.3%, 0.1% and 2.1% respectively. US IG CDS spreads were 1.9bp tighter and HY CDS spreads were 9.5bp tighter. EU Main CDS spreads were 1.8bp tighter and Crossover CDS spreads were 8.8bp tighter. Asia ex-Japan CDS spreads were 2.3bp wider.

Explore BondbloX Kristals – a basket of single bonds listed on the BondbloX Exchange following themes such as SGD REIT Perps, USD Bank Perps, and SGD Bank Perps. Avail an introductory discount of $1,000 for every purchase of $100,000 worth of BondbloX Kristals*. Click on the banner above to know more.

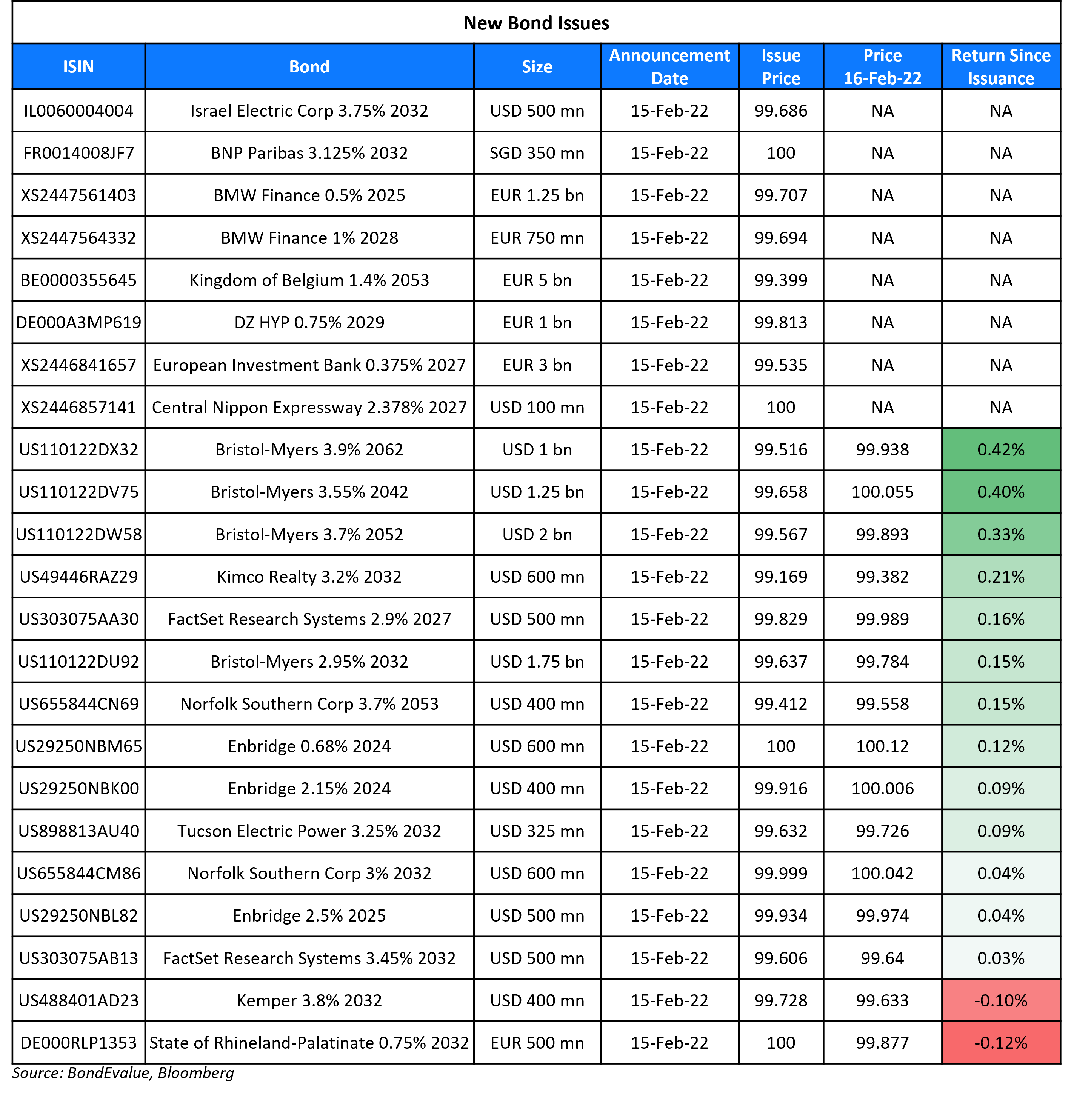

New Bond Issues

- Midea Group $ 5Y green at T+135bp area

- Beijing State-owned Capital Operation and Management € 3Y at MS+105bp area

- Chinalco $ 5Y at T+175bp area

- KDB $ 3/5Y/10Y green at T+60/70/90-95bp area

- Mizuho FG $ 4.25NC3.25 FRN at SOFR-equiv area

- Mizuho FG $ 4.25NC3.25/8.25NC7.25 green/20.25Y at T+105/135/140bp area

Central Nippon Expressway raised $100mn via a 5Y climate resilience bond at a yield of 2.378%, at SOFR mid-swaps + 57bp as compared to initial guidance of MS+high 50bp area. The bonds have expected ratings of A1 by Moody’s. Proceeds will be allocated to the financing of eligible projects expected to contribute to climate resilience and adaptation, including some expressway renewal projects on selected bridges and the reinforcement and repair of slopes.

Bristol-Myers raised $6bn via a four-tranche deal. It raised:

-png.png)

Proceeds will be used to fund tender offers, repayment of debt and remainder for general corporate purposes.

New Bonds Pipeline

- Aluminium Corporation of China hires for $ bond

- Petron hires for $ 7NC4 bond

- Electricity Generating (EGCO) hires for $ 7Y or 10Y bond

- Kalyan Jewellers India hires for $ 5Y bond

- Dongtai Communication hires for $ 65 mn 180-day bond

- Zhengzhou Airport Economy Zone Xinggang Investment Group hires for $ bond

Rating Changes

- Moody’s upgrades LG Chem to A3; outlook stable

- Fitch Upgrades Astrea IV’s Class A-1 Bonds to ‘AA-sf’ and Class B Bonds to ‘Asf’; Affirms Class A-2

- Fitch Upgrades Astrea V’s Class A-2 Bonds to ‘A+sf’ and Class B Bonds to ‘A-sf’; Affirms Class A-1

- Fitch Upgrades Astrea VI’s Class B Bonds to ‘BBB+sf’; Affirms Class A-1 and A-2 Bonds

- Fitch Upgrades Syngenta AG to ‘BBB+’; Outlook Stable

- Fitch Downgrades Zhenro Properties to ‘B’; on Rating Watch Negative

- Murphy Oil Corp. Outlook Revised To Positive On Higher Commodity Price Assumptions And Improving Free Cash Flow Profile

- eHi Car Services Outlook Revised To Negative From Stable On Uncertain Operating Environment; ‘B+’ Ratings Affirmed

Term of the Day

Capital Adequacy Ratio

This is the ratio of a bank’s capital in relation to its risk-weighted assets. Capital here includes Tier 1 and Tier 2 capital. Risk weighted assets (RWA) account for credit, market and operational risks with certain weights. Under Basel III, banks must have a capital adequacy ratio (CAR) at a minimum of 8% of RWA. CAR is used as a measure to ensure that banks have a cushion to absorb losses and is used while doing stress tests.

Talking Heads

On Fed to raise rates 25 bps in March but calls for 50 bps grow louder

Ethan Harris, head of global economics research at Bank of America Securities

“The risk is that at some point … they’ll shift to hiking 50 basis points, because it’s very unusual for a central bank to have a zero interest rate in the face of the kind of news we’re looking at right now. I do think the Fed is behind the curve. In my view, the Fed should have started hiking last fall, and so they’ve got some catching up to do.”

Philip Marey, senior U.S. strategist at Rabobank

“Since nobody knows where the neutral rate exactly is, the Fed could get into restrictive territory earlier than it realizes, and that could ultimately lead to a recession”

On ECB Bond-Buying Could End in Third Quarter – Villeroy

It “ties our hand for too long… But this reduction could follow a bi-monthly or monthly pace instead of a quarterly one, and APP purchases could therefore end in the third quarter, at some point to be discussed… This would be a possibility to break the quasi-automatic temporal link between the two instruments whilst retaining the sequencing. Optionality would mean that the lift-off could possibly take more time, if warranted.”

On Asian bonds receiving highest foreign funds in five months in January

Jennifer Kusuma, Asia rates strategist at ANZ

“Overall flow picture in January underlines the attractive risk reward profile of Asia local currency yield bonds for global investors

Duncan Tan, a strategist at DBS Bank

“In the current environment where U.S. rates are rising, but the U.S. dollar is not particularly strong, Asia bonds would be expected to outperform”

On Colombian Election Spooking Bond Investors Buffeted by Peru and Chile

Esther Law, senior money manager for EM debt at Amundi

“There’s similarity between Colombia and Chile/Peru in terms of the anti establishment mood. But Colombia started with a weaker macro matrix versus Peru and Chile, making Colombia assets more vulnerable to uncertainty.”

On Raizen saying Petrobras should raise gasoline prices to level playing field

“At some point, Petrobras will have to make a move in gasoline … (the current price situation) is not sustainable (for the market), Brazil is not self-sufficient… There is potential for an increase in gasoline in Brazil”

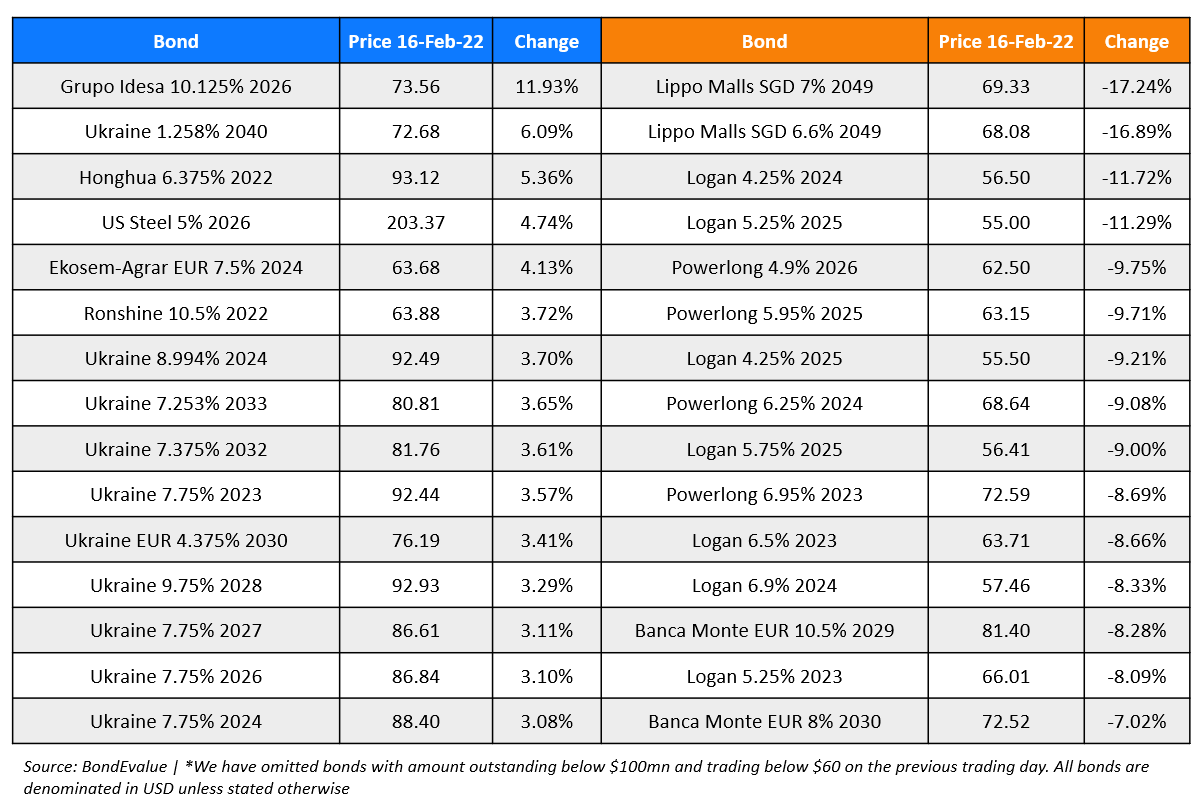

Top Gainers & Losers – 16-Feb-22*

Other Stories

Go back to Latest bond Market News

Related Posts:

.png)