This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

October 11, 2022

US Treasury yields continue to march higher with the curve steepening, led by the 10Y and 30Y yields up 10bp and 11bp respectively. The peak Fed Funds Rate rose 4bp to 4.69% for the FOMC’s March 2023 meeting, underscoring expectations of further rate hikes. US credit markets were closed on account of Columbus Day. US equity markets ended lower with the S&P and Nasdaq down 0.8% and 1% respectively.

European equity markets ended lower too and CDS spreads widened – EU Main and Crossover CDS spreads widened by 3bp and 12.2bp respectively. Asia ex-Japan CDS spreads widened 6.5bp and Asian equity markets have opened broadly lower today by over 0.5%. Pakistan’s central bank kept its policy rate unchanged at 15% Goldman Sachs believes that Hong Kong’s home prices may fall by 30% through 2023, after having already fallen 8% this year.

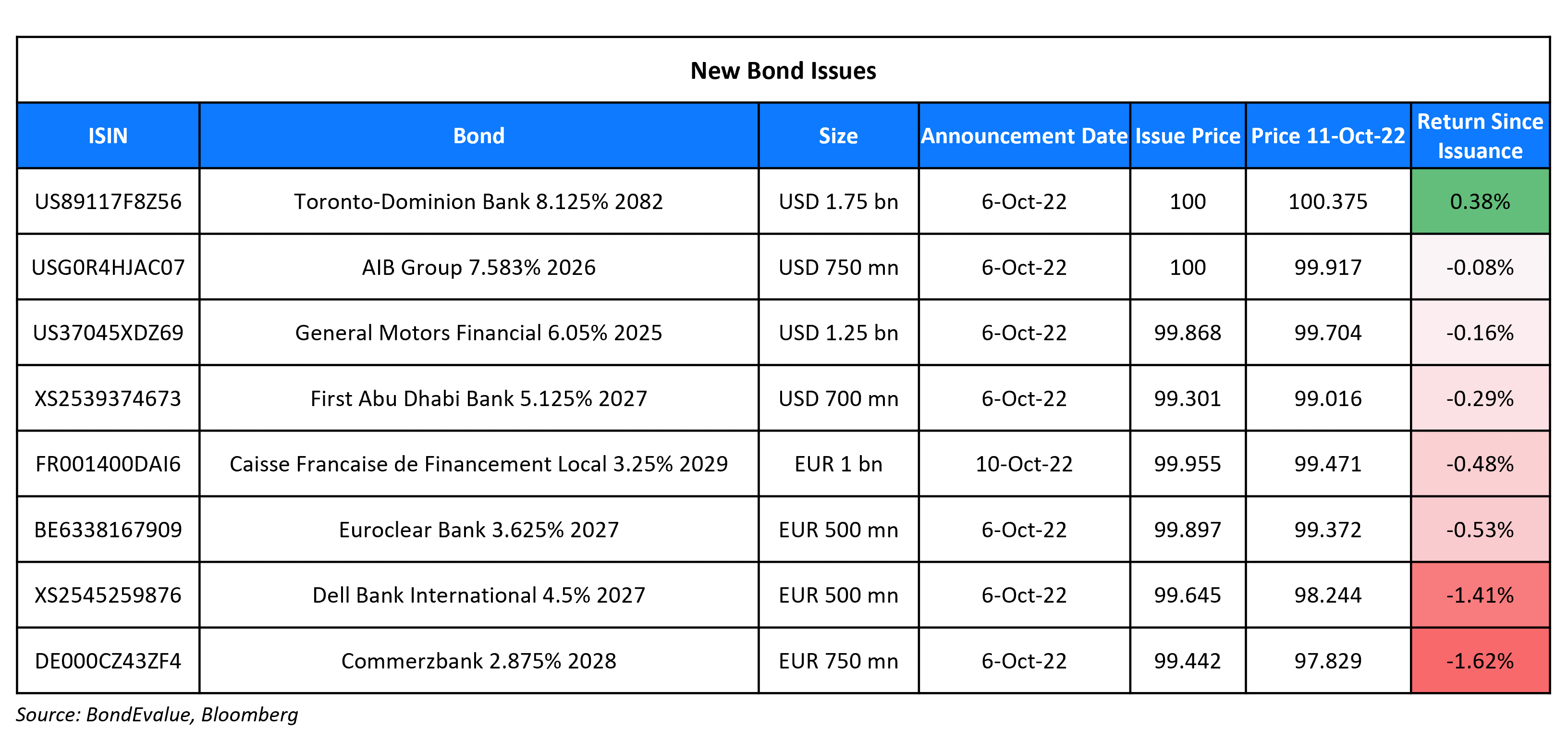

New Bond Issues

New Bonds Pipeline

- Aozora Bank hires for $ 3Y Green bond

- Syngenta Group hires for $ 3.5Y/5Y bond

Rating Changes

- Fitch Upgrades Macquarie Group to ‘A’ and Affirms Macquarie Bank at ‘A’; Outlook Stable

- Transocean Ltd. Upgraded To ‘CCC’ Following Distressed Exchanges, Outlook Negative; Debt Upgraded, New Ratings Assigned

- Moody’s withdraws Sunac’s ratings due to insufficient information

Term of the Day

Trust Loans

Trust loans or entrusted loans are loans where a bank acts as a trustee to lend money on behalf of a trustor, which can be a government agency, enterprise/public institution or individual. Importantly, the bank that acts as a trustee only collects loan handling charges and will not assume liability for the repayment of the loan on behalf of the borrower. They are part of the shadow banking system and help provide quick access to capital especially if credit conditions are tight.

Talking Heads

I can probably name more than one thing I agree with my “former colleagues” on at Pimco, but point taken: bonds, especially 5-year TIPS and ETFs investing in TIPS look better than stocks.

On Expecting a US Recession in Six to Nine Months – JPMorgan CEO Jamie Dimon

“These are very, very serious things which I think are likely to push the US and the world — I mean, Europe is already in recession — and they’re likely to put the US in some kind of recession six to nine months from now… The likely place you’re going to see more of a crack and maybe a little bit more of a panic is in credit markets, and it might be ETFs, it might be a country, it might be something you don’t suspect

On ‘Fragile Liquidity’ in Bond Market Could Threaten Fed’s QT Plans

Goldman Sachs strategists led by Praveen Korapaty

“Both the Fed’s large scale purchases back in March/April 2020 and the BoE’s recent intervention were primarily to restore orderly functioning, and highlight the potential for microstructure issues to short-circuit a central bank’s QT plans… While we don’t anticipate any issues with the Fed’s current QT plan in the near term, the odds of an accident will likely rise as we go deeper into the QT process”

On The Most Powerful Buyers in Treasuries Are All Bailing at Once

Glen Capelo, MD at Mischler Financial

“We need to find a new marginal buyer of Treasuries as central banks and banks overall are exiting stage left… It’s still not clear yet who that will be, but we know they’re going to be a lot more price sensitive.”

Credit Suisse’s Zoltan Pozsar

“Since the year 2000, there has always been a big central bank on the margin buying a lot of Treasuries… we’re basically expecting the private sector to step in instead of the public sector, in a period where inflation is as uncertain as it has ever been… We’re asking the private sector to take down all these Treasuries that we are going to push back into the system, without a glitch, and without a massive premium”

Close alignment on rate hikes, still chance for soft landing – Chicago Fed President Charles Evans

“There’s not really a lot of difference. We’re headed for this four and a half percent-ish federal funds rate by March…We are going to put a lot of restrictiveness in place no matter what the data comes in at, unless there was really a lot in the next two months. There’s not enough time for that… I think we can bring inflation down relatively quickly while also avoiding a recession”

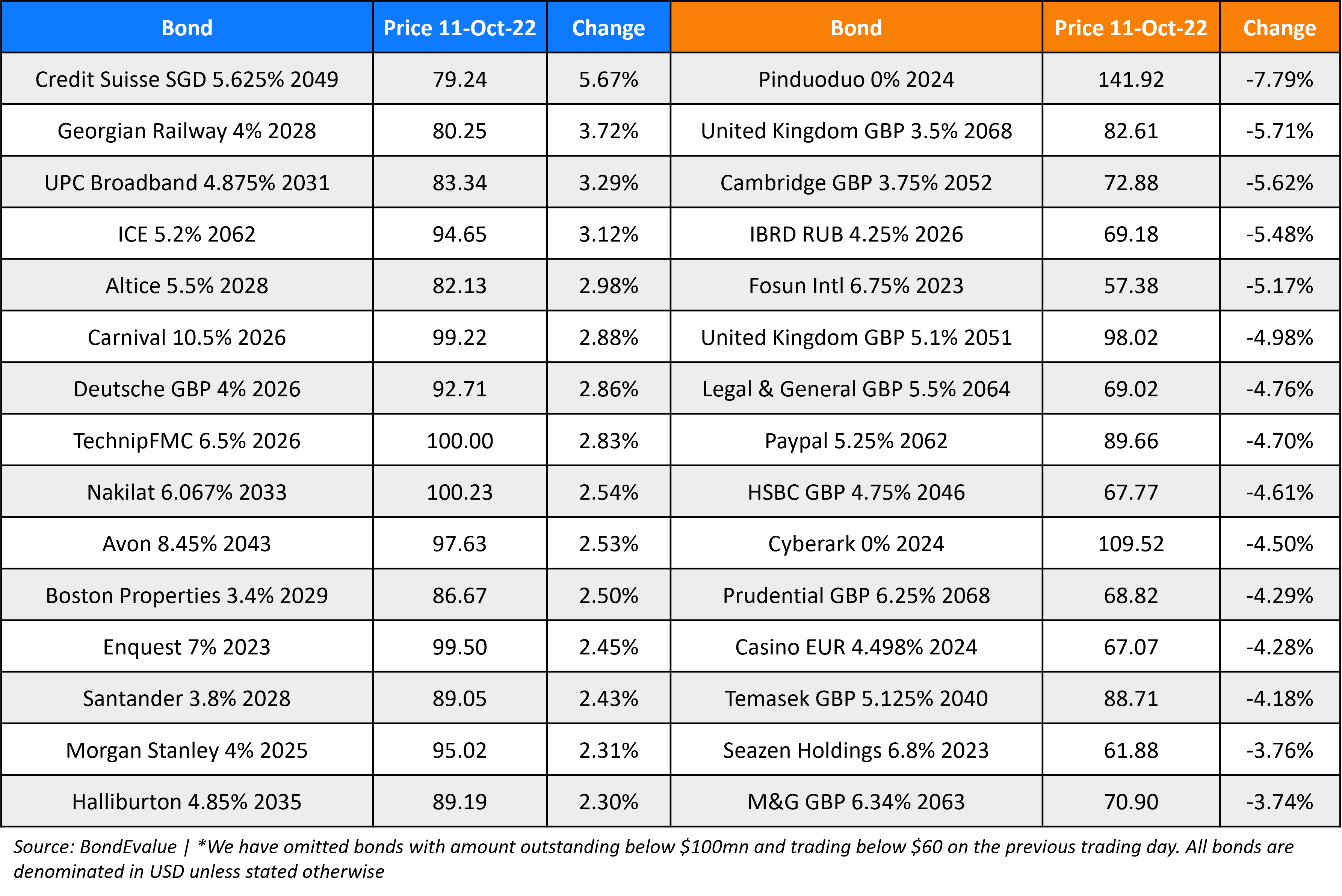

Top Gainers & Losers – 11-October-22*

Go back to Latest bond Market News

Related Posts: