This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

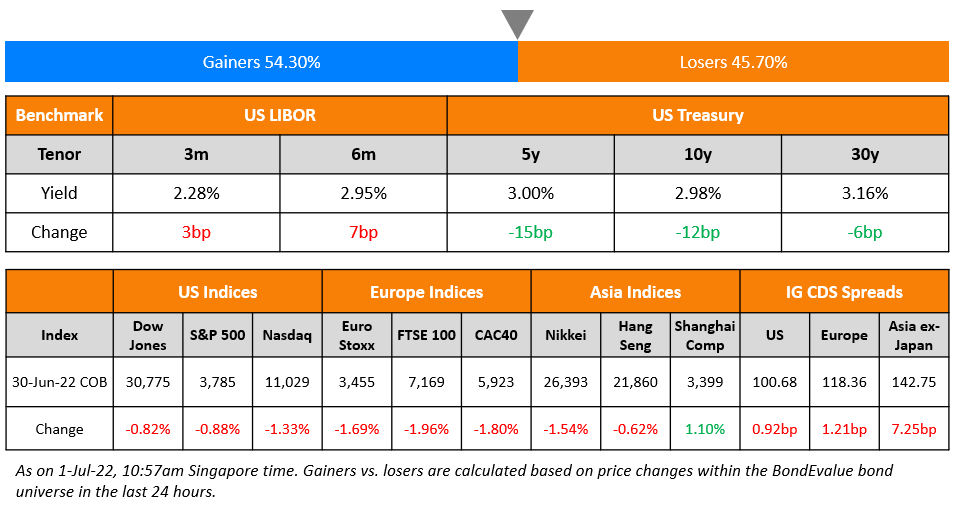

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

November 2, 2022

The peak Fed Funds rate jumped 9bp to touch 5.04% for the May 2023 FOMC meeting. With the FOMC meeting announcement due later today, markets are keenly awaiting for hints regarding the quantum of the rate hike in December meeting’s decision. Markets have priced in an 84% chance of a 75bp rate hike in today’s meeting. However, for the December meeting, markets are pricing in a 45% chance of a 50bp hike and a 48% chance of a 75bp hike. Treasury yields were near almost flat yesterday. In the credit markets, US IG CDS spreads tightened 1.9bp and HY CDS spreads saw a 10.8bp tightening. US equity markets moved lower on Tuesday, with the S&P and Nasdaq down 0.4% and 0.9% respectively. With the US equity indices rallying last week, Citi notes that the moves were driven by limited investor flows, noting that there was “mixed and weak momentum”.

European equity markets ended over 0.5% higher. EU Main CDS spreads widened 3.6bp and Crossover spreads tightened 13.5bp. Asian equity markets have opened broadly mixed today. Asia ex-Japan CDS spreads saw a 7bp tightening.

%20x%20311px%20(h).jpg)

New Bond Issues

Ford Motor raised $1.5bn via a 5Y bond at a yield of 7.35%, 27.5bp inside initial guidance of 7.625% area. The senior unsecured bonds have expected ratings of Ba2/BB+. Proceeds will be used for general corporate purposes. The new bonds are priced at a new issue premium of 13bp vs. its existing 4.271% 2027s that yield 7.22%.

Hangzhou Shangcheng State-Owned Capital Operation raised $208mn via a 364-day bond at a yield of 6.5%, unchanged from initial guidance. The senior unsecured bonds are rated Baa3. Zhejiang Kunpeng (BVI) is the issuer, while Hangzhou Shangcheng is a keepwell provider (Term of the Day, explained below). Proceeds will be used for project development and general corporate purposes.

New Bonds Pipeline

- Korea Investment & Securities hires for $ Green bond

Rating Changes

- Credit Suisse AG Downgraded to BBB- from BBB by S&P

- Fitch Downgrades eHi to ‘B-‘, Maintains Negative Outlook

- Twitter Inc. Downgraded To ‘B-‘ On Significant Debt Increase Following Acquisition; Ratings On CreditWatch Developing

- Moody’s affirms Longfor’s ratings, revises outlook to negative

Term of the Day

Keepwell Provider

A keepwell provision is a legal agreement between a parent company and a subsidiary to ensure solvency and financial stability of the subsidiary for the duration of the agreement. Keepwell provisions are included in bond terms to offer bondholders confidence on the issuer’s ability to repay. The keepwell structure emerged around 2012-2013 to assuage concerns of investors over a bond issuer’s creditworthiness. However, it is important for investors to understand that keepwells are not a guarantee that the parent company will support the subsidiary in the event of a default, and there has previously been no precedent on the enforcement of keepwell structures.

Talking Heads

“If our forecast is right, the most synchronized and aggressive global hiking cycle in 40 years will end by early next year. An important support for risk markets arose from signals that the pace of central bank tightening has peaked and that any further rate hikes from here will likely be smaller in size.”

On Wall Street Banks Seizing Credit Calm to Sell Risky Corporate Debt

Steven Oh, global head of leveraged finance at Pinebridge Investments

“Any reasonable opportunity that banks get to offload exposure from the balance sheet, particularly if they’re able to do so without any type of losses, they’re going to seize it”

Maureen O’Connor, MD of high-grade debt syndicate at Wells Fargo & Co

“The windows to issue are open, but they’re harder to navigate given a number of upcoming catalysts for market volatility”

Barclays Plc strategists

“The combination of tighter financing conditions, low growth, and elevated inflation has historically been negative for credit spreads”

On Cash to Extend Reign as King of the Asset Classes – Citi

“Rolling recessions are likely coming and cash is becoming an increasingly attractive place to wait for opportunity. Cash looks like it is an alternative to investments in risky assets, with yields rising after every central bank meeting… Currently we are in a stagflation environment … This suggests US cash is a good place as traditional assets tend to post negative returns in these environments”

Top Gainers & Losers – 02-November-22*

Go back to Latest bond Market News

Related Posts: