This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

November 9, 2022

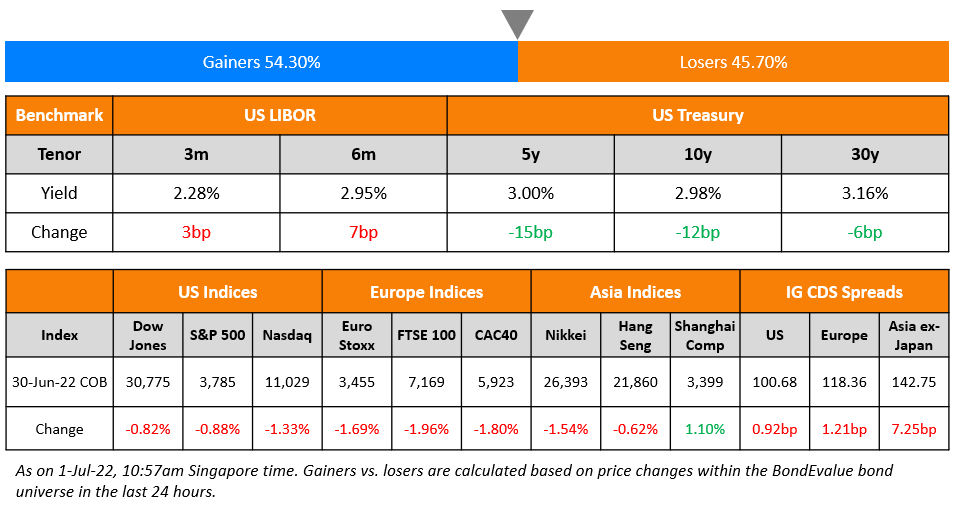

US Treasury yields eased across the curve with the 5Y and 10Y yields down 9bp. The peak Fed Funds rate also eased by 4bp to 5.14% for the June 2023 meeting. Current probabilities of a 50bp hike at the FOMC’s December meeting stand at 54% and that of a 75bp at 46%. In the credit markets, US IG CDS spreads widened 0.3bp and HY CDS spreads saw an 5.5bp widening. US equity markets rallied for a third straight day with the S&P and Nasdaq up 0.6% and 0.5% respectively.

European equity markets were higher too. EU Main CDS spreads tightened 1.9bp and Crossover spreads tightened 4.1bp. Asian equity markets have opened broadly lower today. Asia ex-Japan CDS spreads were tightened by 5.4bp as Korean credit markets continue to see an ease in credit sentiment after Korean insurer Heungkuk Life Insurance Co. reversed its decision to skip the call on its perp.

New Bond Issues

Standard Chartered raised $2bn via a dual-trancher. It raised $1bn via a 3NC2 bond at a yield of 7.776%, 20bp inside initial guidance of T+330bp area. It also raised $1bn via a 6NC5 bond at a yield of 7.767%, 30bp inside initial guidance of T+375bp area. The senior unsecured bonds are rated A3/BBB+/A. Proceeds will be used for general corporate purposes.

Standard Chartered raised $2bn via a dual-trancher. It raised $1bn via a 3NC2 bond at a yield of 7.776%, 20bp inside initial guidance of T+330bp area. It also raised $1bn via a 6NC5 bond at a yield of 7.767%, 30bp inside initial guidance of T+375bp area. The senior unsecured bonds are rated A3/BBB+/A. Proceeds will be used for general corporate purposes.

Ji-nan Hitech Holding Group raised $200mn via a 3Y bond at a yield of 7.2%, 25bp inside initial guidance of 7.2% area. Jinan Hi-tech International (Cayman) Investment Development is the issuer, while the parent is the guarantor. Proceeds will be used to fund construction projects and for working capital

New Bonds Pipeline

- Double Dragon hires for tap of $130mn 7.25% 2025s

- Korea Investment & Securities hires for $ Green bond

Rating Changes

- Fitch Upgrades Kraft Heinz’s IDR to ‘BBB’; Outlook Stable

- Country Garden Downgraded To ‘B+’ On Narrowing Funding Channels; Ratings Withdrawn At Company’s Request

- Fitch Revises Egypt’s Outlook to Negative; Affirms at ‘B+’

- Koninklijke Philips Outlook Revised To Negative Due To Supply Chain Constraints And Weak Credit Metrics; ‘BBB+’ Affirmed

Term of the Day

Bridge Financing

Bridge financing is a temporary form of financing used to cover the borrower’s short-term costs until the moment when regular long-term financing is secured. This form of financing ‘bridges’ the gap between when the borrower’s funds are set to dry up and its next long-term funding option. Oracle Corp had taken bridge facility to help a part of its $28bn acquisition of medical-records systems provider Cerner Corp.

Talking Heads

On Nagging U.S. Treasury liquidity problems raise Fed balance sheet predicament

Ryan Swift, BCA Research U.S. bond strategist

“It is certainly conceivable that, if bond volatility continues to rise, we could see a repeat of March 2020. The Fed will be forced to end its QT and buy a large amount of Treasury securities”

Adam Abbas, portfolio manager and co-head of fixed income at asset manager Harris Associates

“There is some sort of indirect function that QT is exacerbating that lack of liquidity. There’s a derivative effect when you have such a large buyer – we’re talking about 40% of the marketplace – not only step out but become a net seller.”

Scott Skyrm, executive vice president at Curvature Securities

“If you accept that some of that $5 trillion (QE) is driving some of the current inflation, then the solution to the inflation problem must include shrinking the balance sheet”

On China, Russia to drive 10% default pain for ‘junk-rated’ EM firms – JPMorgan Analysts

“We expect another high default year in 2023 focused on specific segments… We still see the possibility of an elevated default rate for the sector in 2023, albeit less so than in 2021 and 2022, if the sector does not receive any direct government support… As much as fundamentals are now weakening, they still remain robust and far from deteriorating rapidly

On European Banks Handling Interest Rate Shock – ECB’s Enria

Lenders “would remain broadly resilient to a textbook 200 basis point interest rate shock”… sees “good reasons to ask banks to strengthen their focus on monitoring and managing interest rate risk.”

Top Gainers & Losers – 09-November-22*

Go back to Latest bond Market News

Related Posts:.jpeg)