This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

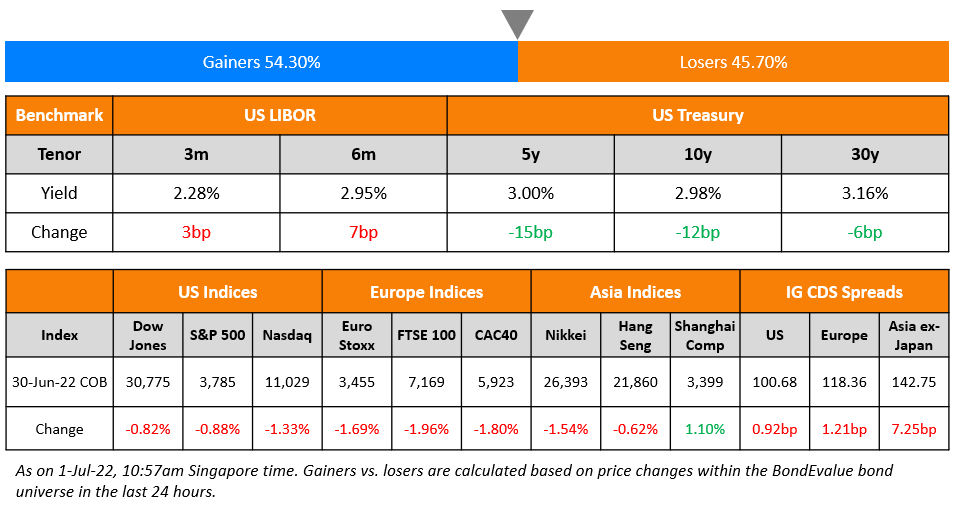

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

November 11, 2022

The US Investment Grade dollar bond index saw its biggest single-day rally in over three decades as Treasuries rallied by 25-30bp across the curve after the better-than-expected inflation print. Some of the top gainers from yesterday’s rally included sovereigns like Egypt and Nigeria that saw its dollar bonds rise by over 5%. IG names including the likes of Apple, Amazon, Alphabet and others saw their bonds rise by over 3 points across the curve.

The peak Fed Funds rate also eased by 14bp to 4.92% for the May 2023 meeting. Probabilities of a 50bp hike at the FOMC’s December meeting now stand at 81% vs. 57% a day prior. US CPI came in at 7.7% for October, lower than expectations of 7.9%. Core CPI came at 6.3%, also lower than expectations of 6.5%. The softer inflation print saw a risk-on rally across equity and credit markets with US IG CDS spreads tightening by 9.4bp and HY CDS spreads seeing a 54bp tightening. US equity markets witnessed a sharp rally led by tech with Nasdaq up 7.4% and S&P up 5.5%. European equity markets also rallied yesterday. EU Main CDS spreads tightened 7.8bp and Crossover spreads tightened 36.4bp. Asian equity markets have opened over 1.5% higher today. Asia ex-Japan CDS spreads tightened by another 2.2bp.

New Bond Issues

Ascott REIT raised S$165mn via a 3.5Y bond at a yield of 5%, unchanged from initial guidance. The unsecured bonds have expected ratings of BBB-.

New Bonds Pipeline

- Double Dragon hires for tap of $130mn 7.25% 2025s

- Korea Investment & Securities hires for $ Green bond

Rating Changes

- Fitch Downgrades Al Ahli Bank of Kuwait’s Viability Rating to ‘bb’

- Fitch Revises Rolls-Royce’s Outlook to Positive; Affirms IDR at ‘BB-‘

Term of the Day: AT1 Bonds

Additional Tier 1 (AT1) bonds are hybrid securities issued by financial institutions to meet their regulatory capital requirements. AT1s typically carry a provision wherein the instruments can be fully or partially written-down or converted to equity if the issuing bank’s capital ratio falls below a certain threshold. This is why AT1s are also known as contingent convertibles (CoCos). The key characteristics of AT1 bonds are:

- They have a perpetual maturity with a call option

- They are subordinated in nature, and the first line of debt to incur losses

- They can be written-down or converted into equity on the occurrence of a “trigger event”

- Coupons are usually higher as compared to other debt by the issuer, to compensate investors for the higher risk AT1s carry

BNP Paribas raised $1bn via a PerpNC5 AT1 bond yesterday, at a yield of 9.25%

For a complete guide to CoCos and AT1s, click here

Talking Heads

On Dollar Suffering Biggest Plunge Since 2009 as CPI Smacks Fed Bets

Florian Ielpo, head of macro research at Lombard Odier Asset Management:

“Inflation retreats for the fourth consecutive month: It has become hard to deny that the Fed’s medicine is working — with lagged effects. With the Fed’s rates’ plateau that is now upon us, time has come to load up on bonds.”

Bipan Rai, head of foreign-exchange strategy at CIBC

“The softer core CPI reading is leading to markets to reprice the terminal rate lower. That’s leading to further pain right now in the dollar… The market has found itself on the wrong side in a big way with averages on positions likely being challenged.”

Jane Foley, strategist at Rabobank

“The Fed is likely to remind the market that underlying inflation is still three-times higher than target and remains persistent, so some of the selloff in the dollar and the rise in risk appetite could be misplaced”

Esty Dwek, CIO at Flowbank SA

“Finally a downside surprise on inflation — the market and the Fed can breathe a small sigh of relief. Markets are understandably happy and believe the Fed will be able to downshift”

Priya Misra, head of global rates strategy at TD Securities

“Inflation is still high and broad-based so not an end of the hiking cycle but they can slow down for sure. It wasn’t just one component that fell. That’s what makes this a legitimate decline. It was a broad-based decline.”

On ‘Value Annihilation’ Haunts Investors in China Property Bonds

Anthony Leung, head of fixed income at Pollock Asset Management

There’s been “total value annihilation” in property firms’ dollar notes…. “The sheer scale of destruction in value will have a profound impact on the investment appetite on all kinds of China risk assets. This loss of confidence will likely be very prolonged, if not permanent.”

Zhi Wei Feng, a senior analyst at Loomis Sayles Investments

The market is “no longer analyzable.”

On calls for ‘more measured’ pace of rate hikes- Fed’s Esther George

“I continue to see several advantages for a steady and deliberate approach to raising the policy rate”… Call for a “more measured” approach.

Top Gainers & Losers – 11-November-22*

Go back to Latest bond Market News

Related Posts:.jpeg)