This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

November 19, 2021

US equities ended higher with the S&P and Nasdaq up 0.3% and 0.5% each. Sectoral gains were led by Consumer Discretionary up 1.5% and IT up 1%. US 10Y Treasury yields were 1bp higher at 1.59%. European markets were trading slightly weak with the DAX, CAC and FTSE down 0.2%, 0.2% and 0.5% respectively. Brazil’s Bovespa ended 0.5% lower. In the Middle East, UAE’s ADX was up 0.1% and Saudi TASI was down 1%. Asian markets have opened mixed – Shanghai and Nikkei were up 0.3% and 0.4% while HSI and STI were down 1% and 0.2%. US IG CDS spreads widened 0.1bp and HY CDS spreads were flat. EU Main CDS spreads were 0.1bp tighter and Crossover CDS spreads were 0.8bp tighter. Asia ex-Japan CDS spreads tightened 1.9p.

US initial jobless claims for the prior week came at 268k, slightly higher than forecasts of 260k. US Philly Fed Manufacturing Index came at 39, higher than forecasts of 24, its highest in 7 months.

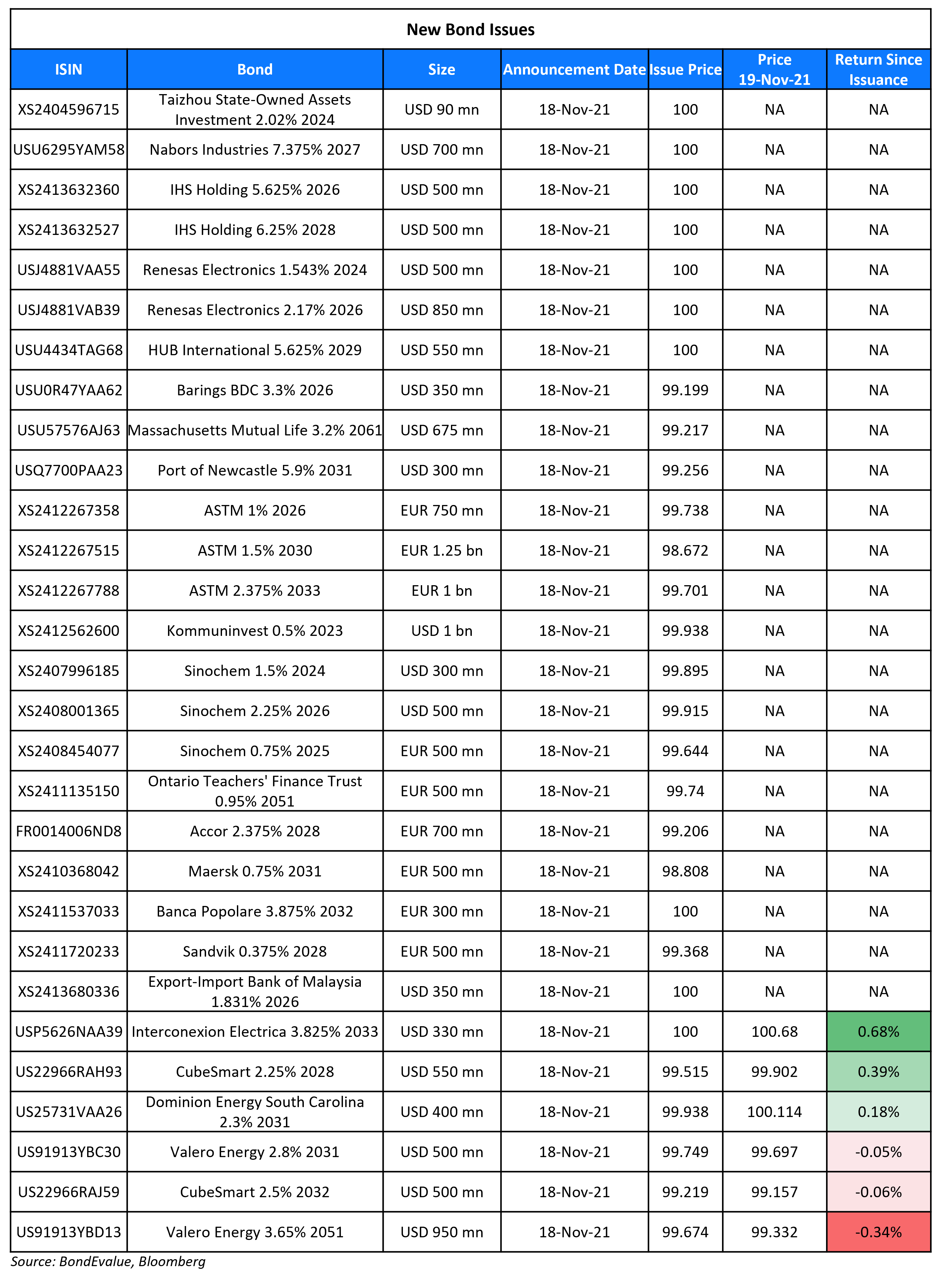

New Bond Issues

- Yueyang Construction and Investment Group $ 5Y at 3.5% area

- Jiangsu Kewei Holding $ 3Y at 2.2% area

- Tianjin Free Trade Zone Investment $ 3Y at 3% final

Sinochem Hong Kong raised $1.36bn-equivalent via a multi-currency three-tranche deal. It raised:

- $300mn via a 3Y bond at a yield of 1.536%, 40bp inside initial guidance of T+110bp area, and priced 8.6bp wider to its existing 1% 2024s that yield 1.45%

- $500mn via a 5Y bond at a yield of 2.268%, 35bp inside initial guidance of T+140bp area, and priced 8.8bp wider to its existing 1.5% 2026s that yield 2.18%.

- €500mn via a 4Y bond at a yield of 0.841%, 20bp inside initial guidance of MS+120bp area.

The bonds have expected ratings of A3/A–/A. The dollar tranche received combined orders over $3bn, 3.75x issue size, while the euro tranche received orders over €950mn, 1.9x issue size. The bonds are issued by wholly owned subsidiary Sinochem Offshore Capital and guaranteed by Sinochem Hong Kong (Group) Company. The bonds have a letter of support from Sinochem Group.

Olam raised S$25mn via another tap of its 5.375% Perp bond at a yield of 5.306%, 6.2bp inside initial guidance of 5.368% area. This comes in addition to the S$125mn tap it raised earlier this week, which was also announced at 5.368% area and priced at 5.306%. This brings the total size of the unrated bonds to S$550mn. The new bonds are priced 1.6bp wider to its existing 5.375% Perps that yield 5.29%.

Export-Import Bank of Malaysia raised $350mn via a 5Y bond at a yield of 1.831%, 30bp inside initial guidance of T+90bp area. The bonds have expected ratings of A3 (Moody’s), and received orders over $1.3bn, 3.7x issue size. Proceeds will be used for general banking and financing activities, working capital, as well as other corporate purposes. Asia took 97% and EMEA 3%. Fund managers and asset managers received 52%, insurers and pension funds 13%, banks 22%, the public sector 12% and private banks and others took the remaining 1%.

Renesas Electronics raised $1.35bn via a two-tranche deal. It raised $500mn via a 3Y green bond at a yield of 1.543%, 20bp inside initial guidance of T+90bp area. It also raised $850mn via a 5Y bond at a yield of 2.17%, 20bp inside initial guidance of T+115bp area. The bonds have expected ratings of BBB- by both S&P and Fitch. Proceeds for the 3Y green bonds will be used for eligible green projects, while proceeds for the 5Y bond will be used for debt repayment and general corporate purposes.

Port of Newcastle raised $300mn via a 10Y bond at a yield of 6%, unchanged from initial guidance. The bonds have expected ratings of Baa3/BBB-/BBB- (Moody’s/S&P/Fitch). Proceeds will be used to refinance existing debt.

Taizhou State-owned Assets Investment raised $90mn via a 3Y bond at a yield of 2.02%, 33bp inside initial guidance of 2.35% area. The bonds are unrated. Proceeds will be used for business development and working capital. The bonds are supported by a letter of credit from Bank of Ningbo Taizhou branch.

New Bonds Pipeline

- Jinan Industry Development Investment Group hires for $ bond

- East Money Information hires for $ debut bond

- NTT hires for € bond

- Plaza Indonesia hires for $ 5NC3 sustainability-linked bond

Rating Changes

- Glenmark Pharmaceuticals Upgraded To ‘BB’ On Expected Maintenance Of Lower Leverage; Outlook Stable

- Moody’s downgrades Cuba’s ratings to Ca from Caa2; maintains stable outlook

- Fitch Downgrades Credito Real at ‘BB-‘; Places on Rating Watch Negative

- Fitch Affirms Morgan Stanley at ‘A/F1’; Outlook Revised to Positive

- Fitch Revises Ryanair’s Outlook to Stable; Affirms IDR at ‘BBB’

- Zhongliang Holdings Outlook Revised To Negative On Slowing Sales And Coming Maturity; ‘B+’ Rating Affirmed

- Moody’s revises Bausch Health’s outlook to negative; affirms ratings

- Fitch Revises Valero’s Outlook to Stable; Assigns ‘BBB’ to Proposed Bond Issuance

- Fitch Revises Outlook on Sino-Ocean to Negative, Affirms Rating at ‘BBB-‘, Removes UCO

Term of the Day

Asset Backed Securities (ABS)

Asset Backed Securities (ABS) are securities that are collateralized or backed by a pool of assets. This pool of assets are made by a process of securitization and could be in the form of loans, credit card debt, mortgages etc. with each security backed by a fraction of the total pool of underlying assets. Thus, an investor gets interest and principal payments while also assuming the risk of the underlying assets. The underlying pool of assets are structured in different tranches with the highest priority of repayment going to the top tranche and then to the second tranche and so on. Goldman Sachs recently said that investors should rotate into securitized debt like ABS from corporate bonds.

Talking Heads

On Wharton’s Siegel Urging Faster Taper After Nailing Inflation Call

“It’s not over… It could get worse unless the Fed gets a handle on money supply growth. “I don’t think the markets are prepared for how fast I think the Fed has to go. So much money was created during the pandemic to cushion the economic effects, but that wasn’t pulled back and that is what’s flowing in.”

On China’s Housing Market to Contract But Not Crash – Barclays

Property investment is likely to fall 5-8% in 1H 2022 while new floor space starts drop as much as 20%. Home sales volume will probably fall 10%-15% in 1H… Our base case housing-market outlook remains a controllable contraction in property investment (and home prices) in 2022, rather than a crash or a financial meltdown”.

On S&P saying it believes China Evergrande default still ‘highly likely’

“The firm has lost the capacity to sell new homes, which means its main business model is effectively defunct. This makes full repayment of its debts unlikely”.

On Lira Chaos Fueling Predictions for More Financial Stress in Turkey

Ogeday Topcular, a money manager at RAM Capital

“This is too much unorthodoxy in action… It may start biting institutions more now and we can see an increase in debt restructurings, which may take us to uncharted waters.”

Jason Tuvey, senior emerging market economist at Capital Economics in London

If the lira keeps falling, “credit conditions would almost certainly tighten”

Nick Stadtmiller, director of emerging markets at Medley Global Advisors

“For the time being, credit investors seem pretty sanguine about the monetary stance… But the risk of a serious repricing in Turkish credit over the next six months or so is definitely higher.”

Henrik Gullberg, a macro strategist at Coex Partners in London

“The situation will deteriorate due to lira depreciation, which will feed into higher inflation until there’s an end to this vicious circle”

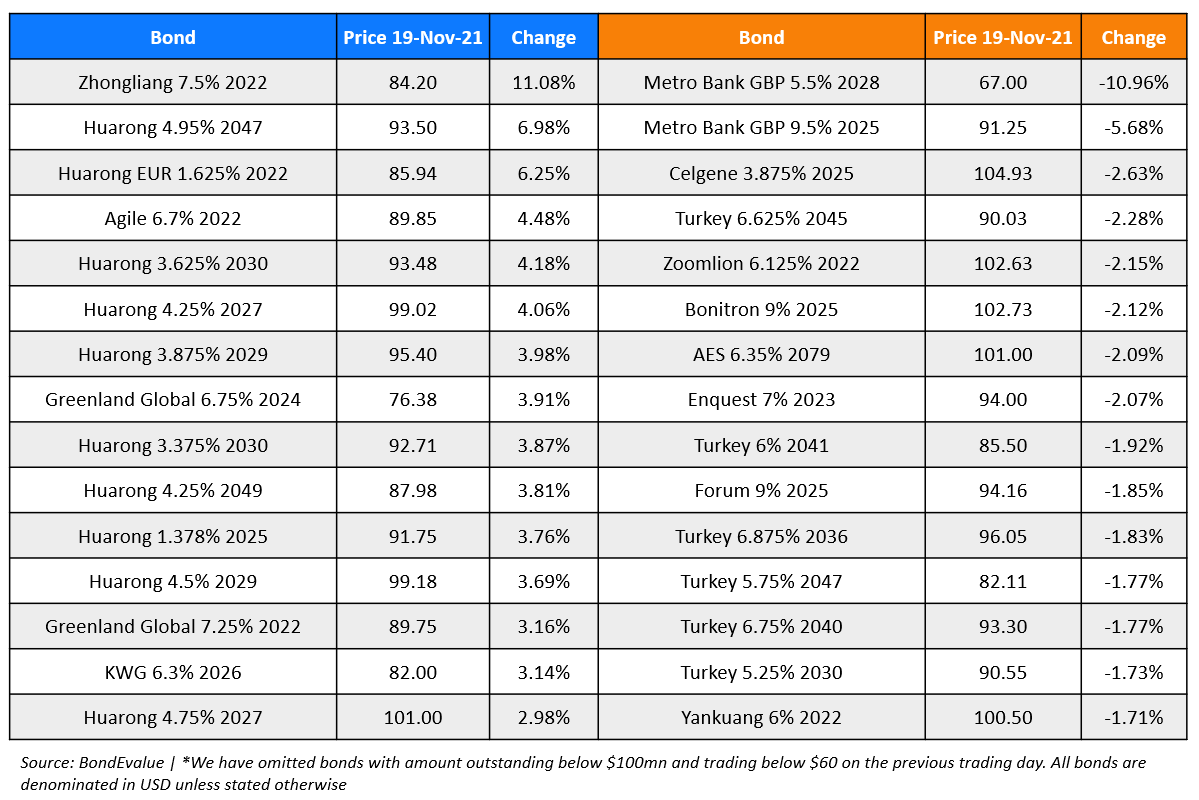

Top Gainers & Losers – 19-Nov-21*

Go back to Latest bond Market News

Related Posts: