This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; Talking Heads; Top Gainers & Losers

February 11, 2021

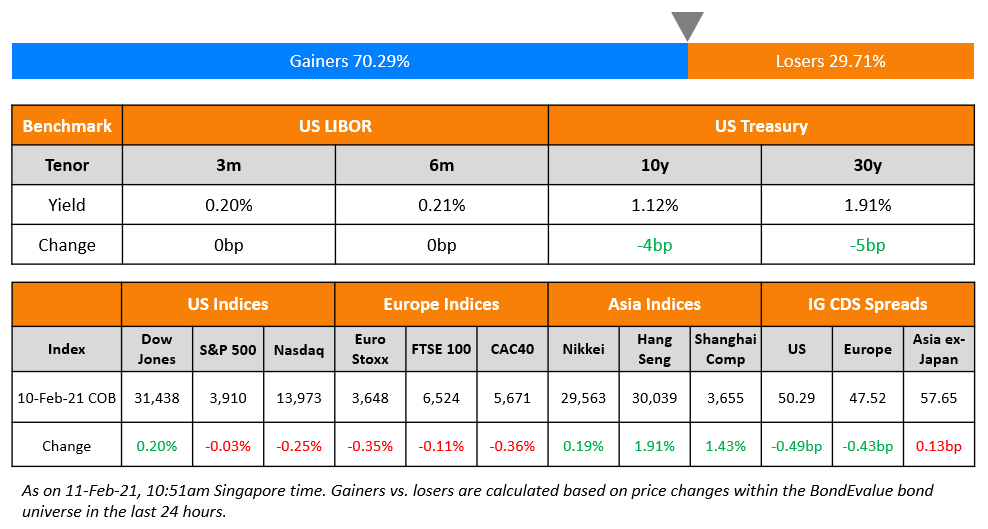

S&P ended flat while Nasdaq was 0.25% lower. US inflation for January came in soft with Headline CPI at 0.3% MoM and a 1.4% YoY rise vs. expectations of 1.5%, while the core rate was unchanged last month vs. expectations of a 0.2% rise. US 10Y Treasury yields eased 4bp with the soft inflation print. European equities posted modest losses of 0.1%-0.2%. US IG CDS spreads were 0.5bp tighter and HY was 2.2bp tighter. EU main CDS spreads tightened 0.4bp and crossover spreads tightened 3.3bp. Asia ex-Japan CDS spreads are 0.1bp wider while Asian equities are slightly lower today. Asian primary markets are quiet ahead of the Lunar New Year holiday weekend.

Bond Traders’ Masterclass

If your first language is Spanish and you are keen on learning the fundamentals of bonds, do join our masterclass on A Practical Introduction to Bonds, which will be conducted in Spanish on February 17 at 9am Mexico City / 3pm London / 7pm Dubai. The session will be conducted by bond market veterans that have previously worked at premier global institutions such as HSBC and Citibanamex. Click on the image below to register.

New Bond Issues

SBL Holdings raised $600mn via a 10Y bond at a yield of 5.134%, or T+400bp, ~43.75bp inside initial guidance of T+437.5/450bp. The bonds have expected ratings of BBB-/BBB- and proceeds will be used to reduce outstanding borrowings under its revolving credit facility and to pay expenses in connection with the transaction. The bonds carry a coupon step-up of 25bp per notch downgrade by either S&P or Fitch, capped at 100bp per agency or 200bp in total. The bonds also have a change of control put at 101.

New Bond Pipeline

- JSW Steel $ bond

- First Abu Dhabi Bank € bond

- Liberty Mutual Group

Rating Changes

- Moody’s upgrades Fresh Market CFR to B3

- Moody’s downgrades Zensun’s CFR to B2; outlook stable

- Tower Bersama Upgraded To ‘BB+’ By S&P On Business Resilience And Improved Debt Maturity Profile; Outlook Stable

- Pitney Bowes Inc. Downgraded To ‘BB’ By S&P On Declining Profitability, Elevated Leverage; Outlook Stable

- Avation PLC Downgraded To ‘CC’ By S&P; On CreditWatch Negative

- Sysco Corp. Outlook Revised To Stable From Negative By S&P; ‘BBB-‘ Rating Affirmed

- Abanca Corporacion Bancaria Outlook Revised To Stable From Negative By S&P On Strengthened Capital; ‘BB+/B’ Ratings Affirmed

- Fitch Places SF on Rating Watch Negative on Proposed Acquisition

- Crown Resorts Ltd. Placed On CreditWatch Negative By S&P On Intensifying Regulatory Risks

- Dell Technologies Inc. And VMware Inc. Outlooks Revised To Stable From Negative By S&P; Ratings Affirmed

- Power Grid Corp. of India ‘BBB-‘ Rating Affirmed With Stable Outlook By S&P; SACP Revised Up To ‘bbb’ On Stronger Financials

- Saudi-Based Samba Financial Group Assigned ‘gcAA+’ Regional Scale Ratings By S&P

Term of the Day

Zero Coupon Bond

A zero coupon bond is a fixed income instrument that does not pay interest or coupon during the tenor of the bond, unlike fixed or floating rate bonds that typically make annual or semi-annual coupon payments. Zero coupon bonds are issued at a discount and redeemed at par, thereby offering a yield to the bondholders. An example of such bonds are US Treasury bills.

Singapore-based distressed oil and gas company KrisEnergy announced today that it has received approval from holders of its S$139.5m ($105.2m) senior zero coupon bonds due 2024 for its restructuring. The plan involves swapping 45% of the debt to exchange shares. KrisEnergy had also asked the investors to extend the maturity of the remaining debt to December 30, 2025 and waive non-compliance of certain covenants and potential events of default.

Talking Heads

“You could see strong spending growth, and there could be some overt pressure on prices,” he said. “My expectation would be that will be neither large nor sustained. Inflation dynamics will evolve but it’s hard to make the case why they would evolve very suddenly in this current situation.”

“Also important is a patiently accommodative monetary policy stance that embraces the lessons of the past — about the labour market in particular and the economy more generally,” he said.

On the need for ‘society-wide’ push to deliver full employment

Jerome Powell, Federal Reserve Chairman

“We are still very far from a strong labor market whose benefits are broadly shared,” Powell said. Returning to maximum employment “will require a society-wide commitment, with contributions from across government and the private sector,” Powell said. “The potential benefits of investing in our nation’s workforce are immense.” “There was every reason to expect that the labor market could have strengthened even further without causing a worrisome increase in inflation were it not for the onset of the pandemic,” he said.

Ron Wyden, Senate Finance Committee Chair

“Chair Powell’s assessment reiterates the need for the strongest possible benefits package in ourCovid relief bill,” said Wyden.

Diane Swonk, chief economist at Grant Thornton LLP

“The Fed is in full risk-management mode,” said Swonk. “The reality is setting in that the virus will be managed instead of eradicated. That leaves a lot of uncertainty about the pace of reopening and what the world will look like on the other side of the pandemic.”

Alejandro Werner, IMF’s Western Hemisphere Director

“I don’t see it as unviable, but clearly it’s an ambitious date,” Werner said. “The Argentine authorities are obviously working very hard on dealing with the need to be able to reach a deal by May.”

Kristalina Georgieva, IMF Managing Director

“You know the saying in Argentina: ‘It takes two to tango,’ so both sides need to do our part and find a pathway to an agreement,” Georgieva said

On long-dated euro zone yields rising as Spain 50-yr sale saturates market

Daniel Lenz, DZ Bank rates strategist

“There is high demand for long maturities because of the hunt for yield, so debt agencies are taking advantage with 50-year issuance,” said Lenz. “But on the other hand, there is discussion over reflation and a concern that long-dated bonds may suffer the most in case of a change in the inflation path,” he added.

Top Gainers & Losers – 11-Feb-21*

Go back to Latest bond Market News

Related Posts: