This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

January 17, 2022

US equity markets ended slightly higher on Friday with the S&P and Nasdaq up 0.1% and 0.6% respectively. Sectoral gains were led by Energy and IT, up 2.5% and 0.9% while losses were led by Real Estate and Financials, down 1.2% and 1%. US 10Y Treasury yields were up 9bp to 1.79%. European markets were lower on Friday with the DAX, CAC and FTSE down 0.9%, 0.8% and 0.3% respectively. Brazil’s Bovespa was up 1.3%. In the Middle East, UAE’s ADX was flat and Saudi TASI was up 0.3% on Sunday. Asian markets have opened broadly higher following – Shanghai, STI and Nikkei were up 0.6%, 0.1% and 0.8% while HSI was down 0.6%. US IG CDS spreads were 0.3bp wider and HY CDS spreads tighter 0.4bp. EU Main CDS spreads were 1.3bp wider and Crossover CDS spreads were 4.1bp wider. Asia ex-Japan CDS spreads widened 3.5bp.

US Retail Sales fell -1.9% vs. a forecast of a -0.1% drop while core retail sales dropped -2.3% vs. forecasts of a 0.3% rise with analysts saying that higher prices caused consumers to curb spending. The People’s Bank of China cut the rate its 1Y policy loan rate by 10bp to 2.85%, its first since April 2020. Yewei Yang, an analyst at Guosheng Securities Co. said, “The PBOC has accelerated its pace of policy easing in order to guide borrowing costs lower and to encourage credit supply… The move suggests China’s economy is weak and it will trigger a significant slide in borrowing costs.”

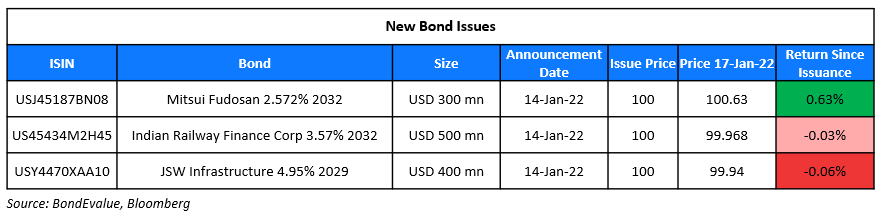

New Bond Issues

New Bonds Pipeline

- Kalyan Jewellers plans $ 5Y bond

- Maxi-Cash Financial offers new S$ 3Y at 6.05%

- Henan Railway Construction & Investment plans $ green bond

- Shinhan Card hires for $ 5Y social bond

- Electricity Generating (EGCO) hires for $ 7Y or 10Y bond

- Petron hires for $ 7NC4 bond

- JY Grandmark hires for $ bond

- ADB marketing hires for $ 5Y bond

- China Oilfield Services Limited hires for $ bond

- Guangdong Provincial Communications Group hires for $ bond

Rating Changes

- Fitch Downgrades Ghana to ‘B-‘; Outlook Negative

- Fitch Downgrades Guangzhou R&F’s IDR to ‘RD’ on Completion of Exchange Offer

- Fitch Revises Greece’s Outlook to Positive; Affirms at ‘BB’

Term of the Day

Local Government Financing Vehicle (LGFV)

Local government financing vehicles or LGFVs are debt-issuing entities set up by local governments in China to fund infrastructure and related projects. LGFVs came into existence because local governments were prohibited from raising debt directly. Hence, these local governments set up off-balance sheet entities known as LGFVs. LGFVs have become popular over the past decade and are regular issuers of Chinese yuan and US dollar bonds. While these issuers are backed by local governments, there were concerns among investors about their ability and willingness to repay debt driven by events in the past when LGFVs defaulted on their bonds.

Talking Heads

Fed Needs Half-Point Rate Hike to Regain Credibility: Ackman

“A 50 bp initial move would have the reflexive effect of reducing inflation expectations, which would moderate the need for more aggressive and economically painful steps in the future. The unresolved elephant in the room is the loss of the Fed’s perceived credibility as an inflation fighter.”

Treasury Market Gets Reprieve as ‘Bond-Bearish Euphoria’ Pauses

Ian Lyngen, head of U.S. rates strategy at BMO Capital Markets

“The initial bond-bearish euphoria appears to be waning… But the combination of stability in other asset classes and further progress toward the cycle’s first hike will steadily embolden those anticipating higher yields.”

Jason Bloom, head of fixed income and alternatives ETF strategies at Invesco

“A 10-year Treasury yield rising toward 2.25% makes sense with the Fed indicating that it will make a fast start to tightening this year. The market thinks the Fed will not raise rates beyond 2.5% without triggering a recession”

Fed Will Find It Hard to Talk About Path Ahead After March Hike

Derek Tang, an economist at LH Meyer/Monetary Policy Analytics

“Forward guidance was an expedient tool when they faced low inflation with disinflationary pressures. t is not clear it is sustainable where risks are bi-directional or tilted to the upside.”

Fed Governor Christopher Waller

“If inflation is just stubbornly high through the first half of this year, we’re going to have to do a lot more”

Patrick Harker, Philadelphia Fed president

“I could be convinced of a fourth if inflation is not getting under control.”

Fed Governor Lael Brainard

“We will simply have to see what the data requires over the course of the year”

Ghana Says Eurobond Yields Don’t Reflect Economic Reality

“Whereas the current trading levels of our Eurobonds have widened, we do not believe that it is warranted nor do we believe that it reflects the strong underlying fundamentals of the Ghanaian economy and our rapid rebound… Ghana’s fundamentals remain strong.”

Sri Lanka economists tell government to default on bond, buy food

Shanta Devarajan, a former World Bank chief economist from Sri Lanka

“This $500 million could enable people, especially poor people, to buy and cook food for themselves and their children… Instead, the government is choosing to reimburse bondholders, who are hardly poor.”

A. Wijewardena, a former central bank deputy governor

“Sri Lanka has an unblemished record of debt repayment but in the present conditions of near-zero forex reserves, it may not be able to keep that record anymore”

Dulindra Fernando, managing director of Ceylon Asset Management

“Now that the government is honoring [the debt], the same economists want the government to default or seek a restructure… It’s frivolous because it irresponsibly neglects the vast cost of default to Sri Lanka. vs. the manageable ISB settlement amounts. Sri Lanka has an impeccable credit record since independence, and [the] opposition now realizes this is the best opportunity to destabilize the government.”

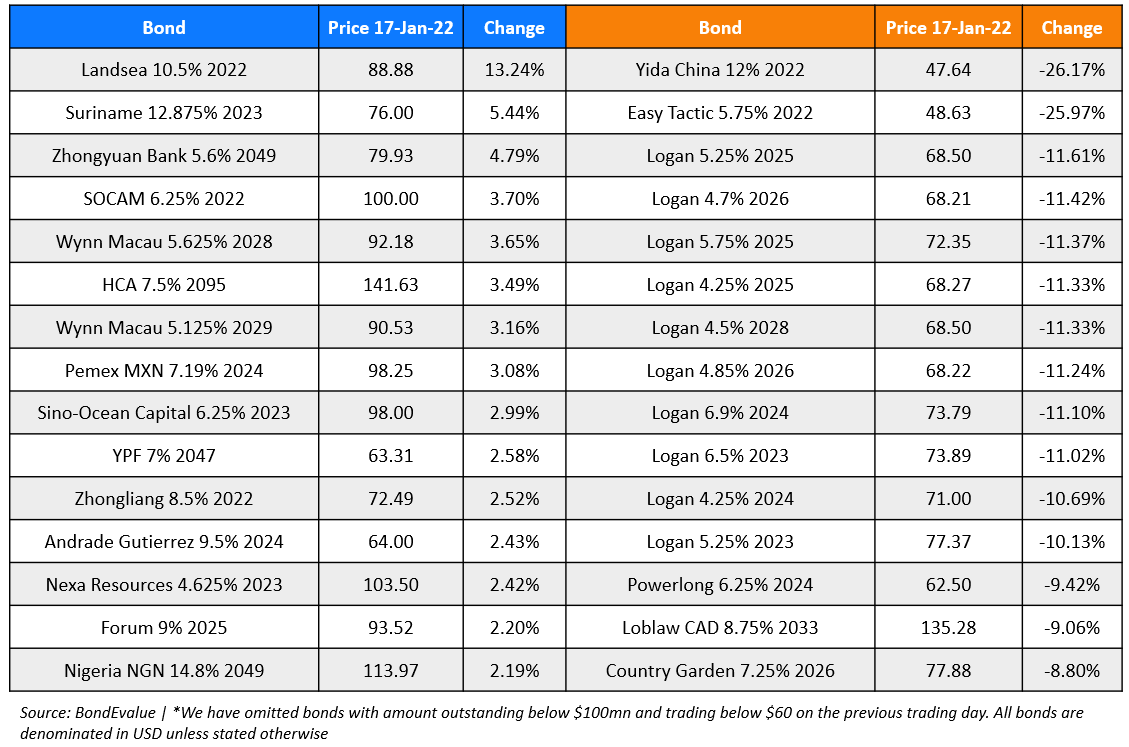

Top Gainers & Losers – 17-Jan-22*

Go back to Latest bond Market News

Related Posts: