This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; The Week That Was; Rating Changes; Talking Heads; Top Gainers & Losers

February 8, 2021

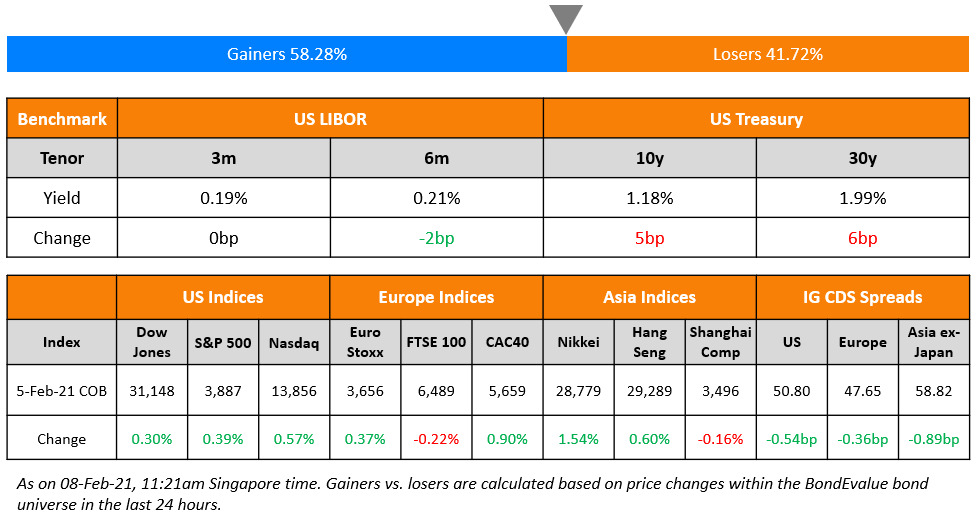

US equities were slightly higher with the S&P and Nasdaq up 0.4% and 0.6%. US non-farm payrolls disappointed with 49k jobs added in January vs expectations of 105k; the previous number was also revised lower from -140k to -227k. US 10Y Treasury yields eased on Friday’s from a high of over 1.18% to 1.16%. The US House approved a budget bill advancing Biden’s $1.9tn relief plan, which may go through Congress even without the Senate’s support. Europe’s FTSE and DAX were marginally lower while CAC and FTSEMIB were up 0.9% and 0.8%. US IG CDS spreads were 0.5bp tighter and HY was 3.6bp tighter. EU main CDS spreads tightened 0.4bp and crossover spreads tightened 1.6bp. Asia ex-Japan CDS spreads are 0.1bp tighter while Asian equities are up ~0.5% higher to start the week.

Bond Traders’ Masterclass

If your first language is Spanish and you are keen on learning the fundamentals of bonds, do join our masterclass on A Practical Introduction to Bonds, which will be conducted in Spanish on February 17 at 9am Mexico City / 3pm London / 7pm Dubai. The session will be conducted by bond market veterans that have previously worked at premier global institutions such as HSBC and Citibanamex. Click on the image below to register.

New Bond Issues

- UltraTech Cement $ 10Y SLB at T+210bp area; books over $10bn

- India Green Power/ReNew Power $ green bond at 4.25% area

New Bond Pipeline

- India Toll Roads / IRB Infrastructure $ 3.5NC2 bond

- Liberty Mutual Group

Rating Changes

- Moody’s upgrades Logan to Ba2; outlook stable

- Moody’s downgrades Meinian Onehealth to B2; outlook remains negative

- Tullow Oil Ratings Placed On CreditWatch Negative By S&P On Risk Of Distressed Exchange Offer

- Moody’s confirms El Salvador’s B3 ratings, changes outlook to negative, concluding review for downgrade

- Zimmer Biomet Holdings Inc. Outlook Revised To Stable From Negative By S&P On Improving Operating Performance, Ratings Affirmed

- Ping An Property & Casualty Insurance Co. of China Ltd. ‘A-‘ Ratings Withdrawn By S&P At The Company’s Request

- Fitch Places Chongqing Energy’s ‘BBB’ Ratings on Rating Watch Negative

The Week That Was

US primary market issuances stood at $57.8bn for the week ended February 5 vs. $39.6bn the week before. IG issuances stood at $49.3bn, up 94% over the prior week’s $25.3bn while HY issuances stood at $8.5bn, down 57% from the prior week’s $14.9bn. The region saw the largest deal of 2021 yet with Apple’s $14bn three-part jumbo issuance overtaking 7-Eleven’s $10.95bn eight-part issuance in the week prior. Besides these, Boeing’s $9.825bn deal and Altria’s $5.5bn issue also made the high-grade list last week. In North America, there were a total of 48 upgrades and 17 downgrades combined, across the three major rating agencies last week. LatAm saw $4.96bn worth of new bond deals, over 5x of the prior week’s issuance, with Mexico’s CFE alone raising $2bn via a dual-trancher. EU Corporate G3 saw an increase with issuance of $26.9bn vs. $18.1bn in the week prior – UBS raised $1.5bn via an AT1 at 4.375% and another $4bn the next day via a three-trancher while German carrier Lufthansa sold euro bonds worth $1.9bn. GCC and Sukuk issuances were marginal with only $1.15bn worth of new bonds in the week. APAC ex-Japan G3 issuances totaled $12.7bn vs $13.1bn in the week prior – Alibaba alone raised $5bn via Asia’s largest dollar bond deal yet. Other issuers that topped the list were Kexim with a $1.5bn deal, Pertamina’s $1.9bn deal and IRFC’s $750mn deal. In the region, there was only 1 upgrade and 13 downgrades combined, across the three major rating agencies last week. Among the notable downgrades was that of China Fortune Land (CFLD) by Moody’s and Fitch one after the other.

Term of the Day

Duration

Duration or Macaulay Duration is the weighted average time until repayment of the invested amount. It is measured in years and is less than the final maturity of coupon bearing vanilla fixed rate bonds. The higher the duration, the higher will be the change in a bond’s price for a given change in interest rates. It is considered a better measure of risk than using final maturity, as it gives weightage to the coupon payments as well. Higher the tenor, greater will be the bond’s duration and higher the coupon, lower will be the bond’s duration.

For very long tenor bonds like century (100Y) bonds or high coupon bonds, the duration is significantly less than the years to maturity. Last year, the Austrian sovereign issued a €2.8bn century bond at a coupon of 0.85% with a maturity in 2120. The bonds duration today is 69.923 years.

Talking Heads

On the debate between Yellen and Summers over risk of overheating from stimulus plan

Joe Biden, US President

“Some in Congress think we’ve already done enough to deal with the crisis in the country. Others think that things are getting better and we can afford to sit back and either do little or nothing at all,” he said. “That’s not what I see. I see enormous pain.

Lawrence Summers, former US Treasury secretary

“There is a chance that macroeconomic stimulus on a scale closer to World War II levels than normal recession levels will set off inflationary pressures of a kind we have not seen in a generation,” he wrote. “I worry that containing an inflationary outbreak without triggering a recession may be even more difficult now than in the past.”

Janet Yellen, US Treasury Secretary

“As Treasury secretary, I have to worry about all of the risks to the economy,” Yellen said. “And the most important risk is that we leave workers and communities scarred by the pandemic and the economic toll that it’s taken, that we don’t do enough to address the pandemic and the public health issues, that we don’t get our kids back to school.”

Jeremy Grantham, co-founder of asset management firm GMO

“When you have reached this level of obvious super-enthusiasm, the bubble has always, without exception, broken in the next few months, not a few years,” Grantham said.

Andy Laperriere, former congressional staffer and Washington-based partner for Cornerstone Macro LLC

“It could impact the risk tolerance for the second package” among some moderate Democrats if Biden rams his big program though, Laperriere said. “If you feel like you’ve walked the plank on package number one, maybe members are more cautious about walking the plank on package number two.”

“I’ve spent many years studying inflation and worrying about inflation. And I can tell you we have the tools to deal with that risk if it materialises.”

“We remain convinced that 2021 will be a recovery year,” she said. “The economic recovery has been delayed, but not derailed. People are obviously waiting impatiently for it.” “Once the pandemic is over and the immediate economic crisis is behind us, we will have a tricky situation on our hands.”

We must “not repeat the mistakes of the past by cutting off fiscal and monetary stimulus at once,” she said.

“Economies will then have to learn how to function again without the help of any of the exceptional measures that had to be introduced as a result of the crisis,” she said. “I am not worried about this, because the capacity for recovery is strong.”

On the dangers in global markets that come with rising bond yields

Gene Tannuzzo, portfolio manager at Columbia Threadneedle

“There is more duration risk embedded in the markets than many may realize,” said Tannuzzo.

Christian Mueller-Glissmann, managing director for portfolio strategy and asset allocation at Goldman Sachs Group Inc

“This crisis and the recovery has led to the lengthening of duration in most assets, but in particular in equities,” Mueller-Glissmann said. “So stocks may not benefit if you get a shift from the market fading deflation, to pricing in inflation. That means multi-asset portfolios really want to manage that duration risk within equities much more aggressively.”

Scott Peng, chief investment officer of Advocate Capital Management

“We have a convergence of a huge surge in deficit spending to fund fiscal programs as well aspent-up consumption along with monetary-policy support,” Peng said. “And at some point, rising rates have to affect equities. Is it at 2% on the 10-year yield, or 5%? That part is debatable.”

Jeroen Blokland, a portfolio manager in the Robeco’s global macro team

“For the first time in years, it seems inflationary pressure is building,” said Blokland. “If you have a typical portfolio whereby 60%of assets is in equities and 40% in bonds, you will be hit on both legs.”

On frothy markets sparking worries of bubbles in European assets

“Compartments of the markets have moved significantly above fair value,” said Kasper Elmgreen, head of equities at Amundi. “Gravity is a powerful force, where there are bubbles building they will eventually burst no matter how elevated valuations can become before this happens.”

Suzanne Hutchins, a portfolio manager at Newton Investment Management

“Markets are fragile and the manipulation by central banks keeping a tight lid on interest rates creates lots of unforeseen risks,” she said.

Jeremy Ghose, head of the credit management business at Investcorp

“People who used to invest only in investment-grade will not be able to live with yields they are getting,” said Ghose. “You are really getting peanuts today.”

Frederique Carrier, head of investment strategy at RBC Wealth Management

“Concerns are mounting as to whether financial markets may have entered bubble territory over the past few weeks,” Carrier wrote. “Instances of excessive behavior in markets have become apparent, and, it seems, more frequent.”

“Local banks will continue to face a challenging time this year because the [ongoing] pandemic is [piling weight on] the city’s worst recession on record,” he said. “We are discussing with the banks to find a way which would safeguard the sector while helping the economy to recover.” “The banking sector overall is still holding well, as the capital ratio stood at 20.3 per cent and the total deposits increased 5.4 per cent last year, among the highest worldwide,” Yuen said. “The local banking sector is still very stable and resilient.” “This is not substantial, but it is good to see that the virtual banks are having a stable growth,” Yuen said.

Top Gainers & Losers – 8-Feb-21*

Go back to Latest bond Market News

Related Posts: