On Bond World Sees Ukraine Paying $300 Million Coupon Even as War Rages

Tim Ash, senior emerging market sovereign strategist at BlueBay Asset Management

“I think they have the cash to pay. The West will be very willing to make sure they pay and Ukraine could get technical assistance. Going into default at a time of invasion would not be great.”

Alberto Gallo, a portfolio manager at Algebris UK Ltd

“We see more upside for Ukraine assets here than for Russia. Even if negotiations end with an agreement today, as we hope, Russia will remain isolated from financial markets and from diplomacy as long as Putin’s regime stays. Ukraine, on the other hand, is likely to join a stronger and more united Europe. It might be late on a coupon. But the long term picture is they will be part of Europe, not Russia.”

On Demand for Cash Jumps From Fund Managers Stressed by Russia

John Hancock Investment Management

“That’s a sign that we’re seeing a lot of negative sentiment out there. Right now, it’s hard to find very many bulls.”

Art Hogan, chief market strategist at National Securities

“Whenever there is a preponderance of geopolitical uncertainty, one of the natural instincts in a defensive fashion is to raise cash levels. It represents pent-up demand for other investments down the road”.

David Sadkin, president at Bel Air Investment Advisors

“Staying in cash and bonds — you’re going to lose your purchasing power. At current yields, cash and bonds have a negative real return so investors in those asset classes are losing ground versus inflation”.

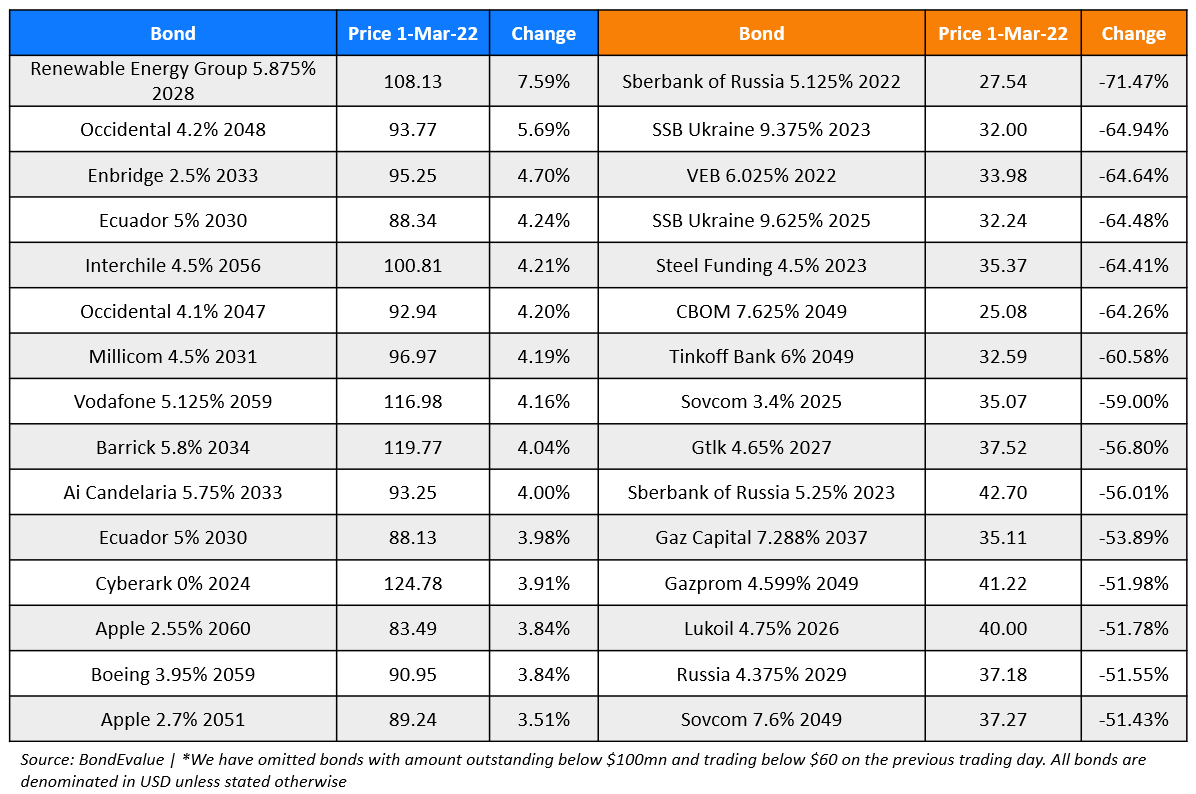

On ‘Just Sell’: Russia Bondholders Jump Right Before Repayment

Kshitij Sinha, a portfolio manager at Canada Life Asset Management

“If you are forced to sell them because of sanctions then you don’t have an option but to just sell. I can also see a case for taking the loss now and selling because now Russia has become un-investable”.

On Fed’s Bostic Says Half-Point Move Possible If Inflation Persists

“I am still in favor of a 25 basis-point move at the March meeting. One data point that I am looking at in particular is month-to-month change in inflation. To the extent we start to see that trend down, then I will be comfortable pretty much with a 25 basis-point move. If that continues to persist at elevated levels, or even moves in the other direction, then I am really going to have to look at a 50-basis-point move for March…. Historically, over the last 10 years or so our moves have been in 25 basis point increments. I was hearing and getting a sense that many expected that was the only type of move we could do. I actually think that is wrong. We need to make sure people have different levels of move in mind, and awareness of those are possibilities”.

On The List of Foreign Companies Pulling Out of Russia Keeps Growing

“Shell have made the right call. There is now a strong moral imperative on British companies to isolate Russia. This invasion must be a strategic failure for Putin.”

Anders Opedal, Equinor ASA CEO

“In the current situation, we regard our position as untenable”

llen Good, sector strategist at Morningstar

“I wouldn’t be surprised if you see more announcements coming down the line about exits. BP had extra pressure given the U.K. government, I’m not sure TotalEnergies will face the same pressures given that the relationship between France and Russia is different.”

Ford Motor Co.

“Our current interest is entirely on the safety and well-being of people in Ukraine and the surrounding region. We won’t speculate on business implications”