This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

4 New $ Deals incl. DBS; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

March 10, 2022

US equity markets saw a sharp rebound on Wednesday with the S&P and Nasdaq closing 2.6% and 3.6% higher. Sectoral gains were led by IT and Financials, up over 3.5% each. European markets saw a massive rally – the DAX, CAC and FTSE were up 7.1%, 7.9% and 3.3% respectively. DAX and CAC registered their largest 1D price gains since March 24, 2020 and November 9, 2020. US 10Y Treasury yields jumped up by 11bp to 1.95% as risk-on sentiment took over. Brazil’s Bovespa ended 2.4% higher. In the Middle East, UAE’s ADX was down 2.2% and Saudi TASI was down 0.9%. Asian markets have opened strong – Shanghai, HSI, STI, Nikkei were up 1.9%, 1.3%, 1.2% and 3.7% respectively. US IG CDS spreads tightened 4.2bp and HY spreads were 23.5bp tighter. EU Main CDS spreads were 6.3bp wider and Crossover CDS spreads were 35.5bp tighter. Asia ex-Japan CDS spreads were 5.4bp tighter.

Learn About Bonds from Senior Bankers | Starting 28 March

In the current environment marred by geopolitical concerns, impending rate hikes and crisis in China real estate, it is imperative for investors and advisors to be able to analyze bonds effectively. This course will help you do just that via 8 interactive sessions conducted live via Zoom by senior bankers starting 28 March. Click on the banner below to know more and to sign up.

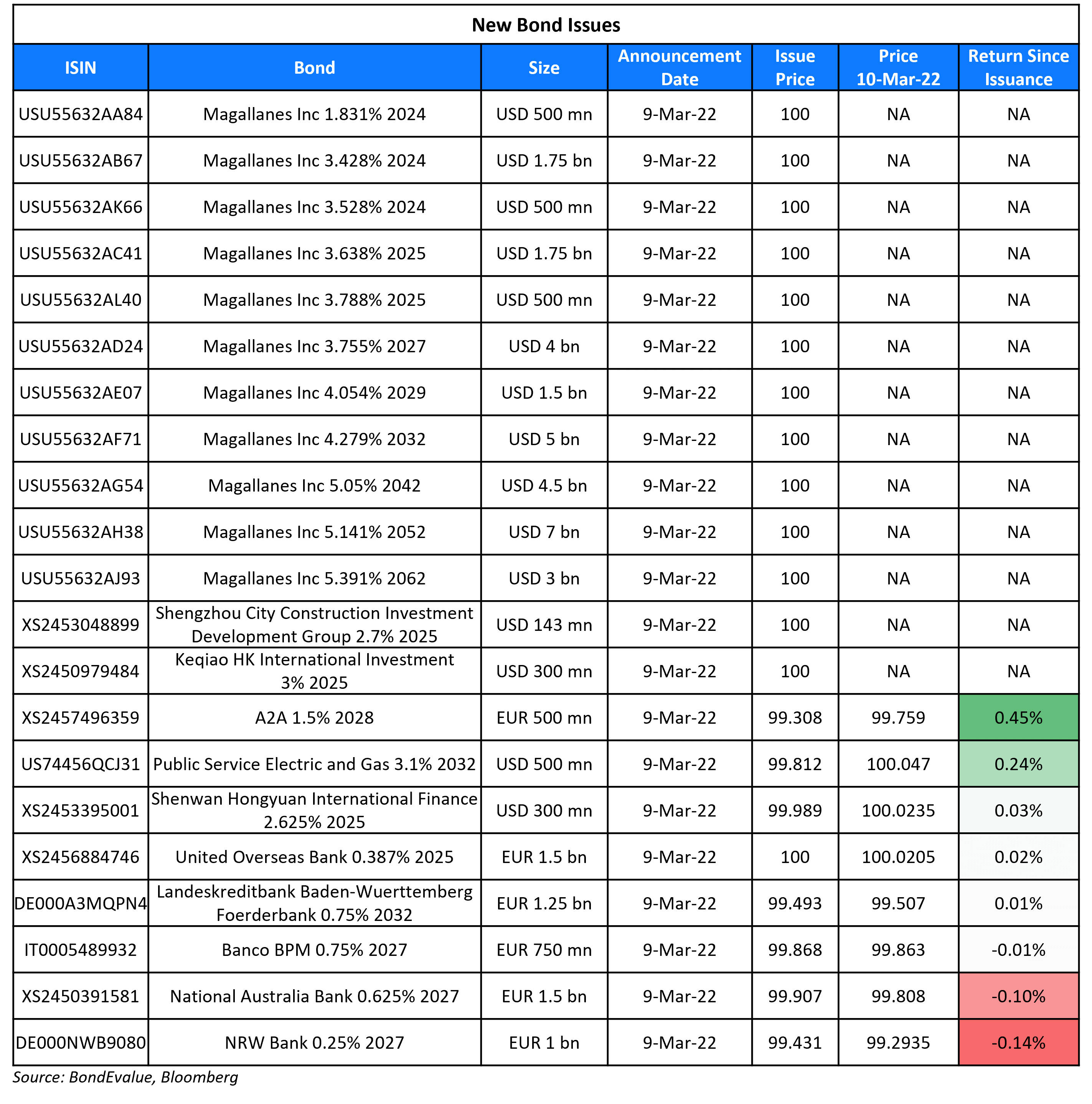

New Bond Issues

- DBS Bank $ 5Y at SOFR MS+68bp area

- Tianfeng Securities $ 2Y at 4.25% area

- Jinjiang Road and Bridge Construction & Development $ 364-day at 3.4% area

- Shanghai Fosun High Technology $150mn 3Y at 3% final

Shenwan Hongyuan Securities raised $300mn via a 3Y bond at a yield of 2.629%, 40bp inside initial guidance of T+120bp area. The bonds are rated Baa2 and received orders over $850mn, 2.8x issue size. Shenwan Hongyuan International Finance is the issuer and Shenwan Hongyuan Securities is the guarantor. Proceeds will be used for working capital and for its overseas business.

Shaoxing City Keqiao District State-owned Assets Investment raised $300mn via a 3Y bond at a yield of 3%, 15bp inside initial guidance of 3.15% area. The bonds are unrated. Proceeds will be used for project construction and working capital.

Ninghai State-owned Asset Investment Holding Group raised $120mn via a 3Y green bond at a yield of 3.65%, 15bp inside initial guidance of 3.8% area. The bonds were unrated. Proceeds will be used for general corporate purposes, construction projects and working capital.

Shengzhou City Construction Investment raised $143mn via a 3Y SBLC-bond at a yield of 2.7%, 20bp inside initial guidance of 2.9% area. The bonds are unrated. The bonds have the support of a standby letter of credit from Bank of Ningbo Shaoxing branch. Proceeds will be used for project construction and working capital.

New Bonds Pipeline

- Mumbai International Airport hires for $ bond

- The Republic of the Philippines hires for $ bond

- Aluminium Corporation of China hires for $ bond

- Petron hires for $ 7NC4 bond

- Electricity Generating (EGCO) hires for $ 7Y or 10Y bond

Rating Changes

- Moody’s upgrades Encore’s senior secured debt rating to Ba2; outlook stable

- Textron Inc. Outlook Revised To Stable From Negative On Improved Metrics, Ratings Affirmed

Term of the Day

Margin Call

In leveraged trades, a trader essentially borrows money from the brokerage firm to upsize the position. Due to the leverage given by a broker, the trader is required to put up a certain sum of money up to a threshold in a margin account so that the broker has some collateral. The threshold is known as ‘maintenance margin’. If the leveraged securities rise in value, the trader is at an advantage since the gains get added to the margin account. Here, the broker does not reap any reward, but is more certain about being paid back in full. However, if the securities fall in value and go below the threshold, the broker triggers a margin call. The margin call is the amount that the trader has to add back to top-up their margin account since the margin account’s value has gone below the threshold/maintenance margin requirement.

Peabody Energy locked in a price of $84/MT to sell coal a year ago, when demand was weak and the pandemic was impacting markets. However, Australian benchmark coal price have risen more than 400% in the last 12 months with the Russia-Ukraine crisis adding to the rally. This saw a $534mn margin call get triggered for Peabody Energy.

Explore BondbloX Kristals – a basket of single bonds listed on the BondbloX Exchange following themes such as SGD REIT Perps, USD Bank Perps, and SGD Bank Perps. Avail an introductory discount of $1,000 for every purchase of $100,000 worth of BondbloX Kristals*. Click on the banner above to know more.

Talking Heads

On Bond Traders Ringing Recession Alarm on Imminent Curve Inversion

Ed Al-Hussainy, a senior interest-rate strategist at Columbia Threadneedle Investments

“We are overdue for an inversion and a resurfacing of all those mothballed conversations that a recession is coming. Bond investors don’t have to wait around for an actual recession to make money”

Margaret Kerins, head of fixed-income strategy at BMO Capital Markets

“The speed at which the curve gets to inversion in this environment is also really dependent on the length of this geopolitical crisis. “

Jack Ablin, CIO at Cresset Capital

“Before the ground war began, the curve flattening reflected a notion that the economy has become so conditioned to low interest rates that Fed tightening by the end of the year would slow activity. A yield curve inversion has predicted previous recessions, and they were also preceded by high energy prices. The Fed will pay attention to an inversion of the yield curve and it will rattle them.”

On Pimco Veteran Readies for ‘New Neutral’ as Rates and Prices Rise

Robert Mead, Pimco’s co-head of Asia-Pacific portfolio management

“The destination of rates is not that scary. Geopolitical events will not let central banks off the hook when it comes to normalization of policy.” If borrowing costs climb to around 2%, monetary policy “will work in terms of slowing that inflationary impulse… Given that we still have in many jurisdictions pandemic policy settings and we also have inflation forecasts that meet the criteria for normalization, risk mitigation for central bankers is to follow a gradual path to normalization”

On BlackRock’s Fink saying Russia essentially cut off from global capital markets

In recent days, iconic American brands like McDonald’s, PepsiCo, Coca-Cola, and Starbucks have all suspended their operations of non-essential products. Financial services brands like Visa, Mastercard, and American Express have taken similar actions, further isolating the Russian economy from the global financial system.

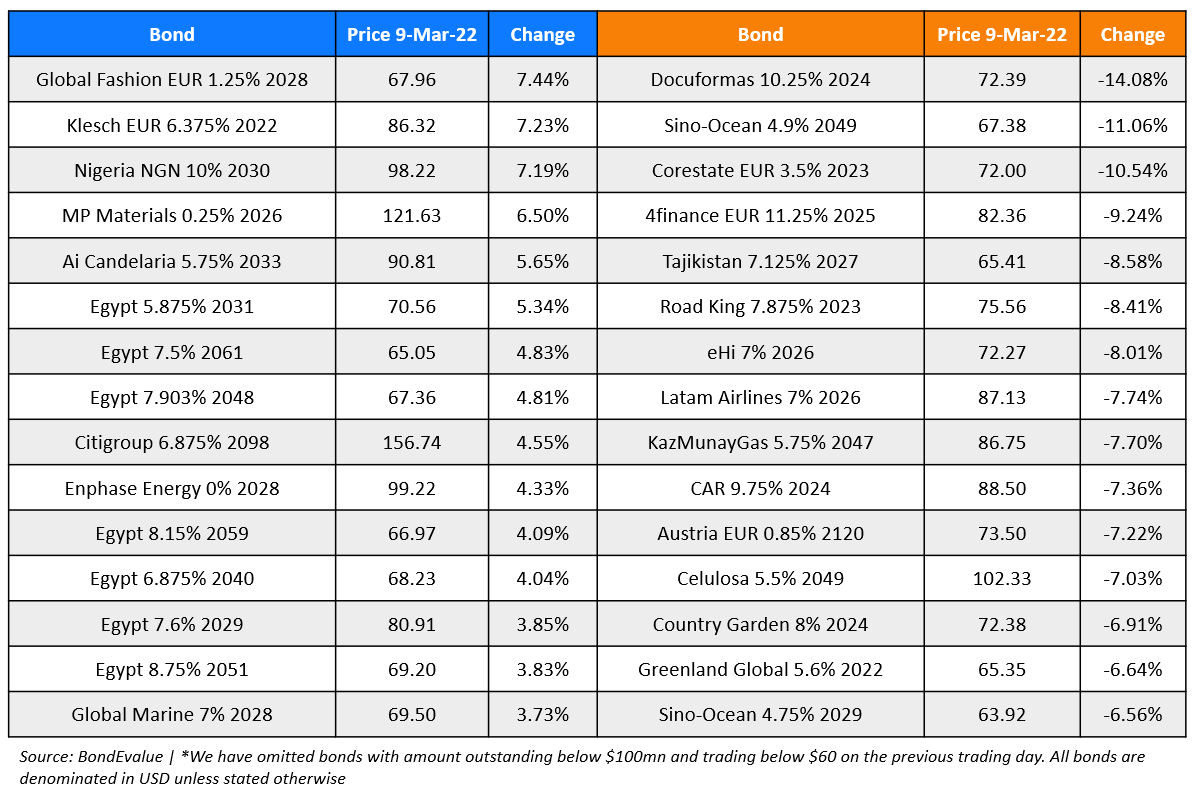

Top Gainers & Losers – 10-Mar-22*

Go back to Latest bond Market News

Related Posts: