This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

March 11, 2022

US equity markets ended lower on Thursday after a sharp rebound a day prior, with the S&P and Nasdaq closing 0.4% and 1% lower. US 10Y Treasury yields were up by 3bp to 1.99%. European markets dropped after a massive rally on Wednesday – the DAX, CAC and FTSE were down 2.9%, 2.8% and 1.3% respectively following the ECB’s surprise change in policy tone. Brazil’s Bovespa ended 0.2% lower. In the Middle East, UAE’s ADX was down 0.5% and Saudi TASI was down 0.4%. Asian markets have opened lower – Shanghai, HSI and Nikkei were down 2.2%, 3.2% and 2.7% respectively while STI was flat. US IG CDS spreads widened 1.2bp and HY spreads were 9.5bp wider. EU Main CDS spreads were 2.6bp wider and Crossover CDS spreads were 14.6bp wider. Asia ex-Japan CDS spreads were 8.3bp tighter.

US CPI inflation for February jumped 7.9% YoY, reaching a new 40Y high after a similar record in January’s 7.5% reading. Core CPI also rose, to 6.4% in February vs. 6% in January. The ECB in its policy meeting surprised markets by speeding up its plans to tighten monetary policy mentioning that inflation was more likely to “stabilize at its 2% target over the medium term”. (Scroll down to the ‘Talking Heads’ section). The ECB indicated that its asset purchase programme (APP) may end in Q3 (data-dependent) vs. its earlier policy of a gradual taper till Q4 post which its APP would continue at €20bn/month indefinitely. It also removed the option for “or lower“ in its forward guidance. The decision saw a spike in European government bond yields – German 10Y Bund yields jumped over 6bp and Italian 10Y BTP’s soared 20bp.

Learn About Bonds from Senior Bankers | Starting 28 March

In the current environment marred by geopolitical concerns, impending rate hikes and crisis in China real estate, it is imperative for investors and advisors to be able to analyze bonds effectively. This course will help you do just that via 8 interactive sessions conducted live via Zoom by senior bankers starting 28 March. Click on the banner below to know more and to sign up.

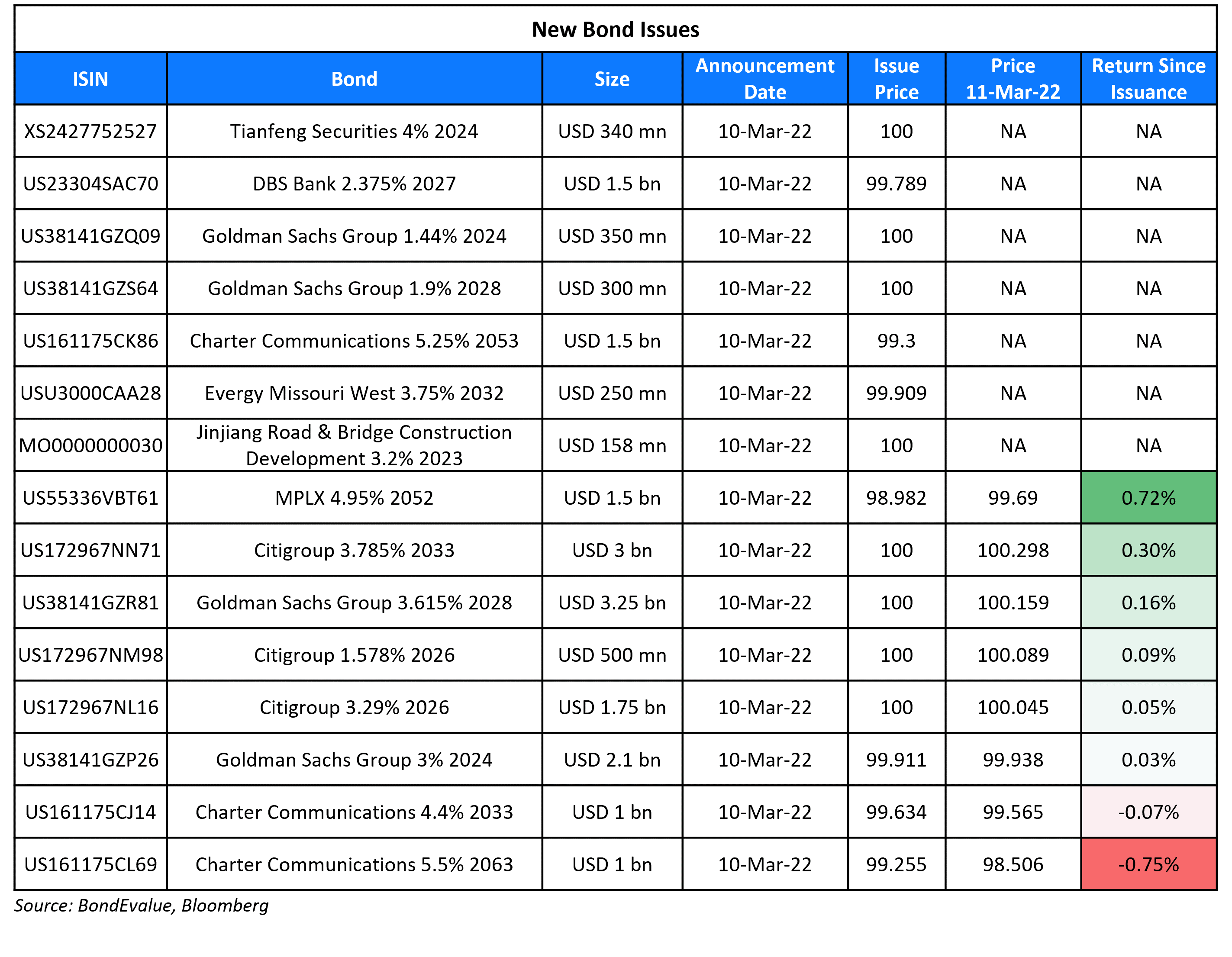

New Bond Issues

- $1.75bn via a 4NC3 fixed bond at a yield of 3.29%, 15bp inside initial guidance of T+155bp area

- $500mn via a 4NC3 FRN at a yield of 1.578%, or SOFR + 152.8bp as compared to initial guidance of SOFR equivalent area

- $3bn via a 11NC10 bond at a yield of 3.785%, 15bp inside initial guidance of T+195bp area

The bonds are rated A3/BBB+. Proceeds will be used for general corporate purposes.

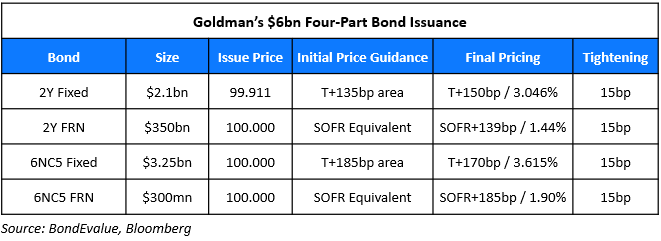

Goldman Sachs raised $6bn via a four-trancher. Details are in the table below.

The bonds are rated A2/BBB+. Proceeds will be used for general corporate purposes. The 6NC5 tranches can be redeemed as per the issuer’s choice at par call daily on or after February 15, 2028. The bonds have a make whole call (MWC) provision on or after September 15, 2022, up to but excluding March 15, 2027.

DBS Bank raised $1.5bn via a 5Y covered bond at a yield of 2.42%, 3bp inside initial guidance of SOFR MS+68bp area. The bonds are rated Aaa/AAA. The covered bond is backed by Singaporean residential mortgage loans, regulated under MAS Notice 648. Bayfront Covered Bonds is the guarantor of the deal. Proceeds will be used general purposes. The bonds by DBS is Asia’s largest USD-denominated covered bond deal (excluding Australia) according to IFR. “Issuers like it as there is less execution risk and spreads have held in remarkably well since the Ukraine-Russia conflict emerged… DBS could have tightened pricing by a couple of basis points but decided to capture size instead”, said some bankers.

Tianfeng Securities raised $340mn via a 2Y bond at a yield of 4%, 25bp inside initial guidance of 4.25% area. The bonds are unrated. Proceeds will be used for offshore debt refinancing

Jinjiang Road and Bridge Construction & Development raised $158mn via a 364 day bond at a yield of 3.2%, 20bp inside initial guidance of 3.4% area. The bonds were unrated and are guaranteed by Fujian Jinjiang Urban Construction Investment & Development Group. Proceeds will be used for project construction, debt repayment and working capital.

Shanghai Fosun High Technology raised $150mn via a 3Y FTZ SBLC bond at a yield of 3%, unchanged from guidance. The bonds are unrated. The bonds have the support of a standby letter of credit from China Bohai Bank Shanghai Pilot Free Trade Zone branch. Proceeds will be used for debt refinancing.

New Bonds Pipeline

- Mumbai International Airport hires for $ bond

- The Republic of the Philippines hires for $ bond

- Aluminium Corporation of China hires for $ bond

- Petron hires for $ 7NC4 bond

- Electricity Generating (EGCO) hires for $ 7Y or 10Y bond

Rating Changes

- NVIDIA Corp. Upgraded To ‘A’ On Continued Growth Prospects And Conservative Financial Policy; Outlook Stable

- Fitch Downgrades Times China to ‘B+’, Outlook Negative

- Moody’s downgrades the ratings of seven Ukrainian banks, ratings remain on review for further downgrade

- Moody’s downgrades Belarus’s ratings to Ca from B3; maintains negative outlook

Term of the Day

FTZ Bond

A Free Trade Zone (FTZ) bond is a bond issued by a company that operates an FTZ or subzone. FTZ’s are a special economic zone for commerce purposes where imported goods are not subject to customs. According to Asia Financial, an analysis by industry insiders show that FTZ bonds can be regarded as foreign bonds, and they are basically the same as foreign bonds in terms of foreign debt filing, projection procedures, fund return and supervision. Chinese conglomerate Shanghai Fosun High Technology (Group) priced a $150mn 3Y Shanghai Pilot Free Trade Zone bond at par to yield 3%.

Explore BondbloX Kristals – a basket of single bonds listed on the BondbloX Exchange following themes such as SGD REIT Perps, USD Bank Perps, and SGD Bank Perps. Avail an introductory discount of $1,000 for every purchase of $100,000 worth of BondbloX Kristals*. Click on the banner above to know more.

Talking Heads

On ECB Surprising With Faster Stimulus Exit on Risk to Inflation

Christine Lagarde, ECB President

“The Governing Council sees it as increasingly likely that inflation will stabilize at its 2% target over the medium term. The war in Ukraine is a substantial upside risk, especially to energy prices… We’re not talking about accelerating, we’re not talking about tightening, we’re talking about normalizing… The support that net asset purchases can give to policy rates is getting close to a conclusion and therefore requires that we decelerate the pace of purchases.”

Paul Craig, portfolio manager at Quilter Investors

“The balancing act faced by the ECB is an extremely challenging one. [Inflationary shock] requires “quick and decisive action… ECB has opted for the path of least resistance.”

David Powell, Maeva Cousin, Bloomberg euro-area economists

“On balance, Bloomberg Economics sees the outcome of the European Central Bank’s meeting as hawkish…[The ECB] loosened the link between the end of bond buying and its first interest rate increase, creating a lot of flexibility around the timing of the first rate hike.”

Pictet Asset Management analyst Frederik Ducrozet

“The bottom line is that inflation worries dominate… Forget about the details, forget about changing the sequencing, the hawks want to stop QE when inflation is edging towards 7%.”

On Bank of America’s Moynihan Seeing Strong Demand for Green Debt

“It’s a pretty amazing thing to see how much capital is coming in, and yet we’re just getting started. You’re going to see a lot of action… Companies need to issue more green bonds…it backs the strength of their commitment”

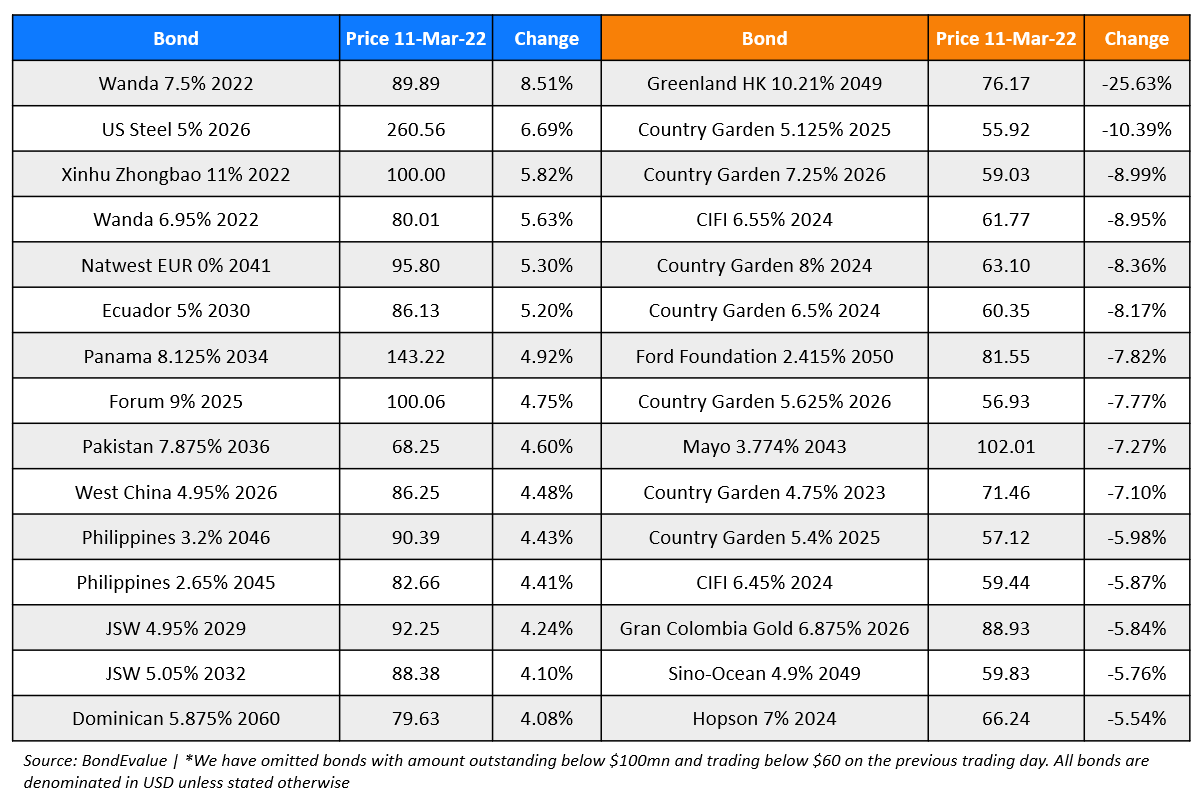

Top Gainers & Losers – 11-Mar-22*

Go back to Latest bond Market News

Related Posts: