This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

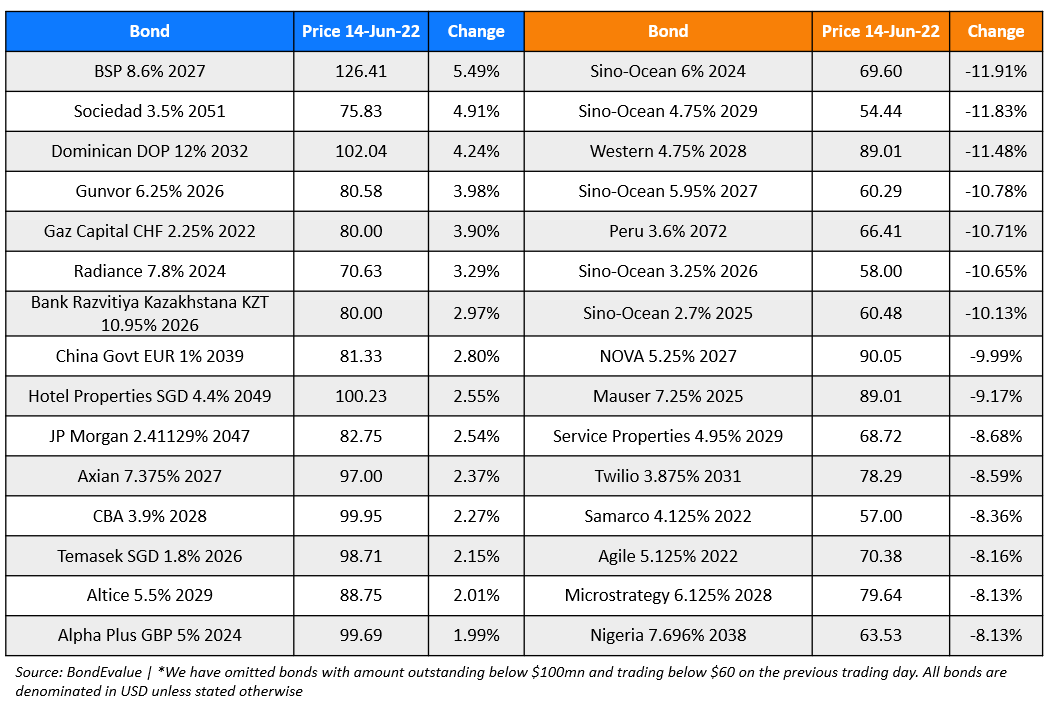

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

June 14, 2022

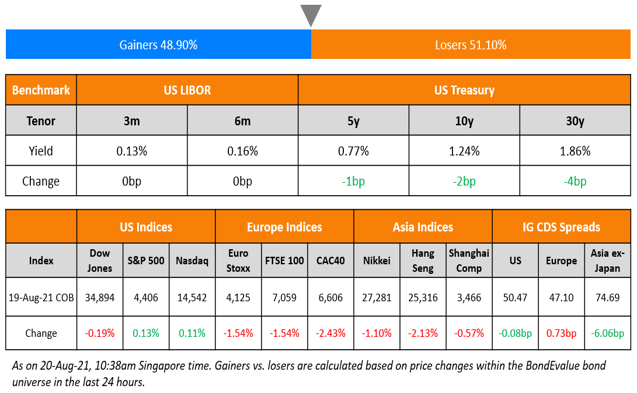

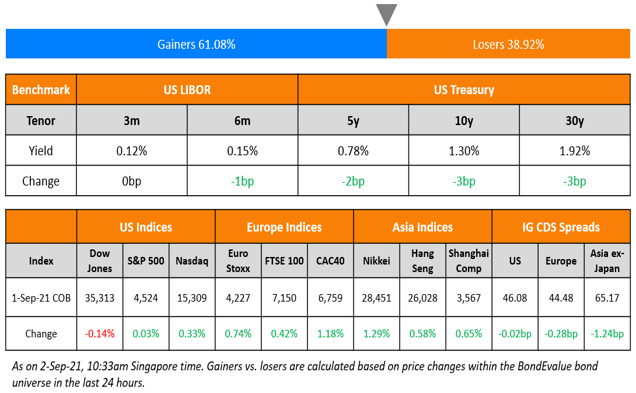

US equity markets continued its downtrend seeing its third consecutive day of stark losses on Monday, with the S&P and Nasdaq down 3.9% and 4.7%. Sectoral losses were led by Energy, down over 5% followed by Real Estate and Consumer Discretionary, down over 4.7% each. US Treasury yields surged, with 10Y rates hitting the highest since 2011 at 3.38%, up 20bp yesterday. European markets ended lower too with the DAX, CAC and the FTSE down 2.4%, 2.7% and 1.5% each. Brazil’s Bovespa was down 2.7%. In the Middle East, UAE’s ADX was down 1.8% and Saudi TASI closed 2.2% lower on Sunday. Asian markets have opened lower as the risk-off sentiment continues globally – Shanghai, HSI, STI and Nikkei were down 1.6%, 1.1%, 0.9% and 2% respectively. US IG CDS spreads widened 7.1bp and HY spreads were 41bp wider. EU Main CDS spreads were 6.4bp wider and Crossover spreads were 32bp wider. Asia ex-Japan IG CDS spreads widened 16bp.

The negative sentiment in equities comes as the probability of a 75bp hike by the Fed in Wednesday’s FOMC meeting has jumped to 96% currently, from just over 3% a week earlier (as per CME data), on the back of a record 8.6% CPI print on Friday.

This masterclass will be conducted by Asian bond and liability management expert Florian Schmidt and will cover sovereign debt crises and solutions, key elements of a debt restructuring, restructuring mind map, creditor types, restructuring frameworks, case studies and discussion on Sri Lanka. The masterclass is ideal for bond investors, advisors, wealth managers and relationship managers.

{{cta(‘5fa6e0f0-3b0a-4b67-8a53-2a7acb2243dc’,’justifycenter’)}}

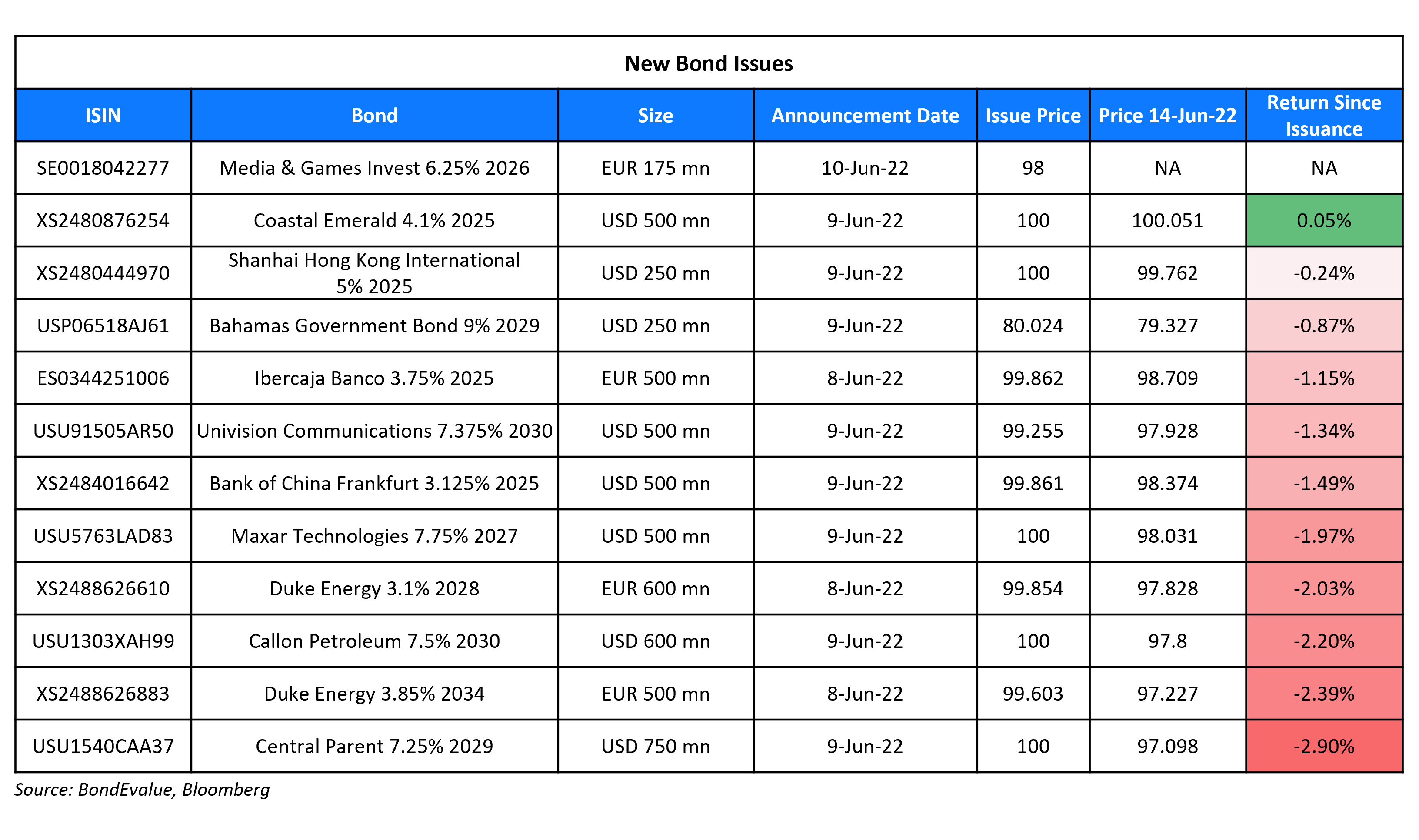

New Bond Issues

New Bonds Pipeline

- Hanwha Energy mandates for $ green bond

- Busan Bank hires for $ Social bond

- Continuum Energy Aura hires for $ Green Bond

Rating Changes

- Fitch Upgrades U. S. Steel’s IDR to ‘BB’; Outlook Stable

- Fitch Upgrades Cemex to ‘BB+’; Outlook Stable

- CoreLogic Inc. Downgraded To ‘B-‘ From ‘B’, Outlook Stable; Debt Ratings Lowered

- Fitch Revises Outlook on Haidilao to Negative, Affirms Ratings at ‘BBB-‘

- Fitch Revises Outlook on UltraTech’s Foreign-Currency IDR to Stable; Affirms Ratings at ‘BBB-‘

Term of the Day

Equity Credit

Equity credit refers to a dollar amount or a percentage of a hybrid security which will be treated corresponding to equity capital for leverage calculation purposes by Rating Agencies. Thus, a security that has a 50% equity credit assigned by a Rating Agency implies that for the calculation of credit ratios, there would be a 50% equity treatment of the borrowing.

Talking Heads

On Huge sell-off rocking Treasury markets, yield curve inverting

Rohan Khanna, UBS strategist

“hawkish European Central Bank communication alongside the inflation print have completely shattered this idea that the Fed may not deliver 75 bps or that other central banks will move in a gradual pace… that’s when you get turbo-charged flattening of yield curves. It is just a realisation that peak inflation in the U.S. is not behind us, and unless we are told so, maybe peak hawkishness from the Fed is also not behind us,”

On Possibility of US Avoiding Recession

JPMorgan Chase & Co. strategist Marko Kolanovic

“Friday’s strong CPI print that led to a surge in yields, along with the sell-off in crypto over the weekend, are weighing on investor sentiment and driving the market lower…However, we believe rates market repricing went too far and the Fed will surprise dovishly relative to what is now priced into the curve…The move in markets prices in more than enough recession risk, and we believe a near-term recession will ultimately be avoided thanks to consumer strength, Covid reopening/recovery, and policy stimulus in China,”

On Traders Bracing for 4% Peak in Fed Rate as Bond Rout Intensifies

George Goncalves, head of US macro strategy at MUFG

“Fed credibility is the lynchpin…They cannot waver, they cannot be dovish until there is evidence of slowing inflation. They are only at 1% and need to get above 3%.

On Inflation angst dragging S&P 500 into bear market; bonds skid

Stuart Cole, Equiti Capital chief macro strategist

“This is happening in spite of the actions that have so far been taken by central banks…, stoking fears that they will have to go harder and faster if inflation is to be tamed, the cost of which is being increasingly seen as lower growth and potentially recession,” said.

Top Gainers & Losers – 14-June-22*

Go back to Latest bond Market News

Related Posts: