This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

July 15, 2022

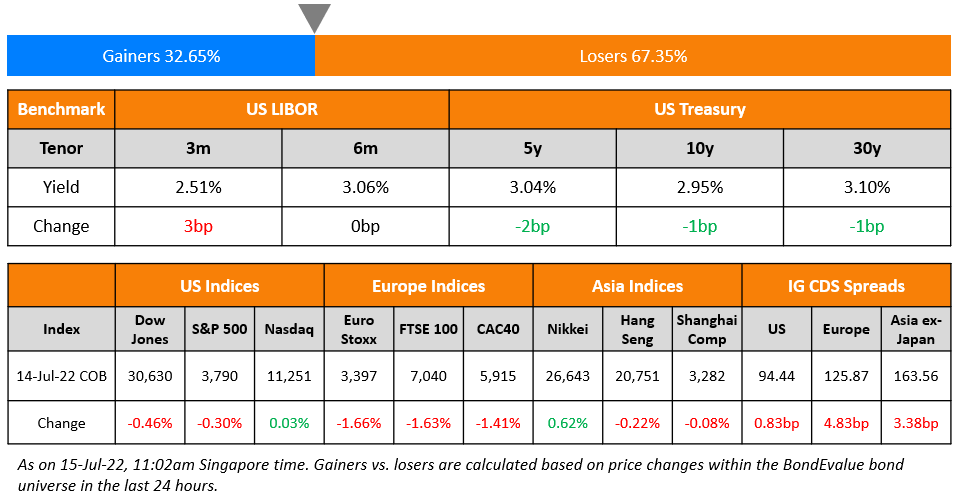

US equity markets opened sharply lower by over 1.8% on Thursday and recovered later before closing – the S&P was down 0.3% and Nasdaq was flat. Sectoral losses were led by Financials with JPMorgan and Morgan Stanley kicking-off the earnings season with soft results (scroll below for details) and Energy, falling 1.9% each. US 10Y Treasury yields were 1bp down to 2.95%. European markets trended lower with the DAX, CAC and FTSE down 1.9%, 1.4%, and 1.6% respectively. Brazil’s Bovespa fell 1.8%. In the Middle East, UAE’s ADX gained 0.9% while Saudi TASI was down 1.1%. Asian markets opened mixed – Shanghai and HSI were down 0.2% and 1.2% respectively while Nikkei and STI were up 0.6% and 0.3% respectively. US IG CDS spreads widened 0.8bp and US HY spreads were wider by 8bp. EU Main CDS spreads were 4.8bp wider and Crossover spreads were wider by 22.2bp. Asia ex-Japan IG CDS spreads widened 3.4bp.

Annual inflation in Argentina came at 64% YoY in June, a three decade high, with expectations that it will rise at an even faster rate in coming months. Many analysts now see annual inflation touching 90% by end-2022. However, the central bank kept rates unchanged at 52%, surprising market participants.

Not sure what to expect in a Corporate Debt Restructuring?

Sign up for the upcoming masterclass, which will be conducted live via Zoom on 18 July 2022. The session will cover:

- In-court vs. Out-of-court restructurings

- Out-of-court debt restructuring techniques

- Understanding Chapter 11 bankruptcy

- Cross-border insolvencies with a focus on China

- Key considerations for a corporate debt restructuring

- Case studies of recent restructurings from Asia Pacific, including a deep-dive into the recent consent solicitation and schemes transacted by Chinese property developers including Guangzhou R&F Properties

New Bond Issues

New Bonds Pipeline

-

Asian Development Bank (ADB) hires for € 10Y bond

- Busan Bank hires for $ Social bond

- Continuum Energy Aura hires for $ Green Bond

Rating Change

-

Croatia Upgraded To ‘BBB+/A-2’ On Confirmation Of Euro Adoption; Outlook Stable

- Fitch Revises Brazil’s Outlook to Stable from Negative; Affirms at ‘BB-‘

- Moody’s changes Minerva’s outlook to positive from stable; affirms Ba3 rating

- Moody’s changes Valero’s rating outlook to stable

Term of the Day

CET1 Ratio

“Common Equity Tier 1 (CET1) Ratio is a financial ratio applicable to banks to measure its core capital as against its Risk Weighted Assets (RWA). Core Capital (CET1 Capital) includes common equity and stock surplus (share premium), retained earnings, statutory reserves, other disclosed free reserves, capital reserves representing surplus arising out of sale proceeds of assets and balance in income statement at the end of the previous financial year. RWAs are calculated to measure the minimum regulatory capital required to be held by banks to maintain solvency. The calculation methodology is such that the riskier the asset, the higher the RWAs and the greater the amount of regulatory capital required. CET1 capital must be at least 4.5% of RWAs according to Basel III.

Contingent Convertible (CoCos) bonds/AT1s commonly have triggers based on CET1 ratios – if the bank’s CET1 ratio falls below a certain threshold, the bonds would convert into equity.

Talking Heads

On Markets Giving Fed Too Much Credibility on CPI – Nancy Davis, founder and PM at Quadratic Capital

“They’re very slowly approaching quantitative tightening… They probably should be doing that in a more aggressive way. The tightening policy is not getting the job done…Raising interest rates is just destroying demand right now. I don’t really see how the Fed hiking rates is going to put more truck drivers on the road.”

On Fed staff say balance sheet runoff could strain Treasury market

Piper Sandler analysts Roberto Perli and Benson Durham

“We wouldn’t say that the Treasury market is stressed. But poor liquidity conditions no doubt exacerbate the already existing volatility. They might also induce the Fed, which cares deeply about Treasury market functioning, to stop QT sooner than it thinks at the moment… contrast between the currently unsettled state of market conditions and the tranquil conditions that prevailed in 2017 suggests that this QT episode has the potential to be more disruptive compared with the benign start to the 2017 runoff”.

On Fed’s Collins Says Addressing Too-High Inflation Is Key Priority

“I do know that this is a very challenging time for our economy… While employment has bounced back after the very deep pandemic shock, inflation is too high and addressing this is a key priority for me and my colleagues.”

“Sri Lanka is clearly unable to repay that debt, and it’s my hope that China will be willing to work with Sri Lanka to restructure the debt… More needs to be done to help the most vulnerable, and this is a key message I will be emphasizing at these G20 meetings… “A key objective of this trip is to push G20 creditors, including China, to finalize debt restructurings for developing countries now facing debt distress”.

Top Gainers & Losers – 15-July-22*

Go back to Latest bond Market News

Related Posts: