This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

April 18, 2022

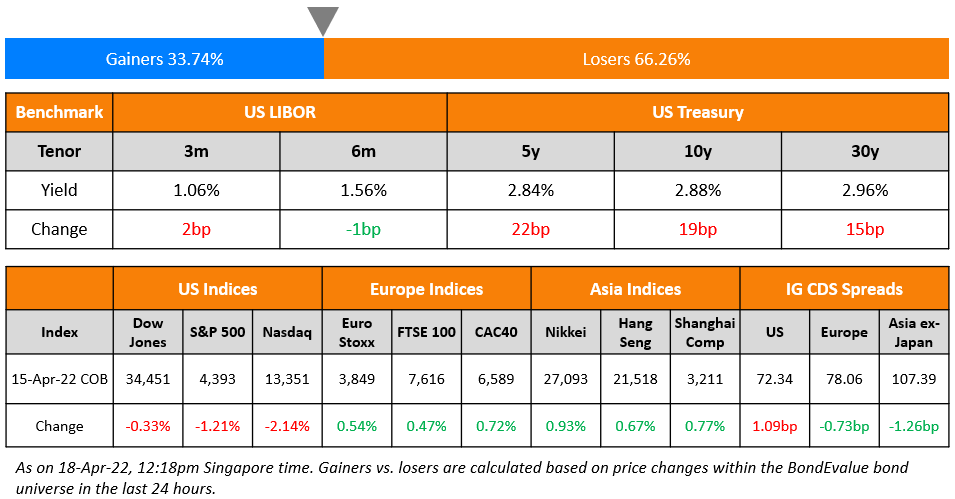

US equity markets dropped on Thursday ahead of the Good Friday holiday with the S&P and Nasdaq down 1.2% and 2.1% each. Sectoral losses were led by IT, down ~2.5%. US 10Y Treasury yields have jumped 19bp to 2.88%. European markets were higher – the DAX, CAC and FTSE were 0.6%, 0.7% and 0.5% higher. Brazil’s Bovespa ended 0.5% lower. In the Middle East, UAE’s ADX was down 1.2% on Friday and Saudi TASI was up 0.5%. Asian markets have opened with a negative bias – Shanghai, STI and Nikkei were down 0.8%, 0.7% and 1.8% while HSI was up 0.7%. US IG CDS spreads widened 1.1bp while HY spreads were 5bp wider. EU Main CDS spreads were 0.7bp tighter and Crossover CDS spreads were 3.3bp tighter. Asia ex-Japan CDS spreads were 1.3bp tighter.

China’s PBOC said it will cut the Reserve Requirement Ratio (RRR) by 25bp for banks, helping release RMB 530bn ($83.1bn) of liquidity.

New Bond Issues

New Bonds Pipeline

- Continuum Energy Aura hires for $ Green Bond

- Korea Water Resources hires for $ Green bond

- Mirae Asset Securities hires for 3Y/5Y SLB bond

- Jubilant Pharma hires for $ bond

- Sael Limited hires for $ 7Y Green bond

- Kalyan Jewellers India hires for $ bond

Rating Changes

- Moody’s upgrades OCI to Baa3, stable outlook

- Fitch Upgrades OCI to ‘BBB-‘; Rates Guaranteed IFCo Bond ‘BBB-(EXP)’

- Bayan Resources Upgraded To ‘BB-‘ On Elevated Coal Prices And Bolstered Resilience, Outlook Stable

- Athabasca Oil Corp. Upgraded To ‘B’ From ‘B-‘ On Projected Debt Reduction And Strengthened Financial Metrics

- Central China Real Estate Downgraded To ‘B’ On Ongoing Business Challenges Amid An Industry Downcycle; Outlook Negative

- Fitch Downgrades SriLankan Airlines’ Government-Guaranteed Bonds to ‘C’

- Talen Energy Supply LLC Downgraded On Unsustainable Capital Structure; Outlook Negative

- Fitch Revises Outlook on Saudi Arabia to Positive; Affirms at ‘A’

- Fitch Revises Outlook on CIFI to Negative; Affirms Ratings at ‘BB’

Term of the Day

Haircut

Haircut refers to a reduction in value of an asset for the purpose of calculating either margin requirements, level of collateral or salvage value. The haircut is generally stated as a percentage and is the difference between the value of the asset and its reduced value. For example, in a restructuring, if a bond worth $100mn faces a haircut of 20%, then holders would receive only $80mn. In the case of a loan, if the collateral is worth $100mn, a haircut of 30% would imply that a loan of $70mn, giving the lender a cushion in case the market value of the collateral falls.

Talking Heads

On Sustainable debt markets shrugging off geopolitical risk, US rate rises

Simrin Sandhu, StanChart’s executive director for credit research

“Green bonds are likely to retain their position as the largest segment of GSSS issuance. However, we expect sustainability-linked bonds (SLBs) to be the fastest-growing segment, given the greater flexibility they offer issuers in terms of use of proceeds… The strong momentum in this segment reflects the greater flexibility offered by these instruments”

BofA analyst Ping Luo

“China’s onshore market is more shielded from US interest rate hikes and global market risks. Domestic politics and environments remain very supportive towards green bond products”

On Goldman Sachs Seeing US Recession Odds at 35% in Next Two Years

“Taken at face value, these historical patterns suggest the Fed faces a hard path to a soft landing.

On ECB Officials Converging on Quarter-Point Hike in Third Quarter

Christine Lagarde, ECB President

Our forward guidance will be determining and helping us determine at the June projection meeting if we decide to terminate net asset purchases, what exactly will be the policy going forward in terms of rates”

Former ECB Chief Economist Peter Praet

“The normalization of rates is something also most of the Governing Council members want to do, is going back to zero, and that probably before the end of the year. What comes after is more controversial. But going back to zero is probably something that is really in the cards.”

Top Gainers & Losers – 18-Apr-22*

Go back to Latest bond Market News

Related Posts: