This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

August 18, 2022

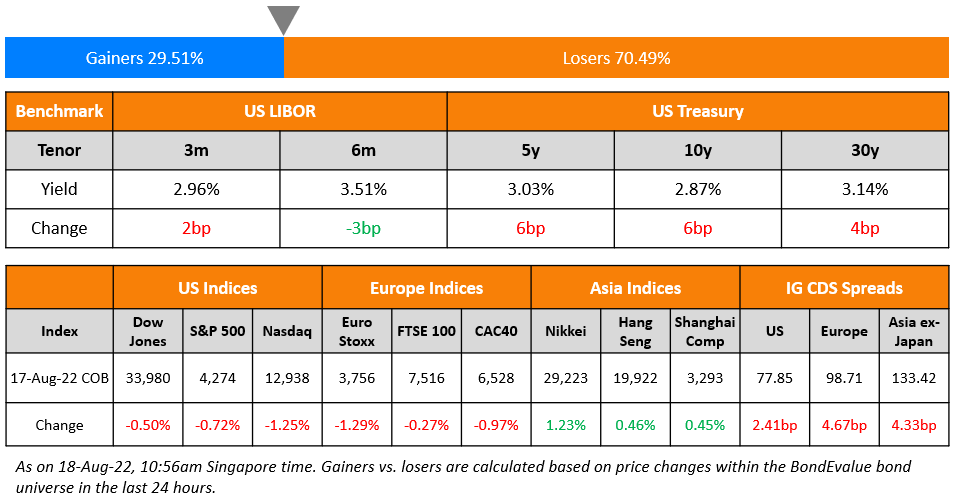

US equity markets ended lower on Wednesday with the S&P and Nasdaq down 0.7% and 1.3% respectively. Sectoral losses were led by Communication Services down 1.9%, followed by Materials falling 1.4%. US 10Y Treasury yields were 6bp higher at 2.87%. European markets also ended weaker – DAX, CAC and FTSE were down 2%, 1% and 0.3% respectively. Brazil’s Bovespa was up 0.2%. In the Middle East, UAE’s ADX and Saudi’s TASI rose 0.7% and 0.8% respectively. Asian markets have opened mixed – Shanghai, HSI and Nikkei were down 0.5%, 0.6%, 0.8% respectively while STI was up 0.5%. US IG CDS spreads widened 2.4bp and US HY spreads were wider by 15.6bp. EU Main CDS spreads were 4.7bp wider and Crossover spreads widened by 27.5bp. Asia ex-Japan IG CDS spreads widened 4.3bp.

The US Federal Reserve’s July meeting minutes showed that the committee’s participants “agreed that there was little evidence to date that inflation pressures were subsiding and a slowing in aggregate demand would play an important role in reducing inflation pressures.” Analysts note that the Fed did not guide for a September meet rate hike in the minutes, but committed to hike rates to control inflation while also acknowledging the importance of timing the slowing down of the pace of rate hikes. Separately, UK inflation rose to a 40Y high of 10.1% YoY in July on the back of higher food prices, much higher than the 9.4% print in June. Citi expects UK inflation to peak at 15% levels in Q1 of next year.

New Bond Issues

Lloyds raised €1bn via a 8NC7 bond at a yield of 3.238%, 20bp inside initial guidance of MS+170bp area. The senior unsecured bonds have expected ratings of A3/BBB+/A, and received orders over €2.3bn, 2.3x issue size. If the bonds are not called by the optional redemption date of 24 August 2029, the coupon will reset to the 1Y MS plus a spread of 150bp.

ING raised €1bn via a 11NC6 Tier 2 green bond at a yield of 4.204%, 25bp inside initial guidance of MS+275bp area. The bonds have expected ratings of A-/A+, and received orders over €2.6bn, 2.6x issue size. Proceeds will be used to finance green projects specified under ING’s Green Bond Framework. The bonds are callable from 24 May 2028 to the reset date of 24 August 2028 at par. If the bonds are not called by the reset date, the coupon rate will reset to the prevailing 5Y MS plus a spread of 250bp.

New Bonds Pipeline

- Energy Development Oman hires for $ sukuk

- Tianjin Binhai New Area Construction & Investment hires for $ bond

- NH Investment hires for $ 3Y and/or 5Y Green bond

Rating Changes

- Peabody Energy Corp. Upgraded To ‘B-‘ From ‘CCC+’ On Improving Credit Metrics; Debt Ratings Raised; Outlook Stable

- Endo International PLC Downgraded To ‘D’ From ‘CC’ Following Chapter 11 Bankruptcy Filing

- Cooper-Standard Holdings Inc. Downgraded To ‘CCC’ On Increased Refinancing Risk And Sustained Weakness; Outlook Negative

Term of the Day

Dim Sum Bond

These are bonds denominated in offshore Renminbi (CNH) and issued outside China (mostly in Hong Kong). The first dim sum bond was issued in 2007 by China Development Bank – a 2Y offshore RMB bond in Hong Kong, with a 3% coupon and size of RMB 5bn ($750mn). These instruments get their name from dim sum, a popular delicacy in Hong Kong. Dim sum bonds are typically issued by issuers that have a need for Renminbi but do not want to go through regulatory approvals as dim sum issuance are not subject to regulatory approval from mainland China or Hong Kong, provided that they are sold to professional investors.

Talking Heads

On Hong Kong Defying Doomsayers With its Splash in Offshore Yuan Debt

Iris Pang, chief economist for Greater China at ING Groep NV

“Rising Dim Sum bond issuance shows Hong Kong still plays a role as a link to the rest of the world and Mainland China in the financial market.”

Becky Liu, head of China macro strategy at Standard Chartered Bank

“We expect continued strong supply of Dim Sum bonds in the foreseeable future, given a further widening in rate differential for short-dated instruments for the rest of 2022, as the Fed is poised to hike further.”

On Turkey Playing the Waiting Game on Interest Rates as Inflation Rages

Per Hammarlund, chief emerging markets strategist at SEB in Stockholm

“I have an emergency rate hike in my forecasts before the end of the fourth quarter, but the timing is highly uncertain…Only a confidence crisis will prompt a hike.”

Selva Bahar Baziki, Bloomberg economist

“The economy is crying out for a rate hike to help curb inflation and support the lira. Despite this, we do not expect the central bank to raise the main policy lever in the near term. The bank sees this approach as a mediating move between the economic fundamentals warranting a hike and the political leadership calling for a cut. In reality, it is leaving inflation untamed and the currency unsupported.”

Nick Stadtmiller, director of emerging markets at Medley Global Advisors

“The government has invested too much political capital in the low-rates policy to abandon it lightly…I doubt we will see rate hikes from the central bank any time soon unless they’ve run out of options.”

On Labor Demand Being Strong But Supply being Uncertain

Federal Reserve Governor Michelle Bowman

“One complication is that the future of labor supply is uncertain, and it is difficult to predict how labor force participation will evolve…There is no magic wand that will draw workers back into the labor force, especially when generous government benefits programs are provided.”

On Fed Officials Seeing the Need to Slow Rate-Hike Pace ‘At Some Point’

FOMC Meeting Minutes

“As the stance of monetary policy tightened further, it likely would become appropriate at some point to slow the pace of policy rate increases while assessing the effects of cumulative policy adjustments on economic activity and inflation.”

Christopher Low, chief economist at FHN Financial

“While the FOMC minutes continue to emphasize the need to contain inflation, there is also an emerging concern the Fed could tighten more than necessary…There is an inkling of improvement on the supply side of the economy, there is a bit of hope in some product prices moderating, but there is still a great deal of concern about inflation and inflation expectations.”

Top Gainers & Losers – 18-August-22*

Go back to Latest bond Market News

Related Posts: