This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

March 18, 2022

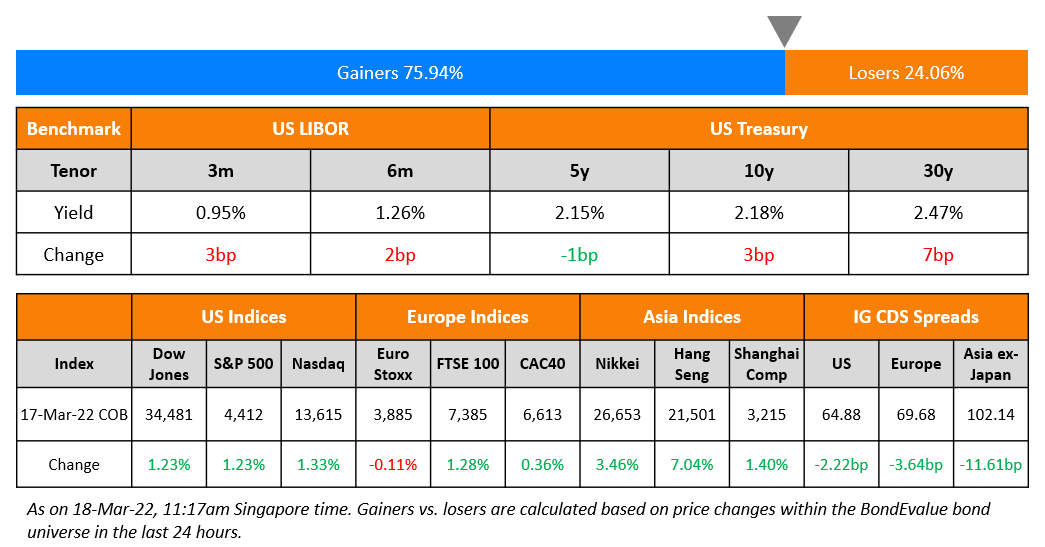

US equity markets closed higher for a third consecutive day, with the S&P and Nasdaq up 1.2% and 1.3%. Sectoral gains were led by Energy, up 3.5%, followed by Material and Consumer Discretionary, up over 1.9% each. US 10Y Treasury yields were up 3bp to 2.18%. European markets were mixed – the DAX was down 0.4% while CAC and FTSE were up 0.4%, and 1.3%. Brazil’s Bovespa ended 1.8% higher. In the Middle East, UAE’s ADX was up 0.2% and Saudi TASI was up 0.9%. Asian markets have opened mixed – Shanghai and HSI were down 0.2% and 2.4% while STI was flat and Nikkei was up 0.3%. US IG CDS spreads tightened 2.2bp and HY spreads were 7.5bp tighter. EU Main CDS spreads were 3.6bp tighter and Crossover CDS spreads were 12.6bp tighter. Asia ex-Japan CDS spreads were 11.6bp tighter.

The Bank of England hiked its policy base rate by 25bp to 0.75%. Turkey meanwhile has kept its policy rate unchanged at 14%.

With the growing interest among investors and professionals in ESG bonds – green bonds, social bonds, sustainable bonds and sustainability-linked bonds – BondEvalue has now enriched its data to include key ESG metrics for ESG bonds on the BondEvalue App. For the product release update, click here

New Bond Issues

- Turkey $2bn 5.5Y at 8.625% final

Deutsche Bank raised €1.5bn via a 10.25NC5.25 bond at a yield of 4.075%, 30bp inside initial guidance of MS+360bp area. The bonds have expected ratings of Ba1/BB+/BBB-, and received orders over €6.5bn, 4.3x issue size. The coupon will be fixed at 4% until the reset date of June 24, 2027, and if not called, it refixes at 5Y MS +330bp.

Credit Suisse raised €3.5bn via a dual-trancher. It raised €2bn via a 4.5NC3.5 bond at a yield of 2.177%, 25bp inside initial guidance of MS+185bp area. It also raised €1.5bn via a 10NC9 bond at a yield of 2.916%, 25/30bp inside initial guidance of MS+220/225bp area. The bonds are rated Baa1/BBB+/A-, and received orders over €10.2bn, 2.9x issue size. If not called on their optional redemption dates of October 13, 2025 and April 2, 2031, the coupon will refix to the 1Y MS + the initial margins of 160bp and 195bp respectively.

Bank of America raised $3.5bn via a two-trancher. It raised $3bn via a 4NC3 bond at a yield of 3.384%, 22bp inside initial guidance of T+145bp area. It also raised $500mn via a 4NC3 FRN at SOFR+133bp vs. initial guidance of SOFR equivalent area. The bonds are rated A2/A-, and received orders over €10.2bn, 2.9x issue size. Proceeds will be used for general corporate purposes.

Nigeria raised $1.25bn via a 7Y bond at a yield of 8.375%, 37.5bp inside the initial guidance of 8.75% area. The bonds have expected ratings of B2/B-/B (Moody’s/S&P/Fitch). Proceeds will be used for the funding of the fiscal deficit.

Wells Fargo raised $4bn via a 6NC5 bond at a yield of 3.526%, 22.5bp inside initial guidance of T+160bp area. The bonds are rated A1/BBB+. Proceeds will be used for general corporate purposes. Wells had also planned an FRN issuance but dropped it at launch.

New Bonds Pipeline

- Hyundai Heavy Industries hires for $ green bond

- The Republic of the Philippines hires for $ bond

- Aluminium Corporation of China hires for $ bond

- Petron hires for $ 7NC4 bond

- Electricity Generating (EGCO) hires for $ 7Y or 10Y bond

Rating Changes

- Yum! Brands Inc. Upgraded To ‘BB+’ From ‘BB’ On Performance And Cash Flow Resilience; Outlook Stable

- Sunac China Downgraded To ‘B-‘ On Weak Liquidity; Ratings Placed On CreditWatch Negative

- Russia Foreign And Local Currency Ratings Lowered To ‘CC’ On High Vulnerability To Debt Nonpayment, Still On Watch Negative

Term of the Day

Private Placement Note (PPN)

Private Placement Note (PPN) is a debt instrument issued in interbank bond market through private placement. A private placement is a sale of securities directly to select private investors, rather than issuing them via a public offering. Investors in privately placed bonds generally comprise large banks, mutual funds, or insurance companies. The advantage of private placements is that they may not be subject to the same strict regulations regarding disclosure and reporting of public offerings. Also, the cost and time savings add to its attractiveness. On the other hand, they may carry a higher rate to entice investors and they limit the number and variety of investors that can take part unlike public offerings. Unlike bonds issued via public offerings, privately placed bonds may not trade on the secondary market.

Explore BondbloX Kristals – a basket of single bonds listed on the BondbloX Exchange following themes such as SGD REIT Perps, USD Bank Perps, and SGD Bank Perps. Avail an introductory discount of $1,000 for every purchase of $100,000 worth of BondbloX Kristals*. Click on the banner above to know more.

Talking Heads

On Powell Saying that the U.S. Economy Would Flourish, But Data Leaves Room for Debate

“All signs are that this is a strong economy… What you have is 1.7-plus job openings for every unemployed person. So that’s a very, very tight labor market. Tight to an unhealthy level, I would say”

On Junk-Rated Turkey, Nigeria Defy Market Chaos to Sell Dollar Debt

Edwin Gutierrez, head of emerging-market sovereign debt at Aberdeen Asset Management

“Both are having to pay up to get their deals done now in the choppy market. To me the bigger surprise is Nigeria given the oil windfall they are currently enjoying.”

Tatonga Rusike, the London-based sub-Saharan economist at Bank of America Corp

“It was unexpected. Our base case expectation for Nigeria’s issuance was in the second half.

On Bank of England raising rates to 0.75%, less sure about future moves

“The Committee judged that some further modest tightening might be appropriate in the coming months, but there were risks on both sides of that judgement depending on how medium-term prospects evolved… [further modest tightening] “is likely to be appropriate”.

On China Credit Investors Finding Themselves at Back of the Line

Raymond Chia, head of credit research for Asia ex-Japan at Schroder Investment Management

“Companies have investors by the throat because on one hand they have no money and in some cases no willingness to pay, while on the other hand they know that investors cannot stomach a full default”

Anthony Leung, head of fixed income at Metropoly Capital HK

“Companies haven’t been transparent about their private debt and upcoming payments, but the market’s also been rife with rumors supposedly linked to short-selling. The lack of transparency has led to a vicious cycle of panic selling and a collapse in the price of securities, which closes refinancing channels.”

Top Gainers & Losers – 18-Mar-22*

Go back to Latest bond Market News

Related Posts: