This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Bond Market News

AVIC Launches $ Bond; Macro; Rating Changes; New Issues; Talking Heads; Top Gainers and Losers

May 19, 2022

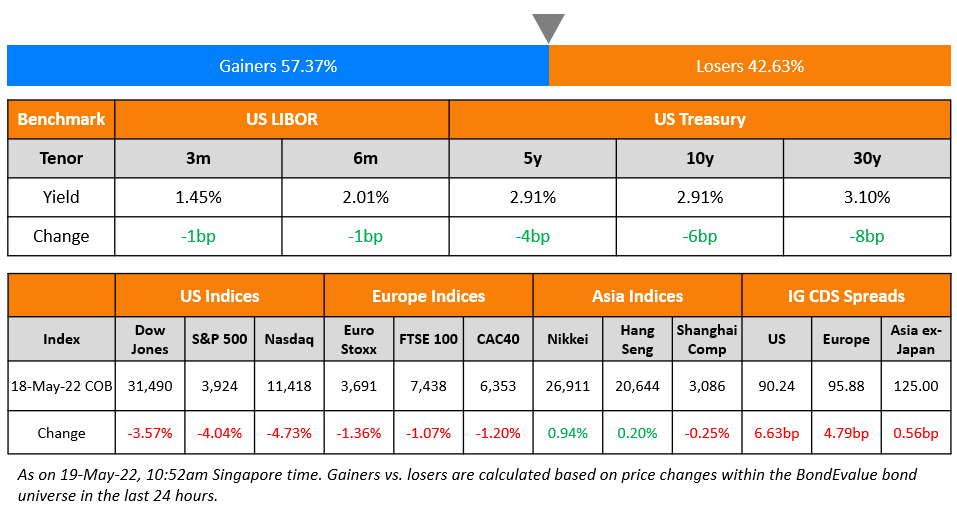

US equity markets saw a massive sell-off on Wednesday with the S&P down 4% and Nasdaq down 4.7%. Sectoral losses were led by Consumer Staples and Consumer Discretionary, down over 6% each. US 10Y Treasury yields fell 6bp to 2.91% on the overall risk-off sentiment that took hold of markets. European markets were lower too with the DAX, CAC and FTSE down 1.3%, 1.2% and 1.1%. Brazil’s Bovespa closed 2.3% lower. In the Middle East, UAE’s ADX was up 1.4% while Saudi TASI rose 0.2%. Asian markets have opened lower – Shanghai, HSI, STI and Nikkei were up 0.1%, 2.3%, 0.3% and 2.1% respectively. US IG CDS spreads widened 6.6bp and HY spreads widened 34.8bp. EU Main CDS spreads were 4.8bp wider and Crossover spreads were 26.2bp wider. Asia ex-Japan CDS spreads were 0.6bp wider.

UK’s inflation jumped to a 40Y high of 9% YoY in April, with food prices jumping 12%.

Trade BondbloX via Singapore-based member CapBridge and Receive Cash Credits.

New Bond Issues

-

Avic International $ 3Y at T+175bp area

- S$526mn via a Class A-1 10NC5 bond at a yield of 4.1%, 27.5bp inside initial guidance of 4.375% area

- $175mn via a Class A-2 10NC5 bond at a yield of %, bp inside initial guidance of 5.625% area

- $200mn via a Class B 10NC6 bond at a yield of 6.375% area

The Class A-1 notes are rated A+/A+ (S&P/Fitch), while the Class A-2 notes are rated A by Fitch and the Class B notes at BBB+ by Fitch. The bonds have a 100bp step-up if the call is not exercised. The Class A-1 notes are split between a S$246mn institutional placement and a S$280mn retail tranche. The Class B note is split into a $100mn retail offer to Singapore-based investors and a $100mn institutional placement to Singapore-based and international investors.

Carnival Corp raised $1bn via an 8NC3 bond at a yield of 10.5%, ~27.5bp inside initial guidance of 10.25-10.5% area. The bonds are rated B2/B. Proceeds will go towards making scheduled principal payments on debt maturing in 2023 and for general corporate purposes.

Westpac raised $2.25bn via a three-trancher. It raised:

- $700mn via a 3.25Y bond at a yield of 3.735%, 15bp inside initial guidance of T+90bp area

- $550mn via a 3.25Y FRN at SOFR+100bp vs. initial guidance of SOFR equivalent area

- $1bn via a 5.25Y bond at a yield of 4.043%, 15bp inside initial guidance of T+115bp area

The bonds received orders over $3.225bn, 1.43x issue size.

Wing Tai Holdings raised S$100mn via a 5Y bond at a yield of 4.1%, 35bp inside initial guidance of 4.45% area. The bonds are unrated and received orders over S$300mn, 3x issue size. Fund managers and insurance companies bought 43% while private bank took 57%. Singapore accounted for 99% of the deal with others at 1%. Private banks have a 25-cent concession.

Shandong Gold raised $100mn via a PerpNC3 bond at a yield of 4.95%, 20bp inside initial guidance of 5.5% area. SDG Finance, an indirect wholly owned subsidiary, is the issuer, and the parent is the guarantor. The bonds have a 300bp step-up if not called after three years. The step-up will also take place if there is a change of control, covenant breach, default or dividend stopper breach. Proceeds will be used for refinancing and general corporate purposes.

New Bonds Pipeline

- Busan Bank hires for $ Social bond

- Kookmin Card hires for $ Sustainability bond

- Continuum Energy Aura hires for $ Green Bond

- Jubilant Pharma hires for $ bond

- Sael Limited hires for $ 7Y Green bond

Rating Changes

- Moody’s upgrades ENBD’s deposit ratings to A2/P-1 from A3/P-2, maintains stable outlook

- Moody’s upgrades Marfrig to Ba2; positive outlook

- Fitch Downgrades Credit Suisse Group to ‘BBB+’; Stable Outlook

- Hyatt Hotels Corp. Outlook Revised To Positive On Accelerating Recovery Momentum

- Fitch Withdraws China Aoyuan Group’s Ratings

Term of the Day

Bridge Financing

Bridge financing is a temporary form of financing used to cover the borrower’s short-term costs until the moment when regular long-term financing is secured. This form of financing ‘bridges’ the gap between when the borrower’s funds are set to dry up and its next long-term funding option..

Talking Heads

On Crisis-hit Sri Lanka braces for debt default as dollars run out

Manjuka Fernandopulle, a Debt restructuring lawyer

“We defaulted with an idea that we would have a restructuring process starting… And that seems not to be moving anywhere . . . The cabinet is not there. The urgency of starting a restructuring process has fallen to the background.”

Ranil Wickremesinghe, Sri Lankan PM

“It is a challenge for the Treasury to find $1mn. The next couple of months will be the most difficult of our lives. We must prepare ourselves to make sacrifices.”

On ECB Needs to Move Quickly From Negative Rates – Bank of Finland Governor Olli Rehn

“It seems necessary that in our policy rates we move relatively quickly out of negative territory and continue our gradual process of monetary-policy normalization… I am not alone, as this is also the indication given by many of my colleagues in the ECB Board and Governing Council.”

On India’s Monetary Panel Sees Need for More Interest Rate Hikes

RBI Governor Shaktikanta Das

“Waiting for one month till the June MPC would mean losing that much time while war related inflationary pressures accentuated.” Further, it may necessitate a much stronger action in the June MPC which is avoidable

External member Jayanth Rama Varma

“It appears to me that more than 100 basis points of rate increases needs to be carried out very soon”

Michael Patra, deputy governor at RBI

“Geopolitical spillovers have thrust upon us a surge in the momentum of inflation we can ill afford. As long as the geopolitical crisis and retaliatory actions persist, so will inflation”

Top Gainers & Losers – 19-May-22*

Go back to Latest bond Market News

Related Posts:-jpg.jpeg)